Chicago and Illinois Update: Job Posting, Tier 2 "Reform", Casino Shenanigans, and More

Sure, why not add more pension debt?

You may have noticed in my recent Pension Watch post, there was no Illinois content.

I like to quarantine the Illinois content to protect all the other states.

Illinois Policy Job Posting

One of my favorite sources on Illinois finance has a job posting:

Director of Fiscal Policy

The Illinois Policy Institute is seeking a Director of Fiscal Policy with outstanding research and communication skills to lead our work on Chicago and Illinois budgets, taxes, pensions, and other fiscal issues. You’ll drive the narrative and strategy for crafting and promoting entrepreneurial, innovative, and impactful policy solutions for turning around the unsustainable situation facing Illinois and Chicago.

As a premier state-based, free-market think tank, IPI provides an ideal platform for you to excel in this role.

This position is based in Chicago.

Responsibilities

Lead solutions-oriented research on Illinois state and local fiscal issues, including budgets, taxes, and pensions.

Source and analyze data regarding fiscal challenges and opportunities.

Write articles and reports for publication on Illinois Policy’s website and in the popular press.

Collaborate with the research and communications teams to develop and execute research and content strategies that advance the organization’s policy and legislative goals, including media engagement.

Assist with fact-checking fiscal policy content for accuracy and consistency.

Draft policy fact sheets and handouts to support solutions-oriented advocacy.

Work with research and government affairs teams to develop bill ideas, create supporting materials for legislative agendas, and advocate for bills through testimony or meetings with lawmakers.

Appear in IPI videos, podcasts, and media interviews to discuss and explain fiscal issues.

Qualifications and Requirements

A bachelor’s degree in economics, finance, accounting, political science, or a related field, with coursework or experience in statistics, accounting, or social science research methods.

A master’s degree or CPA is preferred.

At least seven years of work experience in a government agency or organization dealing with state and local government budget and tax issues, or a combination of graduate studies and work experience relevant to budget and tax policy analysis.

Proven ability to write clearly and effectively for diverse audiences.

Demonstrated commitment to the free-market principles and mission of the Illinois Policy Institute.

Proficiency in Microsoft Office, including Word and Excel, with knowledge of Excel functions commonly used for statistical analysis.

Compensation:

Range of $70,000 to $120,000 base salary, commensurate with experience. Eligible for a performance-based annual bonus on top of the base salary. The compensation package includes health (medical and dental plans with employer-paid share), 401(k), flexible spending benefits, and vacation and sick days.

Location:

The Director of Fiscal Policy will work in our Chicago office. The Illinois Policy Institute has a hybrid work policy under which employees can work from home up to three days each week.

To Apply:

Qualified candidates should submit the following application materials:

Résumé

Cover letter detailing:

Your interest in this position

Why the mission of the Illinois Policy Institute resonates with you

Your salary requirements

Writing sample

Tier 2 Boost on top of $140B+ Pension Debt?

3 Feb 2025, Labor Tribune: Illinois unions calling Jan. 6 Day of Action to fix Tier 2 pensions

Illinois unions are calling for a Day of Action to push the Illinois General Assembly to fix Tier 2 pensions during the lame duck session.

On Monday, Jan. 6, the Illinois Education Association, Illinois AFL-CIO and others are pushing for a one-day lobbying session, setting up a number for constituents and Labor activists to call their legislators and ask them to fix the Tier 2 problem.

In 2010, the Illinois state legislature and then-Gov. Pat Quinn approved a law in the middle of the recession that forced state leaders to deal with decades of underfunding by changing the way state retirement benefits and calculated. It only affected employees who began their jobs after Jan. 1, 2011 – known as the Tier 2 employees.

The changes removed the Tier 1 annual cost of living adjustment, raised the age of retirement from 62 to 67 and changed eligibility from five years of service to 10 years.

Yes, I’m leading with the public employee unions wanting to boost their pensions.

