I’ve decided to bring back Taxing Tuesday as a regular feature for a few reasons.

The main reason is that it’s pretty clear that governments are revenue-hungry and are finding their current sources will not be enough to fulfill the old promises they’ve made (I’ll be writing about that soon enough) and definitely not to fulfill all the spending wish lists they’ve got going forward (and no, they will not be cutting any spending, let’s not get silly.)

But simply raising tax rates will not be popular, especially as taxpayers are paying more for everything around them already.

So let’s see what’s been cooking in the tax world lately.

Norway Wealth Taxes: Results are No Better than Other Wealth Taxes

I will link to a few other of my wealth tax-related posts, at the end, so you can compare.

Reason: Wealth Taxes Result in Rich People Fleeing, Turns Out

If your net wealth is approximately $135,000 or more and you live in Norway, you've long been subject to a 0.85 percent wealth tax. That rate has, as of this year, been hiked to 1.1 percent by the center-left government, and even more gobs of cash will be taken from rich people worth roughly $1.8 million, who will be taxed at a rate of 1.3 percent.

Unfortunately for the Norwegian lefties—and their American counterparts who argue for similar taxes to be instituted here—this wealth tax hasn't really generated the revenue they'd expected. It has instead resulted in rich people boarding their superyachts and leaving those fjords behind forevermore.

Per the Norwegian newspaper Dagens Næringsliv, 30 of the country's multimillionaires and billionaires left the country last year in advance of the wealth tax hike. "This was more than the total number of super-rich people who left the country during the previous 13 years, it added," noted The Guardian. "Even more super-rich individuals are expected to leave this year because of the increase in wealth tax in November, costing the government tens of millions in lost tax receipts."

Before I link my prior wealth tax posts, I want to address the change in the wealth tax rate.

