In general, I have very slow-moving issues to deal with — after all, public pensions supposedly were going to be pulling multiple cities and states into bankruptcy in 2010, and that is still limping along in most places. I’m still waiting for Kentucky to go under.

The issue for states and municipalities in 2010 was the slow erosion of their tax revenues and a similarly slow creep up in pension expenses — not a huge drop in taxes in a short amount of time. Obviously, many individuals are having issues as well, such as the ending of the federal boost in unemployment pay.

There is a big election in November, some ersatz conventions to be had this month (maybe?), and a bunch of political positioning to be had. Supposedly, various politicians in DC are horse-trading to get something done… soon. Maybe. We’ll see.

Let’s take a quick look at the state of the battling HEROES and HEALS acts (seriously, I feel like Captain Planet on one side and the Care Bears on the other battling… it would be an awful editorial cartoon, but I kinda want to see it).

State of the spending bills: priorities way different

NYT on July 30: The Gulf Between Republicans and Democrats on Coronavirus Aid, in 9 Charts

I will share a couple of the charts.

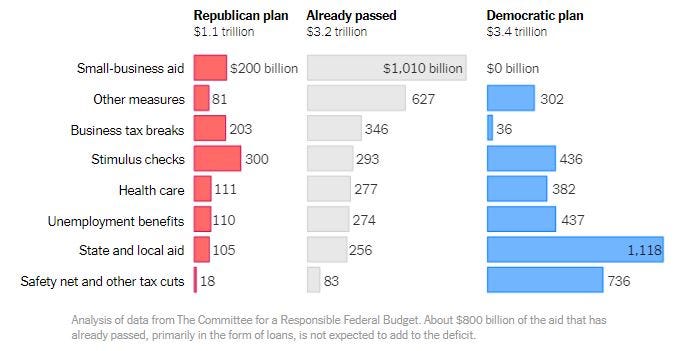

The first chart, at the top of the piece:

There are two bars that are obviously very different in length: aid to state and local governments. There’s a $1 trillion difference in those two bars. I do think it’s helpful to have bars to compare against what has already passed.

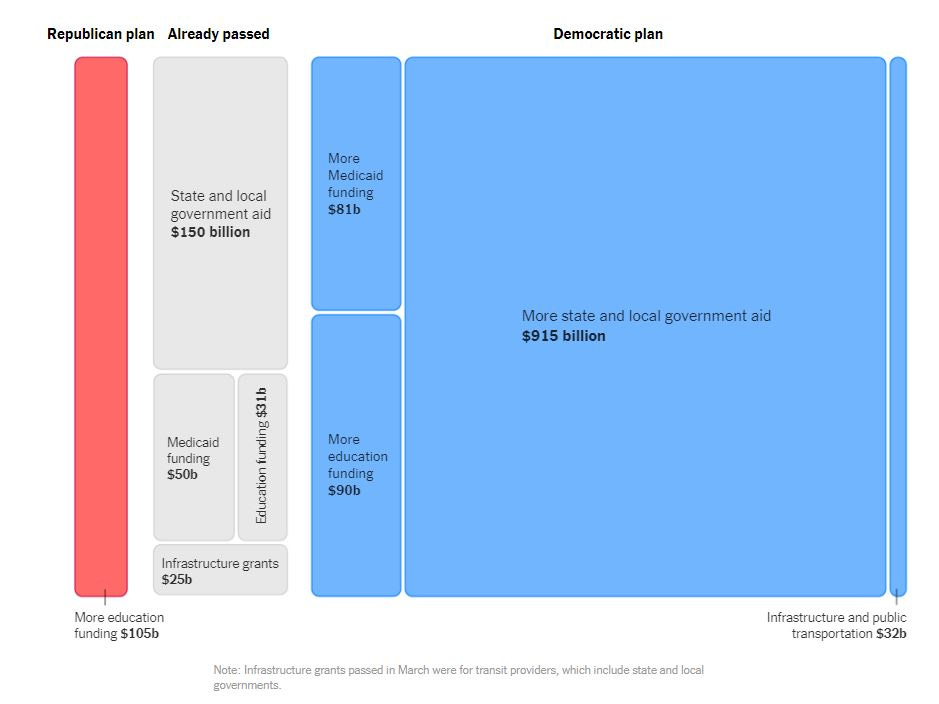

Let’s see that in a different way:

Hmmm. Yes. Interestingly, the amount for additional education funding (on top of what had already passed) is about the same for the two bills. The bulk of the difference between the two bills are the direct aid to state and local governments.

