I have a lot of states I could continue to cover with their fiscal pressure due to COVID (and now rioting/looting).

I was considering doing either New York or Connecticut next, because I pay a lot of taxes to both states. And yes, I have heard plenty from both about their dire need for federal funds and I’ve written about a dumb stunt from Cuomo before while asking for federal funds.

But the following piece decided me: New Jersey is next on the chopper.

Taking first responders fiscally hostage

Bloomberg: N.J. May Have to Fire 200,000 Public Workers, Murphy Says

‘No amount’ of taxes, cuts will fill budget gap, governor says Criticism for ‘certain myth’ that state shirked obligations

New Jersey may have to cut half its 400,000 state and local employees if the federal government doesn’t help make up a $10.1 billion revenue shortage through June 2021, Governor Phil Murphy said.

“I don’t think there’s any amount of cuts or any amount of taxes that begins to fill the hole,” Murphy, 62, a retired Goldman Sachs Group Inc. senior director and Democrat who came to office in January 2018, told Bloomberg Television.

Without federal help, he said, state and local governments will have to dismiss firefighters, police, emergency-medical personnel and others. In New York, Governor Andrew Cuomo has made similar comments and calls for aid to fill revenue losses from the novel coronavirus.

Hmmm, I am sure that if New Jersey has to cut half, they could cut half without touching first responders at all.

First, they could fire the lifeguards who get pensions. In that NYT piece from 2016:

As this fading gambling mecca reels on the edge of bankruptcy, its finances scrutinized by a host of auditors, some objectionable expenses have bobbed to the surface. But none have drawn such broad resentment as the realization that Atlantic City pays about $1 million a year to provide pensions for retired lifeguards.

…..

Seth Grossman, a lawyer and former city councilman, recalled noticing lifeguards on the city payroll in winter months and wondering why. He learned that lifeguards approaching retirement would paint boats and perform other off-season chores to increase the annual income that would determine the size of their pensions.“We used to call it the lifeguard mafia,” Mr. Grossman said, listing some of the powerful alumni of the beach patrol, including two men who represent Atlantic County in Trenton: Senator Jim Whelan, a Democrat, and Assemblyman Chris A. Brown, a Republican.

We will be seeing pensions come up time and again in today’s post. For New Jersey, this is definitely not a fluke. It’s by design.

Back to the Bloomberg piece:

Last week his administration listed more than $5 billion in cuts and deferrals to address the expected $10.1 billion revenue shortage — the fallout from a shutdown he ordered on March 21 to slow the spread of Covid-19. Murphy is seeking to issue billions of dollars in short- and long-term debt, including via the U.S. Federal Reserve’s Municipal Liquidity Facility.

He’s also counting on billions of dollars from Washington, even though President Donald Trump and Congressional Republicans have balked at allowing states to use federal assistance to fill budget holes.

I wouldn’t be counting on it.

“There’s a certain myth out there: We’re just going to help you all because you hadn’t managed your legacy realities, your outstanding indebtedness or your structural deficits or your pension obligations,” Murphy said in an interview taped for Friday’s edition of “Balance of Power,” airing at noon New York time.

The state, he said, had been doing “just fine” steering toward solid fiscal ground before the virus struck. He had made record pension payments to a chronically underfunded system, and last year had budgeted a $1.1 billion surplus, the most in a decade. He also made the first payment to the state’s rainy-day fund since it was wiped out in the Great Recession. “It’s a long slog, but we were making a lot of progress,” he said.

Record pension payments, huh?

Were they big enough to actually meet the normal cost and the full cost of the amortized unfunded liability?

Because New Jersey has never made full payments in 20 years.

Record-setting pension payments can still be underpayments

Let’s look at what that “just fine” looked like, according to the Public Plans Database.

