MoneyPalooza Monstrosity! The Positioning for Asking for State Government Bailouts

Multiple ploys to try to get more federal money. Let's see if it works.

As the House of Representatives passed the HEROES bill on Friday, we’re going to be seeing more and more stories of woe of state governments having to cut this or that if they don’t get their sweet sweet federal money

Some of this politicking occurred before the HEROES bill was even announced, of course. Yes, that was part of the jaw-boning over McConnell’s comment re: state bankruptcy, but having to cut some administrative positions, or to shave down hours or salaries, is hardly the catastrophe requiring $1 trillion.

But let’s see how it’s being positioned.

Holding first-responders hostage

Those who live in profligate states should be familiar with this ploy.

Newsom says federal government has ‘ethical obligation’ to send states funding amid coronavirus

Newsom, along with governors across the country, have said they need the federal aid to help fund many of the frontline workers amid the coronavirus pandemic including healthcare workers and police.

“I hope they’ll consider this next time they want to salute and celebrate our first responders … consider the fact that they will be the first ones laid off by cities and counties,” Newsom said.

Why would you lay off first-responders first?

The only reason they say this crap is because people don’t want to cut firefighters or police officers, unless they are so obviously over-staffed nobody would object.

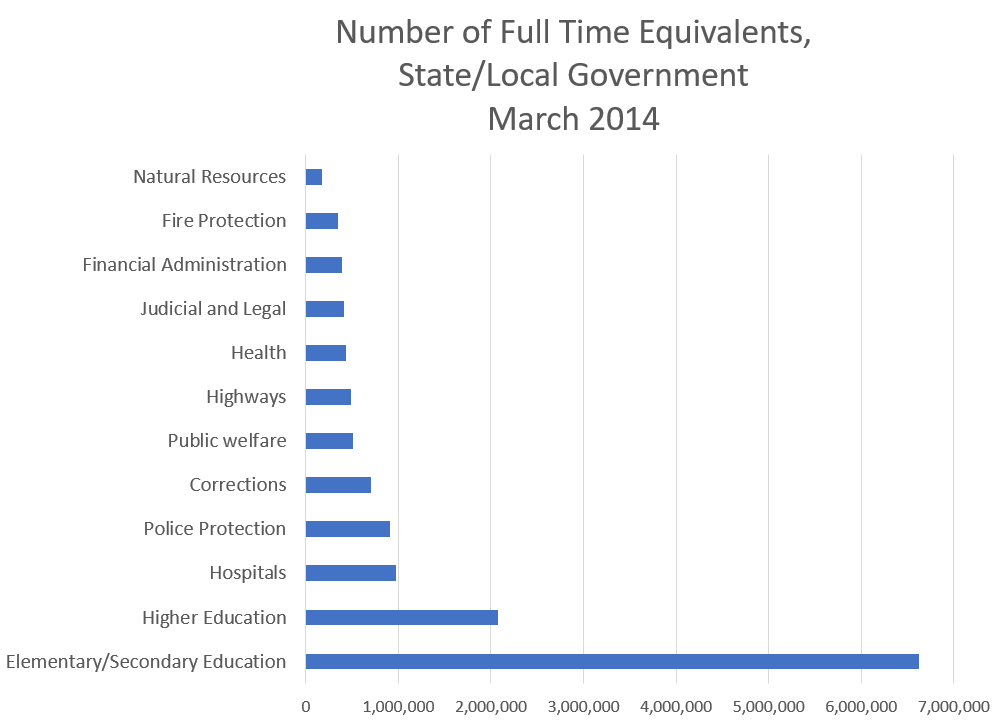

Seems to me there are probably a lot of office flunkies who could [and should] be laid off first. You don’t need that assistant to the Chief Diversity Officer if times are dire, do you? There are loads of bureaucrats, even very highly-paid bureaucrats, who would get cut if you were really serious.

