Pension Watch January 2025: Private Equity Fees, Kentucky, Alternative Assets, and More

A little bit of pension fraud in NY for good measure!

Let’s see what’s been up this last month in pension news!

(Sorry, meant to post this yesterday. My son has been ill all week.)

Transparency in Private Equity Fees?

WSJ, 22 Jan 2025: Pension Funds Want Private Equity to Open Up About Fees and Returns

A group of U.S. pensions and other institutions is pushing private-equity firms to share more information on their fees and investment returns, in a bid to address simmering frustration with the industry’s disclosures.

The Institutional Limited Partners Association, a trade group that counts the retirement plans of public workers in California and Wisconsin as members, proposed this week new guidelines to standardize financial reporting by private-equity firms, people familiar with the matter said.

Public pension plans, university endowments and charitable foundations have about doubled their investments in private-equity funds since 2018, according to Preqin, a company that collects data on private funds. These institutions are among alternative investment firms’ biggest and most-loyal clients. North American private-equity funds now manage some $4 trillion in assets.

Pensions have turned to private equity to plug cash shortfalls for years, tolerating weaker reporting on their investments compared with public funds because most private funds generated higher returns. Now investors want more transparency.

I obscured “Foundations”, holding 12% in private equity. And I notice endowments really took off in their holdings, at 19% of their allocations. But there is a distinction between endowments and pensions, in overall asset allocations and investment goals.

Let’s compare Preqin’s data against the Public Plans Database:

The difference may come from how Preqin and the PPD are calculating that percentage. Preqin may simply be calculating the percentage for a bunch of different plans and averaging. PPD’s percentage is asset-weighted.

The other possibility is that Preqin may be sampling from a smaller private equity “universe”, missing some of the PE investments.

That might also explain the rapid growth being shown in Preqin’s graph, and the more gentle trend shown by the PPD. In 2018, the PPD shows an 8.9% allocation to PE. So while it’s quite a rise from 8.9% up to 14% in 2023, it’s not doubling.

In any case, the problem the pensions have with the PE asset managers is the leverage involved. The pensions have been desperate for yield as interest rates were low, so they wanted to look for all the ways to get higher investment returns (instead of having to ask for higher pension fund contributions).

So the PE managers have been able to give a take-it-or-leave-it pitch, saying that if you want to play in this arena, the opaque and complicated fees are just how it’s done. If you don’t want to take that deal, they’ll find some other institutional investor who does want to take that deal.

Well, the institutional investors are now seeing all sorts of scrutiny and pressures — perhaps they want that transparency and don’t want to take that “standard” opacity.

Hedge Funds Settle with Kentucky…Maybe?

There are multiple stories covering this.

8 Jan 2025, Lexington Herald Leader: KY state pension system to collect $227.5 million under proposed hedge fund settlement

8 Jan 2025, Louisville Public Media: Kentucky, hedge fund firms reach $227 million settlement in long-running pension lawsuit

27 Jan 2025, Northern KY Tribune: KY state workers group blasts pension settlement with hedge funds, presses its own lawsuit

23 Jan 2025, naked capitalism: More Kentucky Dirty Dealings: Attorney General Schemes to Leave Hundreds of Millions in Pension Recovery on the Table, Give Sweetheart Payout to Attorneys, To Settle Claims Against Private Equity Kingpins KKR and Blackstone, Including Ones by Plaintiffs the AG Does Not Represent

24 Jan 2025, Kentucky Lantern: KY state workers group blasts pension settlement with hedge funds, presses its own lawsuit

29 Jan 2025: Is $227M enough? Lawyer takes aim at pension deal, saying it's far less than state is owed

Let me pull from the Louisville Public Media piece:

After seven long and winding years of litigation targeting large hedge fund firms for allegedly mismanaging more than $1 billion of Kentucky’s retirement pension system, the defendants have come to a settlement agreement with the state.

Under the terms of the proposed settlement agreement reached last week and filed as a motion in Franklin Circuit Court on Wednesday, the big investment firms will collectively pay $227.5 million to the state under certain conditions, but admit no wrongdoing in their investment practices.

