Taxing Tuesday: Bezos Moves Back to Florida, Thwarting Washington State's New Capital Gains Tax, Migration Stats Distorted by Pandemic Issues

As much as I'd love to blame taxes, sometimes other issues may be driving people away

Jeff Bezos, head of Amazon, is moving back to Florida, to be close to his parents … he says:

Isn’t that sweet?

Oh wait, who else has also moved to Florida?

What's happening: Ken Griffin, Illinois' wealthiest resident, last year moved the global headquarters of his hedge fund giant, Citadel, to Miami from Chicago.

Eric Schmidt, the former Google chairman and CEO, and his wife, Wendy, have been collecting waterfront homes on Miami Beach's Sunset Islands since at least 2020, with new purchases this fall.

“Collecting”. Ain’t that quaint.

In Ken Griffin’s case, we know he left for reasons other than to be close to parents:

Miller went on to ridicule Griffin’s statement that his decision to leave was driven in part by employees asking to relocate. “Yeah, it’s about the employees,” Miller wrote. Miller and others cynically ascribe Griffin’s decision only to the failing campaign of Richard Irvin for governor, who Griffin heavily supported. Employee concerns about crime, taxes, corruption, insurmountable debts and all the rest had nothing to do with it, they’d have us believe.

Illinois’ loss from Citadel’s departure is enormous. Griffin has personally donated roughly $1.5 billion during his residency in Illinois to a range of philanthropic causes. Over $600 million of that was in Chicago.

Griffin alone has paid more than $200 million in yearly state taxes in recent years, and huge tax sums no doubt have also been paid by his 1,000 Illinois employees, many of whom are very well paid. The Washington Free Beacon reports that Citadel employees have funneled over $1 billion to the state’s coffers over the past decade. See my colleagues’ separate article with more details on the impact.

In Bezos’s case, so far, it’s only him moving to Florida… but I can imagine others following him from Amazon. Why would they need to stay in Seattle? Especially since Washington State wants to hit them for capital gains taxes?

Killing that Golden Goose

Of course, everybody is pointing out that Bezos is just “coincidentally” leaving after Washington State’s capital gains tax law finally passed all legal hoops.

From March 2023: Capital gains tax ruled constitutional by Washington state Supreme Court

The Washington state Supreme Court ruled that a statewide tax on capital gains is lawful, allowing the legislation to move forward nearly two years after it was approved by lawmakers.

The central issue for the court was to determine whether the capital gains tax is an income tax or a sales tax.

In its opinion issued Friday, the court concluded that the capital gains tax “is a valid excise tax under Washington law.” Justices voted 7-2.

The capital gains tax made waves in the tech industry since it targets stocks, which can be a key part of compensation for workers.

The law imposes a 7% tax on capital gains of more than $250,000 from the sale of stocks and bonds, excluding revenue from real estate and retirement accounts, among other exceptions. It’s the first tax of its type in state history. The tax went into effect in January of last year and the first payments are due in April.

….

An estimated 7,000 households — the wealthiest in the state — are estimated to be affected by the capital gains tax law, according to Invest in WA Now. Roughly two-thirds of those households are in King County.

Some opponents of the tax say it poses a significant threat to Washington’s ability to attract business, and keep the state’s wealthiest residents.

This is a problem inasmuch they are counting too much on too few people.

I wonder what tax revenue comes from the loss of Bezos.

I notice that in this response article, the numbers moved: Washington state senator behind wealth tax proposal responds to Bezos’ departure

Frame said revenue estimates from a potential wealth tax in Washington state won’t change, as they already account for some degree of taxpayer mobility and avoidance behavior.

“Jeff Bezos is far from the only billionaire in Washington state,” Frame added.

Frame sponsored a wealth tax bill in the Washington state legislature earlier this year that would have triggered a 1% wealth tax on financial assets such as stocks and bonds, excluding the first $250 million.

Advocates of wealth-related taxes say it’s a way that Washington’s regressive tax laws can be altered to help low-wage earners. Washington does not have an income tax.