They actually have something of a point, for once, and there are two parts.

Tier 2 may be too low for Illinois to allow those pensions to have the safe harbor from being Social Security-exempt, for certain classes of employees.

Tier 2 contributions are subsidizing the costs Tier 1.

Both of these are no-nos. I am not a lawyer, constitutional or otherwise.

I have a fix for #1: Change it so all employees are in Social Security! (I know that this is extremely unpopular. I am not an Illinois politician, so I can propose unpopular things. For a more complicated version of this, I would amend the Illinois state constitution to be able to change benefits going forward, but let me leave that for another time.)

For #2, that’s going to be stickier.

I am just doing a fly-by right now, and this issue needs its own post. So I’m just bringing up the inherent problems with Tier 2 that should be resolved.

Now, let us get to the current activity:

20 Dec 2024, Capitol News Illinois: State lawmakers consider Tier 2 pension changes as new session approaches

Changes that would make Illinois pension systems compliant with Social Security by improving benefits for government employees hired since 2011 could be on the table when lawmakers return to Springfield in January.

The General Assembly passed legislation in 2010 to create a second tier of state pension benefits in hopes of reducing long-term liabilities. But the latest benefits structure for employees entering the government workforce after 2010, known as Tier 2, has raised concerns about its compliance with Social Security and fairness to public employees.

Not all public employees are covered by Social Security. But federal law does require governments to provide benefits that are at least equal to Social Security. If a pension system fails to meet that “Safe Harbor” requirement, the employer must make up the difference. Officials from pension systems have said doing so would be costly, though exactly how much so is unclear.

While calls for changes have grown louder in recent years, the underlying concerns aren’t new, Sen. Robert Martwick, D-Chicago, told Capitol News Illinois.

“It was contemplated by members of the General Assembly during debate for its passage that Tier 2 could create a problem if it didn’t satisfy Safe Harbor,” Martwick said.

This is ostensibly why they’re making the change, especially with the last-minute Social Security boost for people like those Illinois public employees who have some old Social Security work credit or have spouses who do. Gotta catch up!

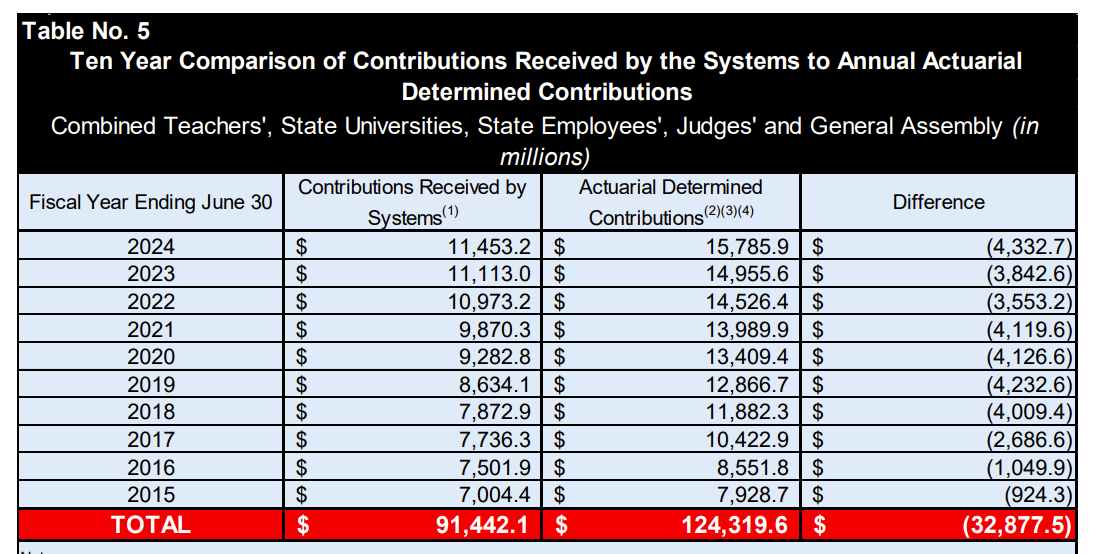

But, given that Tier 2 was made to try to make the unfunded liabilities of Illinois pensions more sustainable, and they still can’t keep up with the required contributions:

How exactly are they supposed to afford even more expensive pension plans?

