I am unlikely to do this much, but as Mish posted about this yesterday:

Will the Fed Cut Interest Rates by 0.25 Points or 0.50 Points in September?

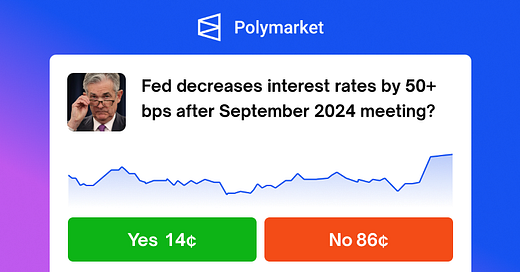

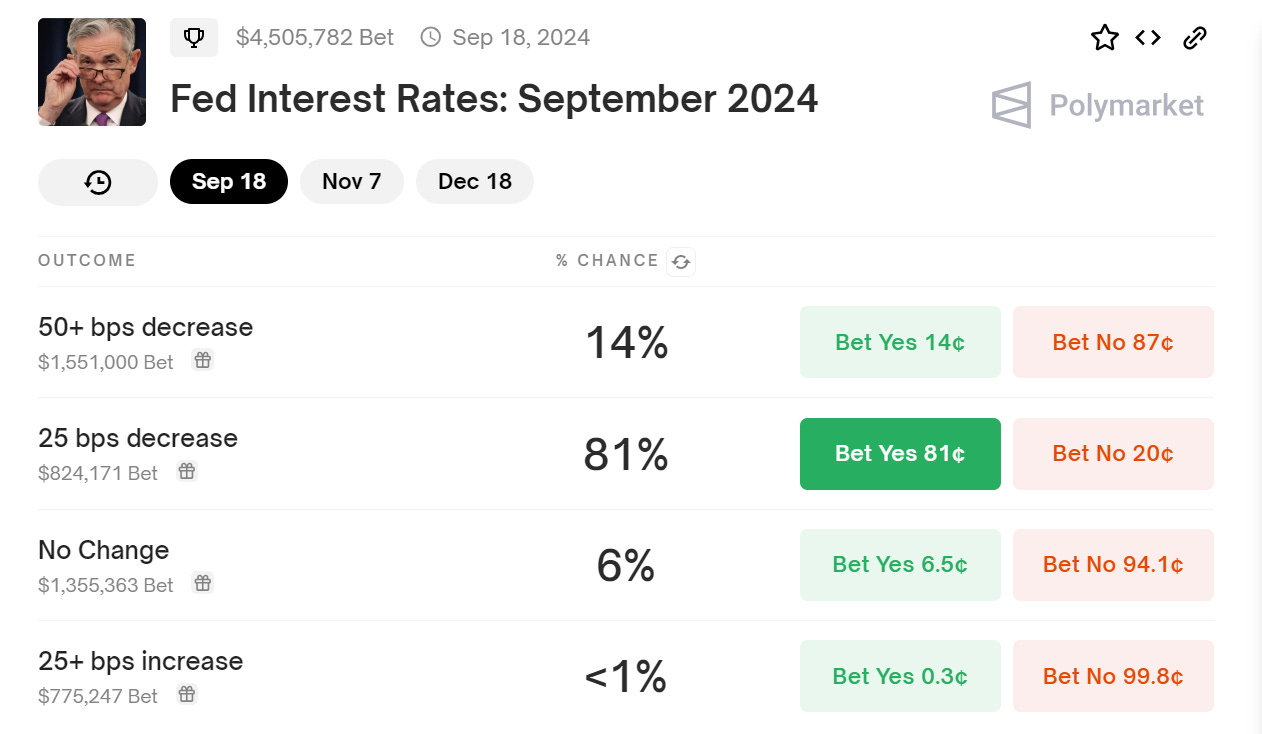

That’s how the probabilities are going from that source, but how about Polymarket?

Here’s the widget — which is supposed to be live, so it will change:

I’m going to take a snapshot here:

So these are different probabilities…

How the 25bps odds have changed over time:

How the 50bps decrease have changed over time:

There has been more action on the 50bps+ bet than the 25bps bet, so it should be interesting to see how this shakes out.

All that said, you see hundreds of thousands of dollars and $1.5 million dollars in these bets (and I’m excluding the other $1.4 million and $775K) — these amounts pale in comparison to the financial assets in the world that will be affected by the 0, 25-bp, 50-bp, or whatever decision made by the FSOC in September.

Shifting Interest Rates All Across the Yield Curve

I keep an eye, daily, on the yield curve:

I know that’s a bit of a mess.

Earlier in the year, it was cleaner:

(Hmm, looks like my formatting got off… I think that happened in one of the forced reboots/updates Microsoft sent my way. Yay.)

That said, you can see the recent drop in short-term rates (1-year, that is), as well as some of the long-term rates.

This does relate to my interest in public pensions… especially as I await the actuarial reports incorporating the new ASOP 4 and the low default pension obligation measure.

Podcast episode:

Public Pension Actuaries to Explain a New Measure

I look at an opinion piece by fellow actuary Larry Pollack, on the new low-default pension obligation measure that is to be added to actuarial reports for public pensions in the U.S. These should start coming out in 2024.

3.11 LOW-DEFAULT-RISK OBLIGATION MEASURE

When performing a funding valuation, the actuary should calculate and disclose a low-default-risk obligation measure of the benefits earned (or costs accrued if appropriate under the actuarial cost method used for this purpose) as of the measurement date. The actuary need not calculate and disclose this obligation measure more than once per year.

When calculating this measure, the actuary should use an immediate gain actuarial cost method.

When calculating this measure, the actuary should select a discount rate or discount rates derived from low-default-risk fixed income securities whose cash flows are reasonably consistent with the pattern of benefits expected to be paid in the future. Examples of discount rates that may meet these requirements include, but are not limited to, the following:

US Treasury yields;

rates implicit in settlement of pension obligations including payment of lump sums and purchases of annuities from insurance companies;

yields on corporate or tax-exempt general obligation municipal bonds that receive one of the two highest ratings given by a recognized ratings agency;

non-stabilized ERISA funding rates for single employer plans; and

multiemployer current liability rates.

With interest rates dropping again, discount rates would drop…. well, that would be interesting to see the results.