I forget, what was the name of the supposed ideological plan that came from some conservative think tank that was just a wishlist from a bunch of conservatives and libertarians partying one weekend? Heritage 2025? I’m too lazy to look up leftist scaremongering.

The following is definitely not from them. That group was more a SALT CAP ZERO! bunch of rowdies. WOOOOO!

National Review, 10 Jan 2025: Blue-State House Republicans Will Fly to Mar-a-Lago to Talk SALT with Trump

A small cohort of House Republicans from New York, California, and New Jersey will fly to Mar-a-Lago this weekend to speak privately with President-elect Donald Trump about how to craft new legislation involving the state and local tax (SALT) deduction, a controversial tax write-off that is set to expire at the end of 2025. Trump pledged on the campaign trail that he would “get SALT back” if elected to a second term — which suggests he’s open to significantly increasing the deduction limit or scrapping the cap altogether.

This is highly annoying to me, but given my own representative is one of the bunch (and he’s been yapping about SALT since he was elected, I can’t say I’m surprised), I can only sigh.

“I’ve been very clear, I will not support a tax bill that does not lift the cap on SALT,” Representative Mike Lawler (R., N.Y.) said last year. “My vote, along with many of my colleagues from New York, New Jersey, California, are going to be critical to pass a tax bill,” he said, adding: “If nothing passes, the cap on SALT completely expires.”

It’s likely that Lawler will present Trump and his team with his own legislative proposal — called the SALT Fairness and Marriage Penalty Elimination Act — which would raise the SALT deduction cap from $10,000 to $100,000 for individuals and would allow married couples filing jointly to deduct up to $200,000.

Lawler has been slashing at the problem for some time. As I’ve written many times before, I am personally affected by the SALT cap. I will be filing married jointly for the last time, with the dinky $10K SALT cap for 2024, and the deductions I would have had go over that cap multiple times due to my high property taxes in Westchester, alongside the high state income taxes I pay to Connecticut. (and a little bit to NY.)

In the future, I’ll be filing as a single person with at least my cognitively disabled son as a dependent. And I’d still go over that SALT cap by multiple times.

All that said, in general, with the higher standard deduction and lower marginal tax rates, it’s all a wash for me under the 2017 TCJA (Tax Cuts and Jobs Act).

If they raise the SALT cap, then something else has to change — and likely the marginal rates would go up. And it would be a wash again.

CRFB Analysis

9 Jan 2025, Committee for a Responsible Federal Budget: Weakening the SALT Cap Would be a Costly Mistake

According to press reports, policymakers are considering changes to the $10,000 state and local tax (SALT) deduction cap as part of their efforts to extend the expiring parts of the Tax Cuts and Jobs Act (TCJA). Specifically, recent discussions have centered around boosting the cap from $10,000 to $20,000 for married tax filers. Although this change would reduce the “marriage penalty” associated with the current cap – which doesn’t vary by filing status – it would also further increase the deficit effect of TCJA extension, provide a windfall to higher earners in high-tax states, and undermine tax simplicity.

