ESG and Public Pensions: What's the Fiduciary Duty When The Money Runs Out?

Qualitative factors are appropriate, but consider the investment horizon

ESG has been a hot-button topic in institutional investing, especially in the public pension world for years. I will drop some links to older STUMP posts on the subject at the end of this post.

Stand.earth, in conjunction with related environmental groups, put out their own report card related to some public pension funds recently:

The Hidden Risk in State Pensions: Analyzing State Pensions’ Responses to the Climate Crisis in Proxy Voting

A first-of-its-kind report, the Hidden Risk analyzes the proxy voting records and proxy voting guidelines of the 19 public pensions that are in states where a state financial officer has indicated it is a priority issue both to advocate for more sustainable, just, and inclusive firms and markets , and to protect against climate risk.

Ahead of the 2024 shareholder season, a first-of-its-kind report “The Hidden Risk in State Pensions: Analyzing State Pensions’ Responses to the Climate Crisis in Proxy Voting,” from Stand.earth, Sierra Club and Stop the Money Pipeline, analyzes proxy voting records, proxy guidelines, and voting transparency of 24 public pension funds in the USA collectively representing over $2 trillion in assets under management (AUM).

Here’s a link to the PDF of their report.

I don’t actually care what their scores are (you can read them for yourself.)

I do care which public pensions are covered and why they were chosen:

How were participants chosen?

This report chose to focus on public pension funds. As diversified and long-term shareholders, pensions are the fiduciaries perhaps most exposed to climate-related and other systemic risks, suggesting they would be the first to incorporate such considerations into their stewardship practices. The report narrowed in on members of For the Long Term, a group helping state and municipal Treasurers, Comptrollers, Controllers, and Auditors navigate the long-term financial consequences of climate change, racial inequity, and other similar risks. While state financial officers have varying levels of governance responsibilities within state pension systems (including none at all), the FTLT network was chosen as it is a network of financial officers that have committed to using their leverage to advocate for “more sustainable, just, and inclusive firms and markets.” The membership of a state financial officer in FTLT could, therefore, reasonably be viewed as a proxy for which state pensions are interested in considering the systemic risks of climate change. This report, therefore, aimed to evaluate the progress made by these first movers.

For the Long Term

Here is the website of For the Long Term:

For the Long Term believes that an investment approach prioritizing long term financial thinking and the interests of all stakeholders is better for value creation and economic growth for not only current and future beneficiaries but for our country and economy as a whole.

By taking into account the needs of employees, customers, suppliers, and the community, companies are more likely to create sustainable and responsible business practices. This, in turn, leads to better relationships with all stakeholders, which results in increased loyalty, better brand reputation, and more stable revenue streams. In addition, companies that prioritize the needs of all stakeholders are more likely to innovate and adapt to changes in the market, which can lead to a competitive advantage and better financial performance in the long-term.

Overall, this stakeholder-focused, long-term approach leads to better relationships with all impacted parties, increased innovation, and a more positive impact on society and the environment. In contrast, an investment approach that focuses solely on maximizing profits for shareholders can lead to short-term thinking and decisions that may not be in the best interest of the company or its stakeholders in the long-term.

In light of the stated mission/goal of this group, it is only fair that a separate group evaluate how well they are achieving these goals. I have no beef with Stand.earth et. al. taking this approach.

List of the Investment Funds and Systems

Here is the list of the systems they covered in their report (in ABC order):

California Public Employees’ Retirement System (CalPERS)

California State Teachers’ Retirement System (CalSTRS)

Colorado Public Employees’ Retirement Association (CoPERA)

Connecticut Retirement Plans and Trust Fund (CRPTF)

Delaware Public Employees Retirement System (DPERS)

Employees Retirement System of Rhode Island (ERSRI)

Illinois State Board of Investment (ISBI)

Illinois Teachers Retirement System (TRS)

Maine Public Employees Retirement System (MainePERS)

Maryland State Retirement and Pension System (SRPS)

Massachusetts Pension Reserves Investment Management (MassPRIM)

Minnesota State Board of Investment (MSBI)

Nevada Public Employees Retirement System (NVPERS)

New Mexico Public Employees Retirement Association (NMPERA)

New York City Board of Education Retirement System (BERS)

New York City Employees’ Retirement System (NYCERS)

New York City Fire Pension Fund (Fire)

New York City Police Pension Fund (POLICE)

Oregon Public Employees Retirement Fund (OPERF)

State of Wisconsin Investment Board (SWIB)

State Universities Retirement System (SURS)

Teachers’ Retirement System of the City of New York (TRS)

Vermont Pension Investment Commission (VPIC)

Washington State Investment Board (WSIB)

Only one of those funds it will not be clear what it’s covering, that’s SURS: that’s for the state of Illinois.

In many of these cases, the investments being overseen fund multiple pension plans, such as with the Illinois State Board of Investment, which oversees investments for multiple plans simultaneously.

