First, let me send you over to Astral Codex Ten, where Scott Alexander is looking at multiple prediction markets, not just Polymarket:

Scott Alexander has been looking at prediction markets more than I have, for longer. He’s not the only one, of course, but he’s got some good discussion about the performance of various prediction markets.

I want to focus more on following up to the snapshots I took on Tuesday and making more general comments on predicting results, and reactions once predictions go wrong:

I took snapshots, because of course many of the live widgets are showing 0%/100% on their displays now, as the results are known.

I am going to take these in the order I put them in the original post:

Presidential Race

Screenshots as of 9:09am ET on Election Day:

Current screenshot:

Comments:

Michigan had been light blue and Wisconsin grey (toss-up), and both are now shaded red. All the light red states are solid red.

Hmm. We will see more in the “swing state” items.

Time series capture on Election Day morn:

The timing of the last little Trump bump was a peak around October 30, at 67%, dropping down to a minimum of 56% on Nov 3, and then back up to 62% on Nov 5. I’m not going to look at the within-day prices. Obviously, there was a quick jump to 100% on Nov 5 itself.

Swing States

Screenshots:

I’m not bothering with a screenshot. They all went to Trump.

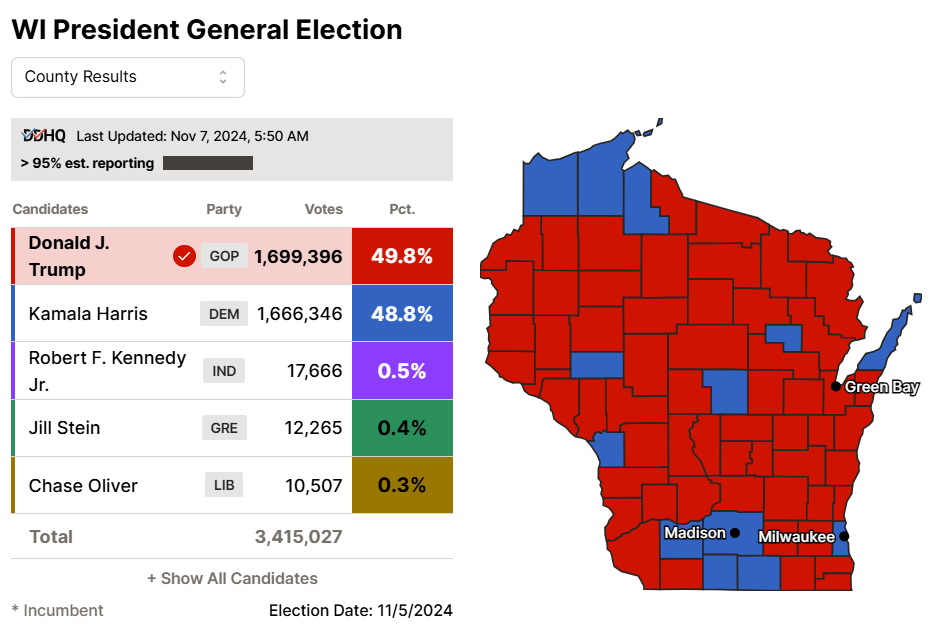

In the above wagering, only Wisconsin was “close”.

Now, remember, the above percentages are not supposed to be the percentages that Harris or Trump will win — they’re wagering on who wins the state.

Trump wins Michigan by 1 percentage point or 0.1 percentage point, he wins… but one would think the larger the margin, the higher the probability wagered above. They’d be more sure.

So Wisconsin should have a closer result compared to Michigan, right?

Using DDHQ estimates, Wisconsin:

Okay, 1 percentage point versus 1.5. Fair.

Senate

It was at 17.5% for Democrats on Nov 5. Until all of a sudden, it wasn’t.

There were no surprises in the Senate.

House of Representatives

As of Election Day, the betting was 50/50 control going to Democrats.

This is where the trajectory went:

Hey! There’s still a chance!

My district: NY-17

This was sitting at 25% chance for the Democrat Mondaire Jones on Election Day. This is how the trajectory went:

So I didn’t get into the whole story of how I ended up in what was supposed to be a toss-up district. This is the result, as reported by NBC:

That’s not exactly close.

Part of why my district is supposed to be “balanced” is that the Westchester County part is supposed to be Democrat-leaning and the other three counties contributing: Dutchess, Putnam, and Rockland, are heavily Republican-leaning. And Rockland County especially came out for Lawler.

As one of my friends pointed out:

That was a preliminary count. In the end, the Westchester count did come up light for Jones. Via NBC:

I saw somebody bitching about Frascone being a spoiler, fake candidate, but even if you threw all his votes in for Jones, it wouldn’t make up the difference.

Frascone got only 2% overall, and the margin was bigger than 2%.

More backstory on my district:

Nov 2022: Election Post-Mortem: New York Karma

Apr 2022: Process is important: SALT cap and NY redistricting

Overall

At this point, they’re still waiting on some House races, so I will hold off on overall evaluation. I have a few more comments to make, but I wanted to get out the initial results.

It looks like Polymarket performed fairly well — you can see that for some thinly-traded markets you could get some volatility and spikes in probabilities, but they were very short-lived.

Scott Alexander makes the argument some of the non-money-based prediction markets performed better, but here is the biggest issue:

I think it’s more likely that real-money markets have structural problems that make it hard for them to converge on a true probability. After taxes, transaction costs, and risk of misresolution, it’s often not worth it (especially compared to other investments) to invest money correcting small or even medium mispricings. Additionally, there is a lot of dumb money, most smart money is banned from using prediction markets because of some regulation or another, and the exact amount of dumb money available can swing wildly from one moment to the next.

For example, I cannot get involved in any of these platforms, due to my day job. There are all sorts of activities I cannot get involved with involving financial markets and other things.

Even for some money-related activities my job does not explicitly disallow me, the friction required in compliance makes it not worth my time. I have a lot of things going on, so it has to be something I really enjoy.

So rather than get involved directly in these markets, I like to watch them.

I have been involved in prediction research, some years ago.

I will write about that in my next post on this subject, when we have a final House result.