I compile these Taxing Tuesday posts in the week running up to posting it… and given the tempo of the Trump Admin, perhaps a lot of it goes stale along the way.

Oh well.

But it also does well to remember what people say along the way (because this won’t be the last time it happens.)

As I’m writing, the Big Beautiful Bill is locked up, or very slowly moving:

Friday, May 16 — Big Beautiful Bill Locked Up in Committee

16 May 2025, National Review: House GOP’s ‘Big, Beautiful’ Bill Blocked in Key Committee Vote as Party Splinters over Spending Cuts

The measure failed in a 16-21 vote, with five Republicans voting no: Representatives Chip Roy of Texas, Ralph Norman of South Carolina, Josh Brecheen of Oklahoma, Andrew Clyde of Georgia and Lloyd Smucker of Pennsylvania.

The party could only lose the support of two of its members and still pass the legislation.

The fiscal hawks who voted down the 1,116-page bill argue the measure doesn’t include enough spending cuts, even as House GOP leadership sources contend the spending cuts outlined in the bill exceed the figures deficit hawks outlined earlier this year amid budget blueprint talks.

The bill must advance in the Budget Committee before it can move forward to the Rules Committee and ultimately the House floor.

16 May 2025, Daily Signal: Why Budget Committee Conservatives Shot Down Part of the ‘Big, Beautiful Bill’

At the close of the hearing, Budget Committee Chairman Rep. Jodey Arrington, R-Texas, said, “I do not anticipate us coming back today,” and encouraged House members to go home for the weekend.

“This bill falls profoundly short. It does not do what we say it does with respect to deficits,” said Roy at the committee markup.

Maybe this will have moved on by Tuesday.

16 May 2025, Mish Talk: Trump’s Big, Beautiful Tax Bill Dies in Committee, Hawks Demand Changes

Wake me up when it gets out of committee.

Oh, it got out of committee in the wee hours of the morning on Tuesday. Or part of it did.

SALT Drama: Triple the cap? Remove it? Something else?

Again, what I, Mary Pat Campbell, living in NY-17, the district represented by Mike Lawler, want from an ideological standpoint: SALT cap zero.

That is, no deductibility of state and local taxes in the federal income tax. Because I’m nasty like that. (Also, I think it will temper state/local politicians from hiking our taxes.)

But what I want, and what actually happens, are very different things. Especially since I’m not the person trying to get re-elected in this very balanced district.

I’m watching email/social media sniping going on among people I know locally, and no, not going to share any of that. It’s not public.

Here are a bunch of pieces of recent commentary on the SALT cap:

Committee for a Responsible Federal Budget, 14 May 2025: SALT Deduction Resources

The Spectator World, 20 May 2025: Don’t let SALT levels bring down the BBB, says Trump

Tom Rogan, 15 May 2025, Washington Examiner: Republicans should let the ‘one big, beautiful bill’ die on SALT hill [Rogan seems to be on the SALT cap zero train]

National Taxpayers Union Foundation blog, 15 May 2025: What Could We Do with $356 Billion Instead of Raising the SALT Cap?

