Taxing Tuesday: Meep Files 2023 Taxes -- plus art! Because of tax breaks!

Also: mansion tax in LA and NYC tries to milk the Wall Street Cows

Continuing my annual observance, though I am later than usual this year — I have had a tough first quarter, and didn’t get around to filing my 2023 taxes til yesterday.

Here’s last year’s entry:

Taxing Tuesday: Meep Files Her Taxes and How to Measure Tax Increases

It’s been a long day. At the butt crack of dawn, one of these “cute” tree rats was skittering across the curtain rods in the library adjoining my bedroom: If you want the whole saga, you can read the short form on Twitter or the long form on Facebook

Here’s my updated graph:

Yes, I have a kid who has gone to college, and I’m grabbing the tax credits I can.

Obviously, this is just a piece of my tax picture - there’s the payroll taxes, the sales taxes, the property taxes, and not even including the state income taxes from both CT and NY above.

It’s simpler just to track the federal tax, and you can see there has been some fluctuation in total rate.

Let’s go take a look at a few other tax tales.

Los Angeles: tax tall tale? Beware the comparison

Great weather, showbiz, etc. — don’t you think a mansion tax would reap great rewards for the government of LA?

Leslie Eastman at Legal Insurrection has the analysis: ‘Mansion Tax’ Slaughters LA’s High-End Real Estate Market

Legal Insurrection readers may recall that in the fall of 2022, Los Angeles voters passed a referendum in the city of Los Angeles for a “mansion tax” that would impose a new transaction tax on any real estate sale in excess of $5 million. The measure passed with nearly 58% of the vote, and owners of luxury homes were selling their properties as quickly as they could to avoid being hit with….a success penalty.

Now it is being reported that luxury house sales plummet have subsequently plummeted 70% in the first year since this tax was enacted.

….

Luxury sales in nearby cities have slowed, but not nearly at the same rate, according to data from the Multiple Listing Service.

In Beverly Hills, single-family sales dropped 24%.

In Santa Monica, single-family sales dropped 29%.

In Malibu, single-family sales dropped 28%.

The real estate drop in the area may be due to a variety of reasons, but a 70% decrease is pretty hefty… but that’s probably because there was a quick sale before the taxes went into effect, so there was an artificial increase in sales for the period being compared against to begin with.

NY Post, March 2023: LA’s rich and famous in wild scramble to sell homes ahead of mansion tax

The real estate market might be cooling nationally, but among the multimillionaire set in Los Angeles, it has been red hot — so much so that some sellers are getting burned.

Sellers have been throwing in brand new Bentleys and McLarens and drastically slashing prices in order to incentivize a quick close.

That’s because a so-called “mansion tax” goes into effect Saturday in Los Angeles, adding a 4% tax for sellers on homes that sell for between $5 million and $10 million and 5.5% on amounts $10 million and above.

So yeah, if there had been an artificial bump up in sales in that market a year ago … yeah, of course there will have been a fall.

I’ve had this happen during COVID times all the time, where I had to keep going back to 2019 for comparisons, because year-over-year comparisons were absurd when there had been deep drops or large increases in tax revenue, for instance.

My main point re: the LA mansion tax is that this is a tax that is imposed only when real estate is sold.

It’s a friction in the real estate market, and if it’s a thin market where only a few such properties are sold each year…

Some 366 single-family [luxury] homes were sold in the 12 months before April 1, 2023, versus 166 sold in the year since, according to the Los Angeles Times.

In a city as large as LA, that’s not very many homes to sell, either before or after the tax. The 366 in sales before the tax could have been a surge in sales to beat the new imposition of the tax. Celebs who barely used their LA pads could have decided to unload them.

This tax is very dependent on these transactions occurring and all the ones likely to occur in the next few years got cleared before April 1, 2023, they may have to be happy with the trickle of revenue they got.

That golden goose is dead, and they have to wait for another to toddle on by.

New York City plans to spend money that may have already wandered away

Nicole Gelinas at NY Post: As NY lawmakers bust the budget, cash-cow Wall Street is moving to greener pastures

As the Legislature slouches into its second week past the April 1 deadline to pass a $233 billion or so budget for fiscal year 2025, disagreements are over non-spending issues, such as housing, and whether to add spending.

