Taxing Tuesday: California Nuts and New York... Whatever We've Got

What we've got is 11% less in sales taxes, but that's not so exciting

Evidently, everybody is getting hung up on the post office right now, so tax issues are taking a back-burner. That said, stuff still goes on.

[Also, yes, I’ve been busy lately. I have a webcast I’m doing tomorrow.]

California Nuts: retroactive income taxes and a wealth tax

California is just full of bad ideas. They need to get out of the sun.

WSJ: California’s Next Tax Increase

Twitter CEO Jack Dorsey may regret cancelling his planned move to Africa this year. Democrats in Sacramento are proposing to raise the state’s already punitive 13.3% top income tax rate to 16.8% — retroactive to January of this year. Now’s a good time for California high-earners to take their money and run.

The Assembly bill would raise the top rate to 14.3% for households making more than $1 million, 16.3% on income above $2 million and 16.8% above $5 million. The combined federal-California top marginal tax rate would rise to 53.8% on wage income and 40.6% on capital gains. Another Assembly bill would apply a 0.4% wealth tax on assets over $30 million.

A bit more on the wealth tax in a moment.

Democrats say the income-tax hike would only hit the top 0.5% of taxpayers and the wealth tax would nab the top 0.1%. But the top 0.5% currently pay 40% of the state’s income-tax revenue — $32 billion in 2018 — and are mobile. California has experienced an accelerating exodus of high earners since the state in 2012 raised taxes on individuals making more than $250,000. In 2018 the state lost $8 billion in adjusted gross income to other states, up from $135 million in 2012, according to IRS data.

This is a trick you get to play only once. (There was something else about prepaying taxes in exchange for vouchers… jeez, wonder what suckers would go for that.)

But seriously, California. You guys are just full of bad ideas that not even New York will touch.

More on the California wealth tax from Reason: California Lawmakers Want a Wealth Tax to Soak the Rich for Living There. Also, for Leaving.

A pack of Democratic lawmakers in California are proposing a wealth tax for the state’s richest citizens, forcing them to pay more essentially just for owning a lot of stuff. They also, amazingly, want the tax to follow Californians who flee the state in response, attempting to make them continue paying taxes on wealth that’s not even in the state.

Assemblymember Rob Bonta (D–Oakland) is blunt about his reasons for introducing the California Wealth Tax (A.B. 2088). Rich people have money. He wants more of it to pay for and expand state services. And that’s it.

That reasoning sounds familiar.

That’s refreshingly direct, though these types of people generally have no clue why rich people have more wealth, and what forms it takes, and how difficult it is to convert that wealth into cash. I hope they’re ready for in-kind payments!

[yes, I know something different will happen]

For rich Californians thinking of leaving rather than paying the state for the privilege of owning things, lawmakers are also attempting to tax the wealthy who vote with their feet. The bill contains a special formula to apply to anybody who has lived in the state within the last 10 years, though the tax burden will slowly drop over time for each year they don’t live in California. It’s pretty much a certainty that former Californians subjected to this wealth tax would challenge the legality of this plan.

Not so much the legality as the constitutionality… and then there are the people who would leave the U.S. entirely. Yes, the U.S. federal government has ways of applying income taxes after people have left for good [for a while], but sorry, California, you need to secede from the U.S. before you can try out your own sovereign remedies.

[and, of course, once they secede, their financial problems get a whole lot worse fairly rapidly, but I’m not about to tell them that.

Over at the Los Angeles Times, Deputy Editorial Page Editor Jon Healey notes that this proposed wealth tax could have effects on capital gains taxes, especially if it encourages people to sell their assets at a loss to lower their tax burdens—and California extracts a significant amount of capital gains taxes from its wealthiest citizens. The result here could be a drop in capital gains revenue in the state, meaning (ironically) less tax revenue overall.

What a complicated math problem!

Anyway, best wishes to California and your idiotic ideas!

New York Sales Tax Collections Down

Okay, I don’t have anything nutty from New York (on taxes) to talk about right now. Just the numbers.

In the press release from the NY state comptroller:

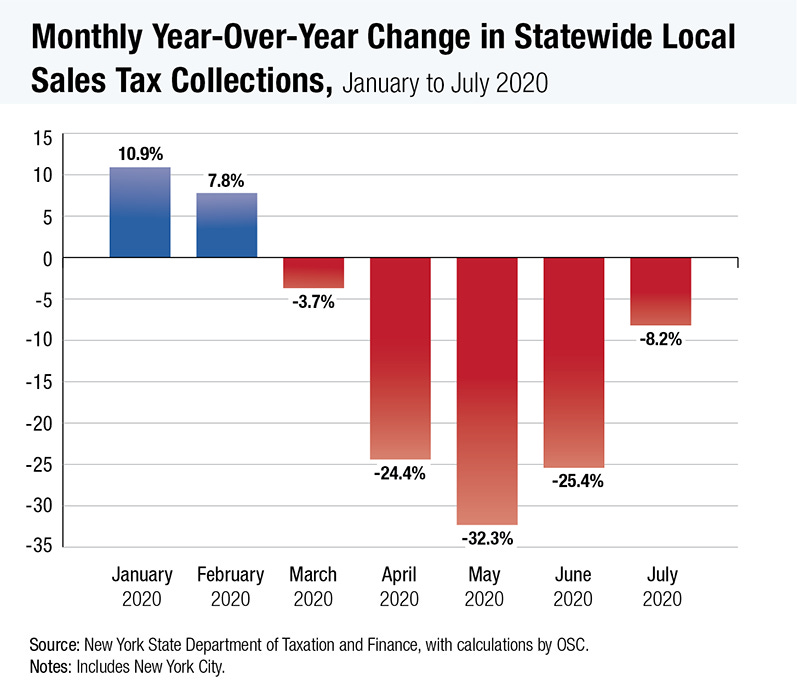

Remember, this is a comparison for year-over-year, so the July 2020 sales tax is compared against 2019. I assume there are strong cyclical aspects to sales tax – do people spend more or less in the summer? Well, the comptroller helpfully links to a spreadsheet (warning: will automatically download if you click) and the results for key localities’ sales tax revenues are given.

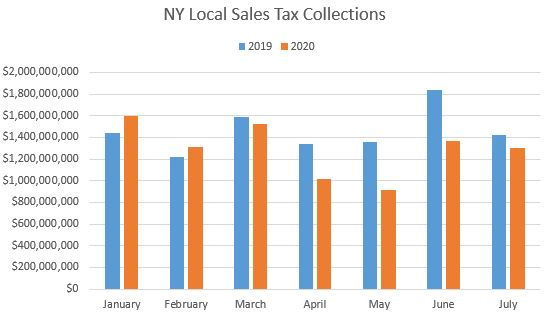

The whole state worth of local sales tax collections is down 11% for January-July 2020 compared to January-July 2019, so that’s not great, but not as bad as the 32% decrease from May 2019 to May 2020. They collected (cities and counties) $9 billion in 2020 so far, compared against $10.2 billion for the same period in 2019.

Let me redo the graph, so you can see the month-to-month amount differences:

Not all places in NY had the same hit. I’m going to sort the list and give you the top (well, bottom) localities for tax effect:

So, first, we have places around NYC (including itself): White Plains (huge commuter hub from north into NYC), NYC, Yonkers (right next to the Bronx), Orange County, Nassau County, and Suffolk County.

Weirdly, Westchester County sales tax collections themselves went up, but our county sales tax rate increases from 3% to 4% on August 1, 2019, so that explains that. Westchester County sales tax collections are up 13.5 year-over-year.

Let’s look at the places not clustered around NYC. There’s Tompkins County (containing Ithaca) and Ithaca…. where Cornell University is. It went to online classes on March 10.

Saratoga Springs is down — most of that decrease matches the overall state… except starting in June. Because Saratoga Springs is where the famous horse racetrack is… and there have been no races.

Albany County is where the state government is.

Seneca County is in the Finger Lakes region – no tourists.

So even within New York State, some areas are hard hit by tax revenue decreases, even if they had seen no appreciable COVID cases. New York, of course, is not the only area so hurting, but 1. I live in New York, 2. I signed up to get the state comptroller updates (and maybe I’m the only non-official/politician actually reading them), and 3. The info shared has been nicely detailed and in spreadsheets. Thanks, comptroller!

Tax stories

Too Much Information: Cuomo Is Protecting His Wall Street Donors From Democratic Tax Bills

WSJ: How the Bidens Dodged the Payroll Tax – spoiler: they used an S-corp to prevent 95% of their income taxed being hit with Medicare tax [the amount they took in income would put them over the Social Security salary tax]

CNBC: ‘Last one out, turn out the lights’: New Hampshire governor says higher taxes prompting urban flight

Dan Mitchell: The Economic Damage of Wealth Taxation

Chicago Sun-Times: Gov. Cuomo knows a ‘fair tax’ would hurt New York. Why can’t Gov. Pritzker figure it out?

COVID-19 pandemic likely to cause sales tax loss for Ohio municipalities

Denmark seeks to fund early retirements with tax increases – by the way, this taxes banks and pension funds, among others

Pied-à-terre tax moves forward in Albany – they might not want to put extra taxes on the people still around paying property taxes in NYC. Just a thought.

Trump’s payroll tax deferral may lead to significant tax bills for workers, business groups warn

Look, when one searches on tax stories in the news, you get all sorts of results.

Tax tweets and memes

In honor of the new Bill & Ted movie:

Enjoy!