Public Pensions April Update: Assets Edition - Tesla, Tariffs, and Earth Day

Looking back two months... it seems like two decades ago

It’s been a while since I’ve had a general public pension round-up… so let me just jump into it!

Teachers Union Against Tesla Stock in Public Pension Funds?

2 Apr 2025, P&I: American Federation of Teachers urges public pension funds to seek Tesla stake review

A national teachers’ union is urging public pension funds to ask their money managers how they will safeguard retirement assets given the steep plunge in Tesla shares this year.

Let me give you the press release from over two months ago:

2 Apr 2025, American Federation of Teachers: AFT’s Weingarten Calls on Chief Fiduciary Officers to Examine Tesla Investments

Today AFT President Randi Weingarten sent a letter to more than 75 state and city chief fiduciary officers who oversee most major U.S. public pension funds, telling money managers to urgently review their current holdings in struggling electric-car maker Tesla. Pension fiduciaries are charged with preserving retirement security for millions of AFT members, including teachers, nurses and other workers. Tesla stock makes up a material portion of those funds’ investments.

Tesla’s first quarter production and delivery report, released today, shows a devastating decline in demand for the carmaker’s vehicles in the U.S., in line with disappointing European results released Tuesday. The data point to a larger trend: a share price divorced from the business’ weak fundamentals. Tesla stock has dipped by roughly 30 percent so far this year, a 40 percent drop from its all-time high in December 2024. The firm’s market capitalization has nearly halved, from $1.5 trillion to roughly $800 billion, over the last three months.

The AFT’s letter requests that state treasurers and comptrollers ask asset managers to assess their Tesla holdings and demand the company share information about billions in outstanding corporate loans partly secured by embattled CEO Elon Musk’s 13 percent stake in the company. At the end of 2024, public records showed Musk had pledged more than 230 million Tesla shares as collateral for unspecified loans, with no disclosure over the price at which he would face a potentially ruinous margin call.

The letter was sent to state treasurers and city comptrollers across the country, including stewards of heavy hitters such as the California State Teachers’ Retirement System, the Teachers’ Retirement System of the City of New York and the Chicago Teachers’ Pension Fund.

In February, Weingarten wrote to leading U.S.-based financial managers BlackRock, Vanguard, State Street, T. Rowe Price, Fidelity and TIAA, warning that her members’ exposure to tens of billions of dollars in Tesla stock in their portfolios presented an unacceptable retirement risk. AFT members participate in pension funds totaling an estimated $4 trillion. To date, none of the managers have replied.

“Today’s precipitous drop in Tesla sales increases the retirement risk to plans that millions of nurses, teachers and other workers are invested in,” said Weingarten. “Our members’ right to retire with dignity and grace after decades of service to families and communities is paramount. It’s why we were bitterly disappointed in the initial lack of response from asset managers, and why today we are urgently asking chief fiduciaries to demand additional and immediate clarity.”

Yes, none of the managers have replied, because no single name stock should be a huge portion of any portfolio, for one.

Here is the April 2, 2025 letter.

And the February 27, 2025 letter. And accompanying press release.

Was she providing a review for all the stocks in the S&P 500? Just wondering.

Here, have a recent snapshot of Tesla stock:

Did I say recent? I mean, the historical record going back to when they went public in 2010.

Which reminds me. Public pension funds are supposed to be long-term investors. Tesla is a volatile stock and also hasn’t been around very long. A public pension fund would hold it among hundreds of other names, if the fund were sizable enough.

Public pension funds shouldn’t be churning their portfolios. I will be going over some coverage of the recent tariff-spurred volatility, and the various public pension fund managers noted that they are in it for the long haul and would not need to sell to realize losses…. (but we shall see).

In any case, no, the professional managers are not going to be responding to a third party who is not the principal/client. In case you were wondering about professionalism issues.

Trump Tariffs and the Pension Fund “Losses”

Yes, scare quotes… though some of the funds may actually have lost money, and the reason would not be complimentary to the people who decided on contributions to the funds. But more on that in a bit.

I decided on this story as an example:

8 Apr 2025, Providence Journal: Trump's trade war took a bite out of RI's state pension fund. Here's how much has been lost.

The Rhode Island pension fund has lost roughly $500 million of its value since President Donald Trump launched his trade war, according a top aide to state General Treasurer James Diossa.

