On the Bailouts That Didn't Happen, Part 1: Multiemployer Pensions

Waiting for Godot, pensions-style

Well, it looks like there’s still wrangling going on about a relief bill, and the various versions I’ve seen going around include all sorts of goodies that were “left out” of earlier bills due to sheer embarrassment. Well, the elections are over, many can stomach the embarrassment for at least two years, some people need to pass a soft landing for themselves as they’ll be out of office in 2021, etc. Plenty of people, left and right, will be making fun of this dumpster fire.

But two large groups, some members in desperate need of bailout (and reform), are getting nothing: state and local governments and multiemployer pensions.

Let me address MEPs first, in this post.

MEPs: the disaster that the federal government has to address soon

There are two reasons that multiemployer pensions have to be addressed:

1. The federal government partially created the problem

2. Central States Teamsters plan, which has hundreds of thousands of participants, is going to fail in a few years and take down all MEP backing in the PBGC

I have addressed the MEP issue somewhat over the years, though both John Bury and Elizabeth Bauer have covered the problem more consistently (and they’re both pension actuaries, which I’m not.) Alas, due to Forbes’s current policies, I can’t provide you with Elizabeth’s material currently, but here is John Bury covering Sherrod Brown’s speech and Chuck Grassley’s speech. Bury provides video of the full speeches, but also provides a short excerpt for the heart of the issue: “we ran out of time”.

ai-CIO: Time Runs Out for Multiemployer Pension Reform in 2020

The clock has run out on multiemployer pension reform in 2020.

Republican Senators Chuck Grassley of Iowa and Lamar Alexander of Tennessee issued a joint statement this week saying there won’t be time to reach a deal to include the proposed reform in an end-of-year legislative package.

….

A little over a year ago Grassley and Alexander released the Multiemployer Pension Recapitalization and Reform Plan in an attempt to prevent critically underfunded multiemployer pension plans from collapsing.The plan proposed creating new powers for the Pension Benefit Guaranty Corporation (PBGC) to take on liabilities from struggling multiemployer plans to help pay their obligations to retirees and current workers. The proposal also called for fundamental changes to the regulation of the plans to ensure benefits are appropriately funded and managed.

The senators said they hope to provide relief for the failing plans that cover approximately 1.5 million retirees should the PBGC’s insurance fund begin to run out of money in 2026 as projected.

…..

The Government Accountability Office (GAO) estimates that 25% of critical-status plans face certain insolvency, with no possible combination of contribution increases and benefit reductions able to help them to improve their status. And according to the Congressional Budget Office, large legacy-liability costs are a product of withdrawal-liability rules established under the Multiemployer Pension Plan Amendments Act of 1980 (MPPAA).

This piece did not indicate that the reason the fund would be out of money in 2026, and it’s pretty much a 100% certainty unless there’s a bailout (with or without reform).

The reason is the Central States pension fund.

It has been failing for years, especially since the UPS withdrawal from the plan. It is huge, and when it runs out of assets, the PBGC’s MEP program will also be wiped out.

Some recent history of the Central States fund

One of my oldest posts on MEPs is from 2015, and it’s on Central States.

Central States pension plan, which is a Teamsters multiemployer pension (meaning it covers Teamsters members in a certain area, and they’ve worked for multiple employers — think UAW pensions here, as well — union members theoretically could switch between employers and be covered by the same pension) has sent out letters telling current retirees and pension plan participants that they have to cut payments.

A lot.

Well, those cuts never occurred, and while the cuts would have staved off failure for a while, the issue was the cuts were insufficient to keep the plan going.

May 2016: Treasury to Central States: You Didn’t Cut Enough

“The Treasury Department on Friday denied the benefit reduction application of the $17.8 billion Teamsters Central States, Southeast & Southwest Areas Pension Fund, Rosemont, Ill.

“In a letter to the pension fund board of trustees, Treasury Special Master Kenneth Feinberg said the application was denied for failing to meet three criteria of the Kline-Miller Multiemployer Pension Reform Act of 2014, which created the benefit suspension process.”

….

John Bury has pulled out his preferred excerpts, including that the valuation approach is a bit optimistic (including a 7.5% return assumption, which is lower than most public pension assumed returns); that the cuts proposed aren’t equitable; and that the notices are too confusing to normal people.

….

I will pull my own favored excerpts that differ from Bury’s:“Under the Act, Treasury, in consultation with the Pension Benefit Guaranty Corporation (PBGC) and the Secretary of Labor (DOL), must approve an application upon finding that the plan is eligible for the benefit suspensions and has satisfied the applicable statutory requirements. 1 The Act requires, among other things, that the proposed benefit suspensions be reasonably estimated to allow the plan to avoid insolvency? Put another way, a key test for any application under Kline-Miller is whether the proposed benefit suspensions take a plan off the path to insolvency.

As described further below, Treasury finds that the Plan’s proposed benefit suspensions are not reasonably estimated to allow the Plan to avoid insolvency.”

