Around the Pension-o-Sphere, 27 Mar 2024: Illinois, Minnesota, and Teamsters Payback?!

Wait, they're going to pay back the bailout? Really?

I have been deep in mortality trends, so let’s take a quick break to check in with some of the pension news of late…. or, in one case, non-news….

Boasting about piddling debt-paying-off in Illinois

A bunch of people noticed the governor of Illinois boasting using federal bailout funds to pay off a bunch of miscellaneous debts:

I’m not big on Dave Ramsey, but I’ve seen some people with debt problems helped by Ramsey’s techniques. If one cannot get out from under overwhelming debt… you gotta start somewhere.

After all, bankruptcy is not an option open to states….

I do want to somewhat give kudos to Illinois for at least de-leveraging a bit with the recent revenue bonanzas they’ve gotten. But…

Yes, when it comes to Illinois and its pension debt, we get this:

Let us consider Illinois’s largest state pension plan, Illinois TRS.

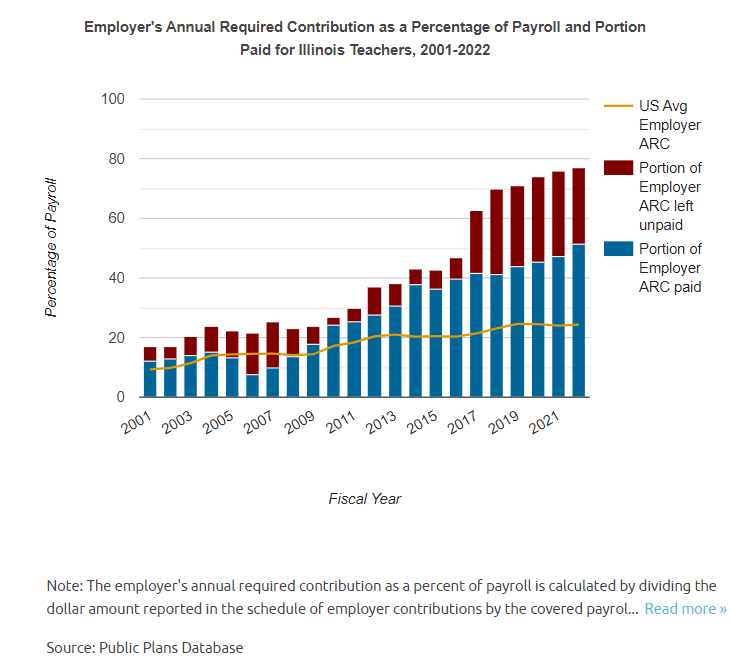

This has been what the contribution plan they’ve been pursuing:

The red portion is the part they SHOULD be paying.

At what point do they plan to pay what they should be paying?

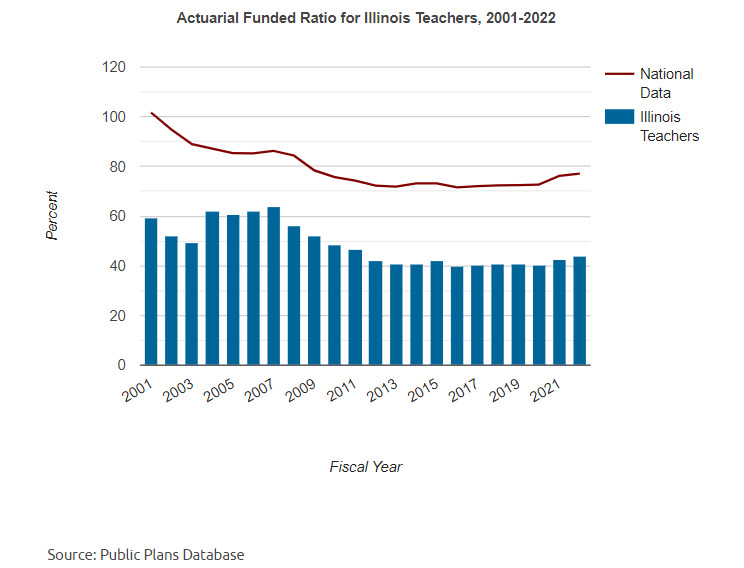

This is the funded ratio, by the way:

It’s been hanging around 40% fundedness for about a decade.

