Taxing Tuesday: OBBB Reactions Round-Up

Yes, Something Got Passed. Now we have to deal with the aftermath.

Yes, I got a little tired of the wrangling over various crap getting messed with as they were getting to the end of Trump trying to re-up his 2017 bill, so didn’t want to spend much time on things that might get scrapped.

But a final bill was passed, reconciled, etc., and signed.

We now have this Big Mess of a Bill, with its myriad items. There’s already one judicial injunction (which I’m not going to touch, because I’ve got bigger fish to fry today.)

Let me do a round-up.

Top-Level Analysis: Kenneth Hunter and Tax Foundation

Kenneth Hunter Summary: States need to figure out the bill's impacts on their budgets, and individuals won’t have their federal income taxes go up, in general.

Kenneth Hunter has both video & text.

Tax Foundation comes with two links:

4 July 2025: “One Big Beautiful Bill Act” Tax Policies: Details and Analysis

7 July 2025: The Good, the Bad, and the Ugly in the One Big Beautiful Bill Act

Tax Foundation Summaries:

The One Big Beautiful Bill Act provides certainty for US households by permanently extending the TCJA individual rates and brackets and makes permanent one of the most pro-growth tax policies available: expensing for investment in short-lived assets and domestic research and development. However, it focuses too heavily on political carveouts like the “no tax on tips and overtime” exemptions and misses a critical opportunity to address the deficit and simplify the code.

Basically, this is a mess of a bill coming from the wrangling within one political party, that stretches out over one ginormous country, where members within that party have differing goals. There were some trade-offs made that led to complex results and a messier tax code.

As it usually ends up.

SALTy stuff

I have to address the SALT aspects, because of course, I do.

The final SALT component was that the SALT cap was lifted to $40,000, with some complications to make the math work out.

This is what my representative, Mike Lawler, had to say about it:

3 July 2025: Congressman Mike Lawler Delivers Historic Tax Relief with Passage of the OBBB

Today, Congressman Mike Lawler (NY-17) issued the following statement after the House voted to approve the final version of H.R. 1, the One Big Beautiful Bill Act, preventing the largest tax hike in American history and delivering long-overdue relief to middle- and working-class taxpayers.

Following last week’s confirmation that the final bill preserved Lawler’s SALT compromise, raising the cap to $40,000 with a $500,000 income ceiling and 1% growth for five years, the bill returned to the House and was passed with these core tax provisions intact, including:

Extension of key provisions of the Tax Cuts and Jobs Act (TJCA) of 2017, like the more than doubling of the standard deduction that most filers take

No federal tax on tips or overtime pay

Expanded child tax credit

Expanded tax credits for seniors

Preserved small business deductions

Expanded pass-through SALT deductibility

Look, I get why Lawler is big on SALT, and here’s a couple of very recent news items to explain why:

7 July 2025, Axios: Scoop: Sean Patrick Maloney mulls political comeback against Mike Lawler

Former Rep. Sean Patrick Maloney is considering challenging Republican Rep. Mike Lawler in NY-17, according to people familiar with the matter.

….

Zoom out: Lawler is a key target of the DCCC as one of three Republicans to win a district that voted for former Vice President Kamala Harris.

Lawler is also considering running for governor, which could potentially set up a showdown with Rep. Elise Stefanik (R-N.Y).

"With at least seven far-left candidates already announced in the Democrat primary for New York's 17th District, I'm sure Democrats are excited about the prospects of Sean Patrick Maloney making a come back — because it worked out so well the last time," Lawler posted on "X".

7 July 2025, The Hill: Lawler mocks potential Maloney comeback campaign

After a report that former Rep. Sean Patrick Maloney (D) is considering challenging Rep. Mike Lawler (R-N.Y.) in the midterms, the Hudson Valley representative sarcastically weighed in on the prospect of a rematch with the man he unseated four years ago.

“I’m sure Democrats are excited about the prospects of Sean Patrick Maloney making a come back — because it worked out so well the last time,” Lawler wrote on social platform X.

It’s easy for me to be an ideologue on SALT. I’m not the one running for office.

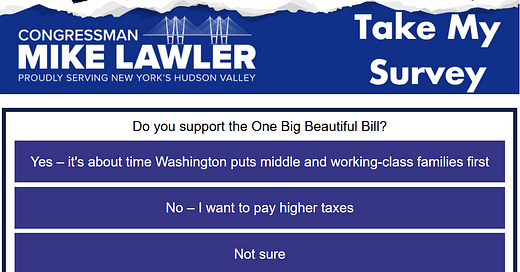

Just wait… breaking news…. I just got an email from him at 5pmET today, as I’m on his email distro as a constituent. Here’s a screenshot from the bottom of the email:

Okay, yeah, we know this kind of crap.

Again, I think the SALT deductibility gives New York and similar states an incentive to go whole hog on their high-taxing ways. I think it ultimately hurts me.

But I think my fellow voters around here don’t see it the same way, and I’m sure Lawler knows that. He has to work hard to get elected around here.

Leftover Links

7 July 2025, The Nation: How Republicans’ Endowment Tax Will Hurt Higher Education

4 July 2025, CNN Business: Here’s who stands to gain from the ‘big, beautiful bill.’ And who may struggle

5 July 2025, Politico: How Trump’s Very MAGA Tax Cuts Break with GOP Tradition

5 July 2025, msn: Kentucky's Thomas Massie one of two House Republicans to vote against Big Beautiful Bill

7 July 2025, Reuters: Trump tax bill averts one debt crisis but makes future financial woes worse

3 July 2025, The American Prospect: Republicans Are Cutting Medicare. Not Only Medicaid, Medicare. (yeah, if you think future Congresses won’t change anything… like if you think Social Security will get cut in 2034)

6 July 2025, WSJ: The GOP Gambles on ‘Trump Accounts’

8 July 2025, Eide Bailly Tax News & Views :Tax News & Views Big Beautiful Blueberry Roundup

7 July 2025, CT Mirror: CT Dems struggle to analyze, and frame, ‘big, beautiful bill’

4 July 2025, League of Women Voters: Unnecessary and Disastrous: LWV Responds to Signing of Budget Reconciliation Package

3 July 2025, National Review: Trump’s New Budget Law: Very Big, Sometimes Beautiful

6 July 2025, GeroDoc: The Big, Beautiful and Deflationary Higher Education Bomb: The "Bennett Hypothesis" Wins.