Okay, let’s do a quick round-up of the tax themes going around. Given where I live, and that Mike Lawler is my rep, I’m going to keep hitting SALT (State and Local Tax deduction from federal income tax) as a theme.

Blue State Blues

I’m going to answer a very easy question from Steven Hayward at Powerline

THE DAILY CHART: WHY DO DEMS WANT TAX CUTS FOR THE RICH?

Democratic House leader Hakeem Jeffries has his knickers in a twist because House Republicans refuse to re-instate the state and local tax deduction. But I thought Democrats want to increase taxes on the top 1%? This ought to be an embarrassment, but Democrats long ago got over being embarrassed by hypocrisy. I say to House Republicans, keep pouring SALT into self-inflicted blue state wounds.

He’s obviously being facetious.

One reader said to me that the whole SALT cap was a way for the Republicans to stick it to the Democrats, and yes, we all knew it to be true.

I’m the weirdo who wants the SALT cap at zero for longer-term reasons. I want all sorts of things that I know I won’t get. Oh well.

I have written about this multiple times before — the Congressional districts with the highest incomes are mostly represented by Democrats. We’ll see this for the prior Congress, when the House was controlled by the Democrats. We’ll see this for now, when it’s controlled by Republicans.

When the Democrats controlled the House, well, the Dems representing the high-income, high-tax areas were told NO on repealing the SALT cap.

When Congressional Control Was in Democratic Hands, it was Dem-v-Dem on SALT

This post from 2021 shows how it broke out at the time: Taxing Tuesday: The SALT Cap Battle Continues

The post was from August 2021, and remember, this was about the time the Delta wave of COVID was hitting… the worst wave of COVID deaths was about to happen.

But no matter! Time to argue about removing that SALT cap!

Bloomberg, August 10: ‘Mr. SALT’ and N.J. Ally Fight Ocasio-Cortez to Revive Tax Break

A major push by a group of U.S. lawmakers to secure an expansion of the federal deduction for state and local taxes — which on Monday won inclusion in a critical budget plan — owes much to a pair of onetime roommates in the nation’s capital.

One, Tom Suozzi, has the nickname “Mr. SALT,” and the other, Josh Gottheimer, is co-chief of a sometime influential bipartisan House group known as the Problem Solvers.

Together, they’ve helped to gather a caucus of 33 representatives battling to remove or raise the $10,000 cap on SALT deductions imposed in the 2017 Republican tax-cut package. Success at getting that included in final legislation this fall would offer relief to middle and higher-income residents in higher-tax states such as New York and New Jersey.

Tom Suozzi lost his seat in the weird stuff that happened in NY and is running to replace George Santos (speaking of weirdos) today. We’ll see what happens with that. He’s a Democrat.

Concerning the SALT cap, it has everything to do with the economic demographics of the district the people are representing. There is no way that anybody representing Long Island, or Westchester, or the high-income areas of NYC, would argue against removing the SALT cap (or loosening it).

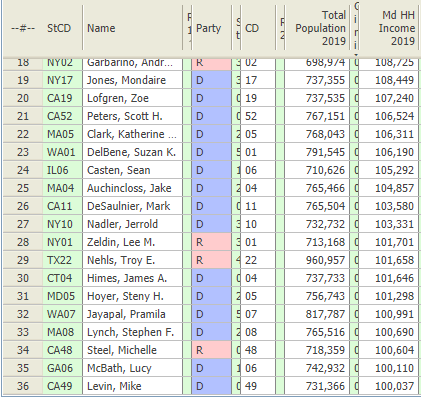

At the time, I got the demographics of the districts from this site, and this is what I had:

Now be careful about the overlaps of the screenshots.

This was my estimate at the time:

Oh look, the heavily Democratic states like New York, New Jersey, and California have HUGE SALT deductions. HUH.

I was being pretty crude in the range, and yes, even states without income taxes have SALT — there are state & local taxes other than income taxes, you know.

Indeed, my PROPERTY taxes are a lot more than my income taxes in some contexts. I’m not going into details.

Current Congress… The Highest Income Areas are Still Democrats

The website that has the info is still there, and let me try to take snapshots.

I will have to provide my own highlights… for some reason, they removed the red and blue coloring of the parties.

You may see some very familiar names. You may understand why some of these folks would be interested in removing the SALT cap.

George Santos is actually gone from Congress (this table was last updated in June 2023), and that’s the district Tom Suozzi is running to fill for a few months before running AGAIN in November.

You see that the high-tax states of California and New York are well-represented.

New Jersey is also there.

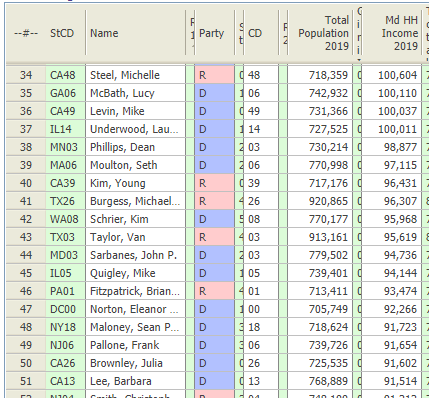

Scrolling down for another view:

Ah, Mike Lawler, my rep, is in there (I will be linking to him soon). Ah, we’re #27.

But we’ve got some more high-tax states entering the chat, with Massachusetts coming in, and Washington.

Remember, these are showing only the median household incomes, not the extremes, and it certainly isn’t showing the tax burden.

Mike Lawler’s proposal

It makes sense — you don’t want to penalize married couples compared to two individuals similarly situated.

If you’re going to have a SALT cap, it needs to make some logical sense for all the different configurations (which is why I prefer SALT cap zero… it’s simple! No worries! But nobody likes my simple solutions!)

Of course, the way Congress does these things, if you “take away” money from the feds, they want to get money from somewhere else.

I do like Lawler — he does hustle, and he keeps trying to make things work.

It’s tough to be elected as a Republican in this corner of New York, and trying to reduce the bite of that SALT cap is important for his constituency (of which I am a member).

Related posts

Feb 2023: Taxing Tuesday: Be My Valentine, SALT Cap

Jan 2023: Taxing Tuesday: Let's Tax the Rich in NY! It Will Really Work This Time!

July 2019: Taxing Tuesday: SALT cap zero! Great new taste!

May 2020: MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

October 2019: Taxing Tuesday: Huzzah! Long Live the SALT cap!

October 2018: Taxing Tuesday: Don’t Blame the SALT Cap for the Pain of High Taxes, Also: The Quest for Trump’s Tax Returns in Tweets

August 2021: Taxing Tuesday: The SALT Cap Battle Continues

April 2021: SALT Cap Tussle: NY Democrats Have an Ultimatum

April 2022: Process is important: SALT cap and NY redistricting