Unsurprisingly, the type of politician who does this ploy tends to be a Democrat [note: not all Democrats do this, and I’m sure some Republican mayors have tried this tactic at some time or another in order to increase taxes and spending]. So the media generally aren’t going to comb through state payrolls to see who’s juicy for layoffs to save money.

I bet one could find much juicier parts of the budget to cut that would save a lot more money than cutting first responders.

But Democrats assume nobody will ever call them on this, except, of course, for suspect right-wingers.

If there’s a good reason to cut the first responders first, other than holding them hostage for money from other parties, I have yet to hear it. Please tweet at me (meepbobeep) or email me (marypat.campbell@gmail.com) if you know of another reason. Please try to send me plausible reasons – they don’t have to be real, but they do have to explain why you’d start with people actually doing stuff as opposed to office paper pushers. This is one I seriously don’t understand as anything other than a naked political tactic without any other practical purpose.

By the way, this crap well precedes the recent bill. In “reaction” to McConnell’s comments about state bankruptcy, a representative said the following:

I am tired of that bullshit

Threats of Depression

Economic depression that is.

This is kind of the “professional” version of “YOU WANT US ALL TO DIEEE!”, which is tedious enough.

Derek Thompson at The Atlantic: We Can Prevent a Great Depression. It’ll Take $10 Trillion.

I’m not going to copy over all his points. You see the normal talk re: direct cash payments to individuals and businesses at the beginning of the piece.

I want to copy over these bits:

For state and local governments: After the Great Recession ended, state and local government employment continued to decline, falling by about 500,000 jobs from 2009 to 2013. The pandemic has torched income and sales taxes, which has decimated state and local-government treasuries. An analysis by the Center on Budget and Policy Priorities estimates that state budget shortfalls in the next three years could approach $700 billion.

If the U.S. wants to preserve any hope of a fast recovery while protecting hospitals, schools, fire departments, and transportation systems from sudden budget cuts, the federal government has to provide aid to states and local-government budgets. The latest plan from House Democrats carves out $1 trillion for state and local governments over the next year. The best course of action might be to allocate $500 billion for this fiscal year with an automatic trigger that would authorize up to $500 billion more in 2021 or 2022 if sales and income taxes still haven’t recovered. Total cost: $500 billion to $1 trillion.

Let’s stop there for a moment. Maybe the $300 billion difference between projected shortfalls over three years and the $1 trillion in the bill is supposedly made up for in local government revenues [maybe].

But the amount of money in the HEROES bill is very ill-motivated.

What is still “hilarious” to me is that even with this dollar boost, the proposed amounts wouldn’t cover the one year’s worth of pension contributions that Illinois wanted to ask for. Reminder graph re: the payment for 2020:

Illinois would get less than $10 billion, the amount they asked for to cover their pensions.

Back to the piece:

When you add it all up—the $3 trillion already spent, the $3 trillion now required, and trillions more to accelerate the U.S. recovery—the total price tag for averting another Great Depression could be about $10 trillion.

That number is a stunner, but so is the crisis. The U.S. economy is $22 trillion—or at least it was before the crisis. If the federal government spends $10 trillion over the next, say, four years, that would mean a fiscal shot of about 10 percent of total economic activity over that period. In an economy where one in five Americans are out of work and several industries have no clear path to normalcy, it’s not ludicrous to think that the appropriate fiscal medicine for an unprecedented crisis will amount to a tenth of GDP over several years.

…..

Conservatives and others might balk at the $10 trillion figure, for its sheer largeness. But this is no time for meganumerophobia. Rather than seeing trillion-dollar relief packages as “large” or even “bold,” you should see them for what they really are: an appropriate response to a once-in-a-century economic calamity. The U.S. can avoid another Great Depression. But it has to develop the civic stomach for fiscal-spending amounts that might have seemed impossible just months ago.

Making up an ugly-sounding word is not the most persuasive move; people who understand finance are not going to be impressed. More to the point, I don’t think it will do a damn thing to move the Senate. As top-of-mind a bailout is for state politicians, I think having to answer for nursing home deaths might be more compelling for the populace at large. I could come up with more choices.

