States Under Fiscal Pressure: Illinois

Read on for references to both Pandora's Box and Don Giovanni

[Yes, enticing, isn’t it]

California bumped Illinois from first spot, but Illinois has a lot of issues, and, unlike California, we’ve not heard about a single proposed budget cut yet.

Oh, and they’ve been issuing bonds with some of the highest yields in the muni market because of course they are.

So let’s hit the issues, in no particular order.

Illinois looking to raise public employees’ salaries

As hundreds of thousands of Chicagoans are getting laid off or seeing their pay slashed as a result of the economic shutdown, Chicago’s Mayor Lori Lightfoot has been quietly finalizing the $1.5 billion, five-year contract she negotiated with the Chicago Teachers Union six months ago. WBEZ reported on May 5th that final contract negotiations are “nearly complete.”

At the same time, Gov. J.B. Pritzker still plans to pay $261 million in raises to AFSCME workers, part of a $3 billion multi-year, guaranteed contract he signed with the union last year. Never mind his lockdown has contributed to the joblessness of more than one million private sector Illinoisans.

Pritzker and Lightfoot’s actions lay bare how Illinois would spend federal state aid for the pandemic. Public payrolls are getting slashed around the country – California’s Gov. Gavin Newsom just announced 10 percent wage cuts for state employees and a 10 percent reduction in public school funding – but not in Illinois. Quite the opposite.

Given that the federal bailout ain’t happening (at least not at the size Illinois asked for, but I haven’t seen Mitch McConnell move a damn inch on giving the states more than already has been shoveled out), I do wonder how they plan on paying for this.

Because the revenue forecast for Illinois is no more sunny for Illinois than it was for California.

Projected COVID fiscal impact on Illinois

Illinois Policy Institute: ILLINOIS PERSONAL INCOME TAX REVENUE COULD FALL UP TO $6.6 BILLION FROM COVID-19 LOCKDOWN

The severe economic downturn brought on by the coronavirus outbreak and measures taken to contain it could cause state personal income tax revenues to fall by 14.7% to 33.8% this year.

The economic effects of the current COVID-19 outbreak and measures to contain it are massive. Experts are predicting national declines in gross domestic product ranging from 24% to 50% in the second quarter of 2020, which would translate to a contraction between $54 billion and $113 billion for the state of Illinois.

That’s just income tax on individuals, of course.

Let’s look up more information from the Institute of Government and Public Affairs at the University of Illinois.

The state gets most of its tax revenue from three sources: Individual Income Tax, Corporate Income Tax, and Sales Tax. These “Big Three” taxes account for over three-fourths of total tax revenue and almost half of all state revenues.

……

Figure 3 (page 5) shows the results of our analysis for the total amount of Big Three revenue sources. If the COVID-19 recession is similar to the 2007-09 recession, revenues for these sources will fall in calendar year 2020 by around $3.2 billion.3 In the low-severity scenario from McKibbin and Fernando (MF4), the revenue loss will be less, around $1.9 billion. For the moderate-severity scenario (MF5), the revenue loss is estimated at $3.9 billion in 2020. In the severe pandemic scenario (MF6), the revenue loss will be an estimated $6.4 billion. The alternative scenarios all predict a recovery of revenues to more of a normal path after 2020, but the speed of recovery differs markedly.

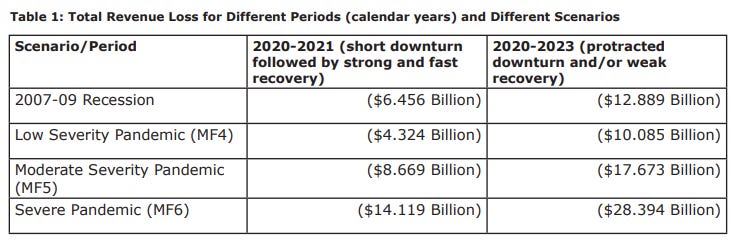

Table 1 recaps the total revenue loss over different periods that are projected by the model under each scenario. If the recession is short and recovery is strong and fast, the total revenue loss will be more like the middle column. But a protracted downturn or a downturn followed by a weak recovery will produce results more like the right column.4 In either case, the revenue loss for the individual and corporate income taxes and the state sales tax is likely to be substantial.

Let’s just say that raises at this point in time is ill-considered. They couldn’t afford the salaries before… they certainly will not be able to afford it after the revenues plummet.

Illinois goes to the bond market and pays for it

So, Illinois had found that it still has access to cash, at least through the bond market. However, they’re having to pay pretty high yields, considering.

Illinois pays peak penalty to borrow

Institutional buyers jumped at the junk-level spreads Illinois offered on its $800 million of new money, general obligation bonds Wednesday.

Illinois may have recorded a punishing new peak for its spreads for a primary outing, but the state sees the $8.4 billion of orders submitted by investors in a fragile municipal market still recovering from a tumultuous March as an accomplishment.