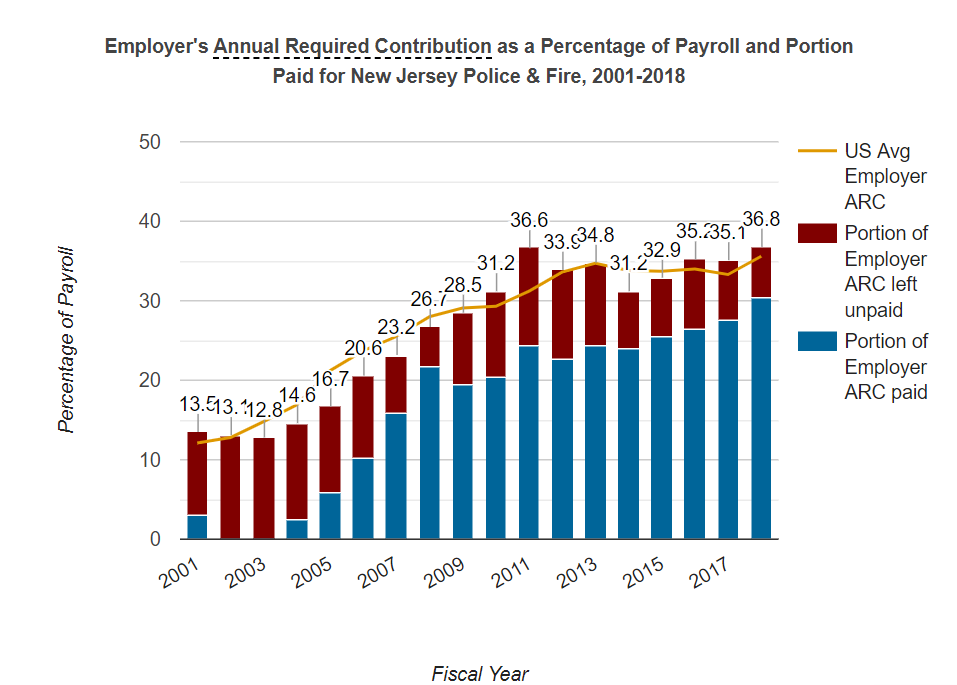

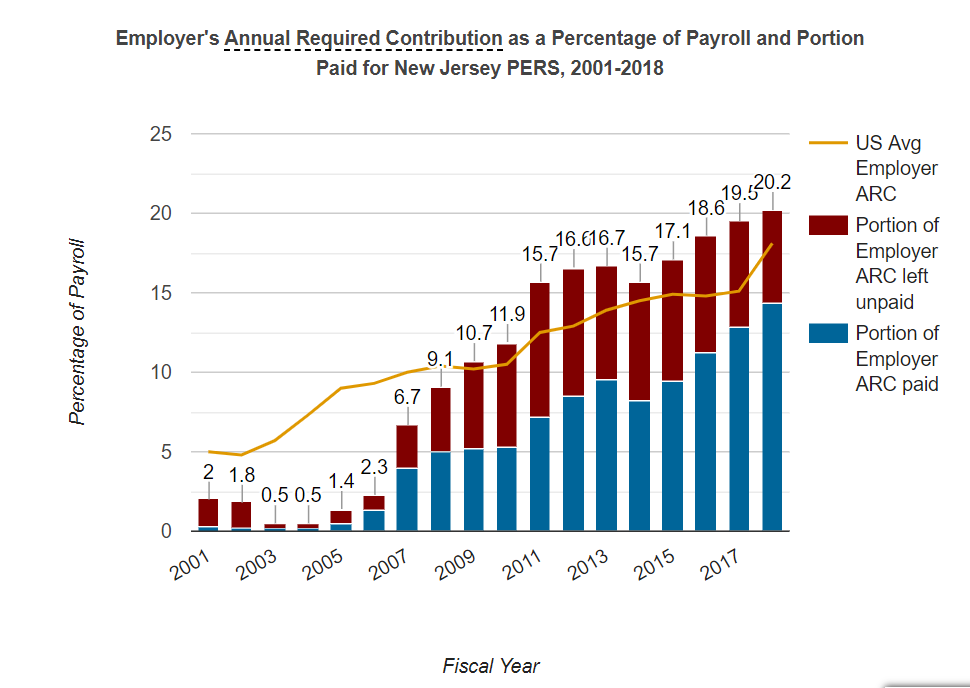

There are three plans listed for New Jersey in the database: PERS (for generic employees), teachers, and police and fire.

