The Hill, Jan 30, 2024: GOP moderates send warning shot to Johnson over tax deal

Moderate House Republicans sent a warning shot to Speaker Mike Johnson (R-La.) on Tuesday, coming close to blocking legislative action on the House floor in protest of the bipartisan, bicameral tax deal not including an increase in the state and local tax deduction (SALT).

Taking a page out of the playbook normally used by hard-line conservatives, four moderate New York Republicans — Reps. Anthony D’Esposito, Andrew Garbarino, Nick LaLota and Mike Lawler — initially joined Democrats in voting against a procedural rule for four unrelated pieces of legislation, enough opposition to sink the effort and shut down business on the floor.

Some things to note: Mike Lawler is my representative, as I live in North Salem, noted home of the X-Men.

I have written about the situation before - this is one of the highest-tax regions in the country, and yes, the SALT cap screws us over greatly. That was kind of the idea.

Now, I am not a politician so I can mention, I am for a zero cap for SALT (that is, no deduction from individual income taxes for state and local taxes).

The concise reasoning is that SALT deductibility provides incentives for SALT to go ever-higher as people are told that higher local taxes will be deductible from federal income taxes. It gets out of hand. It fuels bad fiscal practices.

By having the full weight of SALT hitting folks, it slows down those local politicians from raising taxes.

The very concise reasoning for Lawler is: he needs to get re-elected.

But he does have an argument: (from an August 2023 STUMP post)

Lifting the SALT cap is crucial to tackling the affordability crisis we are all facing, and something I have made a top legislative priority of mine from day one. That's why the first bill I introduced in Congress was H.R. 339, the SALT Marriage Penalty Elimination Act. This legislation would double the SALT deduction cap for married filers, eliminating an unfair tax penalty that currently halves the deduction for married filers. I subsequently joined Congresswoman Mikie Sherrill (D-NJ) in introducing H.R. 680, the Tax Relief for Middle Class Families Act, which will increase the SALT cap from $10,000 to $100,000. I also joined several of my New York colleagues on another bill led by Andrew Garbarino to eliminate the cap entirely. That bill was H.R. 2555, the Securing Access to Lower Taxes by ensuring (SALT) Deductibility Act.

I'm proud to serve on the bipartisan SALT Caucus, where I am continuing to work with colleagues on both sides of the aisle to secure the SALT relief Hudson Valley families need. My colleagues who joined me on today's op-ed serve alongside me in the SALT Caucus and I have been working with them on the above bills and many other SALT relief measures.

He is correct that it’s bipartisan. Both Democrats and Republicans from high-tax locations have been trying to get that SALT cap to be loosened somehow.

It would benefit me directly, at least in the short term. I got over the SALT cap by a few times.

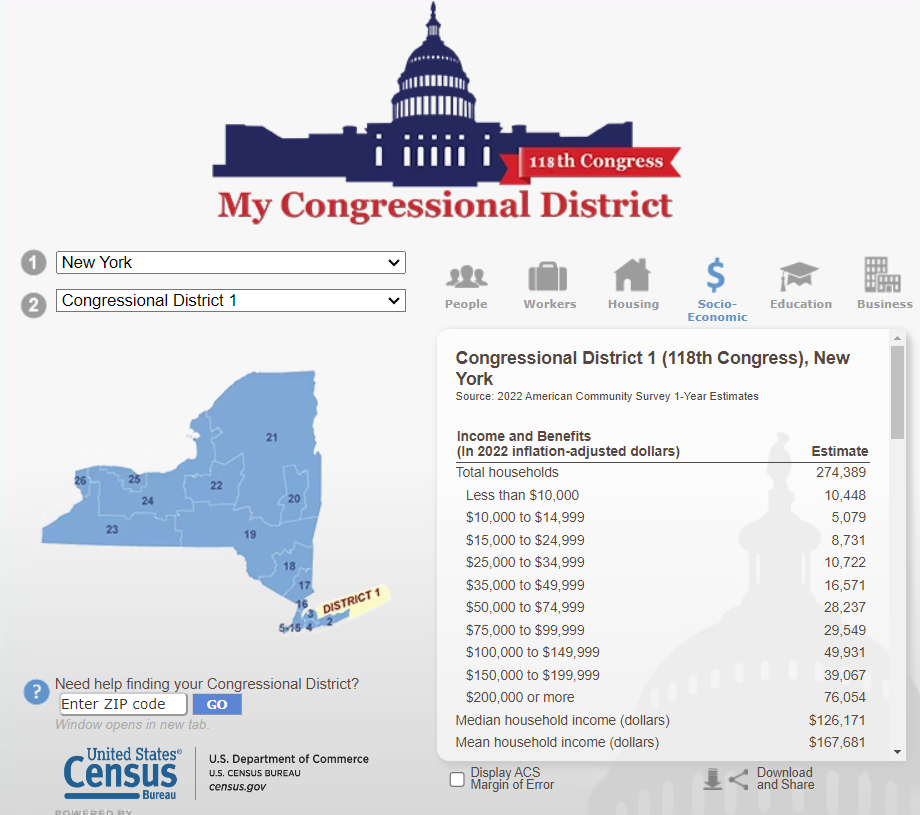

Updating the District Statistics

I see the statistics for my district have been updated:

We have even more households over the $200K income level now.

