Rhode Island COLAs: Increasing Expenses for Very Underfunded Plans

There are different choices to be made -- and different consequences will come

With all the drama coming out of Ohio STRS, my attention has been distracted from other things going on in the public pension world.

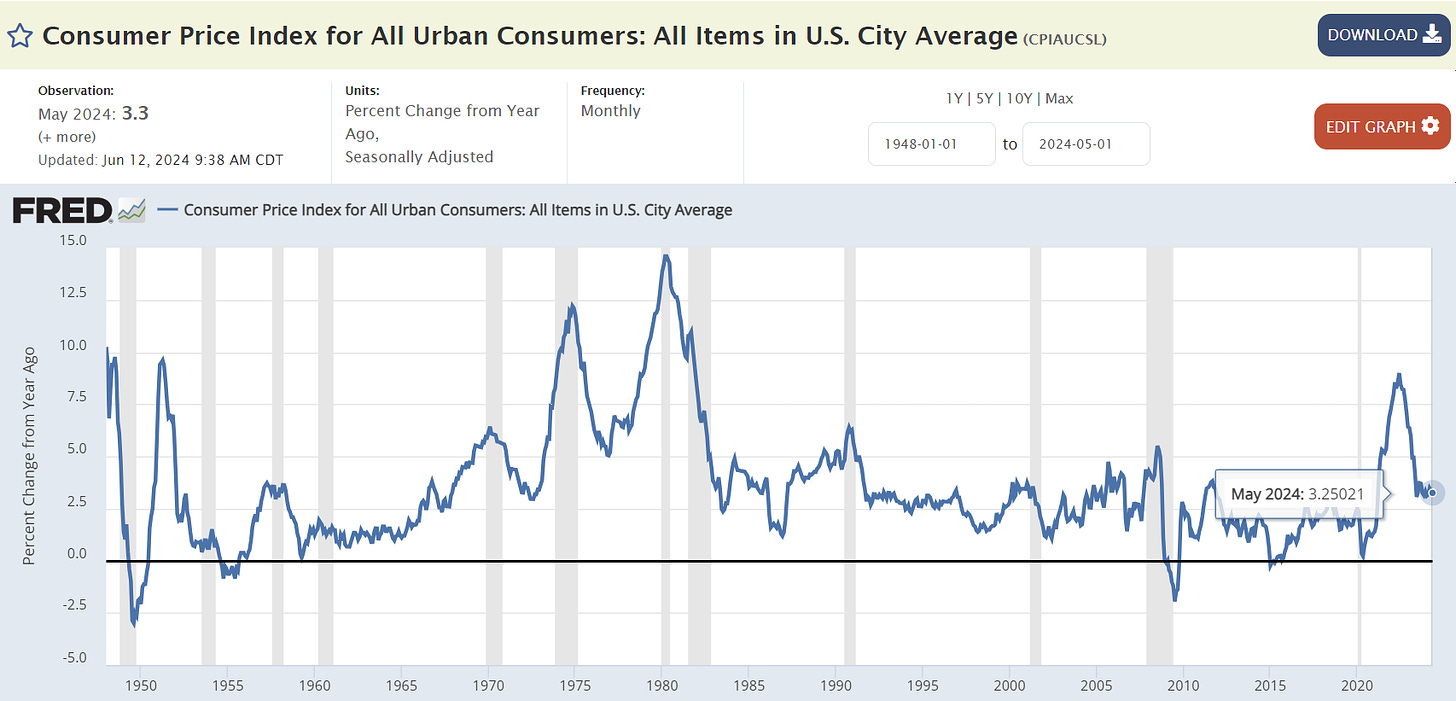

Given the relatively high inflation in recent years:

It’s not only Ohio STRS that has retirees and pension plan participants angered by lack of cost-of-living increases. Some other states had cut COLAs years ago due to their own pension funding issues. Rhode Island was one of those states.

Let me give you the recent news, and then the background.

