MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

The SALT Cap is the least of the states' problems

Yesterday, I took a first stab at estimating state aid by state in the HEROES bill [which I’ve been calling the MoneyPalooza Monstrosity!]

There are other bits I also want to look at, but luckily, the other bits have been seen before… so I’ve written about it before.

For those who wish to investigate themselves:

Here’s the bill. It is 1815 pages.

There have already been some amendments to this bill in the House of Representatives, but so far none of them touch on the parts I want to cover.

Text surrounding the SALT Cap

Let’s go to the summary first:

[page 38-39] SUBTITLE G – DEDUCTION OF STATE AND LOCAL TAXES

Sec. 161. Elimination for 2020 and 2021 of limitation on deduction of state and local taxes. Eliminates the limitation on the deduction for state and local taxes for taxable years beginning on or after January 1, 2020 and on or before December 31, 2021.

So it’s a removal of the SALT Cap for two tax years.

Here is the full text from the bill: [I’m removing line numbers to make it more readable]

[pages 224-225]

Subtitle G—Deduction of State and Local Taxes

SEC. 20161. ELIMINATION FOR 2020 AND 2021 OF LIMITATION ON DEDUCTION OF STATE AND LOCAL

(a) IN GENERAL.—Section 164(b)(6)(B) of the Internal Revenue Code of 1986 is amended by inserting ‘‘in the case of a taxable year beginning before January 1, 2020, or after December 31, 2021,’’ before ‘‘the aggregate amount of taxes’’.

(b) CONFORMING AMENDMENTS.—Section 164(b)(6) of the Internal Revenue Code of 1986 is amended— (1) by striking ‘‘For purposes of subparagraph (B)’’ and inserting ‘‘For purposes of this section’’, (2) by striking ‘‘January 1, 2018’’ and inserting ‘‘January 1, 2022’’, (3) by striking ‘‘December 31, 2017, shall’’ and inserting ‘‘December 31, 2021, shall’’, and (4) by adding at the end the following: ‘‘For purposes of this section, in the case of State or local taxes with respect to any real or personal property paid during a taxable year beginning in 2020 or 2021, the Secretary shall prescribe rules which treat all or a portion of such taxes as paid in a taxable year or years other than the taxable year in which actually paid as necessary or appropriate to prevent the avoidance of the limitations of this subsection.’’.

© EFFECTIVE DATE.—The amendments made by this section shall apply to taxes paid or accrued in taxable years beginning after December 31, 2019.

I apologize for my software turning every left parenthesis-c-right parenthesis into the © symbol. I am too lazy to figure out how to make it look right.

In any case, removing the SALT cap is actually fairly straightforward in the bill, without a bunch of the legalese gobbledygook we have to deal with in these ginormous bills.

SALT Cap: Let’s Set it To Zero

Yes, I know that’s not on the table at all. Here is what is:

Well, it’s really a giveaway to the state governors of places like Connecticut, New York, and California, as well as local governments. The problem is that, of course, their high-taxing ways have created a dependency…. and those “rich” folks aren’t as rich as they had been. Hmmm.

I do feel like flogging this particular horse right now, but not with new words. I’ve written about this a lot with Taxing Tuesday for a few years now. A sampling:

October 2019: Taxing Tuesday: Huzzah! Long Live the SALT cap!

October 2019: Taxing Tuesday: Poor Little Rich People and the SALT Cap

March 2019: Taxing Tuesday: Those Evil Billionaires…Who Blue States Depend On

Those Blue States are so greedy, wanting to keep taxing rich folks to themselves. How dare they not share with the federal government?

In lieu of “Classic STUMP” for this Friday, I’m going to sample from the above pieces, with some edits from the originals.

The SALT Cap Bites California and New York

[Originally from March 2019: Taxing Tuesday: Those Evil Billionaires…Who Blue States Depend On ]

And of course, not only California and New York.

February 2019, Victor Davis Hanson: On the Cusp of Catastrophe, California Has No Margin for Error

California’s 40 million residents depend on less than 1 percent of the state’s taxpayers to pay nearly half of the state income tax, which for California’s highest tier of earners tops out at the nation’s highest rate of 13.3 percent.

In other words, California cannot afford to lose even a few thousand of its wealthiest individual taxpayers. But a new federal tax law now caps deductions for state and local taxes at $10,000—a radical change that promises to cost many high-earning taxpayers tens of thousands of dollars.

If even a few thousand of the state’s 1 percent flee to nearby no-tax states such as Nevada or Texas, California could face a devastating shortfall in annual income.