Most people’s eyes glaze over when you start throwing around too many numbers, but I think they understand the difference $1000 billion being allocated over two years and a supposed $700 billion shortfall over three years.

It’s not the federal government’s place to make everybody whole. That’s a dangerous expectation to try to set.

Other projects getting cut

WSJ: States Postpone Road Projects, Saying They Need Federal Aid

State transportation departments say they need far more aid than the $15 billion earmarked for them in the latest coronavirus relief package and are already delaying projects.

They always need more than what’s given to them.

The bill, crafted by House Democratic leaders and passed Friday night largely on party lines, has little chance of passing the Senate, where top Republicans say they want to wait to see the effects of previous pandemic relief.

“You’re absolutely going to see this impact here in the coming months on what state DOTs were planning to do,” said Jim Tymon, executive director of American Association of State Highway Transportation Officials. “They’re just not going to have the money in the bank.”

The association had requested $50 billion for the state transportation departments.

Without aid, many in the industry said, it could be years before transportation projects are fully funded again. After the 2007-09 recession, it took until 2015 for U.S. highway spending to rebound, said Dave Bauer, president and chief executive of the American Road and Transportation Builders Association, a trade group.

“We didn’t even have to deal with the traumatic drop-off in gas tax revenue that we are currently experiencing,” he said. “It’s very hard not to look at our history and see how this situation could become even more of a disaster if we don’t have action.”

Even if the economy rebounds, many people may continue working from home, depressing gas purchases and gas-tax revenue, officials say. State transportation departments on average expect a roughly 30% decline in revenue over the next 18 months, according to AASHTO.

Well, jeez, that’s less wear-and-tear on roads. And less exhaust! Less carbon emissions! Why aren’t you folks happy?

Yes, I understand they’re talking to the people who run these departments as well as the construction companies who get money from these contracts. I fully understand they’re unhappy. So are a lot of other people.

Maybe the COVID hotspot should remain closed for a while

Well, maybe we can just shut up shop and declare New York City a failed project. I have been telling people I know in NYC that if they can’t stand the risk of infectious disease, living in Manhattan is not the best idea.

I think some people don’t want to suffer that risk and will move away ASAP. They just never thought of the crud, etc., they caught from living in the city before because the results were just feeling like shit for a while. Not the risk of permanent lung damage, if not death.

That said, given what one learned from the Black Death – a disease with horrendous mortality rates [two forms had 100% mortality, and the “mild” form, bubonic plague, merely killed 80% of sufferers] – people generally went back to the city as things calmed down. Check out my video on Defoe’s Journal of the Plague Year for more city-folk behavior, using London in 1665 as an example.

A little more persuasion, but not quite there

WSJ op-ed: States Were Prudent; Here’s Why They Need a Bailout Anyway

This is the second time through the wringer for state and local governments in recent years. In the 2007-09 recession their revenues plummeted, health expenses climbed, and pension funding gaps — the shortfall between state pension assets and expected payouts — widened.

Stopping for a moment. First, the recession was 2008-2009. Second, as an actuary, I may think something from over ten years ago was “recent”. I have an excuse. I think in terms of decades for projection purposes.

But I know the frequency of recessions from history, and we had had a long time in economic expansion.

Most states, across the political spectrum, spent the next 10 years repairing their finances. Total state and local debt fell steadily from 21% of U.S. gross domestic product in mid-2009 to 14%, or about $3 trillion, at the end of 2019, according to Federal Reserve data. Progress on pensions has been much slower: The funding gap in state and local plans stood at $4 trillion at the end of last year, or 19% of GDP, little changed from a decade earlier.

Yes, I know.

