Looks like there’s yet another management changeover at Calpers.

ai-CIO: CalPERS CIO Nicole Musicco Will Step Down

The California Public Employees’ Retirement System announced the departure of Nicole Musicco, the fund’s CIO, effective September 29. Musicco cited attending to the “immediate needs of family” in Toronto as her reason for leaving CalPERS.

Deputy CIO Dan Bienvenue, who has been with CalPERS since 2004 and has held several leadership roles with the office, will serve as interim CIO until a replacement is found.

“Leading the CalPERS investment office has been an honor, and I am proud of the work my team has done to fulfill the retirement promises made to the 2 million Californians who have spent their lives in public service,” Musicco said in a statement. “However, at this time I need to prioritize those who need me the most, my family and children.”

Musicco often traveled between Toronto and Sacramento for family reasons, according to the statement.

I will get to the recent gossip in a moment, but let’s look at the “respectable” media coverage first.

Leading Private Equity Pushes Within Calpers

WSJ: Departure of Calpers’ Musicco Casts Pall on Its Private-Equity Push

Nicole Musicco strongly advocated for investing in private markets during her short time as chief investment officer of the largest U.S. public pension.

Brought in from RedBird Capital Partners last year, she made investing in private equity a central plank of her strategy for the $463.58 billion California Public Employees’ Retirement System after a decade of subpar returns brought about, she believed, by a lack of investment in private assets.

On Friday, Calpers said Musicco would step down as chief investment officer at the end of the month. Her exit jeopardizes the drive to expand Calpers’ private-markets bets, and by extension, the possibility of future returns for the underfunded system.

Quick comparison of allocations

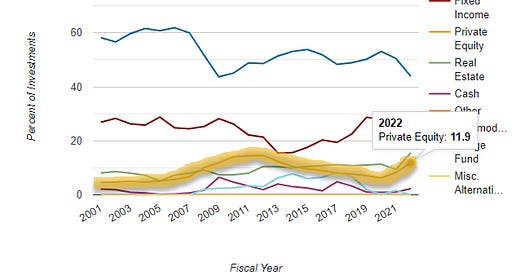

To do a quick data grab from the Public Plans Database, Calpers did have a dip in private equity allocations, and it is at a lower allocation than I’ve seen compared to public plans as a whole.

Here’s a graph from the database (annotated by me) that shows the Calpers private equity trajectory compared to other asset classes.

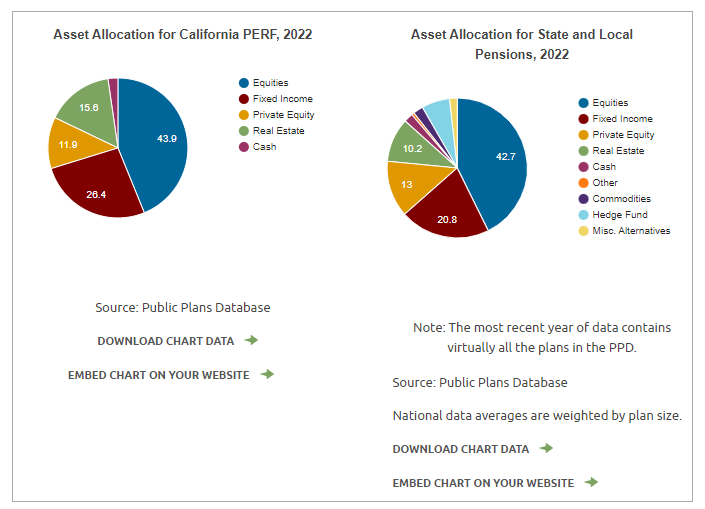

Here are some pie charts comparing Calpers’ allocations to similar pension plans’ allocations:

So yes, Calpers does have a slightly smaller private equity allocation… but if that 1 percentage point in allocation in killing you on private equity… it really may be all the other stuff. Frankly, it doesn’t look all that bad for FY2022.