So the proposed cuts were denied for being insufficient to stave off disaster.

This was the response: Central States: I Guess the Plan is To Run Out of Money

“Pensions may be cut to ‘virtually nothing’ for 407,000 people

“One of the biggest private pension funds in the country is almost out of money, and fresh out of options.

The Central States Pension Fund has no new plan to avoid insolvency, fund director Thomas Nyhan said this week. Without government funding, the fund will run out of money in 10 years, he said.”

That is still the schedule we’re looking at — failure by 2026.

Interlude: a prediction from 2016

Back to my post from May 2016:

THE PLAN: FAILURE

So, there’s no current cut to the plan, which means everybody keeps getting their full benefit til the money runs out. At which point the benefits get drastically reduced. Much worse than what was proposed by Nyhan.

…..

Remember, they’re showing that the maximum pension for 30 service years will be about $12K. That’s a lot less than current Central States benefits.

…..

THERE WILL BE NO BAILOUTSThis all goes to say: there will be no bailouts. Mish agrees.

Also, this should be a signal to public employees and retirees in some places (like Illinois and New Jersey), which Mish and Mark Glennon point out.

Yes, it’s sad that retirees will get heavily slashed in retirement when they have little flexibility to increase their income. But that being sad didn’t stop Detroit pensions from being cut. That should have been a signal as well.

Detroit got no bailout. Central States will get no bailout. Neither Illinois nor New Jersey (nor California nor Connecticut nor…) will get bailouts.

There’s simply not enough money to fulfill all these promises.

So they will be defaulted on.

Whether or not there’s a formal bankruptcy process to recognize that default.

I’ve adjusted my estimate on bailouts for Central States — there is a very non-zero chance they’ll get a partial bailout (hell, after this year, maybe they’ll get a top-up) — but I have no expectation that Illinois or NJ (or California or CT) will get a bailout, even if Kamala Harris were President, AOC Speaker of the House, and Bernie Sanders Senate Majority Leader.

But let me not get ahead of myself.

The failing Central States fund: when will it fail?

John Bury looked at their latest Form 5500 when filed in October 2020:

In the midst of another 5500 filing season (86 to go) but the plan most likely to bring the PBGC (and the entire private pension system) down got their form in early this year.

…..

Total participants @ 12/31/19: 375,199 including:Retirees: 194,115

Separated but entitled to benefits: 123,532

Still working: 57,552

…..

Asset Value (Market) @ 1/1/19: 13,168,043,720

…..

Contributions 2019 (MB): $741,716,950

…..

Payouts 2019: $2,836,578,310

Expenses 2019: $58,289,201

Let’s do a very simple calculation. If we assume the money goes out the door at the net rate of $2.1 billion/year (contributions less payouts and expenses) and there’s $13 billion is assets as of January 2020, then the money runs out in 6.2 years —- aka, during 2026. Of course, that’s holding everything constant. You can go to Bury’s post to see his historical tables to see how participant numbers have changed, as well as assets and liabilities.

The contributions cannot even cover the payouts. This is a fund in an asset death spiral – deeply underfunded, and not able to get enough in contributions to prevent disaster. Far more retirees than active participants. They really need a bailout.

Central States will pull the PBGC MEP program down with it

Other MEPs have failed, or have successfully cut benefits to current retirees to stave off complete failure, but Central States is the iceberg coming for the PBGC. Central States is the reason that the PBGC projects failure of its MEP program by 2025.

Two graphs from the PBGC’s report:

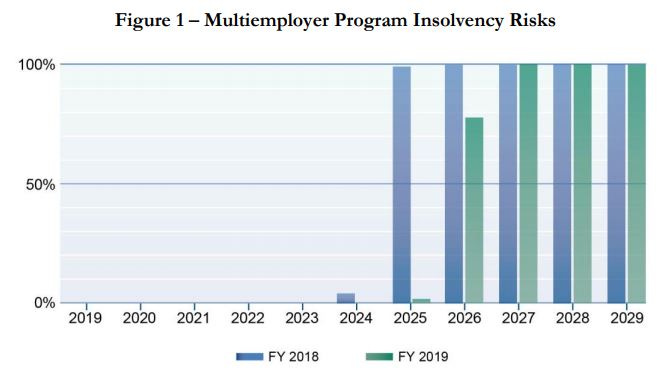

Figure 1 shows that between the FY2018 and FY2019 reports, they shifted the failure date off by a year. But it’s pretty much 2026 when it all would hit the wall.