“We were encouraged by the size and range of the orders from more than 120 investors,” capital markets director Paul Chatalas said in a statement.

Lord, investors. You should stop encouraging Illinois.

The 10-year bond in the deal landed at 5.65%, a 452 basis point spread to Municipal Market Data’s AAA benchmark and a 331 bp spread to the BBB benchmark. The state is rated at the lowest investment grade level of Baa3/BBB-minus with a negative outlook.

Illinois headed into the deal with its one-year bond at a 373 bp spread, its 10-year and 25 year at a 415 bp spread. The deal’s long bond came in below secondary levels settling at a 396 bp spread.

These are large spreads, in case you were wondering.

Commentary from Seeking alpha: Illinois paying up to borrow money

Looking to raise about $750M across several maturities today, Illinois is reportedly paying 5% to sell paper coming due in 2021 – that would be several hundred basis points above benchmark rates (U.S. two-year yields are at 0.16%, for instance).

The 10-year paper is reportedly priced to yield 5.8%, more than 400 basis points above benchmark.

Illinois is also selling 25-year bonds, apparently priced to yield 5.95%.

Miller Tabak’s Michael Pietronico: “The Prairie state just dished out some pain to its taxpayers … Greece is likely having a nice chuckle.”

I don’t think Greece is spending any thought on Illinois (and vice-versa).

Frankly, state bankruptcy would not help Illinois until all these sources of funds dry up.

As long as there are people desperate for tax-free yield…. and they think they’ll get paid (because there will be a bigger sucker along to pay when the debt has to roll over)… Illinois will keep going back to get more money hits.

But wait — what’s this?

Illinois eyeing the Federal Reserve as a source of funds

I haven’t written much about what the Federal Reserve has been up to [mainly because I have to think and write about it for paying work. So sorry, y’all, you ain’t gonna get that material here].

But I have no problem sharing what other people have written. I just won’t make any comments.

Illinois eyes using Fed muni facility for cash-flow borrowing

llinois, the U.S. state in the worst fiscal shape even before the coronavirus outbreak, may be able to use the Federal Reserve’s new Municipal Liquidity Facility (MLF) for a pending cash-flow borrowing, now that the program will bid competitively for debt issued by eligible governments.

The central bank on Friday laid out a process under which the MLF, a tool announced last month to ease cash-flow pressures for state and local governments struggling with reduced tax revenue due to the coronavirus pandemic, could purchase their debt through competitive bidding.

Illinois is the lowest-rated state, at a notch above junk, and just this week had to pay a much higher yield than other states in the U.S. municipal market. A state spokeswoman told Reuters on Friday the MLF is under consideration now that a bidding process is available for the program.

…..

The Fed, which has not set a launch date for the $500 billion program, said the MLF will buy debt directly from eligible governments or will commit to buy debt not awarded to bidders in a competitive sale. Additionally, the MLF will submit its own bid in cases where the issuer is required by law to sell debt competitively and does not have the legal authority for a direct sale to the MLF. (Reporting by Karen Pierog; editing by Alden Bentley and Leslie Adler)

Wirepoints: Illinois eying loan from Fed, but who would certify state is solvent? – Quicktake

Reuters reported Friday that Illinois is considering using the Federal Reserve Bank’s new Municipal Liquidity Facility (MLF) for a pending cash-flow borrowing. The program is for states, cities and other municipalities.

But as we reported earlier, the program is only for solvent states and borrowers must provide a written certification that they are not insolvent.

We’ve been trying to envision the meeting among Pritzker Administration officers and staff when they found that requirement in the paperwork.

…..

Maybe the Illinois meeting would go something like this:“I’m not going to sign that. You sign it.”

“No, you sign it.”

“Hey, let’s get JB to sign it. He’ll say anything.”

Go to the link to see a classic commercial.

I do have a lot of questions as to how this program supposedly will work. For right now, it seems even Illinois can tap the muni market.

If McConnell never moves on a state bailout… it doesn’t even require putting forth state bankruptcy legislation…. what will the muni market do?

I’m not sure that we’re going to see the muni market dry up, unless Illinois does something incredibly stupid, like trying for a $100 billion pension obligation bond.

Stating the obvious: We told you so

Not exactly helpful, though true.

