STUMP Classics: The Fiscal State of Connecticut: Totally Screwed

A re-post of a March 2018 piece -- it was very bad even before COVID

Yes, I’m working on a couple more “States Under Fiscal Pressure” posts — notably, Chicago [yes, I know it’s not a state] and Connecticut.

The posts so far:

I may even look at some of places that generally don’t get the headlines, but we’ll see.

As I told somebody last night, people have asked me why I pick on Illinois and Chicago, given I live in New York and work in Connecticut [theoretically]. Did these places kill my dog?

Well, to be blunt, places like Chicago and Illinois make things easy for me. They always have messed-up public finance stories going on. This is my hobby — why make it hard on myself?

That said, Connecticut has some really messed up finances itself, but that comes to the fore only fitfully.

Back in March 2018, I wrote The Fiscal State of Connecticut: Totally Screwed. Below is a lightly-edited version of that post, and I’ll note I had to go to archive.org to get cached versions of some of my links, though they’re only two years old. How fast things move, eh? There’s a new governor of Connecticut, and I guess he wanted to wipe out the memory of the prior one.

So here we go — Connecticut was well messed up financially before COVID hit:

The Fiscal State of Connecticut: Totally Screwed [in March 2018]

And that’s the “aspirational” take.

Here’s the short version of the story. Back in December [2017], the governor of Connecticut [Malloy] called forth a Commission to check out exactly how screwed Connecticut is in its finances.

March 1, [2018,] they issued a draft report.

Conclusion: CT is very, very screwed.

Top findings: Connecticut finances suck

Here are the top findings in the report [page 6]:

While neighboring states and the United States as a whole have economies that are growing, our economy is shrinking—it is actually smaller than it was in 2004;

We are losing ground on numerous key measures of competitiveness: tax climate, business climate, transportation quality, vitality of cities, and more;

We are facing ongoing budget deficits of $2 billion – $3 billion in FY 2020 and beyond, growing by $500 million per year.

They don’t give a comparison in the findings, but the general fund revenue is about $18 billion, so $1 or $2 billion deficits are huge.

Top recommendations: nibbling at the edges

On page 7, they give 10 recommendations. I’m not excerpting them all… here are my top items:

1. Enact a revenue neutral rebalancing of state taxes (which becomes revenue positive when coupled with economic growth) that reduces income taxes in every bracket, selectively raises taxes on business, raises the sales tax rate by less than 1%, cuts exemptions and exclusions from all taxes by 14%, and eliminates the dwindling estate and gift taxes.

2. Raise the gas tax to fund transportation projects and produce a plan for eventual implementation of electronic tolls.

…..

4. Have the legislature assume the responsibility to define state employee fringe benefits by removing them from collective bargaining for new contracts.

….

6. Develop and implement a plan to cut $1 billion out of annual operating expenses.7. Reform the Teachers’ Retirement System to lower costs and to make it sustainable by paying down unfunded liabilities.

Let’s just address these in order.

Shifting from income taxes to business taxes will just run more companies out of the state. Way to go.

Odd about the estate/gift tax, but I don’t care enough to dig into that one.

But raising the sales tax, and gas taxes, means people like me, who have a lot of flexibility in choosing whether to shop in NY or CT, will stick more to NY. I buy gas in CT as it has lower gas taxes. It would be very easy for me to shift which gas stations I would go to.

But then tolls… ugh. Yeah, between NY & CT I, personally, am going to get super-screwed.

I would love to see them implement #4, but I rather imagine that will be extremely contentious. The “TAX THE RICH KILL THE RICH” state union members will not take that one lying down… but I’m not sure they’ve really got much political power anymore. When the whole point of reduction of income taxes is to keep from running out the super-rich, obviously the super-rich have the upper hand.

Reduce operational expenses by $1 billion? Does that include the operational cost of pension benefits? I would really like to see this one, and I can see this being a campaign issue for candidates up and down the ballot in Connecticut this year, from the legislature to governor. I will likely be very closely watching this gubernatorial race this year, because I’m in total despair over New York.

[spoiler alert: the Democrat won, by three percentage points]

And finally… the pensions? Hmmm, that requires its own section.

