Taxing Thursday: It's Up to You, New York, New York

Watching the rich folks getting up & taking their money with them

(Most of this is from Tuesday but… we had 52 hours of no electricity, etc. So Thursday it is.)

Rather than spend my time pointing & laughing at Illinois, let’s take a look at something that will be giving me pain in the short term: NY taxes.

David Sirota: NEWS: Cuomo Blocks Tax Hikes On NY Billionaires Bankrolling His Machine

Before I dip into this, I will note I’ve been following various liberals/leftists on substack, Sirota being one of them, Matt Taibbi being another. I used to be a liberal/leftist myself way back in the 90s, and then the Clintons and their crew basically burned that out of me. Cuomo is one of that crew, as is Rahm Emanuel. I am pretty much a standard conservative at this point, but I do still read liberal/leftist sources, because while I disagree with their ideology, I think people like Sirota and Taibbi are good writers, and they do break some interesting news sometimes, that the “mainstream” parties have little interest in publicizing.

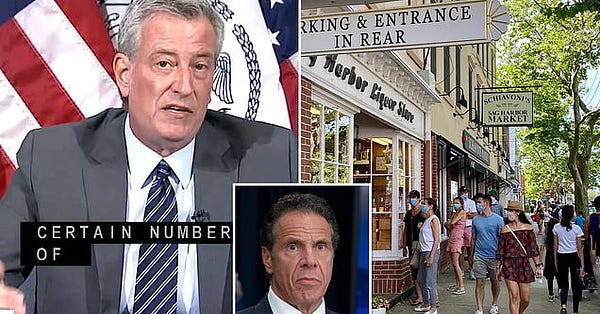

New York Gov. Andrew Cuomo has stood firm against intensifying pressure to avert massive budget cuts by raising taxes on the many billionaires who live in his state. As that campaign to tax billionaires got a recent boost from Rep. Alexandria Ocasio-Cortez and New York’s Democratic state legislative leaders, Cuomo has insisted that he fears that the tax initiative will prompt the super-rich to leave the state. On Wednesday, he doubled down, warning that if the state tried to balance its budget through billionaire tax hikes “you’d have no billionaires left.”

In defending billionaires, Cuomo is protecting a group of his most important financial boosters: More than a third of New York’s billionaires have funneled cash to Cumo’s political machine, according to a TMI review of campaign finance data and the Forbes billionaire list.

New York disclosure records show that 43 of New York’s 118 billionaire families have donated money to Cuomo’s campaigns and the state Democratic Party committee he controls. In all, those billionaires and their family members have delivered more than $8 million to Cuomo’s political apparatus since his first gubernatorial campaign. That includes large donations from billionaires in the last few weeks as Cuomo has fought to stop tax hikes on billionaires.

Thing is, Cuomo is correct to fear the billionaires will go and not come back.

One of the reasons to hang out in NYC is that’s where the cool people are…. except it’s very unappealing to be stuck with the city with the highest excess mortality in the whole country, and the cool people may migrate somewhere else, like Wyoming.

Now, the billionaires do pay a hell of a lot in taxes, and New York has a wealth of such billionaires compared to, say, Connecticut.

Back to Sirota:

Democrats Push Plan To Raise $5.5 Billion A Year From Billionaires

New York Democratic lawmakers have been floating proposals to address the budget crisis with tax increases on the wealthy. One initiative would raise capital gains tax rates on those with more than $1 billion of assets, raising more than $5.5 billion of new public revenue from billionaires each year. New York City alone is home to more billionaires than any other metropolitan area on the planet.

Yes, and these people could live anywhere they want to on the planet.

They may decide they don’t want to live in New York anymore.

Sirota links to this July 17 piece: Cuomo rejects AOC push to hike taxes on New York billionaires

On Thursday, Cuomo said taxes that target the 118 billionaires living in New York could drive them to relocate and argued the state already has one of the highest tax rates for the wealthy in the country. (According to a 2018 analysis published by the Institute on Taxation and Economic Policy, New York imposes an 11.3 percent levy on the top 1 percent of earners — the second-highest in the country).

A variety of things to note: these people don’t have $1 billion in income each year. They have >$1 billion in wealth, and most of their wealth is tied up in the companies they own. It’s just wealth on paper.