Several boards of the Kentucky Public Pensions Authority (KPPA) — which manages $27 billion of pension funds for nearly a half million state and local government workers and retirees — voted to agree to the settlement terms in a meeting Friday. The terms of the agreement were not made public until attorneys for the state filed the motion for the settlement Wednesday.

….

If approved by the judge, the settlement will result in “a substantial recovery” of $227.5 million for the state. This includes the return of approximately $145 million in assets held by one company in a litigation-related indemnity reserve established by Prisma, one of the main defendants in the case.

…..

The lawsuit was originally filed in December 2017 by eight retired state workers, alleging that top officials in the state retirement system — then known as the Kentucky Retirement System — and several large investment firms they hired had breached their fiduciary duties and mismanaged pension funds with risky and secretive hedge fund investments.

Among the firms sued were Wall Street giants Blackstone, KKR/Prisma Capital Partners and Pacific Alternative Asset Management. Numerous KRS executives, board members and consultants were also named as defendants, including former executive director Bill Thielen, former chief investment officer David Peden and former board member and Prisma executive William Cook.

The litigation would take many turns from there.

….

The report singled out Peden, Prisma Capital Partners and its co-founder and CEO Girish Reddy for "alleged fiduciary duty violations, conflict of interest and ethics code breaches" related to the pension system entering a strategic investment partnership with the firm from 2014-16. The lawsuit alleged Reddy, Peden and Cook were among those who conspired to give the firm full control of the system's $1 billion hedge fund portfolio without disclosing their Prisma conflicts.

As for Cook — a former Prisma executive who was appointed to the KRS board in 2016 — the report was unable to determine if the KKR Prisma investments benefited from his trusteeship, as investigators were not able to issue subpoenas or obtain personal correspondence and financial accounts.

Hmmm.

The settlement is for the lawsuit between the state and the funds. There is another lawsuit involving retirees/pension participants directly.

The separate lawsuit that's still open was filed in 2021 by Lerach on behalf of several “Tier 3” state employees, whose retirement plans rely on the pension system’s financial success.

She wants to ensure the settlement plaintiffs believe is inadequate doesn't shut the door on their pursuit for more money from the defendant hedge funds and their owners: KKR & Co., Prisma Capital Partners, The Blackstone Group and Pacific Alternative Asset Management.

The lawsuit's latest filing pokes several holes in the settlement, arguing it would only marginally benefit the state and its employees while giving an exit ramp to legal teams on both sides after years of litigation.

….

The initial lawsuit the attorney general's office eventually took over — Mayberry et al. v. KKR & Co., L.P. et al — was filed in 2017 and claimed the state's retirement system had fallen in "a $25-50 billion hole" due to risky and secretive investments by hedge funds that system leaders had trusted with their money.

There is a long and complicated profile to the Kentucky pension trajectories. I hadn’t covered them recently, but had many posts at the old site, reaching back to 2015:

7 June 2015: Kentucky Pension Blues: What’s Up With ERS?

25 April 2016: The Woefully-Underfunded Kentucky Retirement Systems

19 May 2016: Kentucky update (and trying something new)

12 June 2016: March of the Deadbeats: Illinois, New Jersey, Kentucky, Puerto Rico and Central States

11 August 2016: Kentucky Pensions Update: Their Investment Returns Also Sucked

8 September 2016: Kentucky Pensions Update: Governance Woes

18 November 2016: Kentucky Update: Republicans Take Legislature, Pensions Still Suck, Hedge Funds to Exit

18 January 2017: Kentucky Pension Assets: Trends in ERS, County, and Teachers Plans

25 January 2017: Kentucky Pension Liabilities: Trends in ERS, County, and Teachers Plans

21 February 2017: Kentucky County Pensions: 60 Percent Fundedness and Decreasing is Awful

4 June 2017: Geeking Out: Testing Kentucky ERS to Death

5 June 2017: Kentucky Pensions Even Closer to the Brink: New Assumptions, New Report

25 September 2017: Kentucky Pension Blues: Let’s Get This Fire Started

25 October 2017: Kentucky Pension Battle: Reform Proposal Announced and Nobody’s Happy

14 Mar 2018: The Kentucky Pension Mess: Ain't Getting Cleaned Up Now

3 April 2018: Kentucky Meltdown: Teachers in Revolt, Bill in the Sewers, and Nothing Actually Solved

13 April 2018: Around the Pension-o-Sphere: Mostly Kentucky, Some California, and Pew Rains on the Parade

27 April 2018: Around the Pension-o-Sphere: Kentucky, New York, Colorado, and a Really Bad Graphic

11 May 2018: Around the Pension-o-Sphere: Kentucky Lawsuit, Crazy Calpers, MEPs, and More

19 Dec 2018: Things Fall Apart: Pension-o-sphere update - Kentucky, MEPs, and more

After 2018, there wasn’t much to report. This lawsuit limped along, which was never going to make pensioners whole.

Kentucky ERS is one of the worst-funded state-level funds in the country:

This is what their contributions look like:

Lots of things are going underneath these graphs.

But that contribution pattern, pre-2015, is not the fault of the hedge fund managers.