28 Jan 2025, Op-ed, Chicago Sun-Times, By Ted Dabrowski, John Klingner and Ed Bachrach : Illinois taxpayers deserve answers before state pension costs rise

Illinoisans concerned about their ever-growing tax bills will want to push back against the next government handout in the making. State lawmakers and government unions are working to sweeten pensions yet again. The total cost to taxpayers of the various benefit-hike proposals range from a few billion dollars to as much as a whopping $80 billion. Any of those proposals will make Illinois’ already insurmountable pension burden even more unbearable.

At issue are the 2010 pension reforms that created a new tier of beneficiaries with reduced but still handsome benefits, known as Tier 2. Lawmakers claim they have no choice but to boost pensions in order to quash concerns that the benefits of some Tier 2 workers are too low. Those lawmakers say Illinois is not complying with an Internal Revenue Service regulation that requires a worker’s pension benefits be “at least equal” to the benefits he would have gotten under Social Security.

The problem is, there’s nothing from the IRS itself — nor from the state’s actuaries or any government employer — that shows any individual is out of compliance with those IRS rules. It’s also unknown if the IRS rules will be enforced, or whether they are even enforceable. And even if eventually enforced, there’s a question of how costly complying with the IRS would be.

Until lawmakers prove to taxpayers that something needs to be done to Tier 2, any increase in benefits would be political malpractice.

Unsurprisingly, lawmakers and unions are ready to hike benefits anyway, with the unions wanting to push increases to the extreme. The boosts they are proposing, at a cost of $80 billion through 2045, go so far as to totally unwind the reforms that created Tier 2.

….

Until Illinois can pass better pension reforms, Tier 2 deserves a defense much like the 2013 pension reform bill received when then-Attorney General Lisa Madigan argued for it in front of the state supreme court. She said, on behalf a Democratic majority, that “…the General Assembly has determined that the fiscal problems facing the state and its retirement systems cannot be solved without making some changes to the structure of the retirement systems.”

Illinois’ situation hasn’t changed in the 11 years since then. Illinois lawmakers have no business handing out more pension sweeteners. Instead, their goal should be to bring public retirement costs in line with what everyday Illinoisans can afford.

Ted Dabrowski is president and John Klingner is the senior policy analyst of Wirepoints, an independent, nonprofit research and commentary organization. Ed Bachrach is founder of the Center for Pension Integrity.

I question Illinois’s ability to keep up with its current pension promises. Forget about adding to them.

Illinois is already not paying its full pension bill. Adding to the promise means they will fall farther behind.

Other coverage of the Tier 2 bill:

22 Jan 2025, P&I: Illinois Tier 2 pension reform bill could cost state $30 billion, actuary says (based on only 3 of the systems: teachers, state employees, and university employees)

23 Jan 2025, Jim Dey at The News-Gazette: Labor's dream: More money for higher pension benefits

25 Jan 2025, ABC7: Better Government Association weighs in on proposed fix for Illinois' $143 billion in pension debt

25 Jan 2025, Rich Miller, Chicago Sun-Times: Price tag for union-backed state pension reform is nearly $30 billion

Jan 2025, Illinois Auditor: SUPPLEMENTAL DIGEST TO RETIREMENT SYSTEMS’ AUDITS - 10-year history of the unfunded liability, etc. of all the state pension funds, combined

Chicago Casino Shenanigans

A little birdie shared the following with me:

24 Jan 2025, Bits About Money: A very Chicago gamble

[I added emphasis below, and for people into details should read the whole thing.]