Nobody is asking: Where does the money come from?

They should because New York’s cash cow — Wall Street — has been finding greener pastures.

….

The reasons the city and state didn’t have to cut spending during the pandemic were twofold: extraordinary federal aid but also extraordinary Wall Street revenues.

Wall Street has always made up a small fraction of state and city jobs — 2.1% and 4% of private-sector jobs, respectively.

But because of high salaries and bonuses — a half-million-dollar annual average — and New York’s high personal-income taxes, the industry makes up an outsized share of tax revenues.

As the comptroller notes, the state reaped $28.8 billion in tax revenues from Wall Street in fiscal year 2023 (when taxes on that record 2022 year were paid).

That haul represented a full 27.4% of state taxes — mostly paid in nosebleed personal-income taxes on bonuses and salaries, via the 10.9% state levy on top earners (and an additional 3.9% city level).

….

In a city and state economy supposedly on the upswing, the securities industry shed jobs in New York last year — with 5,200 jobs in the city, or 2.7% of industry positions, disappearing.

That might not be alarming by itself.

But nationwide, the industry grew by 3.4%, or nearly 30,000 jobs.

Put another way, the industry isn’t losing jobs; it’s moving them to other states.

It has been pointed out to New York politicians often that the work need not be done in New York.

And the various politicians, who like taking and spending the money, scoff and move on.

Some have taken stock (and bonds and derivatives and…) during the pandemic and have decided they’d rather be in Texas or North Carolina or even Florida, rather than deal with devolution to the “authentic” NYC of random attacks of women by mentally ill men, who are briefly arrested before being released to attack later the same day.

One of the tax boosts of NYC…

I left Wall Street in 2011, well before any of this crap. I just go in to visit the art from time to time.