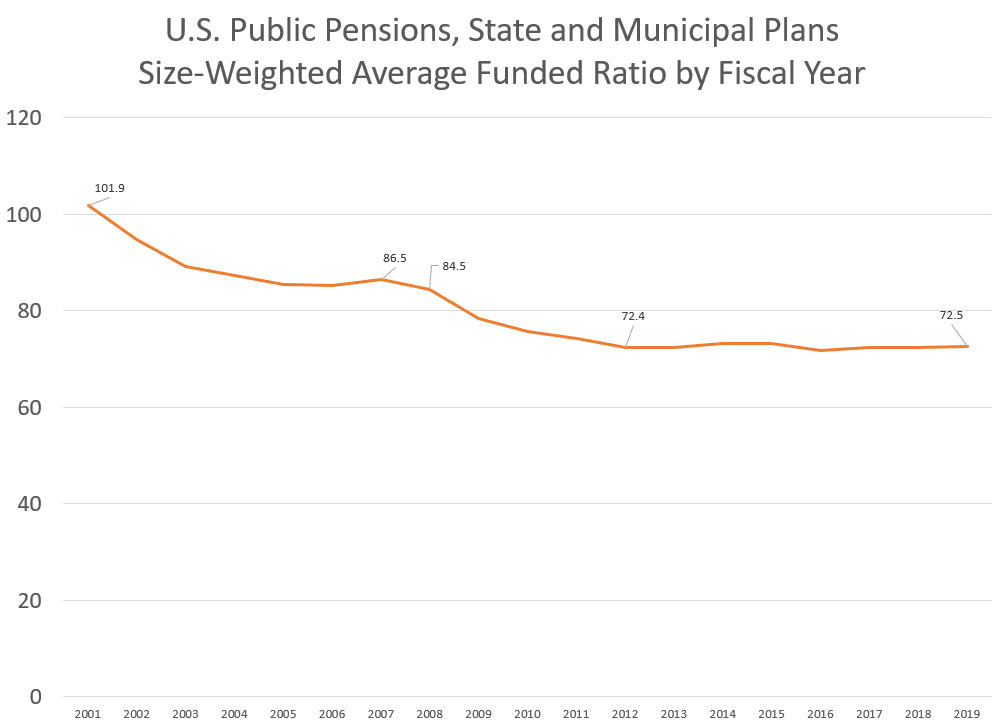

A reminder: even before COVID-19 lockdowns hit, public pensions were not doing well. Here is the aggregate funding level:

From fully-funded in fiscal year 2001, down to about 80% in the recession, and then stuck at about 72% for a decade. Not improving. Even with the longest period of economic expansion in the entirety of the history of the U.S. This is not a problem the federal government can fix.

Well, it could… but just not in the way state and local politicians want.

[One of the biggest reasons I don’t have to deal with the 80% funding myth much anymore is that many of these pensions have been wallowing well below 80%, and don’t even see that as an attainable goal in a reasonable amount of time.]

Jumping forward in the piece:

As for pension plans, federal liabilities dwarf those of the states. Future pension and health benefits for civil service and military retirees are about $5 trillion, according to the Treasury Department. Social Security’s 75-year funding gap hit $16.8 trillion last year, or 78% of GDP. Medicare’s funding gap is several times bigger.

And yet it is the federal government that can borrow now, not the states, which are generally required to balance their budgets. And unlike the federal government, they can’t print money to repay their debts. That limits their ability to run deficits to soften recessions.

I have skipped over several bits of “the federal government’s debt is a whale compared to the gnat of state and local government debt”, by the way, which is an interesting way to try to persuade.

Thing is, the states are borrowing. Especially Illinois. I plan on beating up on Illinois later this week for its current behavior.

Just because there is a strong economic case for federal aid doesn’t mean it should be a blank check. Mr. Zezas estimates it would take $200 billion to $680 billion to fill the hole in state budgets. That is much less than what Democrats are asking for. Illinois wants money to shore up a pension system that has been lurching toward disaster for years.

Yep, and even the HEROES bill doesn’t give Illinois anywhere near the amount it asked for.