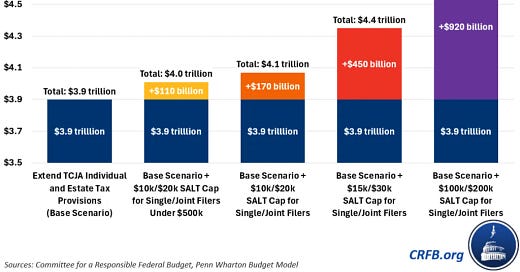

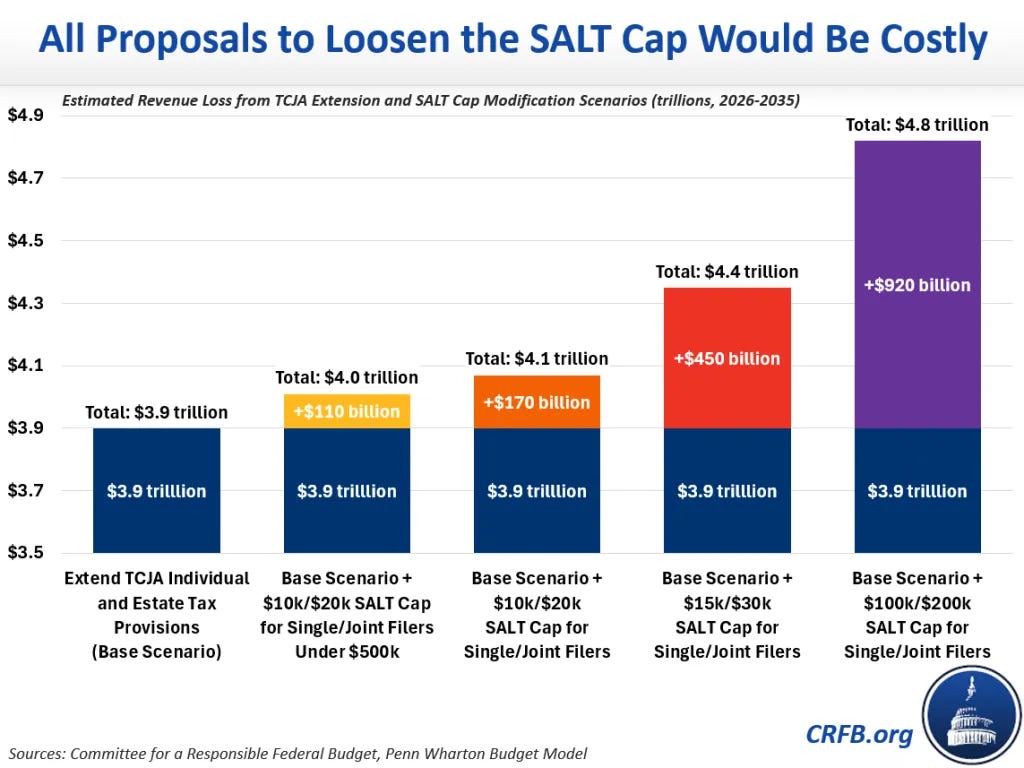

The one all the way to the right is Lawler’s proposal (without changing any tax brackets or marginal tax rates).

