I saw that an ignorant person decided to open his big mouth re: retirement age and Social Security — this happens to be Ben Shapiro, and I will address what he has to say about Social Security and retirement age … another day.

I get the schtick - to get people to react, and to get a bunch of people talking about him, get more people coming to his media sites, yadda yadda.

But it’s not particularly helpful for individuals trying to plan retirement ages for themselves.

The actuaries would like to help

Hi there, I’m Mary Pat Campbell, and I’m a life actuary, meaning I pay attention to when people die.

Some of y’all may already be very aware of this through my whole Mortality with Meep feature.

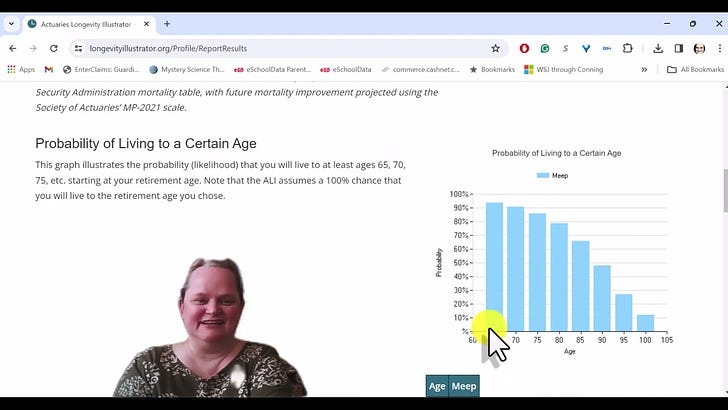

Some of my fellow actuaries have put together a website and tool called the Actuaries Longevity Illustrator, which shows what crap marketing folks we are … because it’s about planning retirement length.

I’m not a marketing person myself, but shouldn’t it be named something like the Actuarial Retirement Planning Calculator or something? We should be able to come up with a better name for this thing.

In any case, we have the expertise to provide the information as to the distribution of your possible retirement ages… and no, life expectancy is not the appropriate metric.

But first, a video!

The Actuaries Longevity Illustrator: a Demo

Please don’t mind the ghostly artifacts from the AI tools… it’s a little better than what I had before, but it’s a work in progress.

If you want to share the video alone, it’s at YouTube here: When to Retire? Actuaries Longevity Illustrator - One Person - 2024 Edition

I’ll try to do a few more with the Longevity Illustrator for ages other than a 50-year-old, with couples and some other age combinations.

Some general notes on choosing a retirement age

Not everybody will watch that video or play around with the Actuaries Longevity Illustrator. That’s okay.

But going with default choices for retirement ages is often not a good idea.

People may go with 59 1/2, as that is the earliest they’re allowed to tap tax-advantaged savings in the U.S. without having a tax penalty.

Some go with 62 because that’s the youngest they can start collecting Social Security old-age benefits for workers.

Some pick 65, because that’s when you’re eligible for Medicare coverage.

Everybody born in 1960 or after has a full retirement age of 67, so maybe they’ll pick that.

Some pick 70 because Social Security benefits do not accrue past that age.

Some pick even older, because they’re forced by tax laws to take distributions from their tax-advantaged savings (these are called required minimum distributions.) This used to be 70 1/2, but now it’s been pushed up to 73.

But here is my main point: ignore the reported life expectancy numbers in the media, because that’s a measure intended from birth, and you’re not looking at retiring at birth (unless you were, and congrats on your aristocratic heritage).

For many people of average health in the U.S., there is a decent probability of living to 90 years old and beyond if you make it to age 65. Just planning to live to age 80 is not going to cut it for retirement planning anymore.

Indeed, living to 100 is more the concept for Gen X retirement planning (and definitely for millennials).

If you want to retire at age 60, and you live to 100, that means you probably have to be saving money at a fairly high percentage (or somebody doing it on your behalf.) Or perhaps you will reduce your expectations in retirement.

Yes, a retirement age of 70 is not unreasonable (that’s around what I’m aiming for — 70 or 75.)

You May Not Get to Choose

You see there is a wide range of choices. Ben Shapiro says don’t retire at all, but sorry, he is a fool. Many people don’t get a choice:

ProPublica, 2018 updated in 2019: If You’re Over 50, Chances Are the Decision to Leave a Job Won’t be Yours

ProPublica and the Urban Institute, a Washington think tank, analyzed data from the Health and Retirement Study, or HRS, the premier source of quantitative information about aging in America. Since 1992, the study has followed a nationally representative sample of about 20,000 people from the time they turn 50 through the rest of their lives.

Through 2016, our analysis found that between the time older workers enter the study and when they leave paid employment, 56 percent are laid off at least once or leave jobs under such financially damaging circumstances that it’s likely they were pushed out rather than choosing to go voluntarily.

Only one in 10 of these workers ever again earns as much as they did before their employment setbacks, our analysis showed. Even years afterward, the household incomes of over half of those who experience such work disruptions remain substantially below those of workers who don’t.

….

In a story this year, ProPublica described how IBM has forced out more than 20,000 U.S. workers aged 40 and over in just the past five years in order to, in the words of one internal company planning document, “correct seniority mix.” To accomplish this, the company used a combination of layoffs and forced retirements, as well as tactics such as mandatory relocations seemingly designed to push longtime workers to quit.

….

Under the law, retirements are supposed to be voluntary decisions made by employees. The 1967 ADEA barred companies from setting a mandatory retirement age lower than 65. Congress raised that to 70 and then, in 1986, largely prohibited mandatory retirement at any age. Outraged by companies’ giving employees the unpalatable choice of retiring or getting laid off, lawmakers subsequently added a requirement that people’s retirement decisions must be “knowing and voluntary.”

Yet for almost two decades now, when HRS respondents who’ve recently retired have been asked whether their retirements were “something you wanted to do or something you felt forced into,” those who’ve answered they were forced or partially forced has risen steadily. The number of respondents saying this has grown from 33 percent in 1998 to 55 percent in 2014, the last year for which comparable figures are available.

That is about people feeling the companies themselves making them retire.

But reality itself may force one to retire: even in an office job, one may have disabilities that prevent one from being able to work.

As with mortality, disability rises rapidly with age:

Older Americans are significantly more likely than younger adults to have a disability. Some 46% of Americans ages 75 and older and 24% of those ages 65 to 74 report having a disability, according to estimates from the Census Bureau’s 2021 American Community Survey (ACS). This compares with 12% of adults ages 35 to 64 and 8% of adults under 35.

One may be able to continue to work, but I have seen people being forced to retire due to their health status. I’ve seen this happen to tenured professors, who retired very young due to early-onset dementia.

Be Prepared (and Find Meaning in Multiple Places)

Being an actuary, I’m all about possibilities.

I know that I may become more disabled than I already am (I have chronic pain issues that interfere with using my hands, and then sometimes I just can’t work.) So I may have to retire or change to doing something else entirely. I may need to leave NY.

I may work for money up until my death (whenever that may be).

I’m not going to tell people that they have to find purpose in paid work or that they can’t find purpose in paid work. Both are foolish to say.

But I do know that many people do have difficulty, and many men have a lot of trouble, after they retire. Many lose their social network from work. They lose their regular pattern of life. And they see things dwindle and the people they know start dying at an increasing clip. Alas, suicide rates increase for men with increasing age.

So my recommendation is to seek meaning outside work anyway, because you may not get a choice of the timing of your retirement.

I also recommend consider that you may live a lot longer than you think, so plan retirement age accordingly, if you do get to choose the timing of your retirement.