Rhode Island COLAs to be restored to some retirees

Boston Globe, 7 June 2024: R.I. House passes $14 billion state budget

Legislators praised the budget for providing cost-of-living increases to pensioners who retired before 2012 rather than waiting until the retirement system is 80 percent funded. The budget would allow other pensioners to get COLAs once the system is 75 percent funded. And it would allow for calculating pension benefits based on the average of the highest three years of compensation rather than five years.

Representative Charlene M. Lima, a Cranston Democrat, noted she has been an outspoken critic of the 2011 pension overhaul championed by former state treasurer and governor Gina M. Raimondo, who is now the US commerce secretary. And she praised Shekarchi for including the cost-of-living increases in this year's budget despite “substantial and unexpected burdens” such as replacing the Washington Bridge.

“Until today, we have not seen any substantial effort to begin to correct this injustice,” Lima said. “We will continue to do more to get more retirees their just desserts next session until all retirees are made whole.”

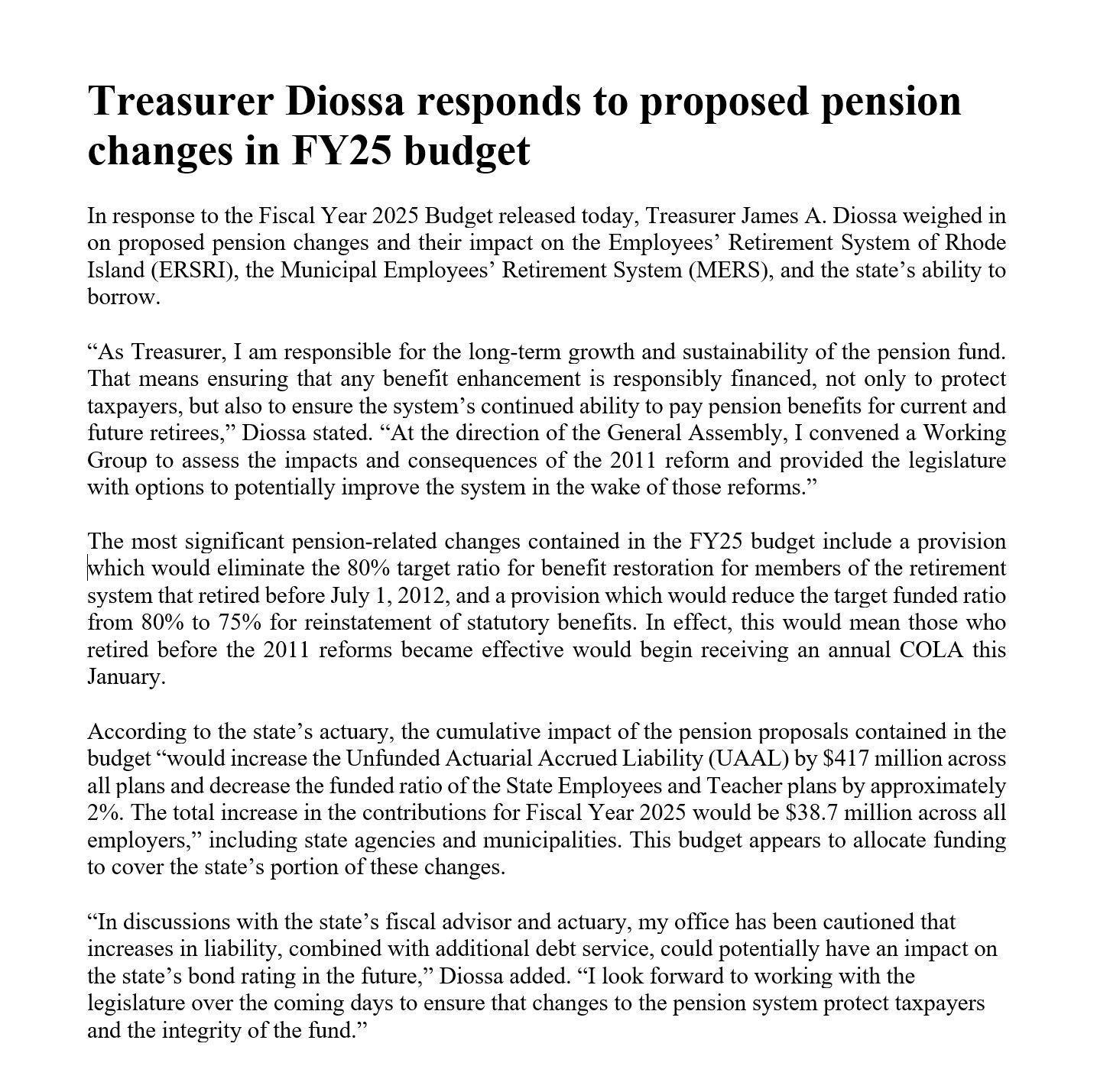

General Treasurer James A. Diossa has warned that those pension changes would increase the unfunded pension liability by $417 million and “could potentially have an impact on the state's bond rating in the future.”

I will get to that warning in a moment.

Going to the Treasurer’s site has a link to a summary of the provisions in what was just passed.

I bolded the whole thing, because both the choices listed: COLAs restored and highest 3 years instead of highest 5 years — these will increase the cost of the pension liabilities, and almost definitely by a lot.

Current state of funding for Rhode Island Pensions

Rather than pull from the Public Plans Database, as I usually do, I’m pulling from Rhode Island’s own Pension Advisory Working Group materials.

Because it has history and projections.

The actuarial firm GRS had the following slides for the November 2, 2023 meeting:

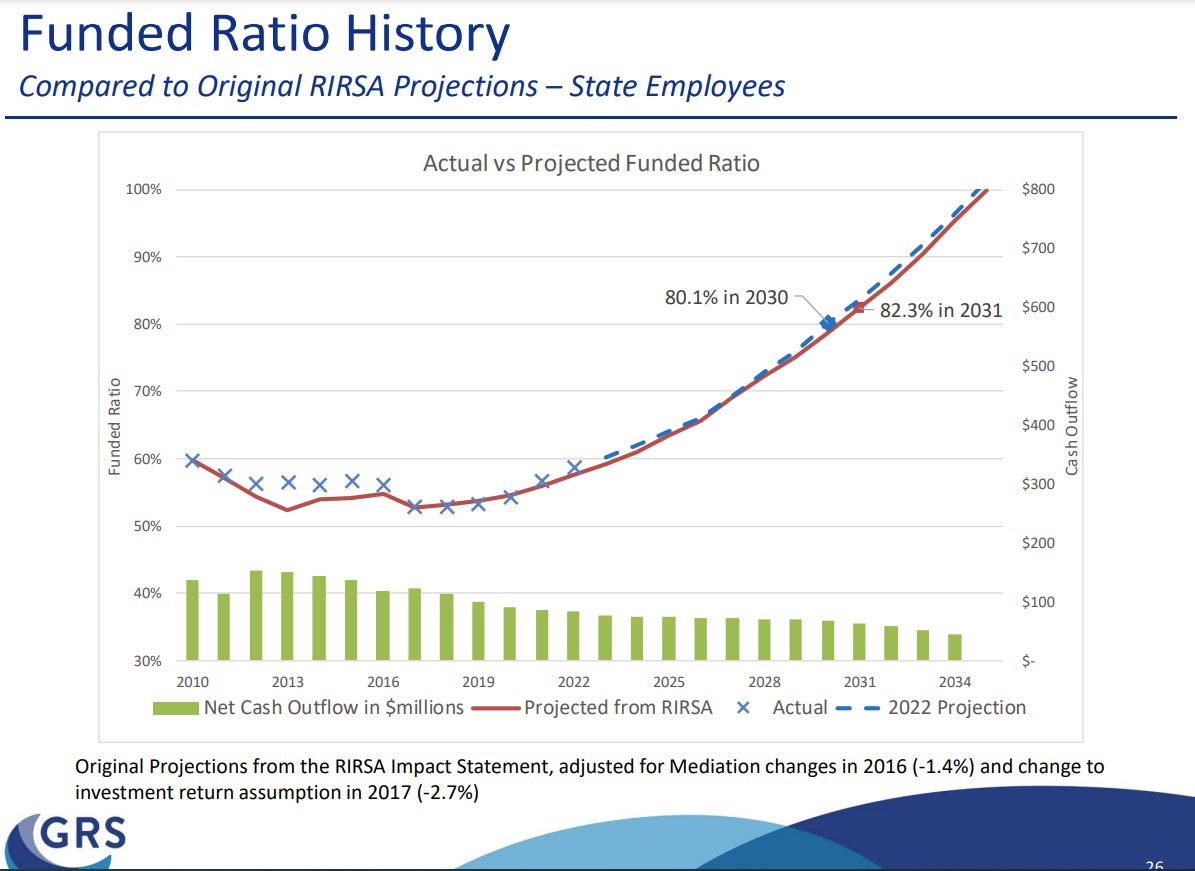

[slide 26]