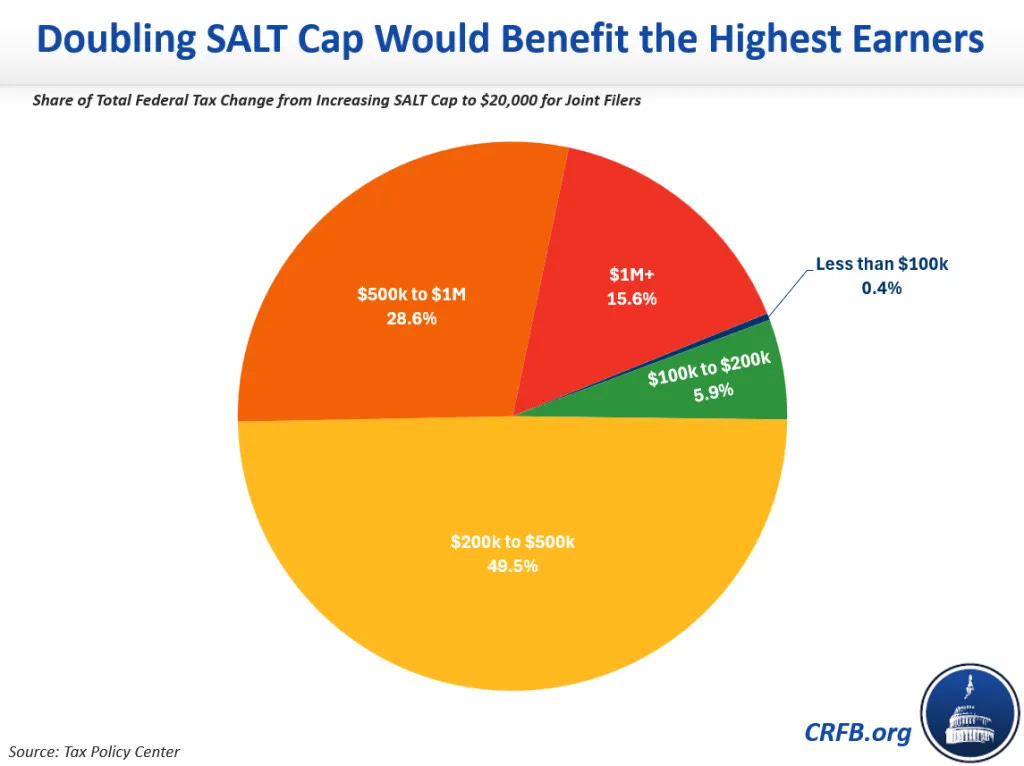

This is a big ole duh, given the SALT deduction primarily went to high-income folks in the first place.

Also, federal income taxes are primarily paid by the highest-income people. So this isn’t terribly impressive.

All that said, I would like to see the analysis of setting the SALT cap to zero.

Post-Trump meeting chatter

The above was all from pre-weekend meeting(s). What do people say now?

11 Jan 2025, NY Post: Trump tells NY Republicans he wants to raise SALT cap, ‘kill’ congestion pricing: ‘It’s got to go’

President-elect Donald Trump said he’s on board for scrapping congestion pricing and lifting the cap on state and local tax deductions, The Post has learned.

….

Trump, 78, also said he supported the Republican pols’ effort to raise a cap on the amount of state and local taxes New Yorkers can deduct from their federal taxes known as the SALT cap, the pols said.

“He’s fully on board with lifting the cap on SALT,” Lawler said.

“The president reiterated his support for lifting the cap on SALT and talking to us about the need to come up with a number and work through it and build consensus in the House,” he added.

“He said that he understands the plight of New Yorkers who are being abused by our mayor and our governor who treat them like ATMs, and he wants to provide SALT relief,” Malliotakis said.

[grumble grumble SALT CAP ZERO would provide incentive to lower the SALT, you know grumble grumble]

The Governor also took to X Sunday morning to complain that Lawler and the Republicans shouldn’t settle for anything less than a full repeal of the cap.

“New Yorkers deserve a full repeal of the SALT cap. Anything less is a failure—and you know it, Mike,” Hochul wrote.

See?

SALT CAP ZERO!

It’s the only true win!

13 Jan 2025, Roll Call: GOP eyes compromise ‘SALT’ cap in low-to-mid five figures

Blue-state Republicans left a meeting with President-elect Donald Trump confident in his support of raising the $10,000 cap on state and local tax deductions, increasing the likelihood Congress will raise the limit in tax legislation this year.

Trump’s backing for raising the so-called SALT cap will be key to smoothing over possible objections from others in the Republican conference representing lower-tax states, who are content to leave the limit in place. The cap was imposed by the 2017 tax legislation Trump signed into law to bring down the cost of the $1.5 trillion measure, but the president-elect has since changed his tune on the provision.

….

“He gave us the homework to identify a number that could work and cover the vast majority of the middle-class families that we represent,” Rep. Nicole Malliotakis, R-N.Y., said in an interview following the meeting. “What is the number that would provide relief for our middle-class families that can get consensus so we can reach the 218 [votes threshold] and that works within this Rubik’s cube of reconciliation within the topline number that we’re provided by the Budget Committee? That’s the real question.”

House Republicans seeking SALT relief hold differing views on where to set the cap, but a limit between roughly $20,000 and $60,000 seems to be the range under consideration.

Again, with the current higher standard deduction and lower marginal rates, the SALT cap is irrelevant. It’s all a wash.

If they raise the SALT cap, and then raise the marginal tax rates, it’s a wash again.

The average SALT deduction claimed by taxpayers earning between $200,000 and $500,000 in 2017, the last year without the cap, was $23,000, according to IRS data. In New York, the average deduction claimed for that income range was closer to $34,000.