As of the last actuarial report (not in the Public Plans Database yet), the unfunded liability as of June 30, 2023, was $81.9 billion.

And while nobody expects them to pay down all the pension debt in one year, every year they undercontribute to the pensions, the more that debt grows:

Significant issues facing TRS

Historical Underfunding by the State

The Illinois Pension Code sets the parameters for funding TRS. The employer contributions are determined such that, together with the member contributions, the System is projected to achieve 90% funded by 2045. The 2045 funding objective of 90% was set in 1994 as a 50-year objective. TRS members have always contributed their share. The State funding has been inadequate, resulting in TRS being among the worst funded public employee retirement systems in the United States.

That is on page 14 of the actuarial report.

Minnesota Teachers Want a Pension Fund Audit?

A couple of weeks ago, I saw the post by Edward Siedle:

It was a press release that started like this:

Minnesota educators are concerned that the Teacher Retirement Association (TRA), the body that manages the statewide educator pension system, has mishandled employee contributions.

Despite increased teacher contributions and high investment returns, TRA has continued to report minimal gains and a 23.6% fund deficiency. Further mistrust stems from reports of hostile responses to requests for documentation, refusal to hold meetings when members are able to attend, closed door conversations, providing misleading data, and a general lack of transparency.

Again, I went to my usual place: the Public Pensions Database.

I don’t know what they mean by “minimal gains” — little increases in funded position? Well, the actuarial reports might be able to help there.

I also noticed this:

Uh, guys? There is a net cash flow issue here. You can have great investment returns, but the cash flowing out is going to have an effect. The investment returns sound like mostly unrealized gains, meaning it’s numbers on paper, not cash flows…. let’s take a look at the asset allocation.

So… here’s a thing. That big yellow wedge. What’s in that big yellow wedge labeled “Misc alternatives”?

Let’s look at the history:

What happened in 2021 when the “Misc alternatives" jumped up so much? Was that deliberate?

I checked the 2022 ACFR — yes, that’s deliberate. (on page 65)

Private Markets is that “Misc Alternatives” in the Public Plans Database listing.

So, I don’t think anything is necessarily nefarious going on, per se, just that Minnesota is playing “me, too!” that has happened with so many other public pensions.

The portfolio returns have been fine in terms of reaching targets. Still, they find out that is not sufficient to actually raise fundedness… because they never should have been discounting at a flat “expected rate of return” for the liabilities in the first place, and definitely should not have been amortizing unfunded liabilities as a level percent of payroll.

But I will pound that theme into the core of the earth (again) another time.

Central States Teamsters supposed to pay back pension bailout?!

No.

It’s an overpayment, and the amounts involved are laughable, considering.

Here we go:

ai-CIO: After Receiving Extra $127M, Central States Working on Repayment Plan

Pension Benefit Guaranty Corporation Director Gordon Hartogensis testified at a House of Representatives subcommittee hearing this week that the Department of Justice is negotiating with the Central States pension fund for the return of a $127 million overpayment.

The $127 million was improperly granted to the pension fund by the PBGC for the benefit of plan participants that were deceased.

….

In December 2022, the PBGC provided $35.8 billion to the Central States, Southeast and Southwest Areas Pension Plan. The Special Financial Assistance Program of the American Rescue Plan Act allows for PBGC funding for severely underfunded multiemployer pension plans.

Before November 2023, the PBGC did not use the Social Security Administration’s death master file when auditing plan applications for deceased participants, and pension plans do not have access to the file. According to Hartogensis, speaking Wednesday at a hearing before the House Committee on Education and the Workforce’s subcommittee on health, employment, labor and pensions, the inspector general for the PBGC first recommended using the DMF in March 2023.

Hartogensis emphasized that neither the PBGC nor the Central States plan have made any payments to the estates of deceased participants, and “there is no evidence that any of the applicant plans intentionally misled PBGC.”

He added that “we’re implementing a repayment mechanism for any SFA amounts that were paid based on inaccurate census data,” and that Central States is currently negotiating the terms of repayment with the Civil Division of the Department of Justice.