More on Alternatives in Pensions

28 Jan 2025, Harvard Business Working Knowledge: Rethinking Risk: Why Pension Funds Are Betting on Alternative Assets

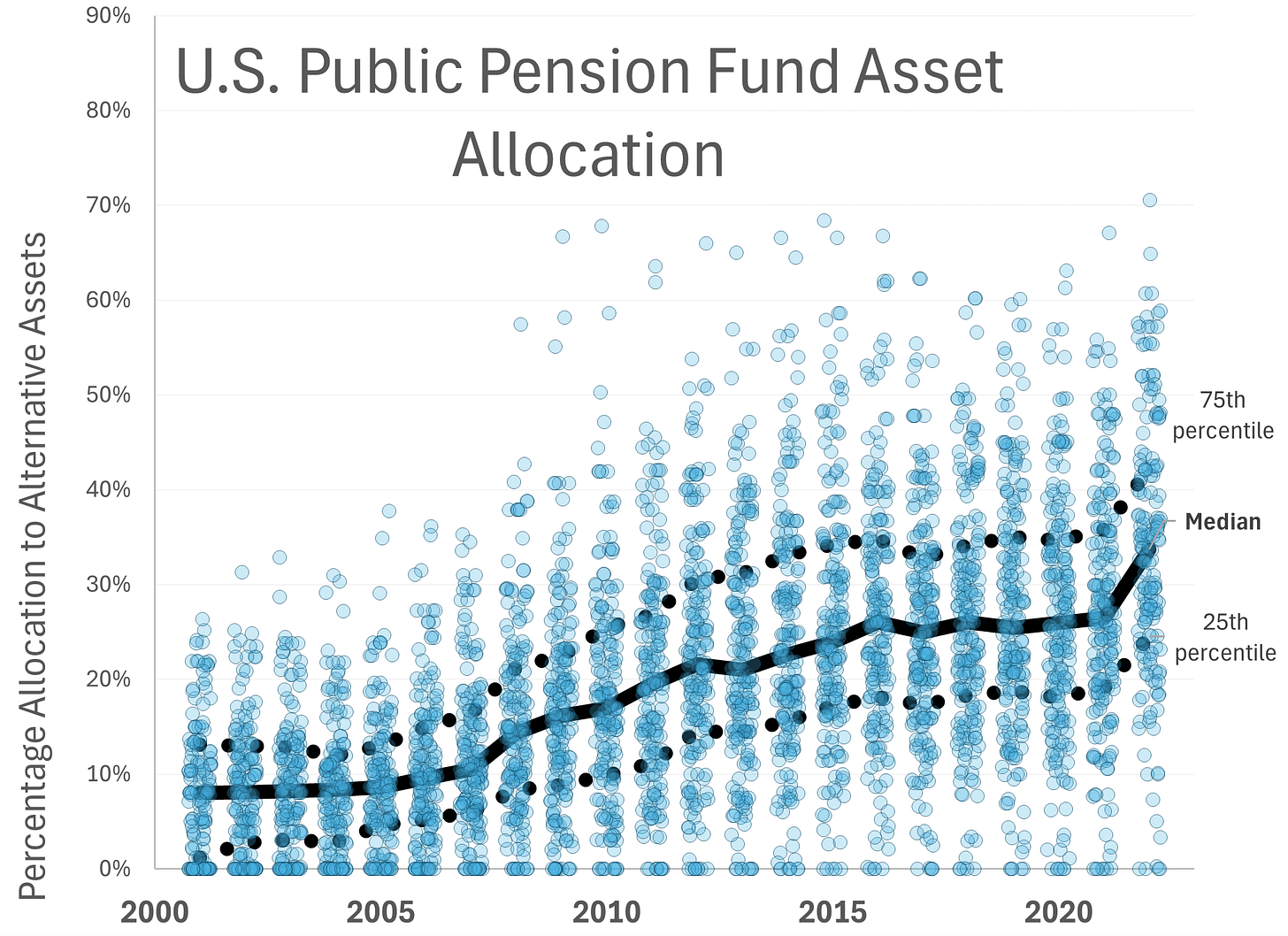

Public pensions in the United States have sharply shifted their riskier investments from publicly traded stocks to alternative assets such as private equity and real estate over the past two decades.

While chronic underfunding in states and counties may seem like the obvious driver of this trend, a recent working paper points to a different story: some pension managers have simply become more bullish on alternatives relative to public equities. According to “The Rise of Alternatives,” these bullish beliefs are shaped by consultants, peers, and experience during the dot-com bubble in the early 2000s.

By 2021, alternative investments made up almost 40 percent of riskier allocations in public pension funds, up from 14 percent in 2001, says Emil Siriwardane, Harvard Business School’s Finnegan Family Associate Professor of Business Administration.

I was going to compare their graph against mine (from the actual academic paper, not the easy-to-read interview)… and I saw they used the same data source: the Public Plans Database. Well, gee.

But let’s check which graph you prefer:

It does look like we’re using different definitions for our allocations, with them including certain assets in their Alternatives-to-Risky Share, and me excluding them. I should do an update of this graph soon.

But let me get away from the graphs and go back to the interview with the HBS researcher:

Siriwardane: The message of the paper is that beliefs are important for understanding why some pensions invest heavily in alternatives. This observation raises a practical question: how do pensions form beliefs? For instance, if you believe private equity will outperform public markets, let’s talk about why. How did you come to that conclusion? What data are you using? Have you been accurate in the past? Are your beliefs justified by the performance of your available investment managers? The point here is to have to an empirically grounded process by which your beliefs are formed.

My view is that with alternatives, like most forms of active investing, there's decreasing returns to scale when it comes to creating alpha. In other words, the bigger you get, the harder it is to outperform, in part because there's more competition. There's more eyes on each transaction.

The implication is that being early to the party in alternatives is advantageous, as it was for endowments in the 80s and 90s. But the landscape has significantly changed over the last thirty years. There’s a lot more competition, especially among the larger alternative asset managers with whom pensions tend to invest. So, my concern is that public pensions may have arrived at the party too late and are now paying fees in these asset classes that are not justified by their performance.

He points out in an earlier bit that some of the pension funds have 0% allocated to alternatives and some have very high allocations. Yep, I noticed that, too.

One can argue it’s about beliefs, but I think he’s missing some of the political dimension involved, such as the pressures not to ask for higher contributions to the pensions, and thus one needs to make up for it via higher returns in the pensions.

In the paper itself, the researchers (he’s not the only one) give two alternative explanations to their preferred “beliefs” point of view: return smoothing and supply-side explanations. Again, it seems to miss the whole dynamic, as well as when things go wrong with alternatives.

NY Pension Fraud

I’ve not been sharing a lot of these, but the NY State Comptroller puts out these press releases regularly:

15 Jan 2025: DiNapoli: Two Poughkeepsie Women Arrested for Stealing NYS Pension Checks From Deceased Pensioner

Two Poughkeepsie women allegedly cashed seven pension checks totaling $8,600 meant for one of the defendants’ deceased mother, New York State Comptroller Thomas P. DiNapoli, Dutchess County District Attorney Anthony Parisi and Dutchess County Sheriff Kirk Imperati announced today. The two defendants, Deborah Brink, 63, and Sheila Moseley, 58, are charged with grand larceny.