While the plunge in value presents no immediate danger to the state's commitment to pay retired public employees across the state their anticipated benefits, Diossa's policy and intergovernmental affairs director, Robert Craven, told The Journal the greater threat is a "prolonged economic decline."

"The market has had an overwhelmingly negative reaction to President Trump’s decision to implement sweeping tariffs and provoke a trade war," Craven said Monday, after the close of the stock market.

"As a result, the value of the state pension fund has declined approximately 4.5% so far this month, about a $500 million reduction, from an estimated $11.5 billion to about $11 billion in total assets," he said, with first-quarter earnings still being finalized.

At the end of this subsection, I will accumulate all the Trump tariff-related public pension stories that I have outstanding.

This piece is actually quite responsible in noting that the while the market value of the fund has dropped for the moment, it doesn’t actually mean much for the long term. Note how I keep emphasizing the long term.

Because most public pensions can ride out short-term market volatility, as long as they’re not forced to sell for needed liquidity, that is, as long as the cash flow needs to pay benefits are fine without being forced to sell assets, they don’t actually realize the losses.

I know this can be very abstract if you’re not in finance and don’t deal with this sort of thing often. This sort of thing is my regular job, so it’s easier for me to be dispassionate about it. But when I’ve looked at what individuals actually do (in the transaction files), a lot of individuals do panic in times of market volatility and sell assets at the worst time and do realize those losses.

But, in general, institutional investors like pension funds don’t.

Except in special conditions, such as being deeply underfunded and needing to sell assets to cover benefit needs.

Back to the Rhode Island story:

The most immediate impact in Rhode Island is likely to be felt by the retirees who have been fighting to win back the annual "cost-of-living" increases that were pared back during the dramatic 2011 cost-cutting pension overhaul championed by then-state General Treasurer Gina Raimondo.

The Rhode Island pension problems were some of the earliest non-Illinois public pension problems I blogged about, pre-STUMP. They were extremely stressed.

There were benefit cuts, specifically of automatic COLAs (cost-of-living adjustments) for retirees. Those haven’t been fully restored.

They sound modest, but as they compound, for deeply underfunded pensions, a benefit that compounds is a real no-no.

Last year, the retirees demanded "immediate reinstatement of [an] annual 3% compounded cost-of-living allowance for all retirees regardless of retirement date," using whatever steps are necessary to pay for it, including the issuance of a "pension obligation bond."

I’m not a fan.

Anyway, Rhode Island isn’t doing well there.

“We’re better than Illinois” is not a great selling point, and that not-great 60% funded ratio would drop hugely if an auto-COLA were put back in.

But back to the point: the funds that will have been especially screwed by Trump-induced volatility are the ones that can barely deal with any volatility because they’re going to be sucked into an asset death spiral.

They have been grossly underfunded, and they don’t have enough contributions to cover benefit cash flows, which means they have to sell off assets. That means realizing losses.

To nobody’s surprise, at least those who know both theory and practice, those following worst practices in dealing with public pensions are the ones most likely to be forced to eat asset losses.

Separately, many of the stories coming out said certain amounts of money lost due to tariff fooforaw…. except, none of it was real, unless there were actual transactions.

I do understand these folks in media, whether industry (finance, insurance, pensions) or general news, need eyeballs every day, so they’re going to say “$200 billion lost!!!” when it’s just numbers on paper, and there was no actual cash for goods/services realized and lost. It’s all change in unrealized losses/gains.

For extremely volatile securities, it’s only a “loss” loss if you lock it in via a transaction.

Obviously, I’ve been pretty busy with other things these past 2 months, so wasn’t able to write about this until now. Other tariff news have happened since then, and since my viewpoint on pensions tends to be on the order of decades (I started blogging on this around 2008, elsewhere), 2 months is just a spit in the ocean.

Let’s see what the market has done since April:

Yes, if you were forced to sell in the dip, you would have realized losses, most likely. If you didn’t have to trade anything, the current market conditions are at about the same place as the end of February.

(Currently.)

It’s just numbers moving up and down. For funds that are supposed to exist indefinitely, not being able to deal with short-term market volatility would be strange. It’s more media and politicians trying to gin up stories than anything else.

Also contrast this with the hyperventilating from the AFT about Tesla stock values.

Hmmm.