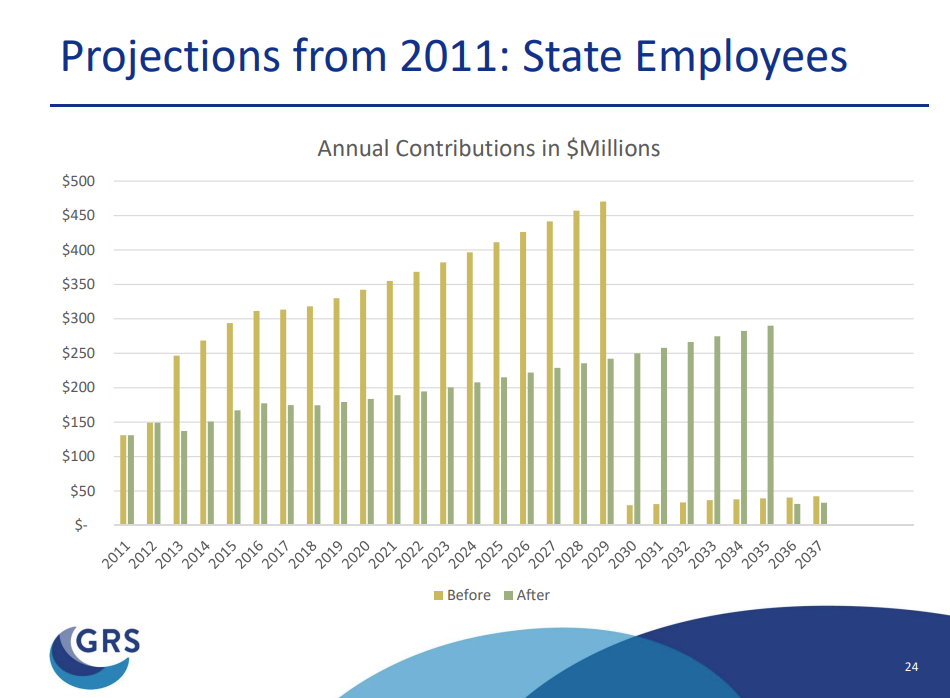

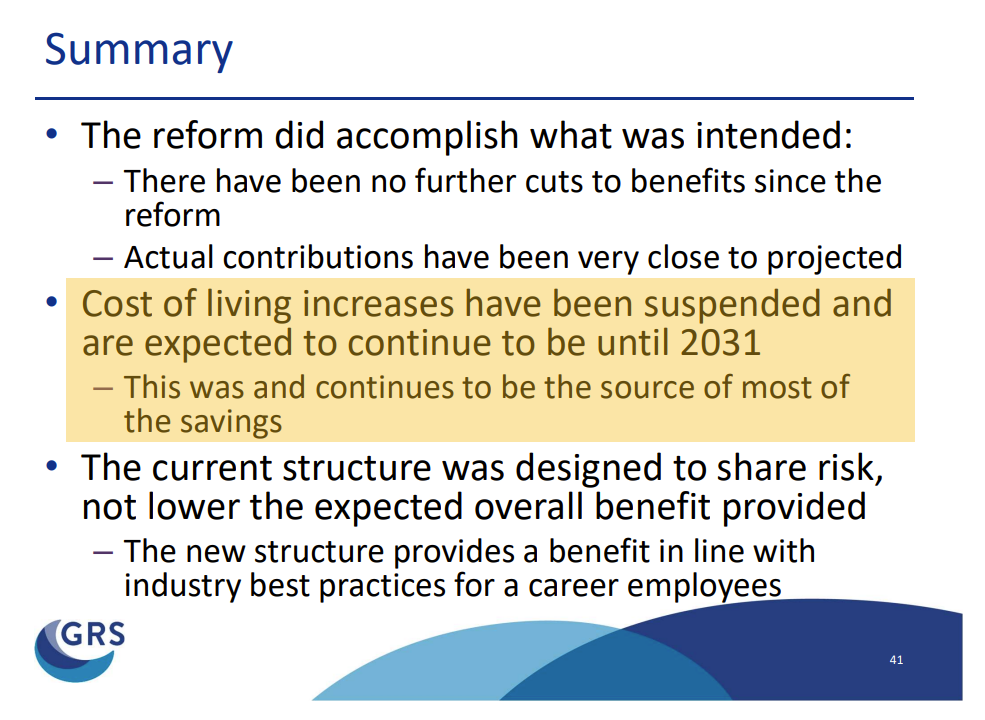

I didn’t put these in order — just wanted to show the effects of the changes with removing COLAs (and there were some other changes), which made the pension promises cheaper.

By putting COLAs back, there will be an immediate increase in the unfunded liabilities.