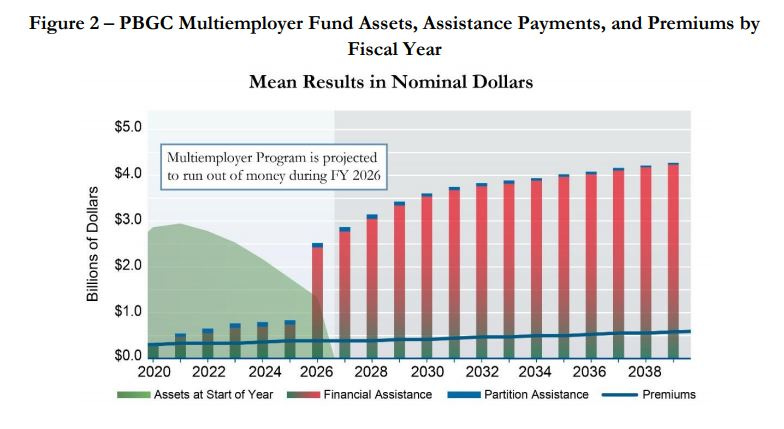

Figure 2 shows that, with the failure of Central States, the PBGC MEP fund would be wiped out in 2027. Cash flows exceeding $3 billion/year would be needed to cover PBGC guarantees for failed MEPs, growing to $4 billion by 2037.

I want to note that these projections “smell” right to me — they’re not just making up anything. Pretty much, it’s a certainty the money is leaving the Central States fund, and it will be all gone during 2026.

When the PBGC takes over the fund, people’s benefits would be cut to the “guarantees”, which have a low limit:

The guaranteed monthly benefit, therefore, is limited to $35.75 per month (($11 × 100%) + ($33 × 75%) = $35.75) times a participant’s year of credited service. The guaranteed benefit is not adjusted for inflation or cost-of-living increases.

For 30 years of service, that translates to a maximum of $12,870/year. For 40 years of service, that translates to a maximum of $17,160/year.

That’s low.

Contrast that to Social Security, which maxed out at $45,480/year in 2020. Heck, contrast that to the PBGC single-employer max guarantee: $69,744 per year for those who retired at age 65.

And even with the super-low pension guarantee, that level for a couple hundred thousand retirees will break the bank.

Just to meet the very low PBGC guarantees will require a bailout of the PBGC.

What next for MEPs?

We have a pretty hard deadline: 2026. If there’s a “market correction” in the next couple of years, that deadline can accelerate rapidly.

I could wargame this various ways – this could be a big election issue in 2022 and 2024. This is going to be the first really large private-sector retirement issue, before we hit the end of the Social Security Trust Fund or a large public pension fund running out of assets.

I have talked with some of the people who are trying to get a Central States fund bailout, and when I talked to them before, I was skeptical that they would be able to be made whole. But with upcoming Congresses… who knows? That may be possible, at least for Central States.

I was foolish in 2017 to think that failing MEPs would be a big political issue that year. I have learned that politicians will often not act, even after the disaster is complete. So that was a relatively recent lesson for me. That they’re still wrangling over a relief bill surprises me not at all.

I will note: Trump never addressed any pension/retirement issues during his Presidency. All sorts of things have occurred during his administration, but MEPs never made it to top level. There were reports and failure to move legislation forward.

Here is one prediction: if there is an all-Dem Congress + White House, there will be a half-assed MEP bailout. By “half-assed”, I mean just enough in assets will be shoved at Central States specifically to keep it limping along for another decade. There will be no reform, and no long-lasting bailout. The can will be nudged a little farther along the ground, not even meriting the term “kicked”. A half-hearted whiff is more like it.

If there remains a Republican Senate + Dem House & White House, there could be a compromise that would provide longer-lasting survival for MEPs, but I imagine the Senate would refuse to sign on without some strong oversight conditions. It probably wouldn’t occur pre-2022, though, because Central States is likely to survive to at least 2024. Dems wouldn’t compromise if they consider it possible that they could win House + Senate in 2022.

If House & Senate are Republican after 2022, then there is a possible reform + bailout.

To be sure, we may have a public announcement of intelligent extraterrestrial visitation within the next month and all of this is blown away. Who knows.

Background reading:

March 2020: Multiemployer Pensions: Prior Bailout Plan’s Shortcomings and State of Play

February 2018: MEP Watch: About Those Plans to Bail Out Union Pensions

November 2019: A New Plan to Deal with Multiemployer Pensions

October 2019: Pensions Primer: Public, Private Single Employer, Multiemployer, and Church Plans – U.S. Landscape

These are all private plans. The reason there has been no action is that this is not a public crisis. This has been foreseeable (and foreseen) literally for decades. PBGC explicitly has no federal funding component.

This has always seemed to me to be a gamble agreed to by both the providers and recipients of private pensions over the years; they could have chosen to make them securely funded, but that would have resulted in smaller pensions and lower immediate salaries. Instead, they chose to take more money immediately, with the promise/hope for higher pensions funded by future providers. The gamble was whether they could find future payers when the bills came due.

I suspect that the huge financial cost of the reaction to Covid is going to reduce the willingness and ability to provide a massive outlay to the subset of retirees with bankrupt private pensions.

I fear that we are going to start testing what level of destruction can be done to the world reserve currency.