Tariff & Pensions Stories

7 Apr 2025, NY1: Councilmember says pension funds are secure amid market volatility

11 Apr 2025, AOL/Independent: Has your pension value dropped due to Trump’s tariffs? Here’s why you shouldn’t worry

16 Apr 2025, P&I: NYC comptroller: Pension funds can handle short-term volatility from 'chaotic' tariffs but warns of long-term harm

4 Apr 2025, al.com: How badly will Trump’s tariffs hurt Alabama’s multi-billion dollar state pension funds?

9 Apr 2025, ai-CIO: Largest Public Pension Funds Lost $169B During Tariff Rollout

16 Apr 2025, ai-CIO: Public Pensions Tout Long-Term Investing Focus Amid Market Volatility

7 Apr 2025, WSJ: Market Losses Wallop Pension Funds

8 Apr 2025, Lost Coast Outpost: California’s Big Pension Funds Lost Billions in Stock Market Selloff. Can They Recover in Time?

NYC Still Looking at Climate Factors for Investing

Or, rather, NYC Comptroller Brad Lander is. Of course, he made his press release on April 22, Earth Day:

As Trump Assaults Climate Progress on Earth Day, Comptroller Lander Pushes Forward Toward Net Zero

I will quote the part that has to do with public pension funds:

Under the funds’ Net Zero Implementation Plan, adopted when Comptroller Lander took office in 2022, public markets asset managers were already required to submit a Net Zero plan to the Comptroller’s office by June 30, 2025. Today, Comptroller Lander announced the strong standards by which his office will evaluate those plans – and made clear that if asset managers do not submit sufficient plans, he will recommend that the boards put those managers’ investment mandates out to bid.

….

Net Zero Update

In 2022, when Lander took office, he proposed and the three pension fund boards adopted the boldest Net Zero Implementation Plan of any large public pension funds in the country, with the goal of achieving Net Zero emissions by 2040. The plan includes strategies to disclose fossil fuel emissions, strategically engage asset managers and portfolio companies to push for decarbonization, dramatically scale up investments in renewable energy and climate solutions, and divest from companies where other strategies failed to reduce risk. The plans required that public markets asset managers submit net zero plans to the Comptroller’s Office by June 30, 2025.

Last month, Comptroller Lander announced that the City’s pension systems collectively achieved a 37% reduction in greenhouse gas emissions & surpassed their climate solutions interim goals one year ahead of schedule.

Today, in a public announcement and a letter sent to the funds’ asset managers, Comptroller Lander set forth the standards by which public markets asset managers’ net zero plans will be evaluated. The minimum asset manager requirements include:

Engage portfolio companies to drive real economy decarbonization, not just portfolio decarbonization

Incorporate material climate change-related risks and opportunities in investment decision-making

Ensure a robust and systematic stewardship strategy that addresses prioritization and escalation of engagement and voting to advance decarbonization.

Managers should set expectations for all portfolio companies to, at minimum:

Measure and report Scopes 1, 2, and material Scope 3 emissions

Set clear goals to reach Net Zero by decreasing their scope 1, 2, and 3 emissions

Adopt a clear transition plan to achieve Net Zero detailing how the company will meet its short-, medium- and long-term climate goals

Align future capital expenditures and lobbying with climate goals and targets

Consider the impacts from transitioning to a lower-carbon business model on workers and communities .

Comptroller Lander would recommend that the Boards put out to bid the investment mandates of any public markets managers that submit inadequate plans that do not meet the Boards’ standards or do not submit plans at all by the June 30 deadline the Boards set for their managers in 2023. Any bidding process would proceed according to the Public Procurement Board (PPB) rules. In any future procurement, Comptroller Lander’s office will rigorously evaluate managers’ climate and stewardship practices against these standards, as part of their due diligence presented to the Boards.

And yes, on the original page, the numbering is “1. 1. 1. 1.” etc. Somebody screwed up the encoding. The actual pdf letter gets the numbering correct.

So, supposedly, this is to provide superior returns for these funds, correct? In the letter itself, Lander claims:

Yet we know that climate risk is financial risk—we have all watched as unprecedented wildfires, extreme flooding, and dangerously hot temperatures have wreaked havoc around the globe, and caused over $2 trillion in losses.

Of course, in some of these cases, like wildfires, proper forest management could have mitigated wildfire risk. That’s separate from any climate risk that normally makes the desert-like areas of California, say, more prone to tinderbox conditions. Especially when they don’t do managed burns or require people to maintain property appropriately.

Flooding is another situation as well….