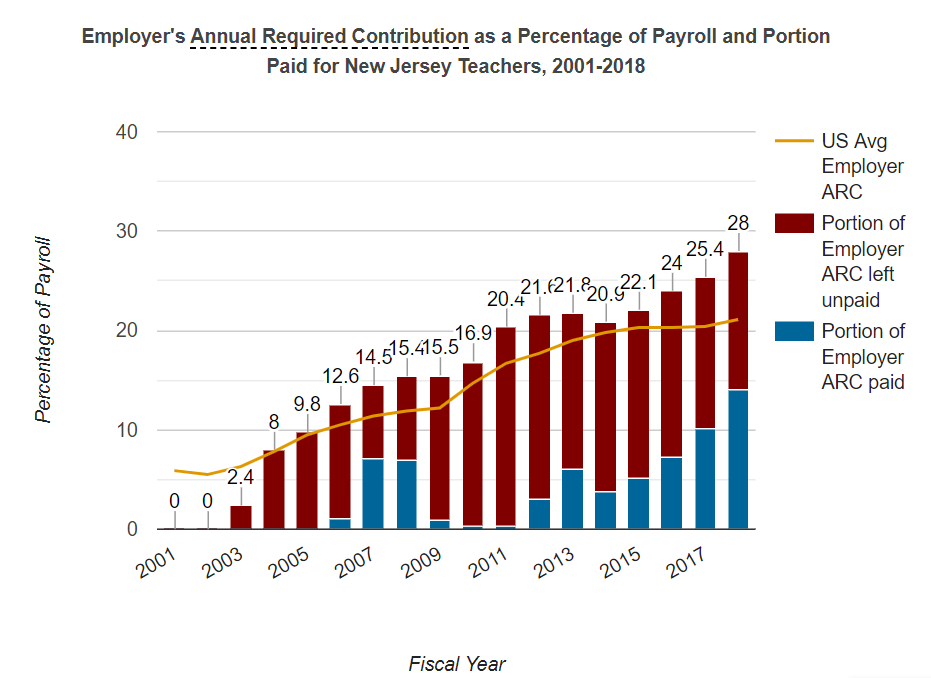

Each of these goes through fiscal year 2018, and it really doesn’t matter what was paid in FY2019, because this is what the contribution patterns looked for each plan going back to FY2001:

Teachers

Police and Fire

PERS

I led with the worst of the deliberate underfunding – the teachers plan – which still appalls me each time I look at it.

In FY2018, there was a record contribution to the teachers pension plan. Because of multiple items:

NJ teachers payroll has only been going up

The “required” contribution has only been going up as a percentage of payroll

This is the first time I see that NJ covered even 50% of what was “required”

Yes, I keep putting “required” in scare quotes because it’s obviously not required in any meaningful sense, if they can boast about covering only half of what they really should have been putting in.

Of these three plans, the teachers plan has been shorted the most.

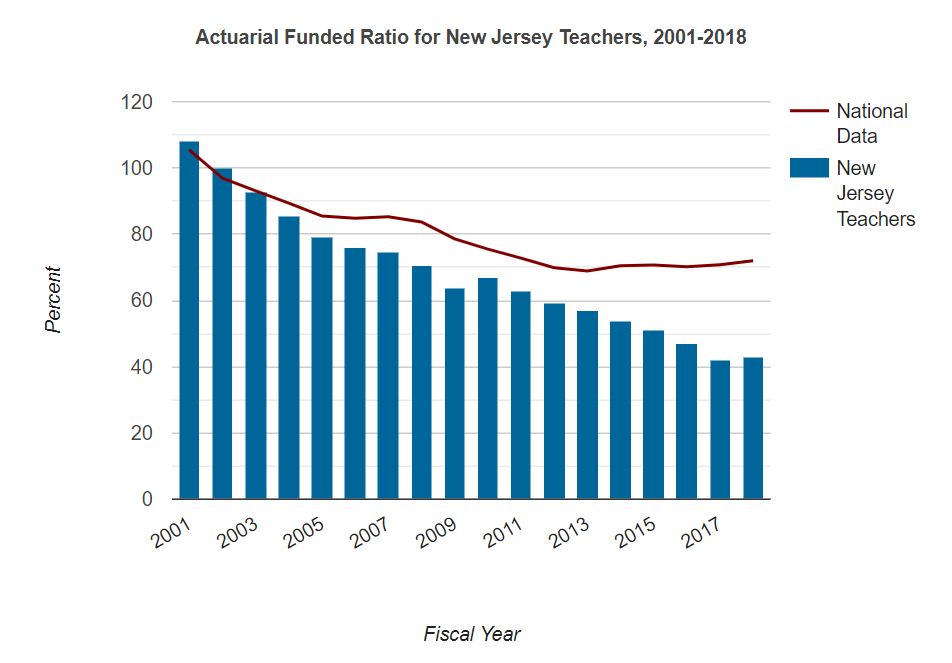

And what has been the result?