Chicago has wanted a casino for a long time

Chicago and the state of Illinois more broadly have a deeply unserious polity. It has mortgaged its future through consistently overpaying public sector employees (principally, in Chicago, police/fire/teachers) and undertaxing. Neither decreasing total compensation of public sector employees nor reneging on previously-negotiated deferred compensation (pensions and healthcare for retirees) nor raising taxes to appropriate levels is considered politically palatable. One reason is that the Illinois state constitution (Article 13 Section 5) makes public employee pensions sacrosanct. The constitution is, of course, not a fact of nature; it is a political compromise by, again, a deeply unserious polity.

Long-time watchers of state and local politics know Illinois pensions are the worst funded in the nation, state officials celebrate when Wall Street upgrades its credit rating from close-to-junk, and the possibility of a federal bailout was a constant political issue for decades until it happened by stealth during covid.

And so Illinois and Chicago specifically are constantly on the make for new revenue streams. One which was mooted since my childhood in the 1980s was an expansion of gambling. So-called sin taxes (on gambling, liquor, tobacco, and similar) are politically attractive because they do not cause as much opposition as raising consumption or property taxes.

And so Chicago has had a decades-long campaign to build a casino within city limits. Why couldn’t Chicago actually get this done in several decades? One reason is the usual incompetence. The other reason is that the political economy of casinos is controversial. Many policies create winners and losers, but casinos inescapably create losers much more directly than most policies up for vote. Local political elites often band together against them, worried about siphoning money from local consumers. They also worry that they tend to create spillover effects, such as crime and moral collapse among a portion of patrons.

And so, as I once mentioned in a podcast with Thinking Poker, pro-casino political coalitions try to pick off anti-casino political elites by assuaging their concerns and/or bribing them. (In Japan, the de facto concession was “We’ll limit the amount Japanese people can lose here and maximize for soaking Chinese tourists. Now, let’s write that down in a way which doesn’t say exactly that, because it sounds bad if you put it that way.”)

In Chicago, much of the opposition came from African American political elites. They had the usual set of concerns for casinos, plus one other which is slightly more idiosyncratic. A belief with wide currency in that community is that the community would be much more wealthy than it currently is, but for vice entrepreneurs siphoning that community’s resources out of the community. This belief has lead to e.g. pogroms against Korean liquor store owners. I direct interested readers to histories of the Rodney King riots or the Asian American experience in 20th century America. (This was covered extensively in an elective I took more than 20 years ago, and so I have since forgotten the academic citations for this true but parenthetical point.)

Bally’s won the bid for the newly licensed Chicago casino in 2022, in part due to offering the right mix of concessions and inducements in its Host Community Agreement. One of those was promising Chicago that the new casino would be at least 25% owned by women and Minorities. The M is capital in the Chicago municipal code, and I will preserve this stylistic choice, because the word does not mean what most educated Americans assume it means. We shall return to that meaning later.

…. [Later]….

Chicago’s peculiar definition of Minority

Long-time observers of Chicago politics might opine that the city very rarely does anything without creating a carveout for politically connected individuals. The local phrase for this sort of social connection is having “clout” or, sometimes, “is clouted.” You can find examples of the sort of carveouts Chicago reserves for the clouted in the professional histories of the board members of Bally’s Chicago, Inc, for example, which are included in the prospectus.

So what’s the carveout here? The definition of a racial or ethnic minority is a legendarily contentious one in U.S. politics, largely because inclusion or exclusion from it makes one eligible (or ineligible) for concrete benefits. Sites of contention often include e.g. are Asian Americans a minority, or are e.g. Cuban Americans Hispanic, etc.

Chicago leaves itself an out for its definition of Minority, which lets it designate any individual or group as a Minority, on an ad hoc, unreported, unaccountable basis. That sounds like I must be strawmanning Chicago. See the below screenshot and explanation in the prospectus

Quoting the prospectus:

Qualification under [the final] clause is determined on a case-by-case basis and there is no exhaustive or definitive list of groups or individuals that the City of Chicago has determined to qualify as Minority under this clause. However, in the event the City of Chicago identifies any additional groups or individuals as falling under this clause in the future, members of such groups would satisfy the Class A Qualification Criteria.