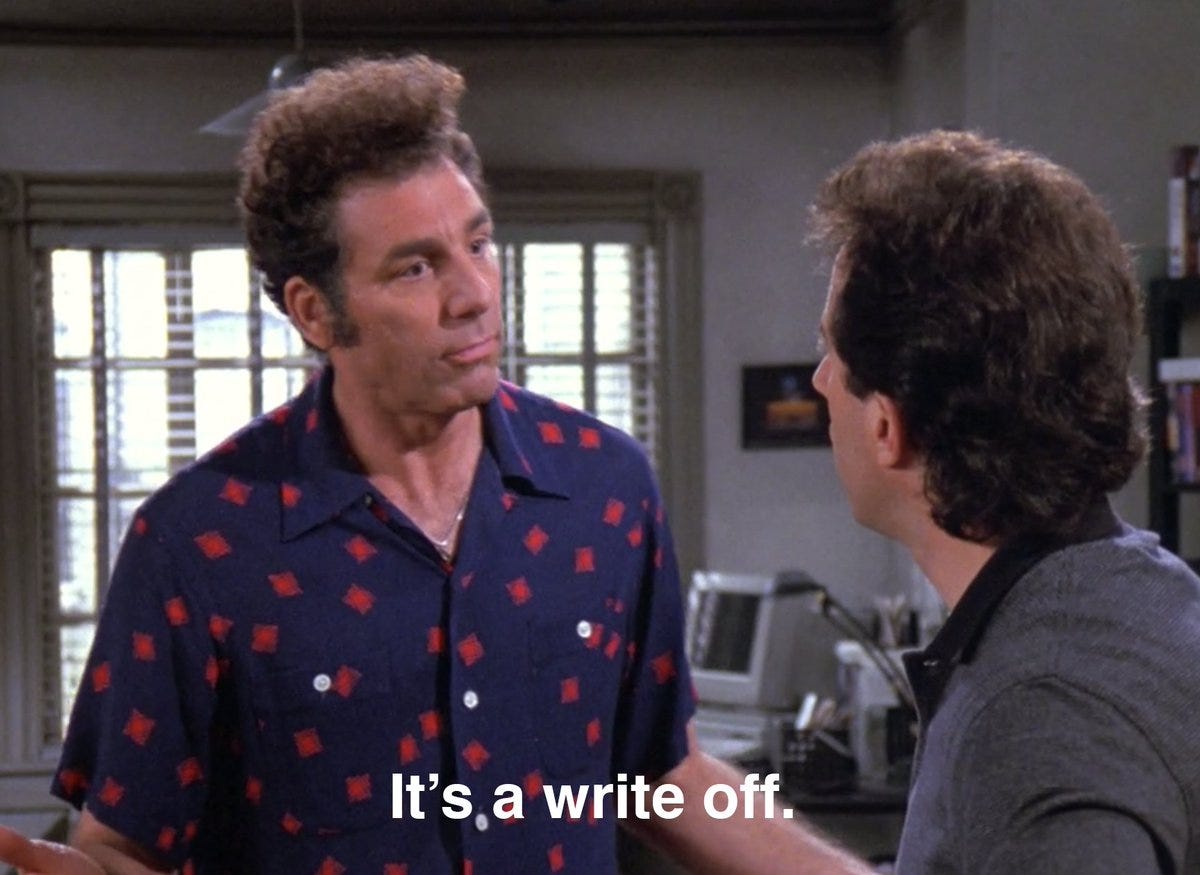

This is something I harp on about a lot — people see 0.85% and 1.1% and 1.3% and think about the difference being subtracting these numbers.

As opposed to thinking about the percentage increase in the amount being paid.

I will make it simple: if you had $1 million, then 0.85% of that is $8,500

With the new rate of 1.1%, that’s $11,000 — almost 30% increase in the tax paid.

But let us assume you were one of the super-rich with $10 million — before the rate was 0.85%, paying $85,000.

With a new rate of 1.3%, the amount paid would be $130,000 — an increase of 53%.

People who are billionaires and multimillionaires, the ones who are such for long periods of time at least, do not stay that way by not reacting to large increases in taxes.

They have options. They don’t have to live in Norway.

They can pine for the fjords, and hold onto their wealth.

Older posts on wealth taxes

This is just a very short selection.

February 2019: Taxing Tuesday: Let's Soak the Rich...Hey, Where Are They Going?

I feel like preening for a moment: one of my most useful skills is that I can learn from other people’s mistakes. I can watch someone do something ill-advised, see the result, and then say “Hey, I don’t need to try that out! That’s going to end in disaster!”

To be sure, I’ve made my own mistakes because I haven’t seen everybody else’s mistakes. But I’ve watched things happen directly, and I’ve read news and history books and been able to draw some conclusions.

Unfortunately, politicians don’t fall into that category.

January 2019: Taxing Tuesday: Save Us Rich People From Senator Candidates

Why is it immoral that some people are billionaires?

I mean, I find it putrid so many politicians and other rent-seekers have become rich (“magically”) on the public dime. One does wonder how someone like Bernie Sanders amassed three homes.

Anyway, no, I’m not that rich, but given how very little money they’d be able to get from this, and how little it would actually prevent billionaires from being tricksy (as in, all of them moving to Zurich… good luck getting to their assets to figure out a full valuation), I would assume if they could get it seen as legal, they’d be pushing the wealth tax down to those who have positive net worth, forget about the “rich”.

August 2018: Taxing Tuesday: Let's Tax Wealth!

SALT Cap Review: SALT (deduction) is bad for the federal tax diet

I am definitely not going to link to all my SALT (state and local tax [deduction]) cap posts (holy moley), but something to remember is that the 2017 tax cuts expire in 2025… and they were “paid for” partly via the SALT cap.

As I always mention, I live in Westchester County, NY — and I work in Connecticut. My SALT goes well over the SALT cap by two times, at least. (I don’t even bother looking at this point.) However, with the drop in federal income marginal tax rates, I basically broke even out of the 2017 tax bill.

Cato reviews: Understanding the State and Local Tax Deduction (SALT)

In 2017, Republicans passed the Tax Cuts and Jobs Act, which cut taxes for the vast majority of Americans and simplified taxpaying by making modest reforms to, among other things, the system of itemized deductions. One of the most politically contentious reforms was a new $10,000 cap on the state and local tax (SALT) deduction. This revenue‐raising change was critical in offsetting the cost of the individual tax cuts, and without it, extending the tax cuts will be next to impossible.

Politicians representing high‐income congressional districts in high‐tax states, such as California, New York, and Illinois, have since campaigned on repealing the SALT cap. This same group of legislators is threatening to derail the Republican’s new economic tax package because it does not increase or eliminate the SALT cap. Democrats dealt with a similar dynamic on major legislation last year.