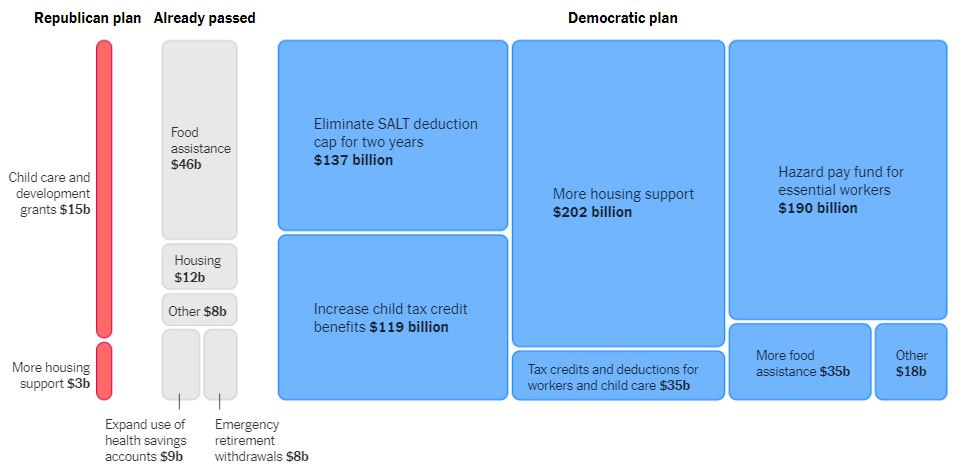

And finally, I found where they put the lifting of the SALT cap in this comparison: [which I would put with indirect aid to state and local governments]

(SALT cap zero!)

In any case, the SALT deduction cap “hurts” people like me – in the short term. In the long term, having an unlimited SALT deduction makes places like NY tax the high-earners with impunity, as they know we can always itemize those deductions. They still have to deal with the bite of AMT (which has bitten me at least once, but not by much.) The real result of the 2017 tax bill for me was a wash – lower marginal tax rates coupled with a SALT cap that I go over by multiples means I’m pretty much where I started.

As noted in a tweet from the Taxing Thursday post, that more is spent on lifting the SALT cap than increasing child tax credits is not the best look for Democrats on spending priorities.

Leftover COVID money?

Liz Farmer at Forbes: States Asking For More Coronavirus Aid, But Treasury Says They’ve Spent Just 25% So Far

State and local governments have been lobbying Congress for months to allocate more flexible aid in the next round of Coronavirus aid. But a new U.S. Department of Treasury report that tracks CARES Act spending says governments have collectively spent just a fraction of the $150 billion allocated back in March.

What gives?

The report, released in late July, totals the spending up to June 30 from the Coronvirus Relief Fund (CRF) for state, local and tribal governments. On average, just 25% of the total funding has been spent.

The obvious answer (to me): the states asking for more money already spent their allocation; other states did not spend the money as they did not need it.

The figure is timely support for the current argument from Congressional Republicans that state and local governments don’t need more federal budget support than they’ve already gotten. The GOP’s proposed HEALS Act contains no additional help for governments and Senate Majority Leader Mitch McConnell has said previously that he’s not interesting in bailing out states with pension problems or other longstanding financial woes.

But the report’s data is, at best, incomplete. At the worst, it’s misleading.

….

What’s more, it’s a bit misleading because it doesn’t include allocated money — money that’s been reserved for an expense, but hasn’t yet been taken from the relief fund. In other words, it’s as good as spent. When including allocated money, the National Association of State Budget Officers estimates that 75% of Coronavirus funding has been accounted for.

Okay, that makes sense, too.

But the main issue is that the earlier funds are allocated for COVID expenses. The real pain for states/municipalities is the drop in tax revenue, not that they’re having to pay more to handle COVID.

Other news/opinion coverage on competing stimulus bills

Brookings: Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

Stimulus Bill Update—“Still Very Far Apart.” Here’s What’s Next

Vox: Why Republicans are dragging their feet on more stimulus

CNN: 40 million Americans are at risk of eviction without a stimulus bill (That’s about 12% of the population)

Why The USPS Is A Controversial Player In The Second Stimulus Bill

Truckers push for key, temporary tax break in stimulus bill – this is the Heavy Vehicle Use Tax. They’re asking for a one-year suspension. That’s more supportable than removing the SALT cap.

Politico: POLITICO Playbook: The politics of walking away – the point here is there still is a regular budget bill fight to be had later this year.

Meep predicts… nothing

Well, I predict that something will pass.

This item says that a compromise bill would include some relief for state and local governments, so we shall see.

The Republicans want aid to go directly to individuals (aka voters), and the Democrats want the various governments thrown a lifeline (especially so the public employees don’t get cut).

I can see the incentives on both sides.

That said, it’s a pretty crazy year. So I make no particular prediction myself.