The giveaway: Aspiring to pay the pensions

This is the true giveaway as to how screwed Connecticut is. I thank Gordon Hamlin, Jr., for pointing out the following passages starting on page 48 of the report:

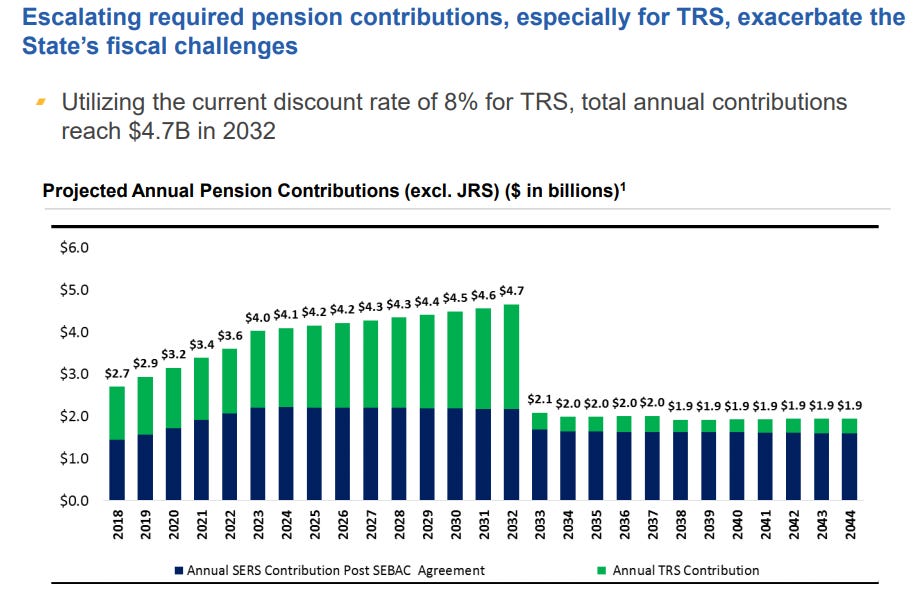

The Teachers’ Retirement System (TRS): Teachers’ pension benefits, and the state funding required to pay them, are putting an unsustainable burden on the state’s budget. With the assumption of full funding by 2032, the state will be required to contribute $2.7 billion to the TRS in that year, implying an annual growth rate in the contribution of more than 6%.

…..

To reach an aspirational goal of 75%, a pay down of $12 billion is required.

So – there are two things here.

They are moving the target from 100% to 75% — and they’re calling 75% “aspirational”.

Oh, and they repeat this aspirational on the next page… immediately followed by this:

To reach an aspirational goal of 75% funding ratio, a pay down of $17.3 billion is required (pension experts would argue that a higher goal of 80% would be preferable).

I WOULD ARGUE THAT FULLY FUNDING THE PENSIONS IS PREFERABLE

Okay, more calmly now, this is the bloody giveaway: they can’t even aspire to fully-funding the pension within 14 years.

To be fairer, they’re also reducing the discount rate to 6% at the same time, so this is not entirely unreasonable. They do note that the 8% discount rate makes the pension liability look artificially smaller.

I just wish they hadn’t called 75% fundedness “aspirational”, and I really wish they hadn’t evoked the 80% pension funding myth.

Graphs on pension contributions

Let me pull out a few graphs from the accompanying presentation (these are also in the report).

Here are the current projected pension payments:

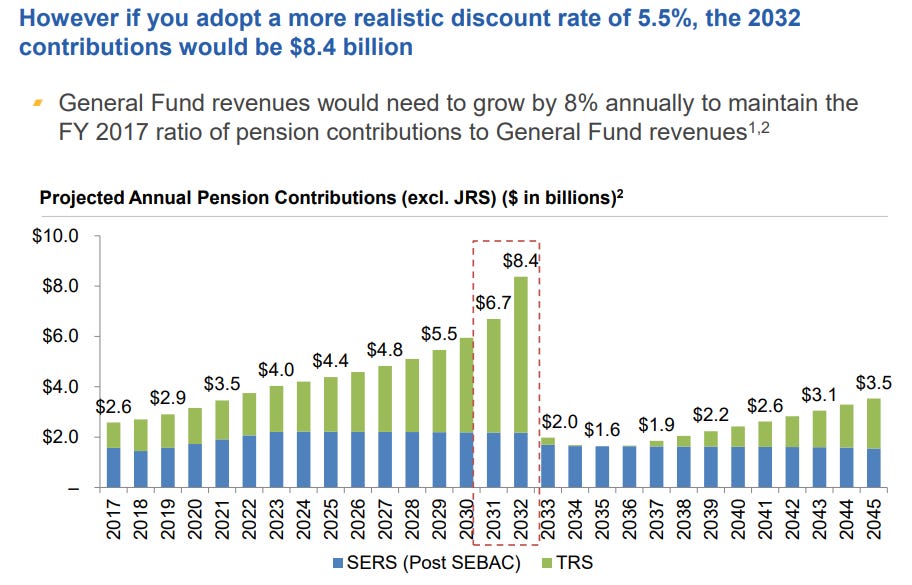

Here are projected payments —- with a 5.5% discount rate (the report had 6%, but let’s go with this):

So yes, that would be a huge strain on finances.

Graphs on migration

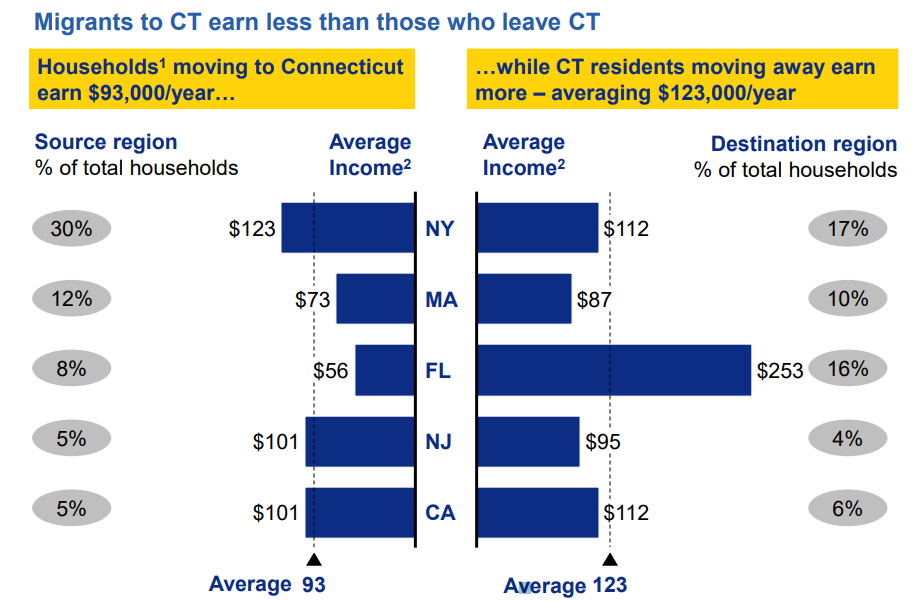

So here is an interesting aspect of the report. They look at the migration patterns.

So one thing I want to point out — perhaps those lower-income people moving in are moving to CT in order to increase their income. I know I boosted my gross income by shifting from a NYC-based job to a CT job.

(Of course, I didn’t actually move to CT… but I sure as hell pay a hell of a lot of income taxes to them.)

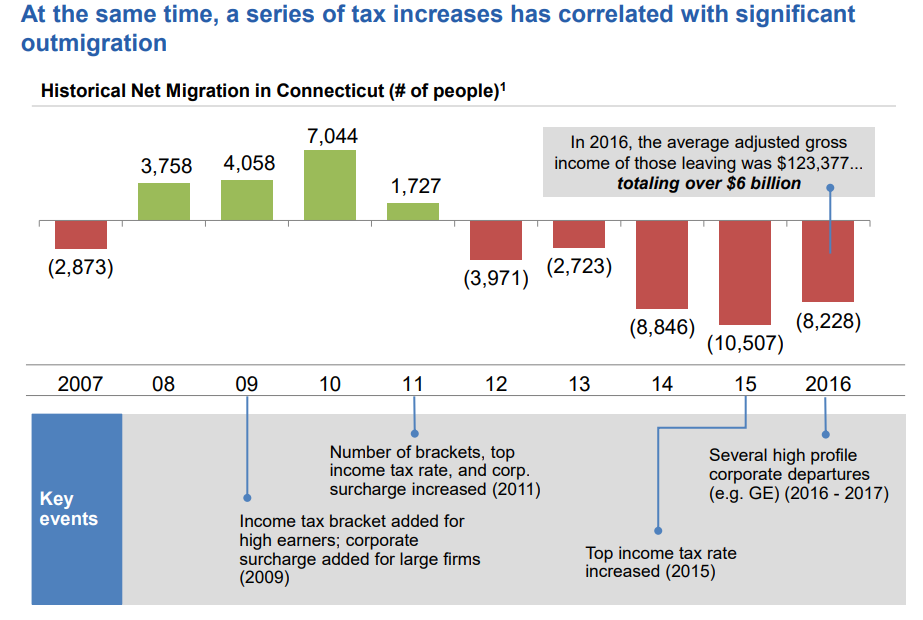

And I really liked this timeline:

By the way – look at all those migrations in recent years, where it’s also pointed out the HQs moved out of CT. Does it seem like a good idea to increase business taxes then, hmmm?

Oh, right, the lottery to fund the pensions

Remember I did that lottery spreadsheet a while back? You can grab the spreadsheet for yourself here.

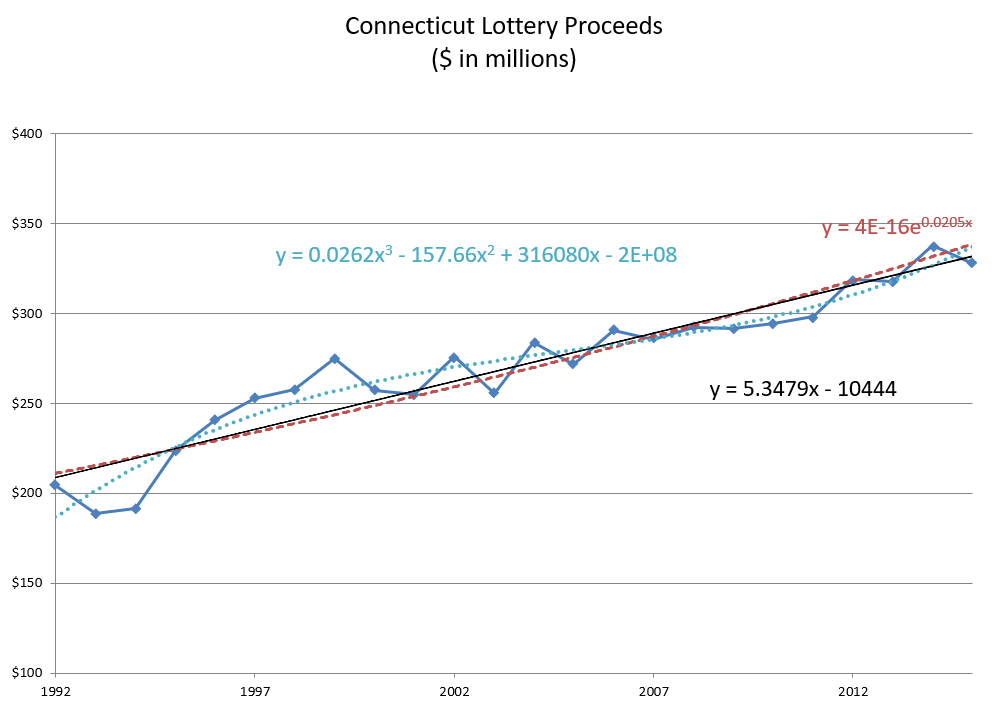

Here’s CT’s lottery revenue history.

Now, that does look like steady growth — of about 2% per year.

But it’s rather poor revenue growth compared to other states — out of the 33 states I have complete data for, it comes in #25 in revenue growth, and it’s well below the 4.5% compound annual growth rate from 1992 – 2015 seen in the U.S. I’m sure the growth is somewhat reduced because of the casinos like Mohegan Sun, and also due to the stagnant state population growth. [In my update of the lottery spreadsheet to 2020, I found CT fell down to #27 in the ranking of 33 states, for growth over 1992-2018]

Finally, the lottery proceeds were only $328 million in 2015. That’s not exactly the billions of dollars needed to plug the pension hole. And what are those revenues going to now? The general fund? Shifting that cash to being dedicated to the pension will not save the state one dollar.

Bottomline: Pain

My prediction for Connecticut: pain.

Lots and lots of fiscal pain. There are not going to be happy fixes to this.

This report indicates, partly, why Malloy bowed out from running again. Nobody is going to be able to escape the fiscal pain… other than by escaping from Connecticut itself. Some unpleasant trade-offs will have to be made. “Cleverness” is not going to patch this up.