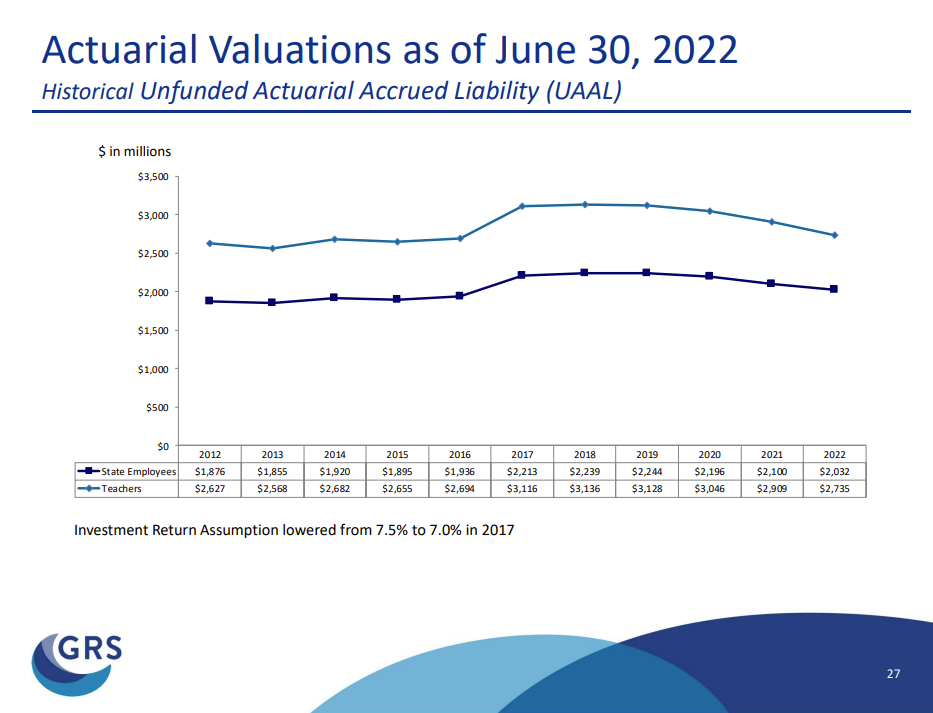

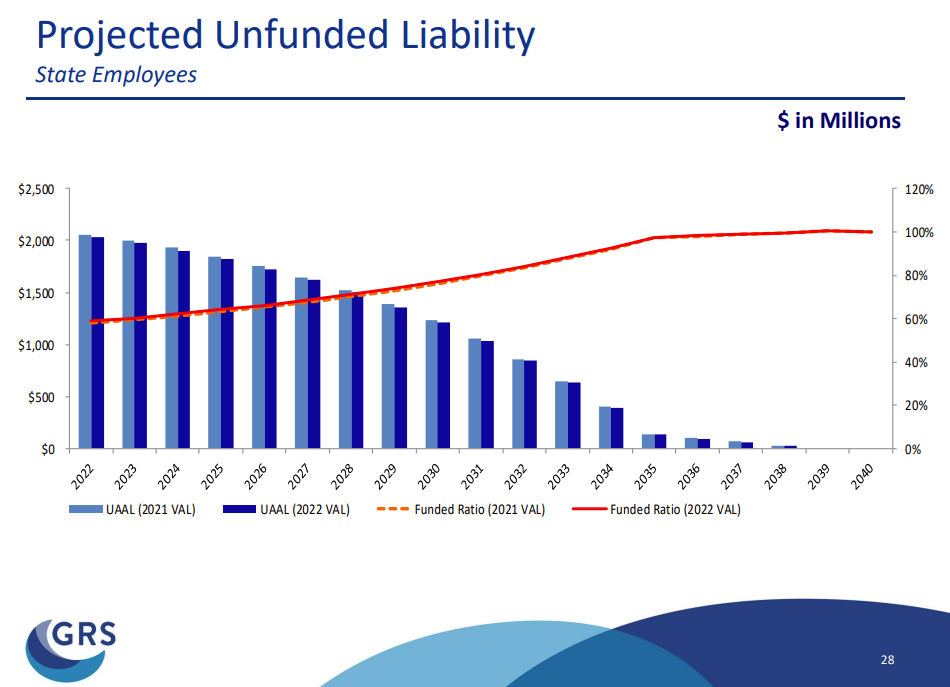

This is the history of those unfunded liabilities:

And projection:

That is assuming no changes:

I want to highlight one thing (highlight not in the original slides):

By putting COLAs back in, the unfunded liability will immediately jump. It doesn’t get smoothed in. It has to be fully recognized for all who get it, and all their future cash flows.

The costs to pay for that extra unfunded liability will get amortized over time, but the plans are still deeply underfunded. This will put more economic stress on the state and municipalities.

Treasurer’s Comments on the COLAs

Rhode Island Current, 3 June 2024: Lawmakers want modest pension adjustments to help retirees. Not so fast, general treasurer says

It didn’t take long for Rhode Island General Treasurer James Diossa to wave a cautionary flag on lawmakers’ proposed changes to the state pension system.

Less than one hour after the House Committee on Finance approved a revised fiscal 2025 budget Friday night, Diossa took to X to respond to recommended revisions in retiree benefits and pension funding ratios. While Diossa stopped short of opposing the changes, he highlighted the debt and increased liability for the beleaguered pension fund, which could hurt the state’s borrowing capacity in the future.

“In discussions with the state’s fiscal advisor and actuary my office has been cautioned that increases in liability, combined with additional debt service, could potentially have an impact on the state’s bond rating in the future,” Diossa said in a statement on X.