….

Brink’s mother worked for the Hudson River Psychiatric Center and Dutchess Community College for over 22 years before retiring in June 1995. She died in May 2020 and all pension payments should have stopped at the time of her death. The state retirement system was not informed of her death. Upon discovering she had died, the payments were stopped.

DiNapoli’s investigation found that seven pension checks issued to Brink’s mother, totaling $8,607.58, were cashed with forged signatures after she died.

An analysis of the bank records revealed that Brink cashed four of those checks, totaling $4,898.56, and that Brink’s friend, Moseley, cashed three, totaling $3,709.02. Brink and Moseley had access to the addresses where the checks were delivered. After the deposits were made, the retirement system was able to recoup $2,460.98.

16 Jan 2025: DiNapoli: Syracuse Man Arrested for Allegedly Stealing Over $21,000 in Pension Checks Meant for His Deceased Mother

31 Jan 2025: DiNapoli: Ithaca Woman Charged With Stealing Nearly $70,000 in Pension Payments

DiNapoli’s office put these announcements out fairly regularly. These are individually small amounts compared to the total amounts of pension payments going out, but that’s not anything he can control. Publicizing charging people for pension fraud is something he can control.

Unlike some of the prior pension fraud stories, such as the man who dressed as his dead mother, what with so many direct deposit and other non-physical ways to access pension checks, these cases of pension fraud were a little simpler.

You can see why the comptroller would want to publicize that serious criminal charges come along with cashing somebody else’s pension checks after they die.

Other Public Pension News

8 Jan 2025, American City & County: Public pension funding remains “fragile” but showed improvement in 2024

6 Jan 2025, PlanSponsor: Research Quantifies the Broad Economic Impact of Pension Payments

8 Jan 2025, Pittsburgh Post-Gazette: Pa. treasurer among 15 nationwide urging states to divest pension funds from China

9 Jan 2025, P&I: Reform measures boosting health of Vermont’s pension funds, treasurer says

Society of Actuaries, Jan 2025: Pub-2016 Public Retirement Plans Mortality Tables Exposure Draft

13 Jan 2025, Alaska Beacon: As Alaska lawmakers begin introducing bills, public pension revival is poised to advance

21 Jan 2025, Governing: Public Retirees’ Big Win — and What Might Happen Next

24 Jan 2025, ai-CIO: Oregon Bill Would Ban State Pension Investments in Private Markets Funds Invested in Fossil Fuels

23 Jan 2025, Gothamist: ‘Double dipping’ NY lawmakers ‘retire’ to collect a pension and salary at the same time

30 Jan 2025, CT Insider: Lawmakers approve more scrutiny for state employee pension boosts following CT Insider investigation

30 Jan 2025, CT News Junkie: Think Tank Calls For Change To Connecticut’s Teacher Pension Funding

29 Jan 2025, Sacramento Bee: California pension beneficiaries send billions in economic ripples across the state

15 Jan 2025, CT Mirror: CT pension financing is inequitable for both teachers and students

Might a future big payday have something to do with the large investments in private equity?: https://www.ai-cio.com/news/former-connecticut-treasurer-named-chief-public-pension-strategist-at-apollo-global-management/

I think PE is more about keeping liabilities low (increases "expected return" used for discounting) as trying to get genuinely high returns. I mentioned this (it's not an original idea of mine) in my Policy Brief for the Reason Foundation and gave an example: "in 2015, the chief investment officer (CIO) of Idaho’s Public Employee Retirement System, Bob Maynard, with rare and admirable candor, described Idaho as “skeptical” of private equity but referred to the “phony happiness” that results from actuaries and accountants accepting numbers that “actually do have consequences for actual [near-term] contribution rates.” He stated that “even if [Private Equity] just gave public market returns, we’d be in favor of it because it has some smoothing effects on both

reported and actual risks.”