I look forward to seeing what gubernatorial candidates have to say about this report.

In pain in good times; in agony in bad times

That is where my March 2018 post ended.

I never did see if the gubernatorial candidates said anything about that report.

Lamont has shown up on this blog a few times, mainly in Taxing Tuesday posts. Let me pull out two old posts that mention the current governor of Connecticut.

From September 2019: Taxing Tuesday: CT Legislators Don’t Like to be Blamed for Taxes

Senate Democrats backed away Monday from the new sales tax surcharge on prepared foods, saying Gov. Ned Lamont’s administration made it far broader in scope than lawmakers intended.

The announcement comes on the heels of objections raised last week by House and Senate Republicans, as well as new cost projections from nonpartisan staff that showed consumers will pay $44 million more than originally projected over the next two years.

“We were shocked to see the DRS has somehow interpreted the language in the budget to significantly broaden the base on what meals and beverages could be covered by the sales tax,” Senate President Pro Tem Martin M. Looney, D-New Haven, and Senate Majority Leader Bob Duff, D-Norwalk, wrote in a letter to Department of Revenue Services Commissioner Scott Jackson. “This interpretation goes against the legislative intent of the new law.”

….

The administration said many tough choices were made last spring [2019] when the governor and legislature approved a new, two-year state budget. That plan averted a projected deficit of more than $3 billion, and did so without increasing state income tax rates.

As I noted at the time, they did it by increasing a whole bunch of other taxes, and people were pissed off.

Finally, from February of this year, 2020 Project: Digging Through Connecticut Pensions

I have chosen CT pensions to dig through because its in the worse position, compared to New York.

I pay a lot of taxes to both CT and NY, so I have direct interests in both states. I have issues with NY pensions, but it’s more a case of governance, and I will get to NY issues eventually.

Two items popped up on my radar recently that has nudged me into this project (especially as February seems a bit late to announce a 2020 project).

CONNECTICUT: DESPERATE FOR REVENUE

Even without graphing state/local revenues, I can give proof — the insane plan to try to put a toll on a one-mile stretch of highway.

Yes, really.

…..

“Connecticut Gov. Ned Lamont introduced a plan for 12 statewide tolls, including one in a stretch of I-684 near the Greenwich-North Castle town line that will force truck drivers to pay a toll as high as $20 despite being in the state for only about one mile.”

Again, this was before all the COVID craziness. Lamont had no idea what was about to hit the state.

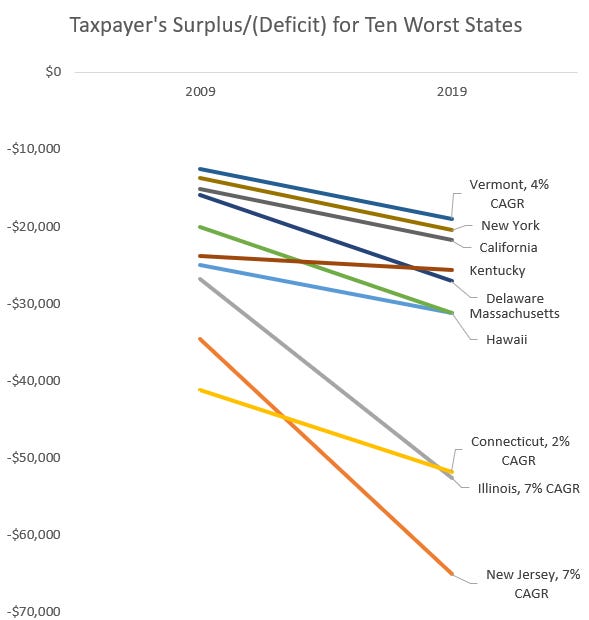

And, for a parting thought, where CT landed on the last State of the States from Truth in Accounting:

CT is the yellow line.

“We’re not as bad as Illinois and New Jersey!” is not quite the selling point.

We’ve seen that Illinois and New Jersey are hard hit, fiscally, by COVID. Connecticut has been hit hard by COVID due to its proximity to New York… and similar problems with nursing homes.

In any case, Connecticut was in a bad place after a decade of the overall U.S. economy doing well. That should have been a flashing red light, and an indication that perhaps zero-based budgeting would have been a good place to start with.

In any case, this gives you a flavor of the disaster I’ll be writing about soon.