Public pension watch: Illinois TRS deeper in the hole, other funds to follow

Explain how you're getting to 90% by 2045, Illinois

From Wirepoints: Reality check: New actuarial report says Illinois’ biggest pension, TRS, sunk $6 billion further into the hole in FY 2022 – Wirepoints Quickpoint

The first actuarial report is out for an Illinois pension for fiscal year 2022, which ended on June 30. It’s for the TRS, the Teachers Retirement System, which accounts for well over half of Illinois state-level pension debt.

Unfunded liabilities grew about $6 billion from $74.7 billion to $80.7 billion on a fair asset value basis. Its funded ratio worsened from 46.2% to 43.8%. The drop occurred despite a one-time, special contribution by taxpayers to the fund of $173 million that was in addition to their annual, scheduled contributions.

Expect Illinois’ other pensions to suffer similarly dismal results as their 2022 reports are published.

There is only one state-wide pension fund that won’t be as poorly funded as the rest, but we can get back to that later.

Expect a lot of bad pension news for fiscal year 2022

All of the Illinois pension funds, just like pretty much all the public pension funds in the U.S., will show bad results for 2022.

The reason is simple to see:

Fiscal years for public pensions tend to run from July 1 to June 30, so I’m looking at stock indices from July 1, 2021, to June 30, 2022, for fiscal year 2022.

For that period, the S&P 500 index (GSPC or the purple line on the graph) was down 12%, and the NASDAQ (IXIC, or the blue line) was down 23%

Most pension funds have a portfolio that will drop with the equity markets. So that’s one part of why the pension plans will show abysmal results.

The other reason is that the funding has been inadequate for decades.

Comments from the actuarial report

Mark Glennon, who wrote that Wirepoints post I linked, notes the actuaries pointed out the inadequacy of the state’s contributions to the pension plan over the years. He didn’t quote the report directly. I will.

Teachers’ Retirement System of the State of Illinois, valuation as of June 30, 2022 — under the heading of “Funding Adequacy” on the 3rd page of the PDF:

The State funding has been inadequate, resulting in TRS being among the worst funded public employee retirement systems in the United States. We strongly recommend an actuarial funding method that targets 100% funding. Generally, this implies payments that are ultimately at least enough to cover normal cost, interest on the unfunded actuarial accrued liability, and the principal balance.

The state funding target was 90% by 2045, but with no trajectory to 100%.

The actuaries specifically bolded this recommendation, and this is not the first time they recommended this in their report.

This has long been a problem for me, as this target was originally set in the 1990s. And it tickled a memory in the back of my mind – a year ago, this issue had come up… again.

Jumping back a year – what is the goal?

About a year ago, I was working on a post that I never finished, jumping off this story:

Dec 8, 2021: Pritzker administration pushes against recommendations for full pension funding goal

Taxpayers are on the hook for Illinois’ unfunded public employee pension obligations, which increased by more than $120 billion in 25 years.

And the governor’s office advises against changing funding goals as recommended by actuaries.

The Illinois Commission on Government Forecasting and Accountability recently published its report for the end of November with a focus on pensions.

It found total unfunded liabilities were nearly $140 billion as of June 30, 2021, driven by the unfunded liability in the Teachers’ Retirement System of the State of Illinois with nearly $80 billion. The total funding ratio is 42.4%. The worst funded system is the General Assembly Retirement System, which is 19.3% funded.

….

The appropriateness of the 90% funding target was questioned by the commission’s actuary, Segal. In a letter to the commission, the company said in an opinion that the 90% goal “is not an appropriate goal.”“We strongly recommend an actuarial funding method that targets 100% funding” over time, the opinion stated.

A letter from officials from the State Universities Retirement Stem, State Retirement System and TRS also “strongly recommended raising the target funded ratio to 100%.”

A letter from Gov. J.B. Pritzker’s director of the Office of Management and Budget said consideration of changes to the funding ratio goal needs to be reviewed carefully.

“An increase in the goal would result in higher payments, but eventually lead to a reduction in the unfunded liabilities in the systems,” GOMB Director Alexis Sturm said. ”Given the current fiscal pressures facing the state, this too is inadvisable to consider until Illinois can eliminate the unpaid bill backlog” and other debts.

“Therefore, at this time, the 90 percent funding ratio continues to be a reasonable and achievable goal for the State of Illinois pensions systems,” Sturm said.

I am skeptical they will reach that 90% level without some interesting tricks… or a more serious pandemic than COVID-19.

The actual public finance behavior of Illinois for decades is what I’m basing my remarks on. I have yet to see any stomach for any actual reform of the promise, promise, promise and not actually pay for their promises.

A look at Illinois’s history of underfunding its pensions

I have a lot of posts touching on Illinois pensions, and touching on Illinois TRS in specific.