So while the scale of aid is up for debate, the federal government’s enormous capacity to borrow, backstopped by the Federal Reserve, isn’t. Sharing that capacity with the states would shield an already crippled economy from the added blow of austerity.

Yes, well, evidently the Federal Reserve has said it is open to directly lending to states and local governments, and supposedly Illinois (again) is going to take advantage of this line of credit. We will see where that goes.

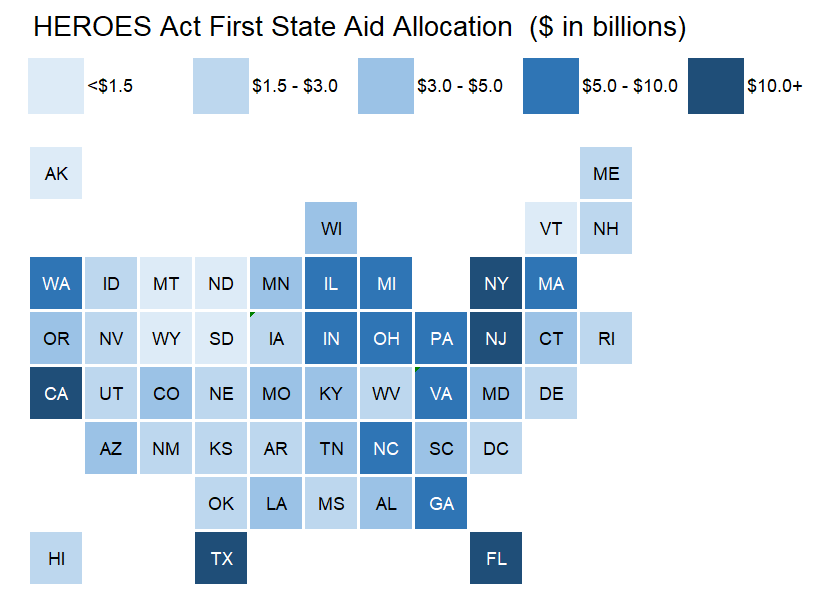

For what it’s worth, I assume there will be more money sent to state and local governments [no matter my opinion on the matter], and the allocation method used in the HEROES bill is not much different from what I consider reasonable.

I just think the amounts that will pass will be much smaller.

Can states borrow?

Yes, duh. And they are.

From Mary Williams Walsh at the NYT: As Virus Ravages Budgets, States Cut and Borrow for Balance

Every state is grappling with a version of the same problem, and all but one — Vermont — have balanced-budget laws in place. And for most, the new fiscal year starts on July 1, leaving them just a few weeks to come up with a plan and desperate for help.

A coalition of five Democratic governors said on Monday [May 11] that state and local governments needed $1 trillion in federal relief or they will be forced to decide between funding public health care programs or laying off teachers, police and other workers.

To be fair, having to lay off teachers is expected. They’re the largest category of state employee.

States have come up with some novel solutions to the current crisis — New Jersey pushed back the start of its fiscal year, making this one 15 months and the next nine — but their simplest options are to cut or borrow.

New Jersey used an accounting trick. What a surprise.

Others are borrowing to cover certain cost increases. California, for example, has already borrowed $348 million from the U.S. Treasury under the federal backstop for states’ unemployment insurance funds. On Thursday, Gov. Gavin Newsom also said the state would have to cut spending on education and other government services.

State governments can also raid their rainy-day funds, if they have them. Ohio’s contains $2.7 billion, but Mr. DeWine said he wouldn’t tap into it yet. “Simply stated, we are going to need the rainy-day fund for next year, and possibly the next,” he said.

Many states normally run on razor-thin margins or rely on the fuzzy math surrounding pension fund obligations to keep their contributions low. That makes it easier to balance a budget now, but balloons the gap between what the funds have on hand and what they owe.

Yes. Pity they didn’t shrink it when times were good. That would have helped.