This piece, also from Fox Business, is from July 31: New York’s wealthy taxpayers may not return, Cuomo fears

New York is faced with swelling budget holes as a result of the coronavirus pandemic, and the state’s governor is concerned the state’s financial situation may get worse if the city’s wealthiest taxpayers leave for good.

This week, the state’s Democratic governor Andrew Cuomo voiced concern that the longer work-from-home policies are in place, the less likely it is that people who have left the city will return.

“In the old days we used to talk about people leaving Manhattan if the situation got bad, if taxes went up, if quality of life deteriorated,” Cuomo said on a call with reporters Thursday. “They left. They left because of COVID.”

Yeah, that’s the problem with being too dependent on wealthy people.

One thing you can say about poorer people: they generally stay put.

Many wealthy individuals abandoned Manhattan for nearby suburbs, or other states entirely, to escape the densely-populated metro as it became an epicenter of the virus outbreak earlier this spring.

….

Roadway Moving President Ross Sapir, for example, told FOX Business that people are moving out of Manhattan in numbers he has “never seen before,” as his company deals with its busiest season since its 2008 inception.And many of the residents who have left belong to higher-income brackets. United Van Lines CEO Marc Rogers told FOX Business that the majority of residents moving out of Manhattan, 61 percent, are earning over $100,000.

I had some friends move away from a town in NJ, from whence they used to commute to Manhattan… but now that their companies have gone to work-from-home policies indefinitely, they moved back to Canada.

Cuomo has asked lawmakers to lift a $10,000 cap on state and local tax deductions, as a means to help residents and potentially prevent high-net-worth people from leaving for lower-tax states.

Or maybe y’all could drop expenditures and taxes. Just spit-ballin.

Heck, the rich people aren’t even showing up to shop:

High-end handbag maker Valentino is suing to get out of its lease on Fifth Avenue in Manhattan, a vacated Barneys New York still sits empty on Madison Avenue just a block over, while bankrupted luxury department store chain Neiman Marcus is shutting its doors for good on Worth Avenue in Palm Beach.

As the coronavirus pandemic brings tourism to a temporary standstill, leaves consumers holed up at home and puts millions out of work, America’s glitziest and most expensive retail districts are losing tenants, and rents are in a free fall. The pressures from the Covid-19 crisis will likely have a lasting impact on shopping streets such as Michigan Avenue — better-known as the “Magnificent Mile” — in Chicago, the Las Vegas Strip, and Rodeo Drive in Los Angeles, to name a few.

It is already beginning to play out with the changes taking place throughout the New York City retail scene, serving as a leading indicator of what’s to come in other major metros, real estate analysts predict.

But it’s all a coordination problem. I don’t mind these millionaire/billionaire taxes, but sometimes it’s just absurd:

Tax hike on California millionaires would create 54% tax rate

Democrats in the California state legislature this week proposed a tax hike on the state’s highest earners to help pay for schools and services hurt by the pandemic.

The proposal would raise taxes on California millionaires, and result in a top tax rate of nearly 54% for federal and state taxes for the highest earners.

….

California’s top marginal tax rate is 13.3%. The new proposal would add three new surcharges on seven-figure earners. It would add a 1% surcharge to gross income of more than $1 million, 3% on income over $2 million and 3.5% on income above $5 million.So the top tax rate would be 16.8%, on income of more than $5 million and the combined state and federal tax rate for California’s top earners would soar to 53.8%. With the deduction on state and local taxes capped at $10,000 under the Trump tax cuts, the top-earning Californians wouldn’t be able to deduct the new taxes from their federal returns.

The tax would only effect the top 0.5% of California taxpayers. But that small group of super-earners — many of them in tech — pay 40% of the state’s tax revenues, according to California’s Franchise Tax Board. The new tax rate would also apply to capital gains, which accounts for a large share of tech income, since California taxes capital gains at the same rates as ordinary income.

So 0.5% are paying for 40% of the state tax revenues? Can anybody see the problem with this?

What is the allure of New York right now?

A similar post at Althouse: Governor Cuomo begs rich people who’ve relocated to their out-of-the-city houses: “You gotta come back.” – she is quoting an editorial from the NY Post: Andrew Cuomo’s dubious bid to keep the wealthy from fleeing New York.