The wealth tax, which did not advance through committees in 2023, would have affected around 700 taxpayers in Washington state, including many who made their fortune in the tech industry such as Bezos, who has a net worth of around $160 billion.

Which is it — 7,000 or 700? Or is it 70? This is starting to be the incredibly shrinking tax base.

Ask Connecticut what it’s like trying to keep tabs on 8 billionaires… until you lose one.

But this particular line made me laugh:

“People move because of their families and because of jobs,” she said. “When I look at his announcement, I’m kind of reminded that Jeff Bezos is a human being like everybody else.”

He happens to be a human being with the command of billions of dollars, which gives him quite a few more choices than many others. He could fly on private jets far more often than most people. He has all sorts of options.

I can believe his current girlfriend prefers Miami over Seattle, but I can also believe he’s had his “family office” folks do some personal finance optimization give him some advice… and telling him that Miami is a good idea.

Tax Migration Stats — Pandemic Distortions

I know this is rich coming from somebody living in one of the highest-taxed areas in the country (Westchester County in New York), but hey, let’s look at what’s been going on with the Tax Foundation’s look at taxes and U.S. net migration between the states.

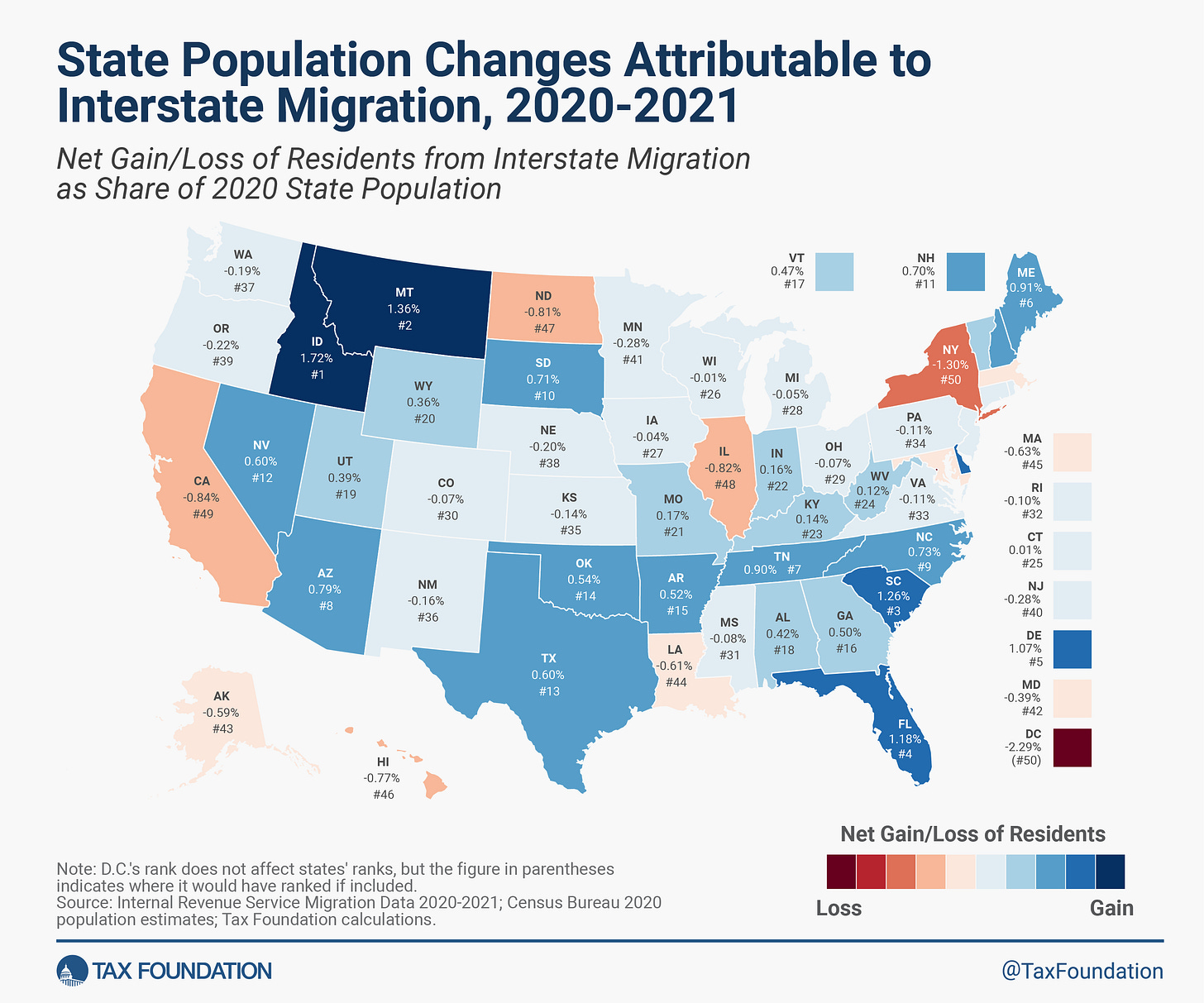

This is based on IRS data to calculate net migration, and Census data to calculate percentages.

This is showing how people moved during the pandemic. All sorts of things are going on here. It’s not just a matter of taxes — it’s also whether there is any point of being in the location.

So the largest percentage decrease we’re seeing is for DC — with little chance for in-person lobbying, why be in DC? The people who could leave, did.