What’s the Investment Horizon? Does the Cash Run Out Before the Climate Impact?

So here’s the issue: not all of these funds are supporting liabilities in the same happy place.

Wisconsin, for instance, has state pensions that have been well-funded for a long time due to how they’ve structured their pension promises.

Wisconsin Retirement System

Contribution Pattern

Fundedness

Wisconsin can credibly make the argument that it is investing indefinitely, and thus climate change impacts, which are for the long haul, are relevant to their investment strategy. They absolutely can claim that 50-year projections on their assets make sense.

Not so much for some of the other pension plans.

Connecticut, for instance, is not quite so well-funded. There is a history there, on the liability side, both with respect to benefit design and contribution policy, that has led to deep underfundedness.

Connecticut Teachers

Contribution Pattern

That contribution spike was a pension obligation bond.

Fundedness

That pension obligation bond really helped, didn’t it.

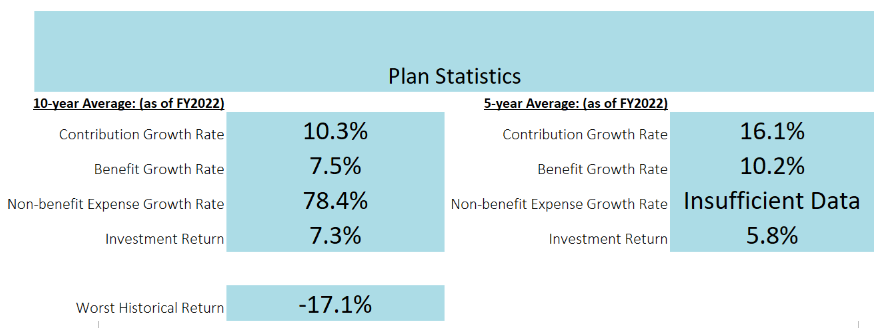

Using my cash flow projection toy model, the plan statistics are a bit harsh:

And even on the modest side of benefit growth rates, investment returns, and contribution growth rates, the plan is under a squeeze:

By all means, the trustees have to act as if, perhaps, the pension fund will continue indefinitely, but they do need to keep in mind they need liquidity in their assets to cover benefits.

To be sure, those non-benefit expenses are almost definitely the pension obligation bond (I didn’t look too closely on that one.) That’s the problem with POBs: they become sure liabilities as well.

Fiduciary duty when the money is there

The point here is that not all the funds sitting on the list are really in the same place when it comes to their real investment horizons. Some of them aren’t really looking at indefinite horizons on their assets. Some of them have got to consider the real possibilities of having to cash out well before any climate impacts come to fruition.

Both For the Long Term and the stand.earth, et. al., coalition cannot admit that the pension funds might ever run out, of course. That would undermine their message.

If the funds are not there for indefinite time horizons, if the planning horizon they have to work with is less than 20 years in the case of some of these funds, it makes no sense for them to try to evaluate the current activity of their equity ownership that will have no effects for 50+ years.

To be sure, some of the issues they are talking about (such as indigenous rights) have immediate effects. But many of the aspects they want corporations to take immediate financial hits for very long-term growth gains. If the specific pension fund cannot be around to join in the asset appreciation on future dividends, that advocacy is problematic.

Some of these funds need to prioritize their issues. I know it’s not going to be popular, but the deeply underfunded plans such as Connecticut and Illinois have got to focus on the problem of sustainability of the cash flows to support their pension promises.

I understand the ESG issue makes for better press coverage and political allyship, but the horizon on the cash flows is getting a lot closer a lot faster than the climate impacts the private-jet-setters supposedly dread.

A lot of politicians have been hoping they would die before the public pension doom horizon would hit. Many have been correct, but many are finding out to their cost that they are wrong.

The ESG-related coverage is not going to save them.

Older ESG Posts

Jan 2023: Kentucky Asset Manager Warning: the ESG Brou-Ha-Ha Continues

Nov 2022: ESG and ERISA: Pity the Poor Tort Lawyers Their Lost Business as Biden Gives a Safe Harbor For Now

2017: Public Pension Assets: It's Not Your Money to Play With, Pension Trustees

2017: Priorities for Pension Funds: Climate Change or Solvency?

2018: Divestment and ESG Follies: A Lack of Humility - Tobacco, Climate Risk, and More

2018: Divestment and ESG Follies: Mandating Women on Corporate Boards

2023: Other People's Money: ESG, Public Pensions, and the Principal-Agent Problem

April 2014: Public Pensions and Blacklists: Harmful to the Pensions

Oct 2018: Calpers Quickie: President Pushed off the Board Due to ESG Over Pension Security

Oct 2015: Public Pension Follies: Divestment! Divest from All the Dirty Things!

2022: Podcast - Public Pensions, ESG, DeSantis, and The Catholic Church