Pensions Round-Up: ESG, Skipping Payments, Technological Debt, and More!

Whose Money Is It Anyway?

Let’s jump right into it!

ESG Issues With Public Pensions

12 Dec 2024, ai-CIO: Ohio Passes Bill Barring State Pension Funds, University Endowments From Prioritizing ESG in Investing, Stakeholder Activism

A bill passed in Ohio seeks to limit the state’s five public pension funds, the workers’ compensation bureau and university endowments in the state from perusing investments influenced by social and environmental policy. Ohio Senate Bill 6, passed on Tuesday, will also aim to ban funds from engaging in shareholder activism.

The bill passed in the Ohio Senate in May 2023, by a vote of 26 to 7. The House passed the bill on Tuesday, 62 to 27, and it now awaits a signature from Ohio Governor Mike DeWine.

The bill cites the fiduciary duty of the governing boards of the pensions, compensation bureau and endowments and requires them to “make investment decisions with the sole purpose of maximizing the return on its investments.”

It goes on to order that each of the named funds’ boards “shall not adopt a policy, or take any action to promote a policy, under which the board makes investment decisions with the primary purpose of influencing any social or environmental policy or attempting to influence the governance of any corporation.”

Okay, that last bit is somewhat foolish.

Poor corporate governance can lead to all sorts of bad results. You want to influence corporate governance as a large investor. It will affect the value of your investment!

I can give all sorts of examples — in terms of corporate governance with poor alignment with investors when you get management capture. (aka the good ole principal-agent problem.)

You want to influence how the top executives are compensated (that’s governance). You want to influence how the board of directors, especially outsider directors, are selected (that’s governance). You want to make sure that interests are aligned and that you don’t get, say, a bunch of people snowed by a charismatic CEO in an area they know nothing about.

Perhaps the bill is well-written to distinguish between corporate governance issues affecting investment value and politicizing the investment. Perhaps.

It sounds like the public employee unions are skeptical:

The legislation faced pushback from labor groups, including the Ohio AFL-CIO, the Ohio Federation of Teachers and AFSCME Ohio Council 8.

“To do right by Ohio’s retirees, pension fund managers must consider all potential risks,” said Frances Sawyer, founder of environmental research and policy firm Pleiades Strategy, in a statement. “This bill limits their ability to do so and prevents them from upholding their fiduciary duty to protect the hard earned retirement savings of the teachers, firefighters, sanitation workers, and all the public employees who keep states running.”

Of course, these groups may be seeking goals other than maximizing returns, seeking to maximize their unions' power.

It’s principal-agent problems all the way down.

More ESG-related pension items:

3 Dec, Politico: Checking in on Jersey’s pro-Israel pension law

17 Dec, Harvard Law School Forum on Corporate Governance: The New Battleground in the Fight over ESG’s Role in Public Pension Investments: The Courtroom

17 Dec, NAIC press release: NAIC Study Reveals Systemic Barriers in Pension Fund Investments for Diverse-Managed Funds

17 Dec, ESG Today: Indiana to Replace BlackRock in Pension Funds Due to ESG Investing Policies

16 Dec, Indiana Capital Chronicle: Pension board votes to remove BlackRock due to ESG violations

1 Dec, High Country News: Is your pension fund liquidating Oregon’s forests?

13 Dec, P&I: San Francisco pension fund updates ESG policies, adds fossil-fuel companies to restricted investments list

Fixing Budgets by Skipping Pension Payments

Before I start quoting these: IT IS A BAD IDEA TO “FIX” BUDGETS BY SKIPPING PENSION PAYMENTS

I will elaborate after quoting.

9, Dec 2024, Pillar Catholic: Washington archdiocese aims to tackle multi-million dollar deficit

In a bid to fill a multi-million dollar annual operating deficit, the Archdiocese of Washington has announced a sweeping reform of its parish assessment system which would make all donations and parish income, even previously restricted gifts and grants, liable to diocesan taxation.

….

According to several priests in the archdiocese, those meetings took place over several weeks in November and early December, at which archdiocesan chief financial officer Liam O’Connor explained that the archdiocese had been operating with a multi-million dollar annual deficit for years, which had further ballooned after the Theodore McCarrick scandal in 2018.

….

“Everyone was pretty shocked about the state of the deficit, and a lot of guys are now worried about the pension fund, too, even though we were told it is fine.”

….

According to Cardinal Gregory’s letter, among the cost-cutting measures adopted by the archdiocese, with the support of the priest council and the college of consulters, are reductions to contributions to both the priest retirement fund and the lay retirement fund — both of which the cardinal said are “fully funded.”

“The contribution to the fully funded Priest Retirement and Special Health Care Fund will be reduced by 50% while still potentially allowing for increased benefits,” Cardinal Gregory said in his letter.