States and large cities can tap a new Federal Reserve lending program set up in response to the coronavirus crisis. For the first time, the Fed will buy debt from, or lend to, states and cities. The central bank issued rules and pricing guidelines on Monday, suggesting the program will be open for business this month. Because the program is considered a backstop, it will charge higher interest rates to most borrowers, so not to outbid regular investors.

But in some cases, the Fed program may be a better deal.

The example given is for Illinois, but I’m going to save that for my beat-up-on-Illinois post later this week.

Mr. Biggs, an economist with the American Enterprise Institute, said Puerto Rico had more bond debt than pension debt, while states have the opposite problem. Illinois and its local governments, for example, had $466 billion of unfunded pension obligations — three times their bond debt of $155 billion.

To keep paying its pension obligations, Puerto Rico simply halted interest and principal payments to bondholders. But even if a strapped state were to do the same, it wouldn’t save enough money to keep paying all the pensions.

If states go bankrupt, “it would be much harder for them to settle it by just canceling the debt,” Mr. Biggs said. “It makes much more of a crisis.”

Indeed. And this is something in response to a question someone had for me this weekend. This is the biggest reason many players don’t want state bankruptcy on the table: in a bankruptcy proceeding, to get the settlement accepted by the court, you have to convince them the debt situation has been settled such that you wouldn’t be back in bankruptcy court in a few years.

Some states could 100% default on their bonds… and still not cover their pension debt. And if they defaulted on their bonds, they would have a hell of a time borrowing in the future.

For some players, any bankruptcy would have to include pension cuts, even for current retirees, as Detroit had to do.

Protect current taxpayers to screw future ones

Oh, sorry. I altered this headline.

Op-ed by Ralph Martire: Federal coronavirus aid to states is needed to protect taxpayers

About one week ago, President Donald Trump favored a federal relief package that included financial assistance to help the states cover their anticipated revenue problems. This was both sensible and responsive to actual needs existing at the state level, as identified by the bipartisan National Governors Association. In a recent letter which the NGA — currently chaired by Larry Hogan, the Republican governor of Maryland — sent to Congress, that Association requested $500 billion in direct federal aid, to cover “replacement of lost revenue” caused by the pandemic.

Huh, $500 billion. That was how much is in part one of the HEROES bill.

Then to really confuse things, Trump himself began questioning whether the feds should provide states with financial assistance. Specifically, Trump tweeted: “Why should the people and taxpayers of America be bailing out poorly run states (like Illinois) and cities, in all cases Democrat run and managed, when most of the other states are not looking for bailout help?”

Well Mr. President, if you really have to ask, here’s your answer.

For starters, it’s not just “Democrat” run states that are seeking financial assistance from the feds. All 50 states are. Please read the letter from the National Governors Association for important context on why and how much. If you want the “Cliff Notes” version, suffice it to say federal funding is crucial to filling an anticipated $500 billion budgetary gap the states are facing. Without significant federal aid, states — which have to balance their budgets — will be forced to cut core services. They also won’t have the means to maintain essential infrastructure and public transportation and will not build the capacity required to stay on the front lines helping people suffering from COVID-19.

And so on and so forth.

This extra money would come from the money machine that goes brrrr, because it’s not like the federal government has access to taxation that the states don’t have access to. They’re all being hit by tax revenue drops.

So one “saves” current taxpayers by bribing them with money taken from future taxpayers. Or bondholders. Or people whose money loses value as it’s diluted.

This is a trick that can work a limited number of times.

Coming attractions: states under pressure

So I will be doing some posts on states under pressure as their revenue drops. Illinois is obviously on my list, as are California and New York. I may add more states, depending. New Jersey is very tempting, and I would also like to look at Florida and Texas. But that will take some time, and I will hit the easiest states to look at first.

Some of these states are talking cuts and many have to get in official budgets before Congress (or, rather, the Senate) may move on anything with respect to money to the states.

I have a feeling a split is going to open up soon, as some states may be seeing their economic activity perk up more…. and others, not so much. Should be interesting to watch.