Here are a few:

2015: Illinois Pensions: Teachers Retirement System (TRS) number-crunching – in which I show that TRS is over 50% of the state’s unfunded pension liability (given that teachers are the largest category of government employees in most state/local levels, duh.)

2016: Much Ado About Discount Rates: Illinois and the Actuaries — a brou-ha-ha over dropping the valuation rate from 7.5% to 7%

2017: Geeking Out (and Illinois Pensions): Fixing a Graph and Assigning Blame for Underfundedness

Let us look at a key graph from that last post.

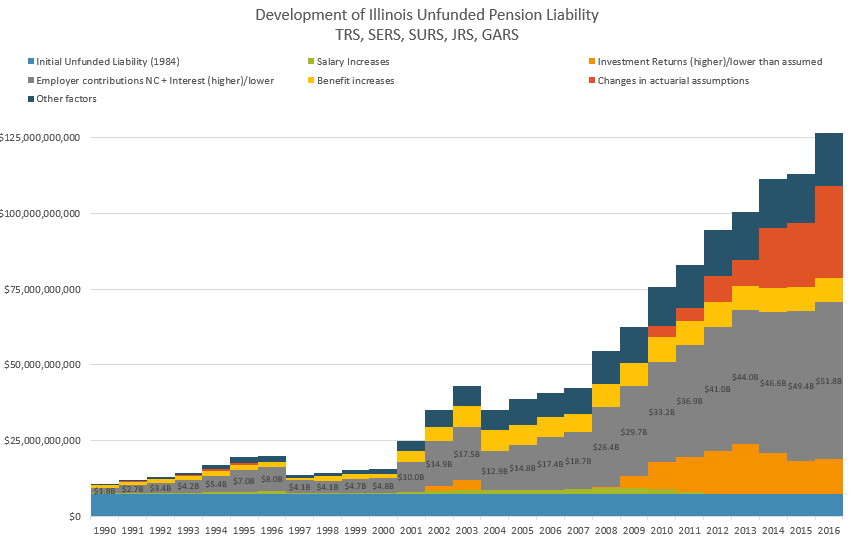

Here, you are looking at the development of the Illinois state pension funds’ total unfunded liability (all five combined) and the growth of that unfunded liability attributed by cause.

Rather than get into how these are developed, let’s just take these elements at face value and note the largest single category here is from “Employer contributions NC + Interest (higher)/lower”.

What that means in plain English: not making the payments they should have been making. That’s the single largest factor, and it’s controllable.

The other items are less controllable. They can’t control the investment returns so much, or whether more or fewer people die or even if they retire. But they can definitely decide to contribute more money.

Let’s switch it to percentage:

Those graphs ended in 2016, or six years ago. Right before the valuation rate was dropped.

Hey, do you think they improved their funding behavior since 2016?

Illinois TRS has not improved its behavior

The Pensions Plan Database is my main source of data on public pensions.