….

You’ll have to ask the city for their list of ad hoc exceptions made under this bullet point. Long-time watchers of Chicago municipal politics, however, might say that asking is of limited utility.

I will note that, as a matter of engineering fact, the web application will blithely accept self-certification under this bullet point for anyone. You are welcome to your guess as to whether Bally’s or any city employee will review the 1,000 investors individually and, if they review them, what the process is for determining whether e.g. a particular Patrick counts as a Minority or not.

I’d wager there is no process at all here. It seems like a better bet than most offered in the casino.

That’s just the bit on who is “qualified” to invest in this particular offering.

There are more pieces to this — the complex corporate structure, whether the entity will distribute any profits to investors, what leverage is involved in the deal, a crypto connection, and on and on.

There is quite a bit of risk in this deal, including the Chicago political risk angle.

Oh, and did I mention the lawsuits?

As Matt Levine and Patrick McKenzie (the author of the above) both noted, this is really poor timing on the part of Bally’s. The federal level of the government is not going to give them cover for an investment open only to people of particular demographic characteristics, no matter how loosely you define them.

31 Jan 2025, Block Club Chicago: White Men Are Suing Bally’s Casino, City Over Investment Offer Aimed At Women, Minorities

CHICAGO — Two white men are accusing the city of Chicago and Bally’s Corp. of discriminating against them, saying they too should be able to participate in Bally’s recent offer of a 25 percent ownership stake in its Chicago casino geared toward women and people of color.

The lawsuit, filed Wednesday in U.S. District Court in Chicago, alleges the city violated the rights of Richard Fisher and Phillip Aronoff, two white men from Texas, who are unable to invest in Bally’s minority ownership stake because of their race. The American Alliance for Equal Rights, a conservative legal group dedicated to challenging diversity and equity initiatives, joined the men in filing suit.

“This race-based stock offering is illegal, and this court should declare it as such,” the 29-page complaint reads.

More coverage of the Bally’s Chicago offering:

30 Dec 2024, Bally’s announcement: Bally’s Chicago Announces Investment Opportunity

4 Feb 2025, iGB: Minority investment opportunity could derail Bally’s Chicago casino plans

24 Jan 2025, Block Club Chicago: Bally’s Chicago Wants Women, Minorities To Invest In New Casino — But Is It A Safe Bet?

30 Dec 2024, Chicago Sun-Times: Bally's to sell Chicago casino ownership stakes to women, minority investors

31 Jan 2025, Wirepoints: Lawsuit filed by Mark Glennon against City of Chicago, Mayor Johnson and Bally’s alleges blatant discrimination – Wirepoints

Other Chicago and Illinois Finance Stories

Links without commentary:

29 Jan 2025, Illinois Policy: Madigan collects $158K while facing federal corruption trial in Chicago

27 Jan 2025, Wirepoints: Illinois extremely late on its 2023 financial report. Explanation needed. – Wirepoints

4 Feb 2025, Center Square: House Republicans say immigration affecting Illinoisans’ finances, safety

Jan 2025 COGFA report: https://cgfa.ilga.gov/Upload/0125%20Monthly.pdf

4 Feb 2025, CapitolFax: Pritzker goes from saying state should ‘not resort to tax increases’ to balance the budget last week, to taxes ‘should not be the first, but rather the last’ resort today

31 Jan 2025, Illinois Policy: Mayor Brandon Johnson would benefit from CPS contract he’s negotiating

"I like to quarantine the Illinois content to protect all the other states."

As an Illinois taxpayer, I support this decision! 😂

Yeah, I live seeing those postings for new college grads with a requirement of 3 years of actuarial software modeling experience...