As the 2025 expiration of the 2017 tax cuts draws closer, members of Congress need to remember that a simpler tax code with lower tax rates must also limit or repeal special interest provisions, such as the SALT deduction. It’s much harder to cut tax rates without broadening the tax base.

….

Estimates show that more than 95 percent of taxpayers benefited from a tax cut in 2018 or saw no change in their tax bill. This leaves a small minority of taxpayers who could have seen tax increases. Higher taxes for some is a predictable outcome of any reform that attempts to limit special interest tax provisions that provide large benefits to a few taxpayers at the expense of others.

However, the problem of higher taxes due to the SALT cap is often overstated. In the hardest‐hit congressional districts in New York and California, with the largest share of taxpayers with estimated tax increases, 88 percent of taxpayers benefited from a tax cut or saw no change.

I saw a very small decrease in my effective tax rate, but that may have been due to my drop in income when I dropped one of my jobs when Stuart was diagnosed with cancer.

But even if I hadn’t, there would have been a small change.

The SALT cap and other limits on itemized deductions make tax cuts possible, simplify taxpaying, and reduce subsidies for high‐income taxpayers and state governments.

Capping the SALT deduction is a crucial ingredient in the classic tax reform recipe of lower tax rates, offset with a broader tax base. The $10,000 SALT cap and other limits on itemized deductions raised $668 billion over ten years, one of the largest individual tax changes used to pay for lower tax rates.

Without the SALT cap and other revenue‐raising components of the 2017 compromise, the old tax rules will snap back in 2026, bringing back the old AMT, higher marginal tax rates, and smaller standard deduction. This is the counterfactual; it is not an option to eliminate the SALT cap in isolation. Without limits on itemized deductions, the rest of the tax cuts are unsustainable. Full SALT deduction for higher tax rates is a bad trade for almost all taxpayers—even those in high‐income coastal states.

I would argue that it is especially bad for people like me, because it encourages high-tax areas to escalate their spending and promises, because, after all, the taxpayers can always deduct those taxes…

Yeah….

Anyway, when it’s playing with other people’s money, it helps when there is a restraint mechanism.

As initially proposed by House Republicans in the lead‐up to 2017, the correct policy is to repeal the SALT deduction entirely.

Woo! Yes! SALT cap zero!

I know politics is the art of compromise, so I don’t see that happening, but I think it would be a good idea.

Older posts on SALT cap

October 2019: Taxing Tuesday: Poor Little Rich People and the SALT Cap

This is rich (to me).

A leftie source complains that highly-taxed folks see their property values drop due to increased taxes.

July 2019: Taxing Tuesday: SALT cap zero! Great new taste!

Okay, it’s me arguing for SALT cap zero. I haven’t seen others promoting the idea, but it’s probably they’re like me: somebody who can be pure on tax ideology because nobody is paying me for this one way or another.

Also, I don’t have to try to get elected or help people get elected.

So it’s easy for me.

April 2021: SALT Cap Tussle: NY Democrats Have an Ultimatum

August 2021: Taxing Tuesday: The SALT Cap Battle Continues

Except it is a giveaway to these rich districts.

Living in one of these rich districts, I’m going to be blunt: the reason I don’t mind paying high taxes is that our community gets value for money, and I’m not joking. I have services available for my son that I would not be able to get in North Carolina (and I’ve told NC friends to move up to NY to get the same services as we get… but they balk at the tax levels.) We have awesome snow-clearing. We have a fabulous town supervisor (who is a Republican, but that’s not the most salient fact) who bitches at our monopolistic utilities to make sure we get downed trees taken care of, lines repaired, etc. This town supervisor is a retired electrical engineer (from IBM), as my dad would have been were he still alive.

Our local taxes are absolutely getting plowed back into our locality, and our state taxes do come to us a lot as well. We’re not doing a huge amount of subsidization of anywhere but NYC. And I benefit from that as well.

But people in non-New York places? What do they get from my SALT deduction?

These arguments remind me of an anecdote from my childhood. We each had $160 from Christmas cash gifts from relatives and we were at the Mall. My ma had about $20 on her to buy a bra.

My middle sister: Please give me $40 so I can have an even $200.

Our mother: I only have enough to buy a bra.

Me & youngest sister: [laughing in middle sister’s face]

It was not a very convincing argument.