From that editorial:

And new levies — a billionaires’ tax, an ultra-millionaires’ tax, etc. are among several ideas Dems are eyeing to plug Albany’s $30 billion two-year budget hole — will only push the rich to flee permanently. Taking their tax money with them.

It’s no coincidence, after all, that New York, where “1 percent of the population pays 50 percent of the taxes,” as Cuomo notes, has been steadily losing residents.

That is not a stable way to finance anything. In a state with about 19 million people, 1% is 190,000 people.

How many of those people need to move away permanently before the sting is felt in the budget?

The reason I linked to Althouse instead of just the NY Post editorial is that her commenters made some excellent points:

gilbar said…

serious question

in our New Normal.. WHY would ANYONE that could move out of NYC, NOT move out?If you don’t need to go into to work

If you can’t go to broadway shows

If you can’t go clubbing

WHAT IS THERE IN NYC TO MAKE YOU WANT TO LIVE THERE?8/6/20, 8:06 AM

The main reason to live in NYC is that you like being around a lot of people. Don’t laugh – there are upsides to it. In a large enough population, you can find any little group interested in the same thing you are. It’s fun to interact with such people in person. There are opportunities for all sorts of things in such an environment, and one of my favorite things was just walking down/up 5th Ave or Broadway and watching people, when I lived in Manhattan. Or just hanging out at the Metropolitan Museum of Art.

But those kinds of joys are thin on the ground in a pandemic. Lots of the really fun stuff, like brunch or live shows, are shut down for now.

tcrosse said…

Come back to what? Everything’s closed.8/6/20, 8:29 AM

So why stick around, if you have the wherewithal to leave?

Mike (MJB Wolf) said…

Almost as bad as California where the 1% pay about 75% of state income tax, causing feast or famine budgeting that tracks the Dow 500 like a mother.8/6/20, 8:17 AM

It tracks like the S&P 500 in California, because that’s where the companies driving the S&P are HQed. New York City and state have the same problem, primarily because of all the finance people and their bonuses. When they get them. In really bad years, there are massive layoffs.

In any case, Cuomo definitely details why New York (city and state) need the rich people back.

He hasn’t really made the case that the rich people have much to attract them back right now. These are the “what’s in it for me?” folks.

Well… what’s in it for them?

Tax stories

Liz Farmer at Forbes: 3 Tax Hikes That Could Come To Your State In The Covid-19 Era

Wirepoints: No, Illinois Does Not Send More To Federal Government Than It Gets Back – it’s even less true for Illinois compared to New York.

CT Mirror: Connecticut’s coffers have swelled — not shrunk — during COVID

WSJ: Congress Seeks to Fix $120 Billion Tax Snafu in PPP Loans

Governing: States Use COVID-19 Relief Dollars to Hold Down Business Taxes

NPR/WBEZ: States Are Broke And Many Are Eyeing Massive Cuts. Here’s How Yours Is Doing.

NPR: Illinois Looks To Borrow $5 Billion In Order To Cover Budget Deficit During COVID-19 (this one is an adjunct to the item above — they have a whole state/local budget crisis series)

Girard Miller at Governing: The State and Local Stake in a Federal Digital-Commerce Tax

Tax Foundation: State Income and Sales Tax Revenues Slide in Second Quarter

Tax tweets and memes

If you didn’t get the bad joke:

Seriously, the above tweet is the main reason this post exists.

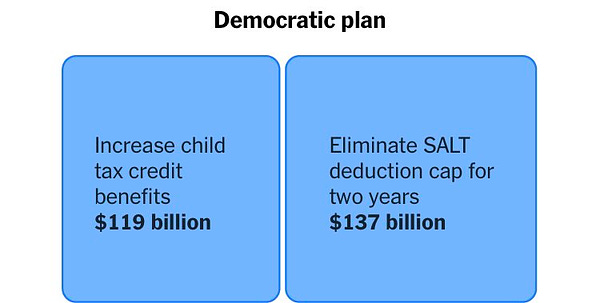

(SALT cap zero!!!!)

Okay, I hope next week is less rocky.