Sheila A. Weinberg of Truth in Accounting: Out of the virus frying pan, into the financial fire

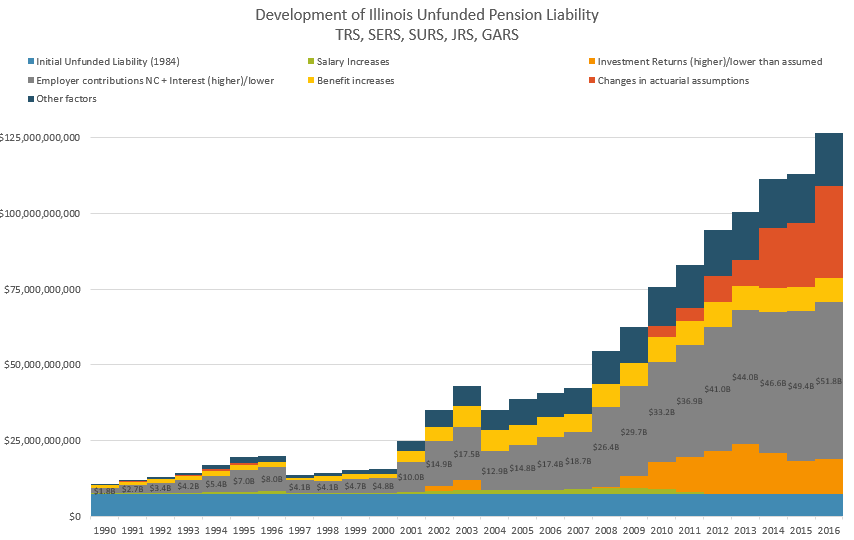

In his daily coronavirus briefings, Gov. J.B. Pritzker has touted that Illinois was in good financial shape before the current crisis hit. He has mentioned several times that the state’s budget was balanced and on its way to running a surplus. His comments might hold true using the political math and accounting gimmicks that have put the state more than $200 billion in the hole, including $139 billion of unfunded pension benefits and $56 billion of unfunded retiree health care benefits.

During his April 27 press briefing, a reporter asked him about the possibility of pension reform. Pritzker responded by saying we must take care of retired state workers and teachers. Yet he “balanced” the budget by not adequately funding their pension plans.

Similar to people ignoring the minimum payments on their credit cards, in his 2021 budget, Pritzker ignored the pension systems’ actuarial calculations that determined $13 billion was needed to properly fund the pension systems during this budget year. Instead, a payment of only $9 billion was scheduled to be made.

….

If Illinois and other states were financially prepared for a crisis, they wouldn’t need a bailout. Financial experts suggest that everyone should have three to six months worth of income set aside in case of an emergency. On June 30, 2019, Illinois had reserves of less than $60,000, and even with the $100 million Pritzker said he was going to put into reserves, these funds would last the state less than a day.Truth in Accounting’s warnings about the state’s dire financial situation have been largely ignored for years. I assume that we were one of the “carnival barkers, the doomsayers, the paid professional critics” Pritzker mentioned during his last state of the state address.

Hopefully, when we come out of this crisis, Illinois will address its financial woes. Just as the governor highlights that we need to look at science when dealing with the coronavirus, he and the legislature need to balance the budget using math and basic financial planning tools, such as having money set aside in case of a crisis.

I’m not sure what gives her that hope. It’s not like it’s been a mystery why Illinois has so many money woes: it overpromises, under taxes to meet said overpromises, and then borrows the difference. Whether explicitly or implicitly.

To do a quick tangent, if you recall the story of Pandora’s box, Pandora let out all the evils of the world, that had been shut up in a jar [we call it a box because we’re more likely to keep our stuff in boxes now, not jars]. When she put the lid back on, one thing was caught inside: Hope.

That has always been a trouble: why was “Hope” in a jar of evils? What did it mean for it to be still entrapped in the box?

One answer I heard from a professor long ago was that it wasn’t the Christian ideal of hope in “faith, hope, and charity”, but that it was a delusional hope. A futile hope.

I’m not at all sorry to point out that I consider it a delusional hope that Illinois, even with [heck, especially with] a federal bailout, would get its financial house in order. There has been no political will to do so at least since 1970.

Yes, I know Michael Madigan will leave the Illinois legislature at some point [immortality hasn’t been practically achieved, after all], but it’s not just Madigan who caused this mess. There have been many enthusiastic participants.

Even when key people are gone, its profligate ways will continue until forced to stop.

We have seen how they behave. We’ve seen how the liabilities on the balance sheet have heaped up. We’ve seen how even basic things like regular vendors’ bills have been short-changed, heavily borrowed for, and then year-after-year deliberately undercontributing to pensions.

How will it end?

Oh, I could go with the T.S. Eliot solution and say: “Not with a bang but a whimper”…after all, it has taken quite a long time for Illinois to build up its profligate ways. It will likely limp along, with enough dribs and drabs coming along to keep it “working”.

But I had a friend comment on a tweet I wrote as I was working on this post:

And yes — what would be delicious is if the state of Illinois were visited by a walking statue, asking it to repent, it repeatedly saying no, and then the statue proclaims:

YOUR TIME IS UP

(at around 5:20)

And then it’s dragged to hell.

Metaphorically.

Okay, I have an odd imagination when it comes to public finance.