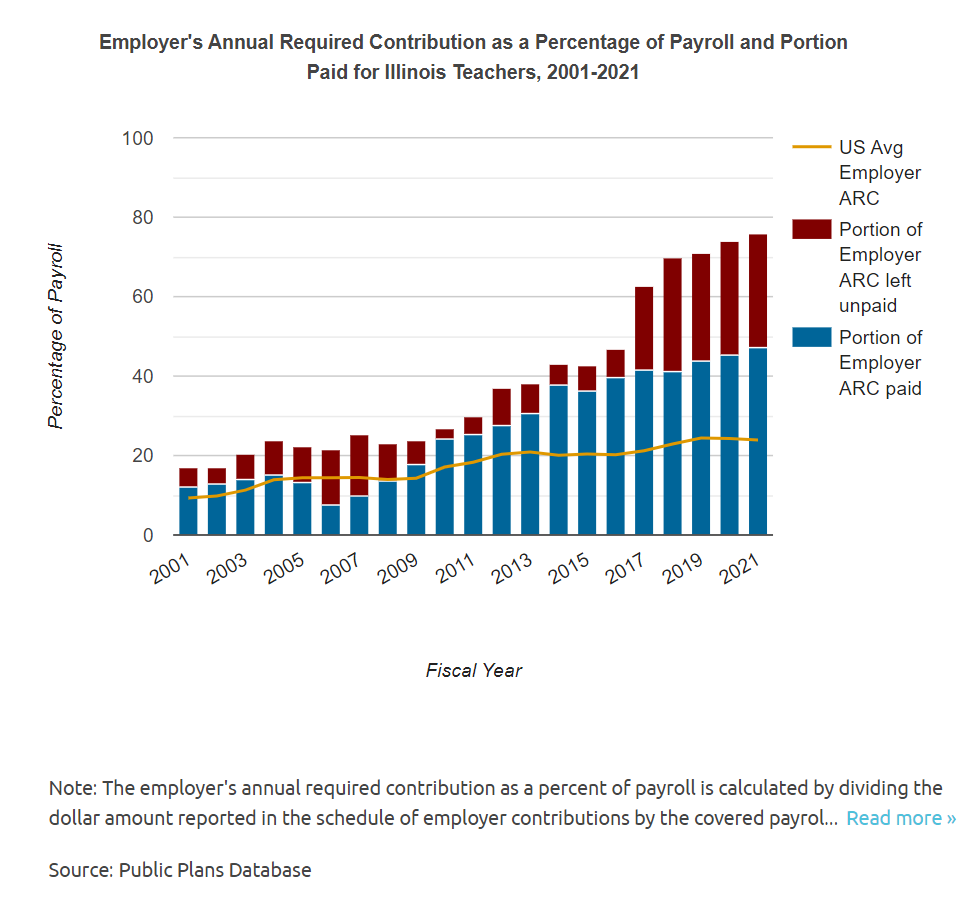

Here is the history of contributions to Illinois TRS:

The red bar amount is what the actuaries calculated is needed to cover current costs — that is what was accrued for the current year, plus amortizing the unfunded liability so that the pension plan would be fully funded within a reasonable amount of time. The step-up in the FY2017 amount is due to the drop in the valuation rate to 7% as I mentioned in my 2016 link above.

The blue bar amount is what the state actually contributed. As you can see by the pattern, it’s just following what the state had decided back in the mid-1990s. They do not care what the actuaries have to say. You see, they have a bunch of promises they’ve made to a bunch of different people, and they can’t afford them all. So they triage.

And here is the funded ratio:

Not updated through FY2022 yet – the small bump-up in FY2021 was due to the stock market going up, and you’re going to see a drop down in FY2022 when that report gets put into their database.

But let’s get real: the pensions have been hanging out at near 40% fundedness for a decade. Exactly when is this trajectory towards 90% fundedness supposed to get started?

How much would it cost to bail out Illinois TRS?

Yesterday, I brought up the concept of bailing out public pensions, given that multiemployer pensions are getting bailed out. How does Illinois TRS compare?

Central States Teamsters fund was 17% funded at the beginning of 2021, with a hole of $57 billion. That was for a pension covering over 350,000 participants.

Illinois TRS is 44% funded as of June 30, 2022, with a hole of $81 billion. There are 440,000 participants. Hmmm. But that’s valuing the liability at 7%, and not at the 2.43% valuation rate used to get that $57 billion above.

I’m not going to bother to try to do an estimate, as these calculations don’t behave well necessarily, but here’s something from the Illinois TRS actuarial report, FY 2022 – page 122:

So, the unfunded liability goes from $84 billion to $103 billion if the valuation rate dropped from 7% to 6%.

Would you like to imagine what would happen if you dropped that rate from 7% to 2.43%?

It would not necessarily increase $20 billion for each drop in one percentage point, but you could test that out for order-of-magnitude effects. And that’s just Illinois TRS.

More pension funds to follow, but not IMRF

I mentioned at the top of the post that there’s one statewide Illinois fund that’s not as poorly funded as the rest — and that’s because the participating employers are forced to make full contributions. That’s IMRF, the Illinois Municipal Retirement Fund.

The IMRF is similar to Calpers, in that local governments participate in this pension fund, and the fund forces the governments to make full contributions to cover the benefits, similar to the federal government forcing an employer to pay payroll tax.

Here is what IMRF’s funded ratio looks like historically:

It was essentially fully funded in FY2021. Being fully funded, and having one bad investment year, is no big deal. That’s going to be easier to recover from than having decades of bull markets wasted because hey, who needs to put money in the pension funds?

Whups.

If you can’t fully fund the pensions EVER, you shouldn’t make the promises

But as in that discussion one year ago, Illinois keeps promising that they’ll put more money in later as they can’t afford it now.

Why should pension plan participants trust that the money will be there later?

There can be some goodwill and understanding, to contribute less in hard times, if in all those good times the state had at least covered full costs.

But no. Not in 25 years of that supposed 50 years of a trajectory towards 90% fundedness.

Illinois TRS has been stuck on about 40% fundedness for a decade. What kind of trajectory is that?

Amortization towards 90% fundedness over 50 years is bullshit.

Fifty years is longer than any teacher’s career. Any amortization period should at most be an average career length, to full-fundedness.

Given at least a decade of underfunding, that means even more future expense if the participants are to get anything like what they expect.

The “plan”, such as it is, is obviously to have other people pay for it — bondholders, federal taxpayers, Illinois taxpayers, and future participants.

But the big problem is that other people may not be there to pay for it.

It would be easier to cover it if the assets were there — hoping somebody will be there to cover the costs is not much of a plan.