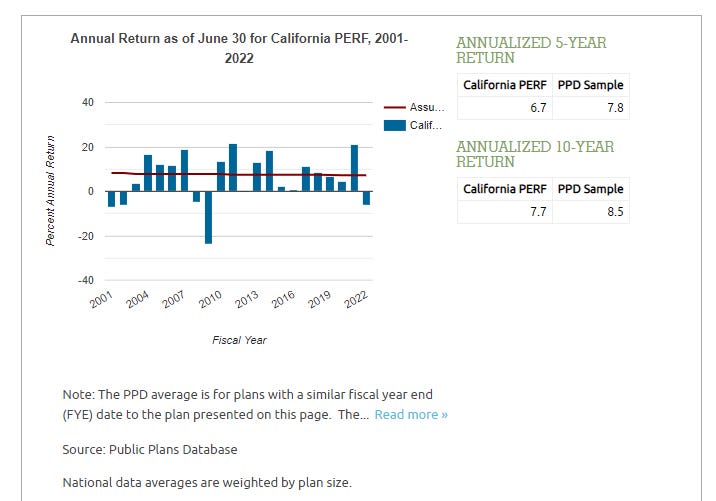

But, what about the performance?

Oooh. Not so great.

And note, Musicco wasn’t there that long to have an effect - heck, that’s just through FY2022, which ended June 30, 2022. She started in spring 2022, as per the Calpers press release announcing her departure.

Sidebar: It takes a long time to exit alternatives

I will address Calpers’ allocations and performance a different time. In researching the history to get up to this point, I found my three-parter on Calpers withdrawing from hedge funds:

Public Pensions Watch: California pension fund pulling out of hedge funds

Public Pensions Watch: Reactions to Calpers Pulling Out of Hedge Funds

Public Pensions Watch: More Reactions to Calpers Pulling Out of Hedge Funds

Thing is — those three posts were all from September 2014, and if you look at the allocation graphs, the allocation to hedge funds didn’t drop to zero until FY2020.

But that’s not the point of this post - this one is Calpers’ management woes.

Let’s look at the history there.

Good help is hard to find

Yet for Calpers, her departure provides another example of its longstanding struggle to attract and retain talent at the top of its professional ranks. The system has had at least six CIOs over the past two decades and it took about 18 months to find and hire Musicco after her predecessor left. By contrast, the $316.7 billion California State Teachers’ Retirement System has had just one CIO, Chris Ailman, since 2000.

Well, Calpers and its management issues have appeared on STUMP many times before. Let me give you a greatest hits list:

May 2018: California Crazy: Governance and Management Problems at Calpers

Sept 2018: Calpers Craziness: A Performance Review... and an Investigation?

October 2018: Calpers Quickie: President Pushed off the Board Due to ESG Over Pension Security

Sept 2020: Calpers Governance Watch: Fallout from ex-CFO Meng Resignation

The thing is (and I will be dropping the gossip links below, reader beware), I don’t know if there’s any issue with Musicco. I do know there are issues with Calpers, and many public pension funds, in that there are lots of politics surrounding it.

You can be absolutely clean, and do you want to deal with this bullshit? You probably have better options than Calpers, don’t you think?

Yes, it’s the largest public pension fund in the U.S., but do you want to deal with California?! Sacramento?!?! It’s thankless.

I wouldn’t blame Musicco for going back to Toronto. It’s got to be nicer than that crap.

Latest skinny from naked capitalism

One source that comes up in a lot of the prior pieces is Yves Smith of naked capitalism. She’s got two pieces on the latest news:

CalPERS Chief Investment Officer Nicole Musicco Resigns Abruptly, Intensifying CalPERS’ Senior Staffing Instability

On September 15, just before it hit the newswires, a CalPERS insider e-mailed me to say the CalPERS Chief Investment Officer Nicole Musicco, was resigning as of September 29. She had been at CalPERS only for about 18 months.

