Taxing Tuesday: Geeking out with the SALT Cap

We in NY-17 ARE the "rich" -- that's why he's going after the SALT cap

I DID manage to make it to the Mike Lawler Townhall on Sunday.

Picture Proof:

Here is some local coverage, but there’s not much of note: Protests and raucous crowds surround Lawler’s 'Town Hall' in Somers

No, they wished they were raucous. Their raucous days were 50 years in the past.

As I remarked to my buddies I came with, it reminded me of when I got comped tickets in college and grad school to opera and classical music back in the 90s: I was surrounded by white hair. These people are from my mother’s generation, primarily: the Boomers.

To be sure, there were a few people younger than me there, but not many. They weren’t the ones throwing a fit.

There were some infantile displays from some senior citizens, who had to be “assisted” off the premises. Poor dears, they did not know how to control themselves.

To the people behind us, who liked calling me & my two friends the “three Karens”, after I retorted to their “TAX THE RICH! TAX THE RICH! TAX THE RICH!”

“WE are the rich….”

I will demonstrate my assertion below.

Because I’m going to write more about the SALT cap (Lawler touched on it only briefly, because the mainly Democratic/prog crowd outnumbered the Republicans/conservatives who showed up.)

Everybody, excepting the media, who were there were from Lawler’s district, NY-17.

SALT Cap Items

Here is an older piece, but it has some stats.

18 Apr 2025, ThinkAdvisor: Why SALT Cap for Some High Earners Gets Special Focus in Congress

Six House Republicans — Mike Lawler, Nick LaLota, Nicole Malliotakis and Andrew Garbarino of New York, New Jersey’s Tom Kean Jr. and California’s Young Kim — have vowed to oppose any bill that doesn’t sufficiently raise the SALT cap, and that a proposal to raise it to $25,000 falls short. Lawler introduced a bill to hike the threshold to $100,000.

The data shows that even in these SALT-heavy districts, the average person isn’t much affected by the cap. For all six Republicans who are members of the bipartisan SALT Caucus, the average amount of state, local and property taxes paid on itemized returns is far below $10,000 per year.

So, here’s the deal. That’s the average. The average taxpayer takes the standard deduction and is just fine.

Lawler’s the highest-ranked Republican on that above ranked list — notice that there are 12 Democrats listed higher, 4 of which come from NY.

Nadler’s and Goldman’s are in NYC, Suozzi’s is on Long Island, but Latimer (ex-Westchester County executive) is down-county in Westchester, NY-16, cheek-by-jowl to Lawler’s NY-17.

Let me do my own analysis, not bothering with partially allocating ZIP codes to Congressional districts. Also, I focused solely on New York-17, Mike Lawler’s district (which is mine), which has these ZIP codes.

Here is the dataset: SOI Tax Stats - Individual income tax statistics - 2022 ZIP Code data (SOI)

To keep it simple, I just combined all the stats (appropriately) from the ZIP codes on the list. It is possible I oversampled from some of the ZIP codes, but I’m not going to worry.

When I used the data from the above dataset (and I share my spreadsheet below), I came up with a much higher average - by which I mean the mean, SALT recorded.

I will focus on the two largest components of the SALT in the itemization: personal income tax and real estate taxes.

Demographics of NY-17 2022 Tax Returns

First, let us look at the overall tax returns from NY-17:

Let me walk you through this graph, because I will have two more of these for you to look at, which will explain Lawler’s actions. The pain of the SALT cap isn’t evenly borne.

This shows all the tax returns for tax year 2022.

The blue bars show the number of returns falling in each AGI (adjusted gross income) bucket.

The red dots show the average total income for each AGI bucket.

To be sure, it does seem like there is a large number of low-income returns, except… how many of those low-income returns are seniors who have a bunch of tax-advantaged income sources? Hmmm. Could also be child tax returns, and other special circumstances (such as various people who are filing for EITC).

In any case, one can see there is a bias towards the >$100K returns.

