Nature is healing… the tax-and-spend politicians are back to their wicked ways.

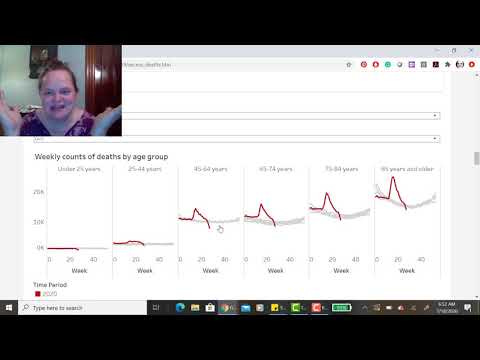

But first…. deaaaaaaaaath

I am still working on updating my specific spreadsheets on excess mortality by state/week; the prior post from May can be found here. In the meantime, here’s a walkthrough of the CDC’s own dashboard as of July 15:

The CDC page is here: Excess Deaths Associated with COVID-19.

Back to the taxes

This could be a “States and Cities Under Pressure” post, but given many states and cities realize that if fiscal help will be forthcoming this year, it will be way below what they’d love to see, we are seeing more talk about increasing taxes. Last week, I mentioned the state revenue pinch likely bringing back Taxing Tuesday.

This may not be a weekly thing, as in prior years (no such fun as soda and bag taxes for right now.) It depends on how active the tax stories get again. However, I’ve had my own pent-up demand for months, so here we go!

Pew on Tax Hikes in 2020

Tax Hikes in a Pandemic: Some States, Cities Say Yes

Nashville City Councilman Bob Mendes tried unsuccessfully for two years to get his booming city to raise property taxes to address its growing municipal needs.

Then came COVID-19. The City Council last month approved a 34% increase.

What changed?

“We’re broke,” said Mendes, who identifies as a Democrat though the council is nonpartisan.

…..

Congress is debating a package of between $1 trillion and $3 trillion in additional aid for states and cities. But the final amount and the rules for spending it are uncertain, leaving states and localities in a pinch.Moody’s Analytics chief economist Mark Zandi told reporters in a recent conference call that if state and local governments don’t get federal support soon, there will be “substantial budget cutting and [governmental] job loss.”

For the record, yes, this has happened before. There was actual governmental job loss in 2009-2010, due to the hit state tax revenues took.

I’ve mentioned a few of the tax ideas in prior posts, like the dumbass Amazon tax in Seattle, but let me make fun of a few of the ideas in passing:

And the District of Columbia Council this month voted to raise the gas tax and eliminated some tax breaks for businesses to raise $63 million toward an anticipated $800 million budget hole.

First, $63 million is not nothing, but… that’s NOT EVEN 10% of the hole.

Second, by all means raise the gas tax when fewer people are driving. I’m sure that will work well as a revenue source.

[dumbasses]

In Nashville, Mendes said the city was in tough shape financially even before COVID-19 laid waste to the city budget. Before the pandemic, Nashville was listed “dead last of the 25 biggest cities in terms of rainy-day funds,” he said in a telephone interview.

Without a sizable rainy-day fund, Mendes said, Nashville had to choose between “taking a machete to the size of city government by furloughing thousands of people, or a [property tax] rate increase.” He had proposed the increase last year and the year before but had no luck. This time it passed 32-8.

One opponent, Councilman Russ Pulley, described Nashville’s budget situation as a “hot mess” but said he would have preferred budget cuts or increases in sales taxes or “sin taxes” on cigarettes or alcohol, rather than the property tax hike.

One of the big issues for Nashville, of course, is that usually it does a brisk tourism business, and used to be a favored spot for business conventions [I had been to many Society of Actuaries confabs there in recent years]

It does not sound to me like this was a necessary binary choice, in any case. Some people could have been furloughed and taxes could have been raised, just different amounts from the all-or-nothing stance I’m reading here. This does not inspire confidence.

Tax respite for states? Tax day finally comes

Delayed tax day to bring revenue lift to cash-strapped U.S. states

downward spiral in revenue in the wake of the coronavirus outbreak will pause this month for most U.S. states as Wednesday’s income tax filing deadline generates billions of dollars in payments that would have been due in April.

But looking past the burst of last-minute payments of taxes incurred in 2019 before the pandemic hit, states’ revenue outlook remains bleak as a spike in U.S. virus cases dampens hopes for a quick economic recovery.

After the federal government moved its income tax filing day to July 15 from April 15, the 41 states that tax wages also extended their deadline, with most also pushing it to July.

That was the biggest contributor to a dramatic drop in their April personal income tax collections, which fell by $44.8 billion or 62% compared with April 2019, according to the Urban Institute.

“We’re going to see much of the foregone revenue from earlier this year catching up now because so much of this was simply the delay in payments,” said Jared Walczak, vice president of state projects at the Tax Foundation.

The question to me is how much of the income tax actually gets collected on tax day. I assume those getting refunds didn’t wait til July 15 to file. So the ones taking advantage of the later date were going to have to pay, I suppose.

We will be finding out soon enough how much the cities and states did (and didn’t) get.

Other Tax Stories

A round-up of tax-related news/op-ed items from the last week:

Foreign Policy: To Pay for the Pandemic, Dry Out the Tax Havens

Illinois Policy: INDIANA DROPS CORPORATE TAX RATE AS ILLINOIS CONSIDERS INCREASING IT

Illinois group launches ‘tax day’ push for constitutional amendment

Schumer pushes for elimination of SALT deduction cap in next coronavirus relief bill

Garden State Looks to Financial Transaction Tax to Fix Budget Woes – that’s New Jersey, if the name threw you off.

Reason: The Pandemic Is a Lucrative Revenue Opportunity for Incompetent Politicians – this is about fines for COVID-related “offenses”. I consider these taxes.

CNN: Payroll tax cut: What it is and why Trump keeps pushing for it

The Hill: White House doubles down on payroll-tax cut opposed by GOP senators – is this to give them cover for not doing a state/city bailout? Heck if I know.

CNBC: Billionaires in New York could pay $5.5 billion a year under new tax – they could, but they won’t.

Ed Hirs, Forbes: What Will An American Carbon Tax Cost You?

Crain’s New York: City’s property tax revenue could take two years to recover – property tax is usually 40% of NYC’s revenues

NBC News: Supreme Court rejects House Democrats’ plea to speed up Trump tax case

I guess we know what Impeachment 3.0 with Windows will get us.

I swear, there’s gotta be a pony in there somewhere!

Taxing Tweets and Memes

Here we go!

Well, I still think it’s all a waste of time. But I suppose I should think of the poor lawyers who need something to do.

A parting thought:

President Coolidge had a lot to say about taxes. The real quote was: “The collection of any taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare, is only a species of legalized larceny.” from his 1925 inaugural address. You can see why the meme-maker shortened it.

Ole Silent Cal was actually wordier than given credit for.