Back in 2019, the concern was losing the rich folks via them moving to other states [and some are threatening that, not over taxes, but over lockdown orders.]

Note these numbers from the 2016 fiscal year:

Revenue sources for California:

Income tax: $90.7 billion

Sales tax: 53.4 billion

Licenses: 8.6

Property tax: 2.5 billion

Income taxes are the highest source. And it’s so dependent on those less-than-1%.

That isn’t sound public finance.

And now that sales of various things aren’t going on here in 2020… the state is bereft of that, too. So you can see why the state aid package is of interest to them. [I estimated $20.8 billion to California in a first set of federal aid for lost revenue in 2020…that’s not really much to fill its tax hole.]

Testimony from the Tax Foundation on the SALT Cap

[Originally from July 2019: Taxing Tuesday: SALT cap zero! Great new taste! ]

Nicole Kaeding of the Tax Foundation gave testimony to the ouse Ways and Means Select Revenue Measures Subcommittee in June 2019. Quoting from an email from the Tax Foundation summarizing her testimony:

2. The SALT cap mainly impacts high-income individuals. Limiting the SALT deduction helped finance broad tax reform and maintain progressivity within the tax code. Prior to tax reform, more than 90 percent of the benefits of the SALT deduction accrued to those with income above $100,000.

3. Even those impacted by the SALT cap often saw a net tax decrease:

They often were previously impacted by implicit SALT limitations, such as the AMT and the Pease limitation, which were repealed by the TCJA.

Some quit itemizing their deductions, switching to the expanded standard deduction.

Many also benefit from lower rates and the expanded child tax credit

…..

5. The impact of the SALT deduction cap on state budgets is overstated. States saw an increase in revenue from tax reform, due to their conformity to the federal tax code. State and local governments have also explored and passed tax increases since the passage of the new SALT cap.