According to several priests in the archdiocese, O’Connor explained at several deanery meetings that the priests’ pension fund was found to be in better financial health than previously thought because of outdated “assumptions” used to calculate its funding and liabilities.

“Basically, the fund was being looked at as though every priest was going to be retired as of their 70th birthday and immediately taken off any parish budget,” one priest told The Pillar. “Obviously that’s not true, 75 is the new 70 at least, and a lot of guys expect to carry on living in parishes and doing some kind of ministry even if it’s at a slower pace — we all know that. But even so, you see a 50% reduction in the [archdiocesan] contribution and you worry.”

This is the most recent publicly-available financial report, which has information as of June 30, 2023. All reports are here: https://adw.org/about-us/who-we-are/financial-reports/

This is the high-level graphic on the retirement funds:

To be fair, compared to public pensions, these look outright sunny.

HOWEVER.

Here is the other bit:

Check the inflows and the outflows numbers. If the inflows are halved, approximately, what is going to happen here?

I don’t have the full actuarial workup to see what the contributions should be, but the outflows are larger than the inflows, I know what is going to happen.

Then there is the lack of backstop for church plans, for either priests or laypeople. Church plans (which both the priests’ and laypeople’s pensions are) are not covered by ERISA. So, if they ever run out of cash from the pension fund, the PBGC doesn’t step in.

More here:

They have that in common with government pension plans, but they also don’t have the taxation power of the government. Sure, this is the Diocese that encompasses D.C., and it’s about “taxing” the parishes there for diocesan purposes… but Catholics aren’t forced to contribute to parishes in the U.S., and we can just wander away, like the sheep we are.

A 50% cut in contributions to the pension funds sounds arbitrary and extremely imprudent.

My comment on the Pillar Catholic piece:

This is the move that so many state and local governments did when the squeeze was on in recessions. They’d cut the pension contributions as an easy budget “fix” — “We’ll make it up when times are good!”

The core problem, of course, is that the normal cost of pensions is an operational cost and is part of employees’ total compensation.

Let’s try this on for size: “We’ll close the budget gap by not contributing to the 401(k)s! We’ll make it up when times are good!”

That is completely illegal in the private sector.

You promise a benefit for employees’ services, you are not allowed to short-change them. You have to pay them when the service is rendered. Even when it’s a deferred benefit — ERISA forced this for the protection of employees.

Unless you work for the government (or a church).

Technical debt is another kind of pension debt

22 Nov 2024, Colorado Sun: Colorado PERA budget calls for 20% jump in spending to modernize its benefit system, even as state pivots toward austerity

Colorado’s public pension board last week agreed to a 20% increase in the Public Employees’ Retirement Association’s budget in order to hire dozens of new staff and begin a yearslong update of the antiquated computer systems it uses to manage retiree benefits.

PERA’s staff insist the large budget increase, which calls for an eye-popping 70 new employees, is badly needed and long overdue. Most of the new workers will help begin modernizing the pension’s administration system, which manages the payroll, benefits and personal data of its 700,000 members.

But the spending surge comes at a difficult time for public sector finances in Colorado. Lawmakers are looking to make $1 billion in spending cuts to the state budget, ushering in a new era of government austerity after years of growth that could have wide-ranging consequences for the public and private sector entities that provide state-funded services.

The computer system PERA uses to track and pay out benefits is 40 years old — the oldest still in use by any public pension in the U.S., said Andrew Roth, PERA’s executive director. The system is so ancient, PERA has a hard time finding workers who know how to use it; those who do are nearing retirement, and younger workers are no longer taught it in school or in training with other employers.

This is the problem of never budgeting for upgrades over the decades, to look cheap in one’s operations year-after-year until the maintenance costs just become way too large… and you’re forced to upgrade.

And that’s really expensive.

Long-term budgeting is not rewarded in government, not really. It’s not your money — it’s the taxpayers’ money! (See principal-agent problem above.)

If you are rewarded for keeping the short-term costs down, guess what happens?

Do you know what also is 40 years old? (No, not me. I’m 50 — just like ERISA!)

Excel!

Guardian: Microsoft Excel’s bloopers reel: nearly 40 years of spreadsheet errors

Okay, that a technology has been around for 40 years is not much of anything. Excel has been changing over those 40 years, and perhaps this particular governmental system has not had (m)any changes.

Back to the Colorado Sun story:

PERA’s board approved a $400,000 increase — a 3% bump — to its $13.1 million budget for employee performance bonuses, which investment staff qualify for if they hit their annual benchmarks. PERA tends to hit its investment benchmarks more often than not, according to staff reports, even as the pension’s path to full funding remains tenuous.