It went from 108% funded in FY2001 down to 43% funded in FY2018.

I shudder to think of its funded level right now.

So, no. Murphy, you don’t get credit for having made hyuuuuge contributions in recent years just to try to keep the funded ratio from sinking lower.

Because those hyuuuuuge contributions didn’t even fill the hole for one year.

Steve Malanga on the hostage-taking

Murphy’s Bail-Me-Out Math: The New Jersey governor threatens huge layoffs if Washington doesn’t solve his budget woes.

Even so, the budget hole that the governor says he can’t possibly fill without Washington’s help is in fact smaller than the $11 billion gap that the state confronted in fiscal 2010. Murphy’s threat illustrates why providing states with huge, unrestricted aid to help their budgets rewards bad fiscal practices and undermines local reform efforts.

…..

It’s not as if the state doesn’t know how to save money. In 2016, a bipartisan commission recommended sweeping reforms to Trenton’s employee pension and health-care benefits in order to derail a growing budget nightmare. The commission warned that, by fiscal year 2021, the state would need to spend nearly $10 billion annually just to fund employee benefits. The commission described gold-standard health benefits for public employees that go well beyond what workers at even the most generous private-sector companies receive, and an underfunded pension system that needs nearly $6 billion annually to stop the rapid pileup of debt.

……

Murphy had plenty of warning about how harsh the next recession would be. In a study published last fall, Moody’s estimated that New Jersey was the second least-prepared state to deal with a downturn, after Illinois. The ratings agency predicted that the state’s fiscal hit in the next recession would amount to up to $6 billion. Even before the virus struck, in other words, Jersey should have anticipated a giant budget hole from an inevitable economic downturn. But Murphy, eager to win backing from public-sector unions, had pledged not to seek reforms to their benefits, so he let the risks grow. “The governor is so tight with the public worker unions that he’ll never make the cuts that are needed to fix the state’s structural fiscal crisis,” the Star-Ledger observed.

…..

Why the rest of the country should subsidize New Jersey’s fiscal mismanagement is a question that congressional representatives from better-run states should be asking.

I have nothing to add to what Malanga wrote, other than you should read the whole thing.

Illegal borrowing?

The writer of the following is a Republican politician in NJ: Ciattarelli: ‘Governor Murphy, I’ll See You in Court’

When you’re in a hole, stop digging. Apparently, Governor Murphy never learned that lesson.

…..

The widespread pain and economic carnage inflicted by COVID-19 restrictions has only made these reforms more critical. We must put ourselves on solid fiscal and economic footing to improve the lives of every taxpayers and adequately prepare for the next emergency – be it a storm, pandemic, or whatever else comes our way.Unfortunately, Governor Murphy continues to lack the political will to take on these problems and to buck the entrenched special interests who control him. Instead, he’s planning to borrow $9 billion to fund an already broken state budget. Not only would such a move further destroy our state’s credit rating, it would also further bury us in debt that some outlets forecast could be as high as $65,000 for each current New Jersey taxpayer.

Worse yet, according to the draft legislation being considered, Governor Murphy plans to repay this exorbitant borrowing, without any say from the voters, with higher sales and property taxes. More borrowing followed by higher taxes needs to be the last resort, not the first.

The Governor’s borrowing scheme is the wrong plan for New Jersey. It is also unconstitutional. As Governor McGreevey learned when Republicans took him to court, and as the non-partisan Office of Legislative Services made clear again this month, the New Jersey Constitution prohibits borrowing “for the purpose of funding or balancing any portion of the budget pertaining to general costs.”

This week, I let Governor Murphy know that if he moves forward with this unconstitutional borrowing scheme, I will initiate a lawsuit and he will see me in court. This is a fight worth having. Governor Murphy simply cannot be allowed to lazily repeat the mistakes that have left us financially ill-prepared to deal with the crisis at-hand. The time to break the cycle of borrow, spend, and tax is now.

Cutting off the money spigot is the only way to get these people’s attention.

I am not a lawyer, but I assume Ciattarelli’s lawsuit will end up going nowhere. Probably dismissed for lack of standing, or some such.

New Jersey pensions running out

There have been various white papers issued about the effects of this year’s market disruptions on public pensions. Here is one such research paper, and yes, New Jersey obviously figures greatly.