The whole statement:

To pull out the salient items:

Funded ratio would drop 2 percentage points (approximately) across the plans, immediately

Unfunded liability across all the plans would increase $417 million

Total increase of contributions for FY2025 would be $38.7 million, and the budget includes the impact for the state.

The municipalities would have increased costs, too, and would have to deal with these increased costs. So that’s something to keep an eye out for.

And, of course, if there were a large market drop and/or a recession, you might be hearing a lot more about this stuff.

The bond rating agencies reports in the meeting materials referenced the pension reform of 2011 as well as the need to keep net flows at a reasonable level. The contribution levels could strain the state and local governments again. We shall see.

Older Posts

April 2017: Rhode Island Pensions: Asset Trends

April 2017: Rhode Island Pensions: Liability Trends

April 2017: Rhode Island Pensions: Let's Be A Happy Family!

September 2014: Public Pensions Watch: Alternative Asset Classes, pt 6 of many, Rhode Island

June 2022:

Dear Mary Pat,

Do you have any confidence that ANY of these issues will be addressed with rational choices like reduction of benefits, reduction of COLA, clear and public increases in funding for these plans? Or is every single state and municipality going to keep lying until TOTAL DEFAULT?

To be fair, it's very likely just the first few total defaults will cripple the whole US financial system to the point the rest is meaningless. That's the future I see.