The hiring spree marks a shift for an agency that has long prided itself on limiting administrative costs, touting in public presentations that it spends less than its peers on staff.

Roth said he came from a pension system in Texas that operated the same way. The downside to that approach, he said, is that an organization the size of PERA can only delay major investments in its operations for so long.

“PERA prided itself on running lean, did a great job of running lean, and now we’re at a period of time where we can no longer run as lean as we have,” he said.

The operational costs for PERA is the smallest bit of PERA’s costs, of course, as with most public pensions. The biggest costs are the pension benefits themselves (as in, the contributions needed to be made to fund those costs).

The reason PERA is underfunded has little to do with its technological debt. Of the three major funds at PERA, only one is highly funded, the municipal plan.

I am not spending time now, so I will leave it as an exercise for the reader what the major differences are between the municipal plan and the state and teacher plans. However, it is similar to the differences between Illinois’s municipal and state plans. That’s easy enough to understand in terms of benefits and contributions.

Pension Story Round-Up

Those were the ones I wanted to comment on for right now. The holidays are coming up, so rather than losing the following stories, let me do a big link dump:

18 Dec, WOSU: What happens when public pensions run low on money?

17 Dec, Edward Siedle: “Catastrophic” Tax Consequences of Minnesota State Pension Errors?

2 Dec, Connecticut press release: Governor Lamont, Comptroller Scanlon, Treasurer Russell Announce Connecticut Pension Funds Achieve Highest Funded Ratios in Nearly 20 Years

13 Dec, WGEM: Illinois House committee discuses potential pension system fixes

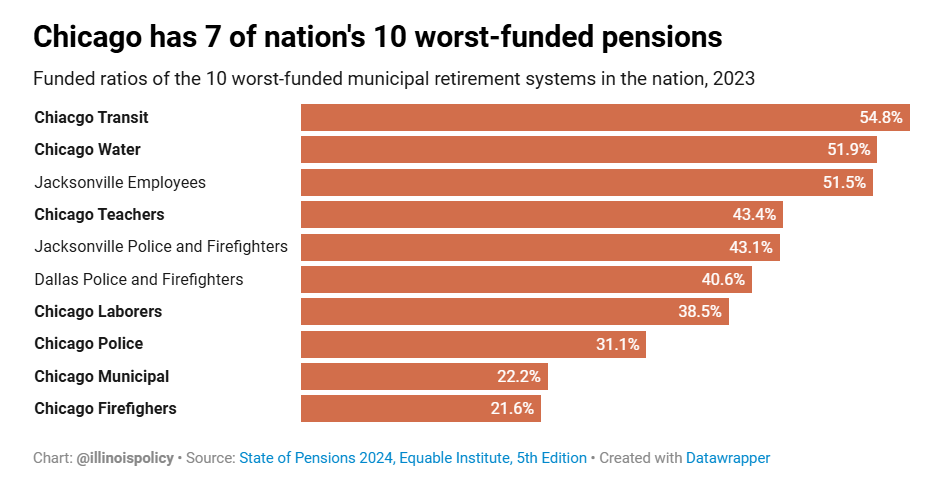

17 Dec, Illinois Policy: Chicago property taxes have doubled in 10 years, thanks to pensions

4 Dec, Ohio House of Representatives press release: Ohio House Passes Bill to Modernize the Ohio Police and Fire Pension Fund

3 Dec, Cleveland.com: Ohio House poised to pass bill requiring cities to pay millions more for police pensions

3 Dec, GoLocalProv: Rhode Island’s Largest Pension Fund Collapse Gets a Federal Bailout

10 Dec, GoLocalProv: Lawyers Representing Retirees in Failed St. Joseph Pension Fund Collect Over $13M and Counting

3 Dec, CT Inside Investigator : Lamont touts pension savings: “It’s freed up an awful lot of money”

6 Dec, The Center Square: Reports agree: Louisiana faces unfunded liabilities in pension system

6 Dec, NY Law Journal: On Governor's Desk: NY 'Death Gamble' Bill That Seeks to Correct Pension Anomaly for Judges

9 Dec, Colorado Sun: “You are here to serve”: As Colorado’s pension costs grow, some PERA members say its board isn’t listening

13 Dec, ai-CIO: PBGC Provides $29.3M to Teamsters Local 11 Pension Plan

10 Dec, Columbus Dispatch: Ohio teachers, retirees get bumps in pension benefits. Teachers can retire 1 year earlier

17 Dec, Pew: State Policymakers Take Steps to Prioritize Effective Pension Funding

I was told it is all "God's Money" and that we are to be "Stewards" so much for stewardship. I wonder where Ted McCarrick got his walking around money.