In 2020, the average estimated funded ratio for the 20 worst-funded plans in our sample is 38.3 percent.10 If markets are slow to recover, their average funded ratio will drop to 32.2 percent in 2025. Six plans – Charleston (WV) Fire, Dallas Police and Fire, Chicago Municipal, Chicago Police, Chicago Teachers, and New Jersey Teachers – will end up with funded ratios of 25 percent or less.

Given the low funded ratios, the more pressing issue is the extent to which these plans will be able to pay benefits. For this assessment, the key metric is the ratio of assets to benefits. For the 20 worst-funded plans, the average ratio is projected to decline slightly from 5.9 in 2020 to 4.5 in 2025. That figure means that, in 2025, they will have on

hand assets equal to less than five years of benefits. Chicago Municipal, Dallas Police and Fire, and New Jersey Teachers, which have severely negative cash flows, will see their asset-to-benefit ratios deteriorate even more dramatically – ending the period with assets equal to less than two years of benefit payments.

And, of course, it’s worse than that. They also calculate what it would take to do pay-as-you-go “funding” of these pensions, compared to current contribution rates.

Unsurprisingly, for these deeply underfunded pensions, that ratio is usually over 1, and for NJ Teachers, it’s 1.52.

That means once NJ Teachers is paygo, contributions would have to increase at least 50% just to pay the cash going out to retirees for that year.

