Alternative Assets in Public Pensions: January 2024 Update

Public plans continued to increase their asset risk,

Liz Farmer’s post at Long Story Short from a few days ago reminded me:

I hadn’t updated my graph of public pension plans’ allocations to alternative asset classes recently!

Public Plans Allocation to Alternative Assets

I will link to older posts on this subject at the end of this, but let me be clear about what is considered “alternative” assets … actually, it would be easier to indicate what is not considered alternative first:

publicly-traded equities

publicly-traded bonds and similar fixed-income securities

cash

That’s it for “core”, traditional investments.

My data come from the Public Plans Database, and I grabbed it today.

The types of assets considered “alternative”:

private equity

real estate

hedge funds

commodities

assorted alternatives/other

So let’s see how it shakes out:

Observations:

There is a non-trivial number of plans that allocate 0% to alternative asset classes

However, the bulk of the allocations have been rising, especially, post-financial crisis of 2009, which would seem odd. It has been steadily increasing, 25th percentile, median, and 75th percentile…

But the scariest bit are the plans with the very high allocations to alternative assets. What is going on there?

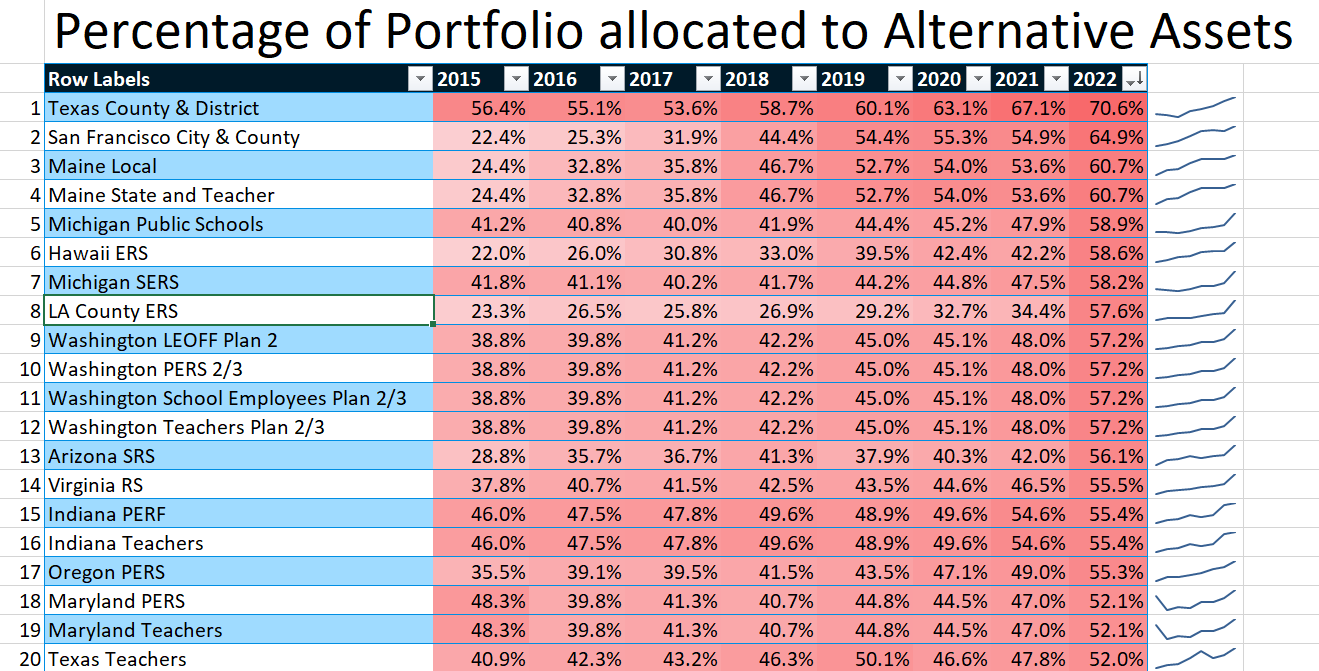

Public pension plans with the highest allocations to alternative assets

In just looking at the plans with the highest allocations to alternative assets, one gets a few odd patterns:

First, you have to deal with the aspect of shared assets management. I assume that the reason Main Local and Maine State and Teacher have the exact same allocations is that they have pooled assets. That’s not unusual in state pension systems.

That said, I see a few very weird patterns - in particular, some relatively low allocations to alternatives jumping up to very high allocations very quickly. What the heck, LACERS?

LA County ERS: A Quick Look

So the one I thought looked weird was LACERS jumping up from 34% in alternatives in FY2021 up to 58% in FY2022.

So I decided to go to the LACERS page at the Public Plans Database.

That the hedge fund allocation went up sharply in 2022 might have been a deliberate choice to put more money in the hedge funds. Sure, it could have been a capital gain in the value, but I think that’s not the case.

The drop in the value of public equities and fixed income was almost definitely driven by the economic environment.

Economic Environment: It’s Not Always a Choice of Allocation

What was going on in 2022 specifically was a huge run-up in interest rates, which pushed fixed-income investment investment values down (the red line).

At the same time, public equities were down.

So the LACERS situation is one where it seems pretty clear — it doesn’t seem like LACERS explicitly was stepping up to a higher alternatives allocation per se, but that the core asset classes had lost value….

…and, frankly, many alternative assets are difficult to value until you cash out. So the value they carry on the books are what you say they are.

Until they aren’t.

So a lot of balance sheets may show over-valued alternative assets, and thus the relatively high allocations.

That’s not a great story.

Spreadsheet

Related Posts

May 2023: Choices Have Consequences: Public Pension Investments in Alternative Assets

May 2021: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

2018: Alternative Assets and Pension Performance: A Dive into Data

2017: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? Has It Paid Off?

2014: Public Pensions Watch: Don’t Go Chasing Waterfalls….or Alternative Asset Classes, pt 1 of many

August 2014: Public Pensions Watch: Dallas Pension Learns About Concentration Risk

September 2014: Public Pensions and Alternative Assets: Dallas Shows How It Can End

2017: Public Pension Assets: Our Funds were in Alternatives, and All We Got Were These Lousy High Fees

2015: Reddit-Public Pension Connection: Alternative Assets and Risk

2014: Public Pensions Watch: More Reactions to Calpers Pulling Out of Hedge Funds

2014: Public Pensions Watch: Alternative Assets, pt 8 of many — New Jersey followup

WOW. These are not small, rinky dink little plans that are diving into alternatives....