22 Apr 2025, Sierra Club: Asset Managers Under Pressure To Do Better On Climate As NYC Pension Lobs Threat

New York City Comptroller Brad Lander announced today, April 22, on Earth Day, that New York City’s pension funds NYCERS, TRS and BERS have set the standards by which the pensions will evaluate the net-zero plans that their asset managers, including BlackRock, are required to submit to the pensions by June 30. Failure to submit plans that meet the pensions’ standards would result in the pensions looking to other firms to manage their investments. Read more in the NYC Comptroller’s press statement.

The move comes just two months after one of the UK’s largest pension funds, The People’s Pension, withdrew $37 billion (£28 billion) from asset manager State Street, criticizing the asset manager for pulling back from sustainable investing initiatives due to increased political pressure after President Trump’s election. That move far exceeded moves by public pension funds in Texas and other Republican-led states to withdraw $13.3 billion from BlackRock after erroneously accusing the asset manager of boycotting fossil fuel investments, a claim BlackRock has disputed.

The thing people forget is the whole principal-agent issue.

Asset managers are there to do the will of their clients.

Asset managers will pull out of climate initiatives if their clients don’t want them … or will pursue them, if their clients want them. It’s that simple.

Thing is — Brad Lander is not supposed to be the ultimate client (though he is, of course, the one choosing any asset managers for NYC funds at this time.)

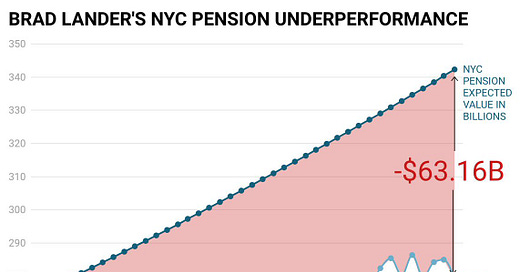

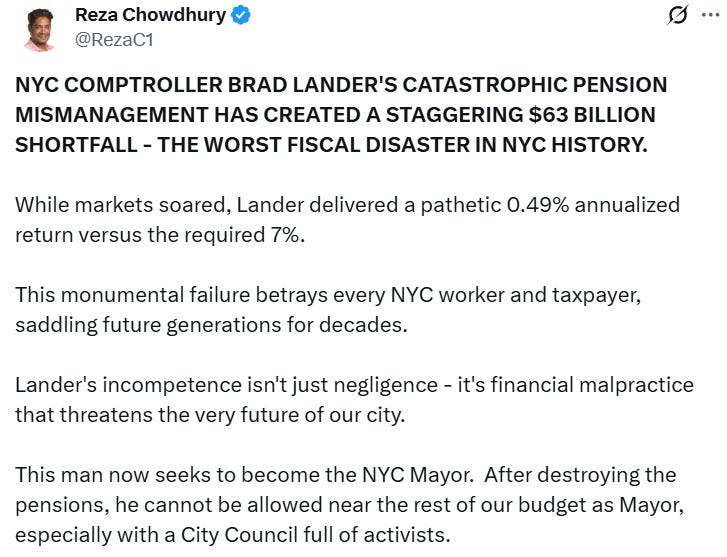

The funded ratios of the NYC pensions are not horrible, but not fabulous, and the fund performance….

I, of course, dispute that 7% should have been expected. But this is Reza’s opinion, and focusing on goals other than financial strength does not look good.

Lander does argue that climate risk is one of the most substantial risks in the portfolio… but it seems to me that other ones loom larger, at least for the lifetime of the cashflows he has currently.

FWIW, Lander has been upstaged by leftier leftists on the NYC race for mayor, so I think he has to sit this one out.

Leftover Links

29 Apr 2025, Governing, Girard Miller: It’s Checkup Time for Public Retirement Plans

22 Apr 2025, Wealth Management: The Increasing Role of Alternatives in Public Pension Plans

16 Apr 2025, WRAL: NC lawmakers pump the brakes on investing state pensions into Bitcoin

22 Apr 2025, ESG Today: New York State Pension Fund Commits $2.4 Billion to Climate Investment Strategies

16 Apr 2025, WSJ: Maine State Pension Lawsuit Highlights Private-Markets Disclosure Debate

16 Apr 2025, Pew: Increased Risk, Complex Investment Landscape Require Prudent Pension Management Practices

15 April 2025, Yale Climate Connections: Can your pension withstand climate change?

15 Apr 2025, City & State NY: Are New York’s biggest pension funds investing in Elon Musk?

What are they (fund managers) expecting to happen when the last of the boomers retire? A zero point anything return gets someone fired.