Blast from the past: projecting NJ pension failure

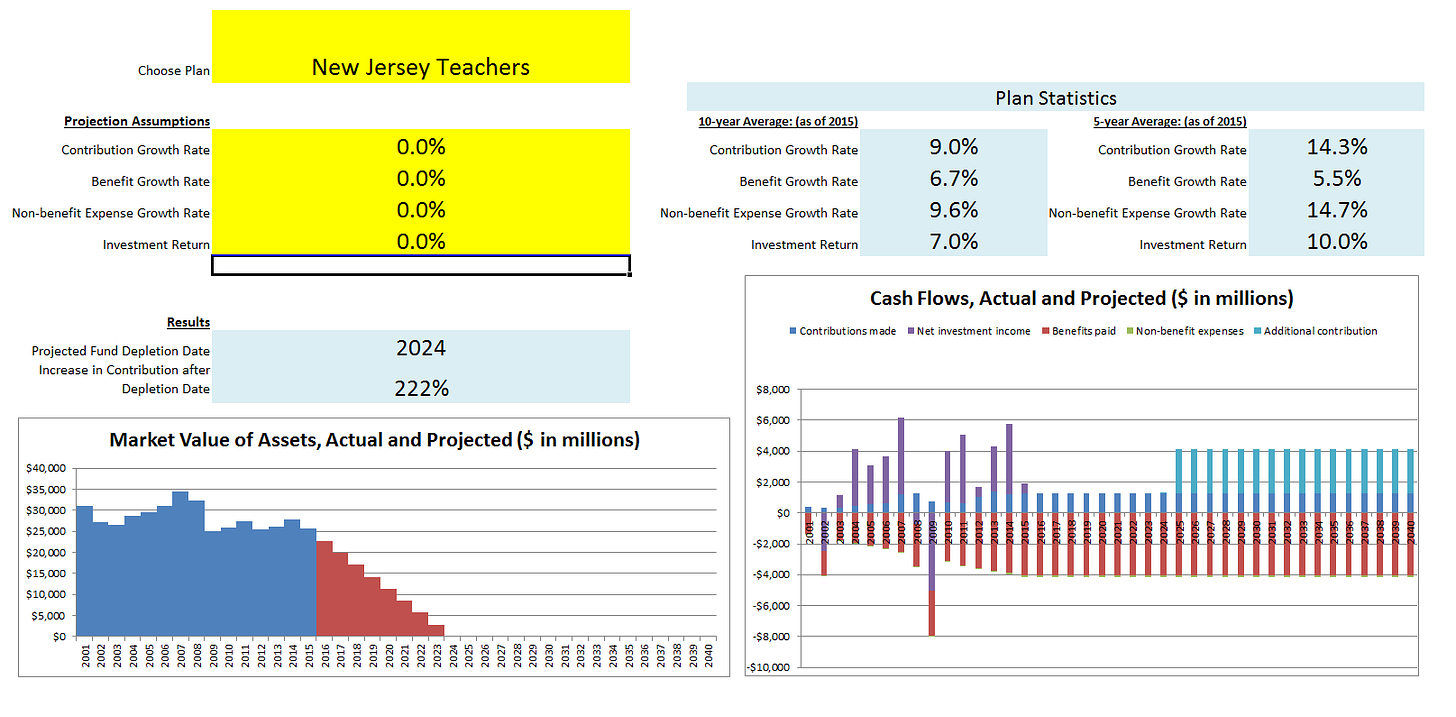

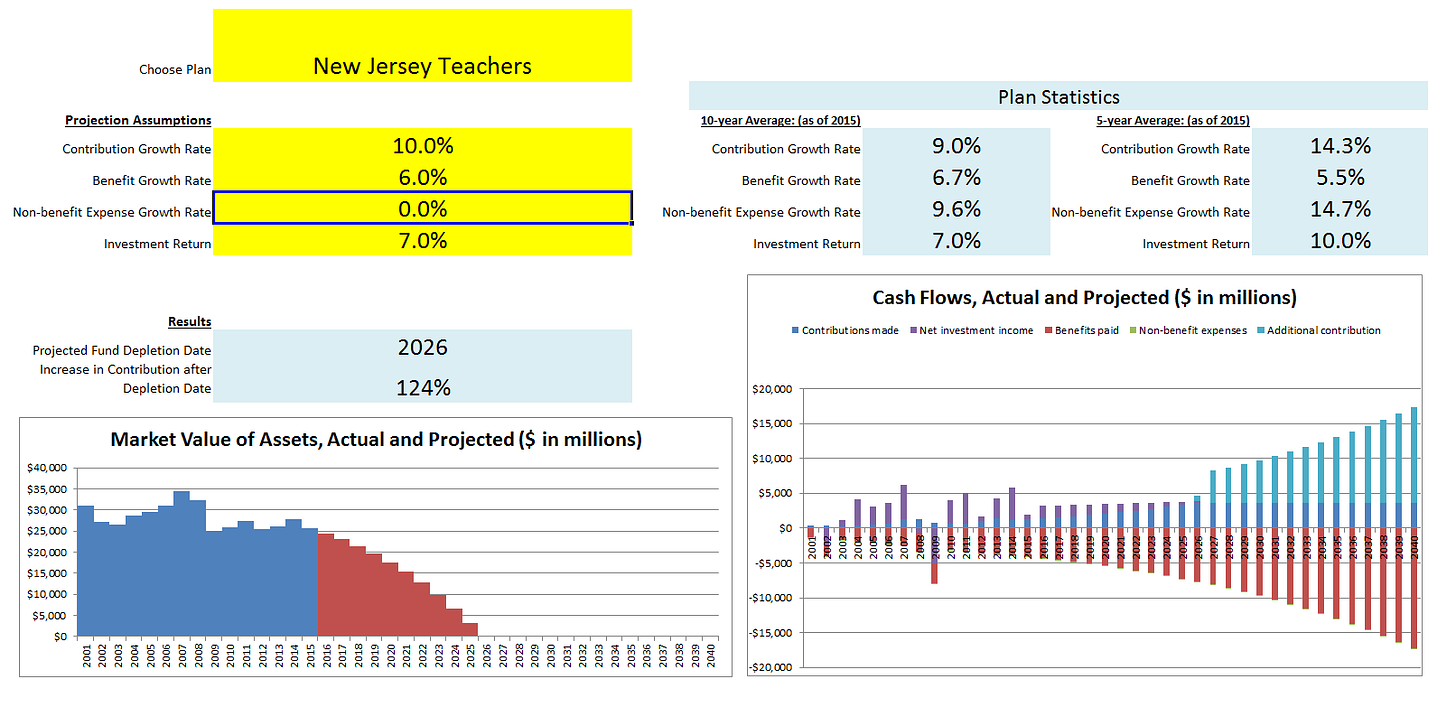

Back in 2017, I posted Testing to Death: Which Public Pensions are Cash Flow Vulnerable?.

I did a variety of scenarios, like this one:

Now, that wasn’t very realistic as a set of cash flow assumptions, so here is a different one for NJ Teachers:

If you look at that specific projection, I estimated that the contribution would have to be boosted 124% – more than double the total – to cover paygo cash flows. But that was before those record pension contributions under Murphy, so the new boost would only need to be 50%.