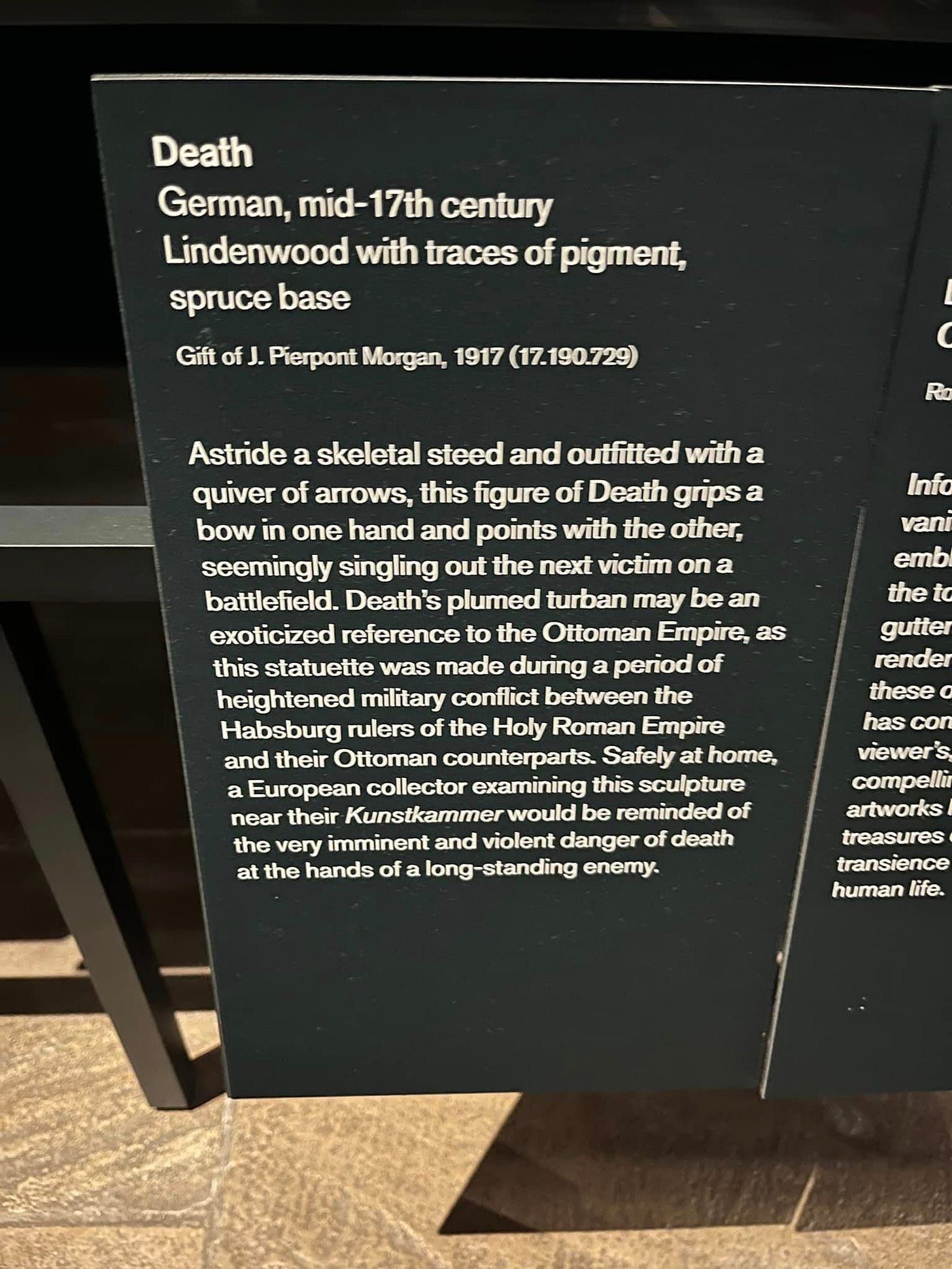

J.P. Morgan donated a lot of his art, and got quite the tax benefit, and he wasn’t the only New York potentate to so benefit: (I’m talking about the person, by the way, not the company).

and here is one of my favorite results from tax breaks:

It’s the Morgan Great Hall at the Wadsworth Atheneum. Yes, J.P. Morgan was involved in that, too:

This space is the centerpiece of the Junius Spencer Morgan Memorial building, a gift from J. Pierpont Morgan in memory of his father. On June 26, 1915, Morgan Great Hall—then called Tapestry Hall—was opened to the public, decorated with sculpture from the collection and tapestries on loan from J. P. Morgan, Jr., a museum trustee.

The museum’s soaring picture gallery now features a salon-style hanging of ninety five European and American works from the 16th–19th centuries, and includes works by artists such as John Singleton Copley, Frederic Lord Leighton, Constance Mayer, Giovanni Paolo Panini, Jusepe de Ribera, and Peter Paul Rubens.

The art there now is not only J.P. Morgan’s collection (anymore). There is still a LOT of J.P. Morgan’s collection in the Wadsworth (they kind of got the also ran stuff the NYC museums wouldn’t take, but the Wadsworth does have some good pieces).

Here’s the hall from the other direction:

The Wadsworth does have a professionally curated collection, but of course, during the Gilded Age, there were plenty of rich families, like the Colts (of the gun fame), who donated art to the museum.

Yes, the tax break (usually from estate taxes), would have been a boon to these families.

And now the public in general get to enjoy the art.

I pay for an annual membership (though yeah CONNECTICUT I pay plenty in taxes to y’all), but the museum is free admission to Hartford residents and kids (17 and under). Check it out!

"This tax is very dependent on these transactions occurring and all the ones likely to occur in the next few years got cleared before April 1, 2023, they may have to be happy with the trickle of revenue they got."

You don't appear old enough to remember, but the US instituted a luxury goods tax. From wikipedia:

"In November 1991, The United States Congress enacted a luxury tax and was signed by President George H. W. Bush. The goal of the tax was to generate additional revenues to reduce the federal budget deficit. This tax was levied on material goods such as watches, expensive furs, boats, yachts, private jet planes, jewelry and expensive cars. Congress enacted a 10 percent luxury surcharge tax on boats over $100,000, cars over $30,000, aircraft over $250,000, and furs and jewelry over $10,000. The federal government estimated that it would raise $9 billion in excess revenues over the following five-year period. However, only two years after its imposition, in August 1993, at the behest of the luxury yacht industry, President Bill Clinton and Congress eliminated the 'luxury tax' citing a loss in jobs. The luxury automobile tax remained in effect until 2002."

Stupid then, stupid now.

Congrats on keeping your Federal Income Tax at a reasonable level!