New York was next after DC, and that was probably mostly driven by all the people leaving NYC. Many people in the city had weak ties there — a few of my friends left. Some weren’t American and went back to the countries they were from, originally. NYC was a bummer in 2020, and not much better in 2021.

California, with its over-the-top restrictions (but also a similar dynamic with many out-of-state migrants to places like LA and SF), also repelled. Illinois has Chicago to blame, I suppose.

I have no idea what’s going on with North Dakota/South Dakota.

Let me quote from the Tax Foundation piece:

The IRS data also show interstate migration broken down by AGI level. Among taxpayers with $200,000 or more in AGI, the top destinations for inbound interstate moves were Florida, Texas, North Carolina, Arizona, and South Carolina. Meanwhile, the states that saw the largest losses of taxpayers with $200,000 or more in AGI were California, New York, Illinois, Massachusetts, and New Jersey. Several of the states losing higher-income taxpayers, especially New York, California, and New Jersey, have highly progressive tax codes under which tax liability rises steeply with income. States that structure their tax codes in this manner have consistently lost higher-income residents to lower-tax states, and not only the residents, but also any associated tax revenue and entrepreneurial activity that goes along with them. Interestingly, New York. with its top marginal income tax rate of 10.9 percent, had a net loss of 27,341 affluent residents, while Florida, one of the states with no income tax, had a net gain of roughly the same number of wealthy taxpayers, namely 27,567.

Sometimes taxpayers choose to move to a lower-tax state at least in part to reduce their own tax burden. But even those who do not consciously select for lower taxes may be doing so indirectly when they prioritize job opportunities and other factors related to the state’s economic competitiveness.