In any case, it’s interesting to see that, even in 3 years, the projections don’t change very much. NJ Teachers fund is in an asset death spiral, and it seems to me it is unlikely to pull out of it.

Revisiting the lottery issue

Also back in 2017, New Jersey decided to use the lottery cash flows as a pension plan asset.

Governor Murphy isn’t to blame — he wasn’t governor then (Chris Christie was). New Jersey’s pension idiocy is a bipartisan thing [don’t get me started on POBs and contribution holidays].

My comment at the time:

This is a dumb idea.

The lottery cash is already being used for something. Moving that cash to the pensions means they have to decide to cut something else. Which they would have to do if they simply said “we’re putting more cash in the pensions”.

Jeez.

Of course, it was an accounting trick, because they decided to use their projection of lottery profits (net present value, of course) as an asset on their balance sheet. As opposed to cash contributions, which would just hit the income statement, as it were.

Back in 2017, I looked at how variable lottery profits could be. A lot of it is driven not only by big prizes, but how much people are willing to buy each year.

Well, New Jersey has learned this the hard way.

By reality.

Pensions & Investments online: Drop in New Jersey lottery proceeds could affect state’s pension contribution

New Jersey state lottery proceeds fell 25.6% in April vs. the year-earlier period and 13.3% for the first 10 months of the current fiscal year, continuing to pressure the state’s ability to make its full fiscal year contribution to the state’s pension system.

John Bury: Gambling on NJ Pension Contribution

Lottery proceeds (which reduce the calculated contributions after application of whatever percentage the state chooses to make of them) are supposed to be a steady stream of income to help with liquidity. The state’s net quarterly deposits make an assumption as to what that lottery income will be and there is no mechanism in place to adjust for differences. Based on past history there will be nothing additional coming from general revenue to make up for the coronavirus losses and the retirement system will be fortunate if lottery revenue does not get poached for general revenue, again based on past history.

That’s an easy bet.

nj.com: N.J. public worker pensions could lose $115M in funding as lottery ticket sales plunge

The New Jersey Lottery is expected to come up about $115 million short in its $1 billion annual contribution to the public worker pension fund as the pandemic slows ticket sales, a treasury official said Wednesday.

The coronavirus and stay-at-home orders have led to a big drop in lottery ticket sales, which are down 13.3% in the first 10 months of the fiscal year, making the lottery unlikely to muster enough cash to make its full $1 billion contribution.

…..

Former Gov. Chris Christie and the state Legislature in 2017 agreed to pledge the New Jersey Lottery as an asset to the pension system to slash its unfunded liabilities and guarantee it about $1 billion in cash each year.Previously, lottery proceeds helped fund higher education programs, psychiatric hospitals, centers for people with developmental disabilities and homes for disabled soldiers.

Well, obviously, Christie hated those things. That’s why he switched the lottery funds over to the pensions.

Or maybe, just maybe, there are trade-offs in budgeting, and the pensions are eating the NJ budget.

More on New Jersey debt

Here are some leftover NJ stories not living elsewhere, without comment. I will put dates on some, because they’re from over a month ago. Not that anything is much better for New Jersey since April.

John Bury: NJ Borrowing: For and Why

April 20: New Jersey governor willing to accept Fed’s offer to buy municipal debt

April 21: Fitch downgrades New Jersey, says combating virus fallout to weaken finances

New Jersey sees first credit downgrade under Gov. Murphy (updated)

Endgame: NJ has little leverage, like the other profligate states

New Jersey, like Illinois, is desperate for cash… and both states were desperate for cash before COVID-19 hit. They crow about supposed budget surpluses planned, if only that bull market had kept being bullish, but those budget surpluses were always predicated on still shortchanging pension funds by quite a lot.

That the NJ pension funds are grossly underfunded is the work of decades. That NJ is in dire financial straits and downgraded again is not only the result of crisis, but deliberate choices made in good times. They were never prepared for a downturn, even though prudent planning would have said they should have been.

But this goes back to my old point: there is little leverage that NJ (or IL or CA or NY or…) has with Mitch McConnell in the Senate. They’re not getting that sweet $1 trillion (or more) from Pelosi’s bill.

So what now? Sounds like a bunch of the profligates will borrow money from the Federal Reserve, I assume they think by the time it comes to pay it back, maybe they’ll have their federal bailout.

That doesn’t sound like much of a plan to me, but hey — maybe they’ll get it.