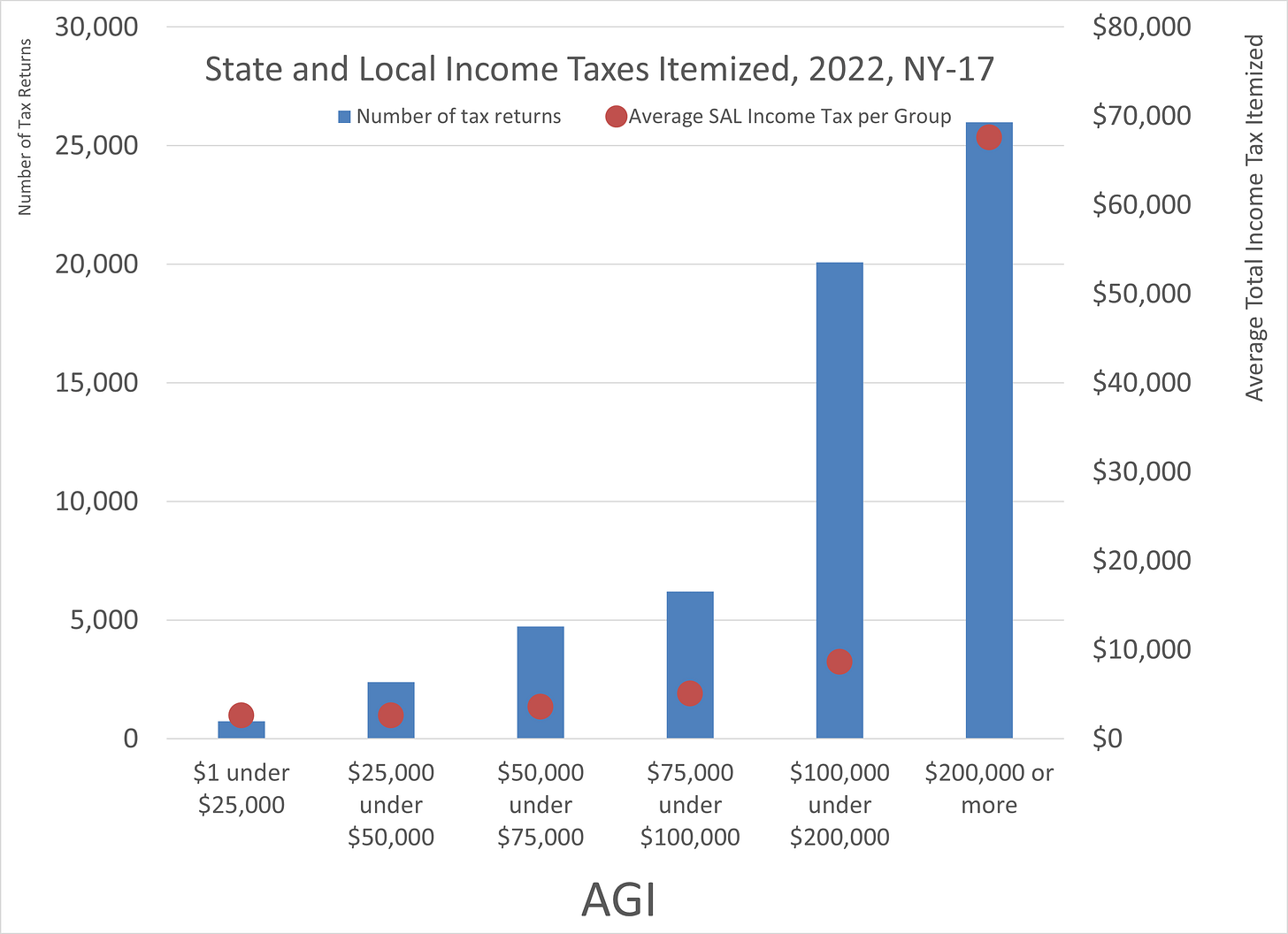

State and Local Income Tax Amounts

Now we’re cooking with gas!

(Before those jerks upstate make cooking with gas completely illegal.)

We’re starting to see where the pain points are coming in.

In the Bloomberg piece, they’re just looking at the average SALT (and that’s for total SALT - I haven’t gotten to real estate taxes yet - these are broken out from income taxes, so I couldn’t tell what the actual total SALT was from the data I could get.) I have data limitations, in certain dimensions, so I decided to look at what I could get at, and where the pain points were.

The obvious pain point: NY’s relatively high state income tax (and if they should also be hit by NYC’s or CT’s taxes… whoo-whee). This would hit the high-income folks the most.

If you average over everybody, high- and low-income people alike, then that’s going to wipe out the distinction of those going over the SALT cap.

See that the $100K - $200K group don’t go over the SALT cap… with just the income tax.