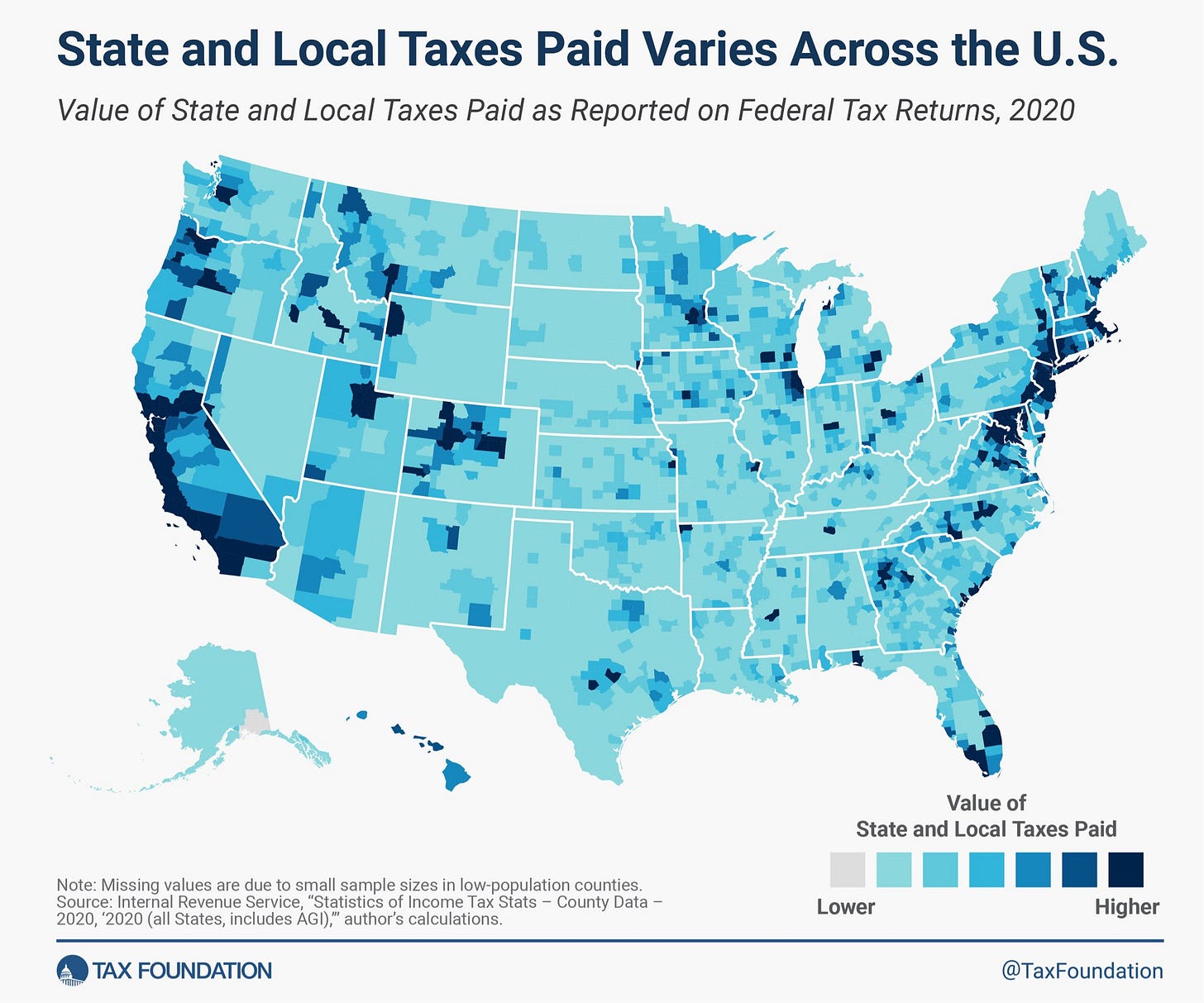

Tax Foundation, 14 May 2025, X.com: [linking to September 2023 piece]

This relates to my prior post: Taxing Tuesday: Geeking out with the SALT Cap, in which I used 2022 data to look at SALT in my district, NY-17.

Some other sniping on X re: SALT

Yes, you can see my likes (and bookmarks) in my screenshots. I’m doing that on purpose.

Oh, I remember that stuff very well.

(Yes, he’s exaggerating for effect. I will pick one time, and it was very funny to me, because it was Democrats vs. Democrats: April 2021 SALT Cap Tussle: NY Democrats Have an Ultimatum — yup, NY Democrats. They didn’t get rid of the SALT cap either.)

That’s enough of all that discussion.

As I showed (and from the Tax Foundation and others) multiple times, of course, almost all of us high-income folks were just fine after the 2017 tax cuts. What happened, with the marginal tax rate cuts and increase in the standard deduction meant most of us ended up with a wash in our taxes.

We didn’t really get a cut, but our taxes didn’t increase either.

It’s just those guys over there (waving generally) did get a cut, and we didn’t. That’s it.

[Pout.]

From the Republicans in high-tax districts:

Three of these reps are from New York.

Other Tax Links

Empire Center, 20 May 2025: House Budget Would Burst New York’s Essential Plan Bubble

Eide Bailly Tax News & Views, 19 May 2025: Tax News & Views Big Beautiful Bill Jumps Again Roundup

The Chronicle of Higher Education, 16 May 2025, Philip Levine: Here’s What Congress’s Endowment-Tax Plan Might Cost Your College

Tax Foundation, 15 May 2025: House Tax Package Could Double Economic Growth Impact by Prioritizing Permanence for TCJA Business Provisions

Pensions & Investments, 20 May 2025: House lawmakers fix glitch in tax bill that would have hurt retirement plans

Reason, 19 May 2025: Not Even the Moody's Downgrade Can Make Republicans Take the National Debt Seriously

Eide Bailly Tax News & Views, 20 May 2025: Tax News & Views Rescuing the Bill Roundup

Mish Talk, 20 May 2025: Trump’s “One Big Beautiful Bill” Would Increase the Deficit by $4.8 Trillion

Don’t Mess with Taxes, 17 May 2025: As an American, Pope Leo XIV also must answer to IRS

Even the Pope?!

Maaaaan.

Love that advertising! Somehow the SALT cap is subsidizing other states. I fail to see the logic that payments to NY and to the Feds is somehow a subsidy to low tax states. Ain't politics great?!

I think His Holiness will get off easy when it comes to the IRS. Clerics get a lot of odd deductions and expenses not available to laymen, and on top of that I think his meals & housing aren't taxable for the same reason BAS and BAH aren't taxable to military taxpayers.