But let me not just focus on my district. Nick LaLota represents District 1, and it’s even richer:

The thing is, there are Republicans from these rich districts who not only did help provide Republicans with their House majority (just barely) for the 2023-2024 Congress, but are also nice donors for them.

So they may need to think carefully about not giving folks a break on the taxes. Because what with the inflation and the unmoving cap, this is putting a squeeze on the high-income, high-taxed folks in these areas.

The Republicans could cede these areas to Democrats entirely, but perhaps they don’t want to.

It’s easy for me to be an ideological purist when I’m not trying to get elected.

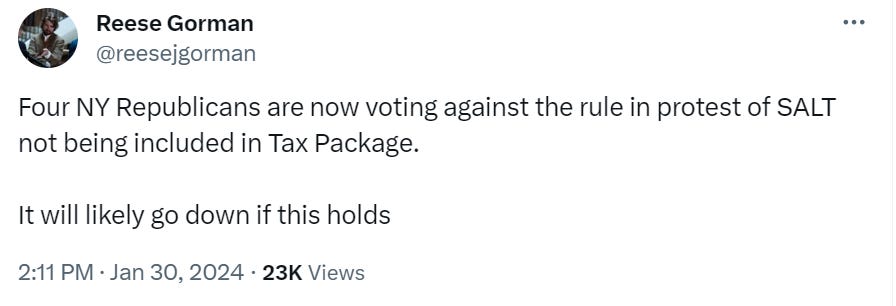

Something Happened; Don’t Ask Me

All of this came to my attention because one of my friends brought this to my attention:

I was not familiar with Reese Gorman, evidently a politics reporter for The Daily Beast.

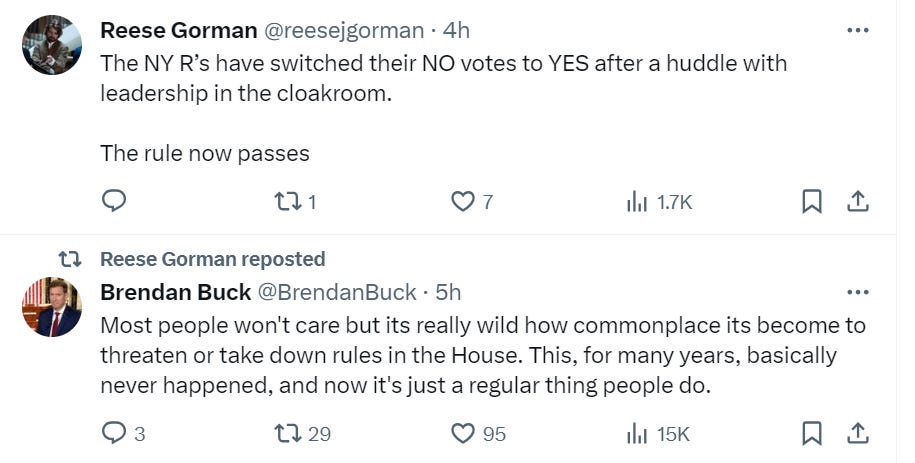

So, things moved forward, but the NY Republicans are not happy.

They’ve got plenty to be unhappy about, and not just because of the SALT cap.

There are shenanigans afoot (surprise, surprise) in NY state regarding districts for the House (yes, again). I may write about that again. But today is not that day.

Related Posts

April 2022: Process is important: SALT cap and NY redistricting

April 2021: SALT Cap Tussle: NY Democrats Have an Ultimatum

(I told you it was bipartisan)

Aug 2021: Taxing Tuesday: The SALT Cap Battle Continues

Feb 2023: Taxing Tuesday: Be My Valentine, SALT Cap

Jan 2023: Taxing Tuesday: Let's Tax the Rich in NY! It Will Really Work This Time!

July 2019: Taxing Tuesday: SALT cap zero! Great new taste!

May 2020: MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

October 2019: Taxing Tuesday: Huzzah! Long Live the SALT cap!

October 2018: Taxing Tuesday: Don’t Blame the SALT Cap for the Pain of High Taxes, Also: The Quest for Trump’s Tax Returns in Tweets