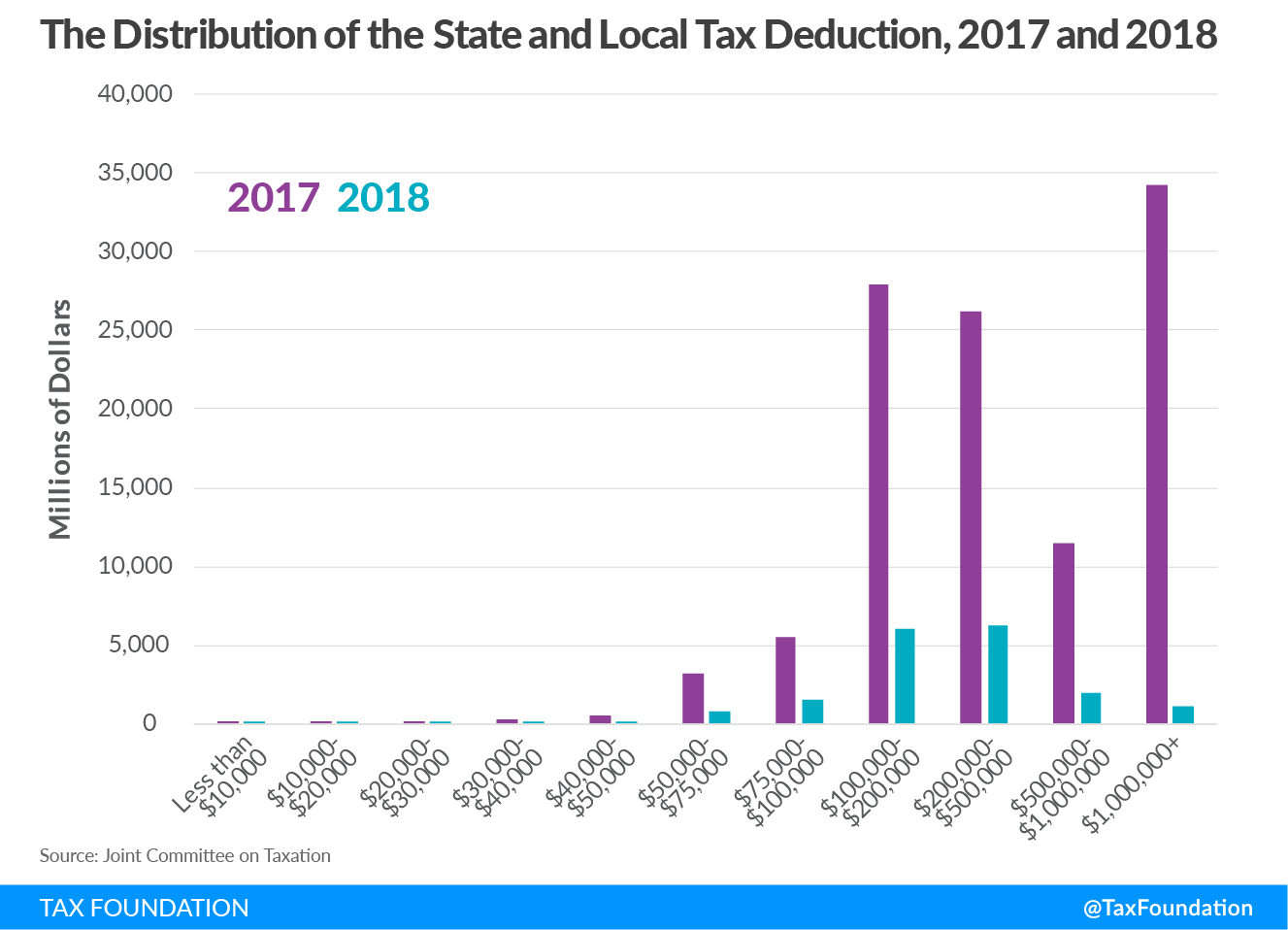

Here is a chart showing how much the SALT deductions were in 2017 vs 2018… and who got those deductions:

Anyway, SALT cap zero! All the way!

I also sampled from comments of those wanting the SALT Cap removed entirely, as they were trying to get a bill through that would do just that [It failed]:

I understand why my constituents [in New Jersey] do not feel Washington is working for them. The SALT cap is simply taking money out of the pockets of New Jerseyans and rewarding mostly-wealthy residents in states that don’t share our commitment to invest in quality schools and public services.

What’s more, the SALT tax cap is an active threat to penalize any state or local government that decides to invest in its future. That is why New Jersey and three other states are challenging it in federal court.<

This administration, unfortunately, is arguing that the SALT cap is not a “gun to the head” of states. That may be true. But, as a federal judge pointed out in a hearing just last week,” … it’s a rope to the neck with a gradual squeezing over time.”

It’s not the federal government’s fault that New Jersey is a profligate. They decided to put that rope on their neck.

It’s not other states’ issue that New Jersey, New York, et. al. want to be high tax paradises. Why should they have to make up for the other states? Tax what you want in New Jersey… but don’t drag the federal government into it.

SALT cap zero!

[Yes, I’m pretty constant there. Reminder: I live in New York, and… well, supposedly work in Connecticut. I don’t know how that’s supposed to work this year. My state & local taxes together are well over $20K.]

Long Live the SALT Cap

Back in October 2019, a federal judge struck down a lawsuit against the SALT Cap in the Tax Cuts and Jobs Act [aka TCJA].

My comment at the time:

The SALT cap is there, and it’s effective. Suck it, my fellow NYers and taxed-up-the-wazoo-in-CTers.

As I’ve mentioned multiple times before, it is an extremely small group of people who actually ended up paying more under the TCJA, and they tend to be extremely unsympathetic people in terms of “needing” financial relief. Very high incomes, and tax-optimizing-all-over-the-place.

What happened to most of us here in High-Tax-Topia is that we got very slight tax cuts. Even I managed to get a tax cut. It was small, but I didn’t have to pay more due to the TCJA.

The states filing over the SALT cap forget stuff like the Alternative Minimum Tax, in which all sorts of deductions disappear, including SALT deductions. The AMT has hit me in the past and generally hits people like me: high income people living in high SALT locations with loads of deductions.

Ultimately, I hope the SALT cap goes to zero (decouple federal and state taxes! NOW!)

No, It Won’t Happen Now

I don’t think the SALT Cap removal is going anywhere in the HEROES bill, and my own preference, setting it at zero, is not going to happen either.

Again, most of the political oxygen being consumed right now seems to be whatever is going on with Gen. Flynn and unmasking [yes, I know – everyone being required to wear literal masks, and then we have this figurative unmasking… a perfect set-up for a tedious modern novel.]

I think many/most of the provisions in the House bill are going exactly nowhere, and while I was waiting for “YOU WANT US ALL TO DIE!” reactions from the Senate [and McConnell, specifically] throwing this bill in the trash, that’s going to have to wait until all this other political noise dies down. I did have some “YOU WANT US TO DIE!” reactions to McConnell’s “state bankruptcy comments, but as that’s three weeks in the past, it may as well have been 20 years ago.

Of course, I like digging into things from 20 years ago. Hmmm.

In any case, there are a few more provisions in the bill that may actually go somewhere: they deal with private pensions, and most importantly, multiemployer pensions. I’ll look at those next week.