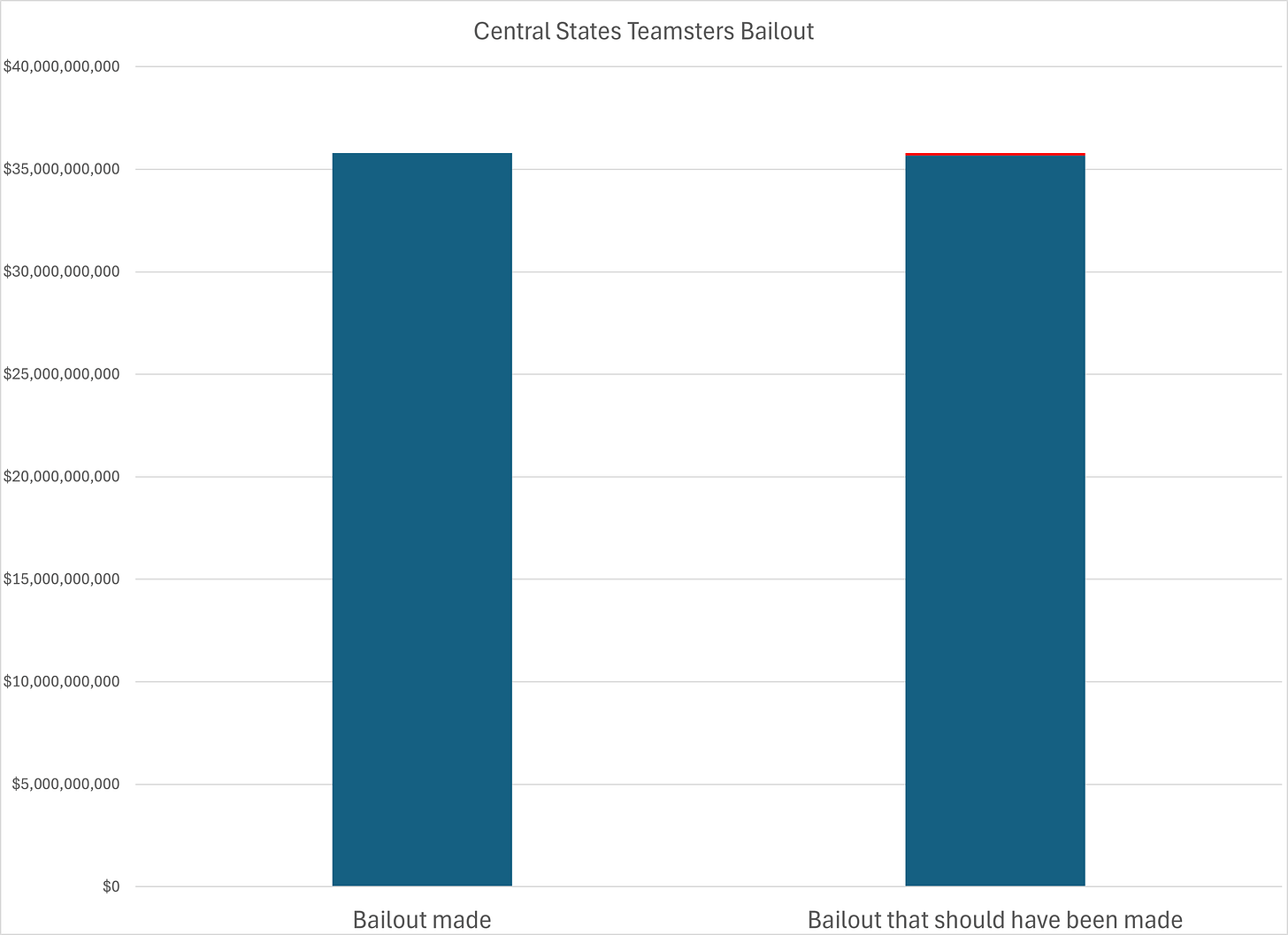

I like doing visualizations — The payment made to Central States vs what they should have gotten without the dead members:

There is a red sliver that represents the overpayment. It’s 0.35% of the original payment.

Yes, the Central States Teamsters plan should pay the overage back. They don’t get to keep the overage.

But not the $35.7 billion given to Central States as their bailout — that is an outright gift.

I hope they manage it well.