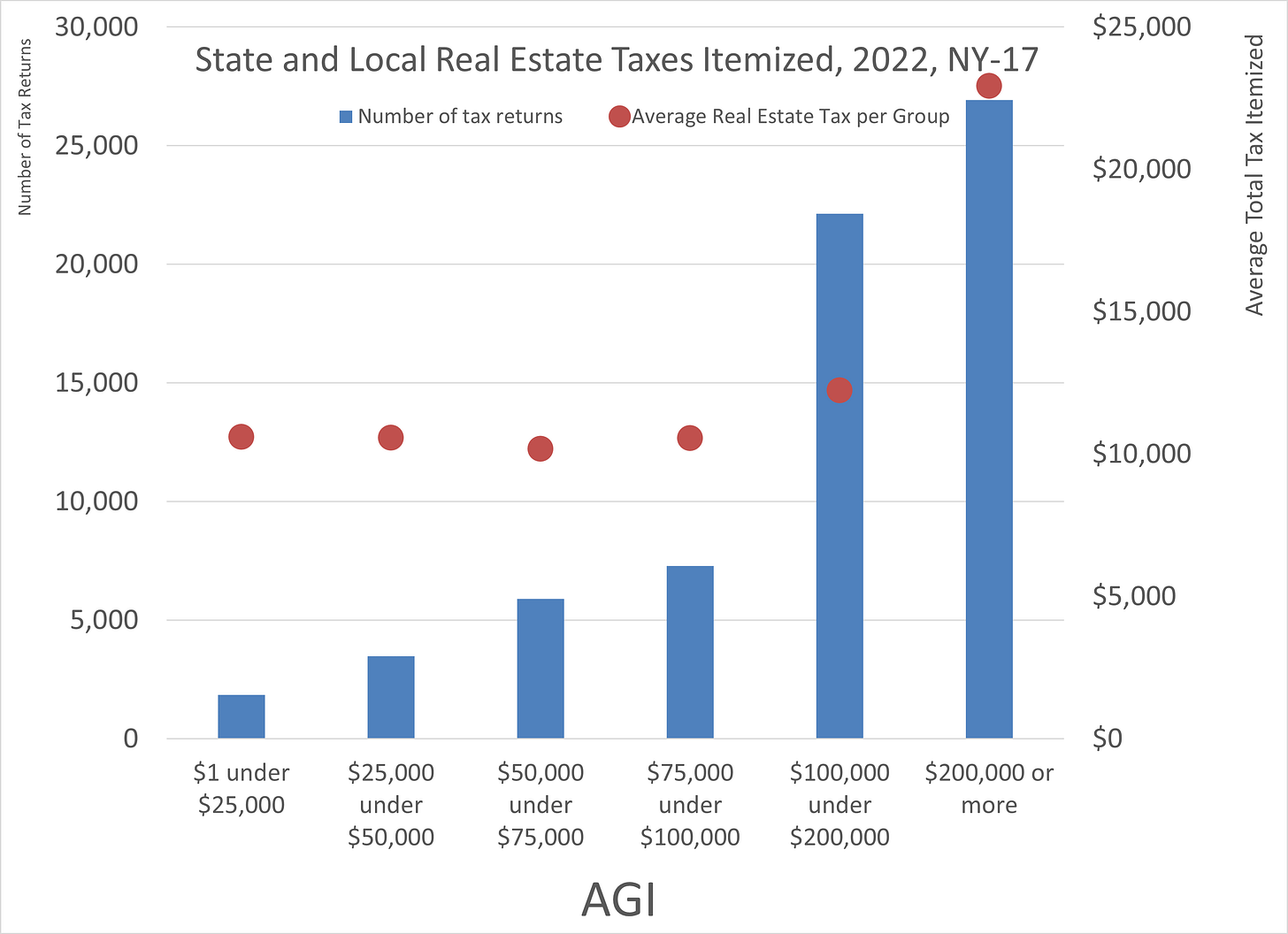

Real Estate Taxes

I’ve pointed this out in the past: what makes Westchester County so expensive is the real estate more than anything else.

Keeps the riff-raff out, doncha know.

You may think this graph looks very odd, after the prior two — what? the average real estate taxes are about the same for those with AGI all the way up to $200K?!

If you think about it, yes… for those who itemized their deductions.

That’s why I’m graphing the number of tax returns with this item for each of the graphs — the average may be about the same, but the number of returns is much lower at the lower AGIs. Those are almost all seniors living in a house in our very expensive county (or Rockland or Putnam).

I will point out that average is at about $10K for that range.

Unsurprisingly, that average is much higher for the highest AGI group.

Limited SALT Deduction — the effect of the SALT Cap

Here’s the end result.

Notice that very few tax returns under $100K AGI have this.

There are other components than the real estate and income taxes I showed above, but in NY, these are the most significant. Because of the way this works, I cannot simply add averages. I could make estimates, but I don’t feel like it.

The most affected here are those in the $200K and more group.

And there are a lot of those in NY-17.

I will talk about myself for a moment, but if I remember correctly… I’m not in any of the graphs above, except for the first… because I took the standard deduction for tax year 2022.

While Stu had cancer, I had to drop a lot of my extra income sources, so my income taxes dropped, and it turned out the increase in the standard deduction meant it was all a wash. The SALT cap turned out to be irrelevant to me (in that period).

To be sure, I’d try the itemization, but it doesn’t get into IRS stats if you don’t actually file the itemization.

Before the 2017 tax change (and before Stu was diagnosed with cancer), I was always itemizing, having to check for the Alternative Minimum Tax, yadda yadda. Others in NY-17 with income tax + property tax taking us over the current SALT cap by a few times know this… but I also know the interactions of the deductions, marginal tax rates, and the fact that…

….

WE are the rich.

(as is AOC.)

(and probably the fashion designer)

Somebody has to pay for all the goodies the people want. I deliberately chose to live in a high-tax area — I moved to NY in 1996 as an adult, knowing what I was getting into.

I wanted to pay for the Met (both the Museum and the Opera), I wanted to pay for snow plowing, subways, and high levels of services for the disabled.

I am paying for this. In New York. Whether the federal government should have anything to do with all these local services, that’s a different issue.

The people screeching for the rich to pay — you are almost definitely as rich as I am, if not more. That you’re annoyed that you have some neighbors with more money than you… maybe you need to be working on your envy. I’m driving around in my Dodge Minivan. You don’t hear me bitching about your BMW (other than your driving abilities).