Thoughts on the Passing Scene: Crazy Finance, Stupid Graphs, and Questionable Spreadsheets

OH MYYYYYYYYY

I wasn’t planning on posting today, but I saw a few clever things, and some stuff I don’t want to make a full post on.

(Also, to note in passing, I’m no Thomas Sowell. But then, who is? Excepting Tom Sowell.)

So let’s get to it.

Dumbest “stimulus” idea

Okay, maybe this isn’t the absolute dumbest. I’ve forgotten some bad ideas at this point, I’m sure.

But this: A new GOP bill would give each taxpayer $4,000 to take a vacation anywhere in the US through the end of 2021 prompted the following exchange between three people I know:

Person 1: LET’S SEE JUST WHEN MR. BOND MARKET SAYS HE HAS HAD ENOUGH!!!!!

Person 2: Is it bad that I’m picturing “Mr. Bond Market” as being like “Mr. Slave” from South Park?

Person 3: No Mr Bond Market, I expect you to die.

[that three-person reaction is why this post exists]

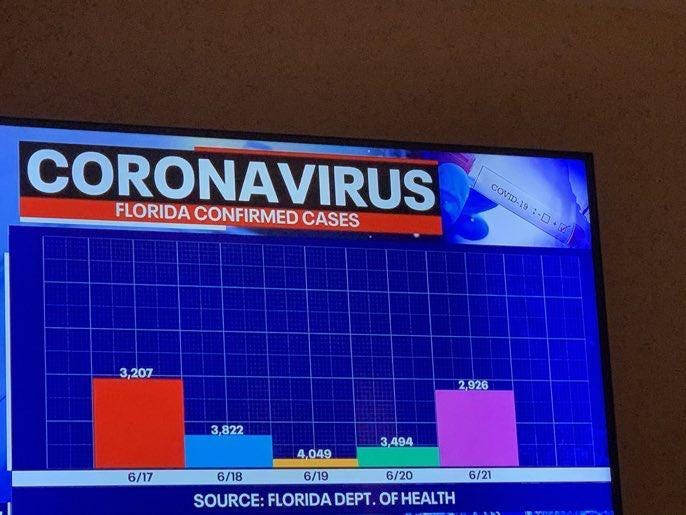

The worst dataviz of…. the last 24 hours

I really have seen some nutty media graphs, and there really is no excuse for this crap.

FFS, I can teach you guys to do customized Excel templates so your graphs can look “cool” – whatever on the colors, the stupid effects, background colors, whatever – and at least they’ll look right.

While the dataisugly subreddit has this covered, my favorite themed site for this is Viz.wtf. (And yes, they’ve got this graph).

Reminder: The math you (and journalists) need to know

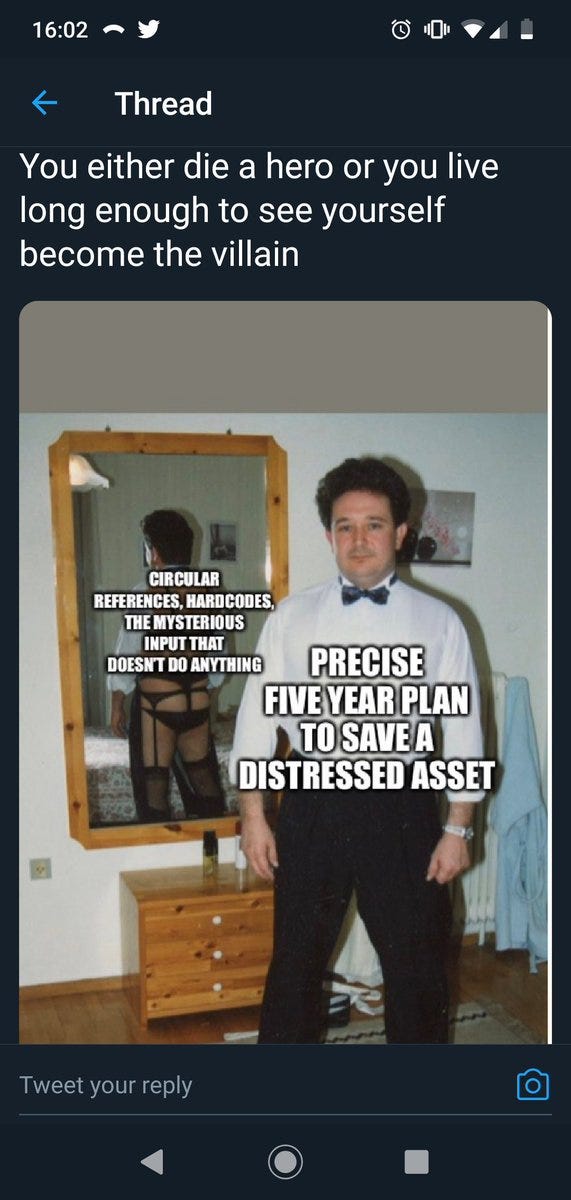

Look-in-the-mirror test

The actuarial profession in the U.S. has a Code of Professional Conduct, with several precepts. My favorite one is Precept 2, which says:

An Actuary shall perform Actuarial Services only when the Actuary is qualified to do so on the basis of basic and continuing education and experience, and only when the Actuary satisfies applicable qualification standards.

Now, most just read this as to having actuarial credentials for a particular field, but that’s really not sufficient for certain work.

We usually refer to the higher standard as the look-in-the-mirror test, which generally doesn’t work for incompetent actuaries [and yes, some exist].

Anyway, this isn’t what they had in mind:

(thanks to the unnamed actuarial type who sent that to me)

(also, if you’re interested, I do spreadsheet best practice webcasts at Actex. You can see some linked here.

Tips for following STUMP: blogtrottr and feedly

In response to my last post, somebody told me they had been following the site using the blogtrottr service.

That reminded me — I had a similar service via feedly, which aggregates all the blogs I like to read. I actually “subscribed” to STUMP via feedly, and there are others, too.

So consider using those services if you don’t like substack.

I do have this atom feed, which I believe both blogtrottr and feedly use. So feel free to use it in any other blog aggregator!

Ending thought from Thomas Sowell

There was no way I was going to steal a title phrase from Sowell without sharing a Sowell quote.

I would also argue this is the reason to read Dickens:

This time it’s different?

Nope, this time it’s exactly the same. And you can look to Dickens to see what that sameness is.

How do we prevent new frauds and asset bubbles? One may take a technical approach, but at the heart is human nature—how people behave, how people have particular goals, and how some will try to get what they want fraudulently. Many of these frauds are successful due to the perpetrator’s own knowledge of human nature. It’s hilarious how often we hear “This time it’s different!”…. and it turns out people’s greed, envy, pride, and pretty much all the mortal sins, come into the mix in the same old way.

See y’all later!