This is bad for CalPERS in many respects, particularly the suddenness of Musicco’s departure, where the official rationale of “immediate needs of family” does not add up, particularly given that California has statutory six week family leave that Musicco was entitled to having passed probation yet did not utilize. We’ll turn to that aspect shortly.

The Chief Investment Officer at a major pension fund is the top producer and should be, and is at CalPERS, its best paid employee. After former Chief Investment Officer Ted Eliopoulos left, CalPERS went through an extended search process for his replacement, Ben Meng, who did not meet the qualifications for the position set forth in the search process. Meng had never managed money but had merely selected managers when he worked for China’s State Administration of Foreign Exchange. Meng resigned in August 2021, a mere nineteen months into the job due to a conflict of interest which this site exposed, that of owning Blackstone stock at the same time he oversaw the approval of a $1 billion investment in a Blackstone fund.

CalPERS then went into another protracted search process, with the press commenting on how unseemly long CalPERS was taking to find Meng’s replacement. CalPERS and its search firm made the pay potential even higher than it had been under Ben Meng, with a five year investment performance component that could bring the annual total to $2.4 million. That was seen as important to encourage the new incumbent to stay, since even the longest-lived recent Chief Investment Officer, Ted Eliopoulos, was in the role for only four years.

That was on Sept 18. I “liked” this dig:

It is also more than a little convenient that Musicco is leaving at the end of annual bonus cycle.

Frankly, this is common. I’ve worked in the financial sector since 2003.

People get their bonuses and then jump ship. That’s how it works, usually. Those bonuses tend to be substantial, and at very high levels the bonuses are higher than base pay.

Now, I have deliberately jumped ship one week before I would have gotten a bonus. I made an explicit point of it and rubbed people’s faces in it, and yes, I absolutely meant it. If you cannot read those tea leaves, bucko, I cannot help you.

But let’s look at post #2:

Bloomberg Details How Unqualified CalPERS Chief Investment Officer Nicole Musicco Floundered Before Sudden Exit; Sports Focus Raises Specter of Possible Conflicts of Interest

Bloomberg gets props for quickly publishing a detailed account of the tenure of CalPERS’ suddenly departed Chief Investment Officer Nicole Musicco, in Biggest US Pension’s Investment Boss Pushed Sports Deals Before Calling It Quits. It’s clear some members of CalPERS’ staff cooperated with the story.1

Bloomberg reporters Eliyahu Kamisher and Dawn Lim lay out a set of facts that anyone who has been in finance or even in a large organization will recognize as that of an executive floundering. This is no surprise given that the search process, under the guidance of CEO Marcie Frost, knowingly chose someone lacking the experience that the Chief Investment Officer search had set forth as required. So CalPERS did itself and Musicco harm by rejecting two qualified white male finalists in the first round, making its diversity requirements paramount, rebooting the search and then choosing Musicco, who they had rejected in the first round.

It may appear unseemly for this blog to say the quiet parts in the Bloomberg story out loud. However, the damage to Musicco, to the extent she didn’t manage to line up a new job out of Toronto that she could take up after a short bit of “family” downtime, the damage was already done by the implausible cover story for Musicco’s abrupt exit, as we explained yesterday, and the further backstory from Bloomberg. So we are unpacking the Bloomberg story to make clear to Frost and the CalPERS board that it’s obvious Musicco’s tenure was a failure, and the blame lies with them for having chosen her in the first place.

You can go over there to read the rest of the post.

In my opinion, sports deals generally suck. They’re good for media coverage, etc. Private equity deals that make the news are generally bad deals, I think. The whole point is not to make the news! That’s why they’re private! (okay, I’m partly kidding there.)

I have my own thoughts on all these purported decision-making, but here is my sole question: why are they unable to grow the needed talent from within their organization?

There are several organizations that should be asking themselves this question.