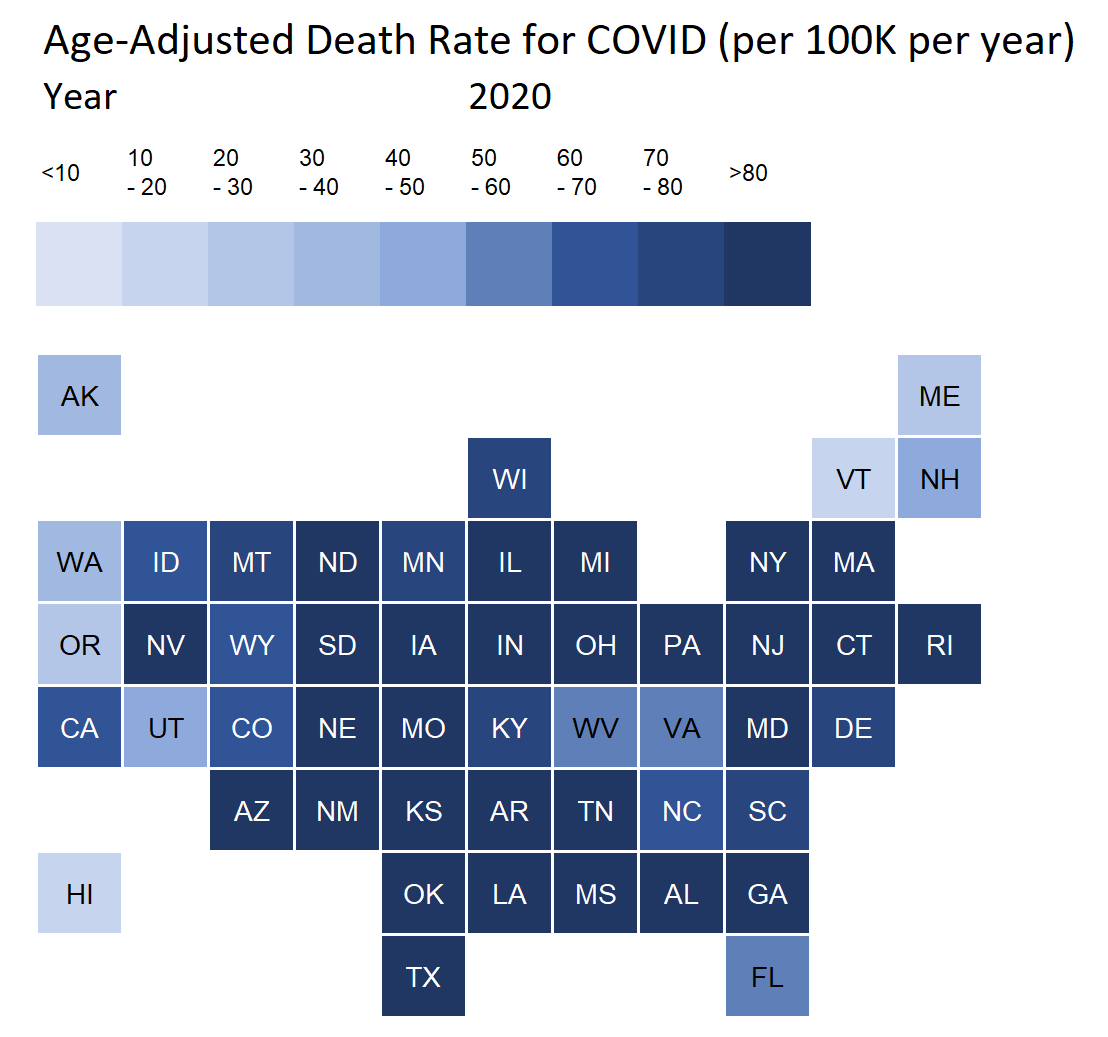

So let me remind everybody what was going on 2020-2021:

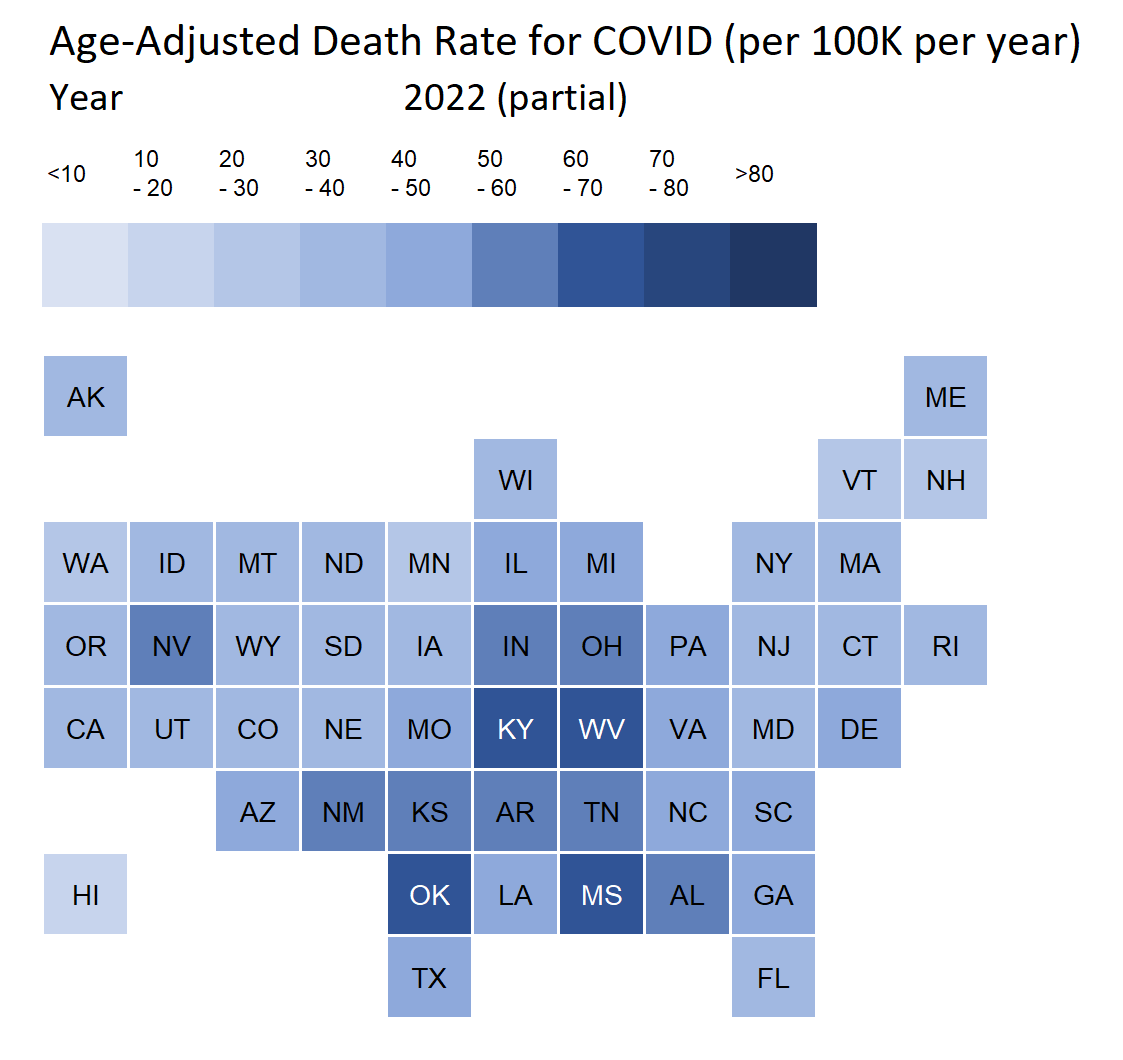

Versus 2022:

I don’t know where the Tax Foundation folks live and work, but I’m a New Yorker, and I love NYC… for the things it can give me. But it could not give me those things during the pandemic years of 2020-2021.

I couldn’t go brunch, I couldn’t go to the museums, I couldn’t do any of my fun stuff in the city! The whole point of being in or near the city is the benefit of the great cultural stuff you may not have opportunities to have elsewhere.

I can imagine many people who rented in places like Chicago and NYC, and were now being required to work remotely, decided “Screw it, I can’t go to the fun places anyway - I may as well move to Florida.”

It need not even require wanting lower taxes — just preferring sun.

The question is whether people move back once the pandemic is over.

(The pandemic seems to be over.)

There is a problem in terms of the number of people and which people.

This IRS-based study is only looking at income moved around…. but a lot of these states and localities have their revenue based not on state/local income taxes. As we know, Florida and some other states don’t have income taxes at all. Some are very dependent on property taxes. Others have fairly high sales taxes.

And as, I’m in New York, all our taxes are high.

Huzzah.

Water flows along the path of least resistance. So does wealth?