The same year, households with $500,000 to $1 million in annual income deducted an average of $56,000 in state and local taxes from their federal tax bill, according to the agency. That’s in line with Lawler’s scaled-back proposal, which he views as a reasonable compromise but may run afoul of marching orders to keep a higher cap targeted to middle-income households, as opposed to wealthier ones.

….

In the meeting, [Malliotakis] pitched increasing the SALT cap for households below a certain income level; allowing it to apply to property taxes paid on a primary residence, but not a second or third home; and rewarding states and localities that freeze or cut taxes with an additional SALT cap increase.

Last year, blue-state Republicans fought to double the $10,000 cap for married couples, saying it would put an end to a so-called marriage penalty written into the law, which applies the same limit on deductions to individuals and married couples. But Republicans are weighing leaving the penalty in place if it means setting a higher SALT cap across the board, Malliotakis said.

After Republicans agree on where to set the SALT cap, they’re likely going to have to also figure out how to pay for it.

Malliotakis floated closing “loopholes” that allow profitable corporations to pay tax rates in the single digits as a possible revenue-raising measure, as well as making fewer tax credits available to people who make too little to be subject to income tax.

Ways and Means Rep. Brian Fitzpatrick, R-Pa., who last week convened a meeting between his “Working Families tax team” and blue-state Republicans, also cited limiting corporate state and local tax deductions as a potential offset. He also pointed to potential changes to the current alternative minimum tax, which was dramatically scaled back in the 2017 tax law and is set to snap back into its old form without action from Congress.

Oh great. I got hit with the AMT a few times over the years (marginally). The AMT often hit high-income people in high SALT locales.

You know, the people they’re trying to save from the low SALT cap.

Malliotakis said she opposes the return of the alternative minimum tax, which capped SALT deductions for many households before the AMT was scaled back in the 2017 law, in any form. New Yorkers are wary of an offset for raising the SALT cap that would also target taxpayers in their state, she said.

You don’t say.

Or, maybe, let’s just suck it up for being a high-tax location…. and realize that no, we can’t make residents of other states and locales pay higher federal taxes compared to us, just because we decided to live the “luxury” of living in a high-tax location. We can do something about that, after all.

(SALT CAP ZERO!)

A menu of more than $5 trillion in potential spending cuts drawn up by House Budget Republicans that became public last week drew heavily on Medicaid, the joint federal-state health care benefit for the poor, food stamps and other social welfare programs. Those cuts are likely to hit populous states hardest.

“We don’t want New York to be taking the brunt of spending cuts either,” Malliotakis said. “We should not be in a situation where New York is getting an unfair burden … when it comes to spending cuts and then we’ve got to fight for SALT relief. It’s got to be more proportional. The haircut has to be across the board.”

This isn’t just about New York's large population but also about the state's decision to spend a lot on Medicaid as a matter of policy.

Just like we decided to be a high-tax place in general.

That’s not on the federal government.

I understand these politicians want to get re-elected (and I don’t), but that’s reality.

This is just the beginning of wrangling, and the political reality is the Republicans have razor-thin majorities, and need the Republicans like Malliotakis and Lawler, who were elected from high-SALT locales. They need something for their constituencies to get re-elected. I may be one of Lawler’s constituents, but I’m not normal.

More SALT (and related federal tax) coverage

11 Jan, Politico: Tax break for homeowners on table as blue-state Republicans huddle with Trump

11 Jan, The Hill: SALT-focused Republicans to meet with Trump as they threaten to hold up bill

12 Jan, Washington Examiner: Lawler optimistic ‘real tax relief’ can be negotiated among House GOP on SALT

8 Jan, NY1: N.Y. congressional Republicans temper SALT cap expectations ahead of Trump meeting

13 Jan, Philip Bump, WaPo: Republicans want concessions before California gets its tax dollars back

14 Jan, USA Today: Exclusive poll: For Trump, a strengthened hand but skepticism on tax cuts, tariffs