Classic STUMP: Public Pensions Primer--How Discount Rates Work

Too high discount rates can end in bad results for retirees

Five years ago, I had run a series of posts on basic concepts that are key in valuing public pension promises.

I want to re-run a few of these over the next few Fridays, with data updates where applicable, and some editing.

Difference between public pension practice and finance theory

First, there’s William F. Sharpe, a Stanford professor who won 1990 Nobel Prize for Economics for his work in developing models to aid investment decisions. The Financial Analysts Journal interviewed him last year. Here’s what he said:

“Is this a disaster? You bet…. It’s a crisis of epic proportions…. [Pensions] value liabilities at 7.5% or 8% on the grounds that they are pretty sure they’ll earn that in the long run. This is crazy. It gets even worse. Because they want to minimize the reported value of the liabilities, they want to use a high discount rate, and in order to justify it, they have to build really risky portfolios. Consequently, they believe that one of the great things to do is put money in private equity, or maybe a hedge fund, because then they can assume an extra 300 or 400 bps of expected return for an illiquidity premium (or just because hedge fund managers are so smart). So, the tail wags the dog.”

…..

Second, there’s Eugene Fama from the University of Chicago, often called “the father of modern finance.” He won the 2013 Nobel for his work on financial markets. He was interviewed a year and a half ago by Chicago Magazine.

….

“States discount their liabilities—I think Illinois uses a discount of 7.5 percent [it’s in fact between 7 and 8]—arguing that’s the expected [annual] return on their portfolio. But the expected return on a portfolio is totally irrelevant. What counts is, How risky are the claims that you have to meet? You’ve made a promise to your employees that you’ll pay them a certain fraction of their income that is usually indexed. Which means it’s a risk-free real outcome. What’s the risk-free real rate? Is it anywhere near 7.5 percent? It isn’t. Historically, it’s like 2 percent. A 2 percent discount rate would approximately triple Illinois’s pension liabilities.”

I’ve added emphasis.

There have disputes for years over the appropriate discount rate to use in valuing public pensions. However, before we can have those disputes, I need to explain what this means. This is one of the first exams that actuaries have to take, but I’m not assuming that those reading this are actuaries.

Even if you do know the math, you may also want to see difference in results from real numbers.

Present value of a future cash flow

Let us suppose that you promise to pay $1000 to somebody one year in the future.

How much is that promise worth today?

That’s the concept of present value.

If we assume you can set aside some money $PV right now, and it earns an annual interest rate i over the year, the amount in one year would be $PV x (1 + i) = 1000.

So the Present Value of $1000 would be 1000 / (1 + i).

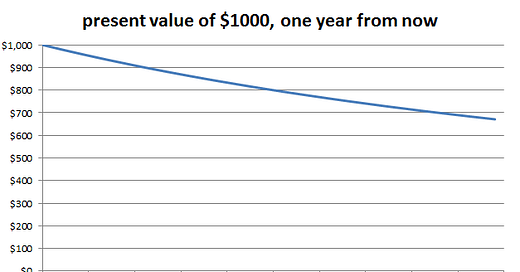

Let’s put in some actual numbers here so you can see the effect of interest rate choice. To make things simple, I’m going to use the same interest rates for all my examples: 0%, 5%, and 10%.

The 0% interest rate is the easiest to understand. It means we earn no interest/return on assets saved, so the present value is always the same as the future value. So we’d get $1000.

The 5% interest rate means we calculate 1000 / (1 + 5%) = 1000/1.05 = $952

The 10% interest rate means we get 1000 / (1 + 10%) = 1000/1.10 = $909

Let’s make a little table:

0%: $1000

5%: $952

10%: $909

I’m rounding to the nearest dollar for simplicity.

Things to note:

The present value is less than or equal to the future value (and equal to only when interest rate is 0%)

We call the present value a discounted value of the future value, and so the interest rate used in the calculation is called the discount rate

The higher the discount rate, the lower the present value

If you double the discount rate, that does not mean the present value is halved.

Let me put up a graph of the present value of $1000 one year from now.

Present value for a cash flow multiple years in the future

What if it’s not $1000 in one year, but $1000 ten years from now?

If we put in $PV now, then we get PV x (1 + i)^10 — that’s compound interest.

So if we solve for $PV = 1000 / (1 + i)^10

Let’s do a table:

0%: $1000

5%: $614

10%: $386

Where we had small dollar amount differences for a one year discounting, now that we’re discounting for 10 years, the differences in discount rate make for extremely different results.

Let’s update our graph to compare the ten-year present value to the one-year present value.

You can really see the difference in results.

This is key when thinking about pensions, as we have multiple cash flows in the future, not just a single cash flow.

Present value with multiple future cash flows

Let us suppose that instead of getting the $1000 all at once, you get $100 each year for ten years, starting one year from now. So you will ultimately get $1000 in total, but just doled out over time.

The “easy” way to understand this is to discount each individual cash flow from when it is paid to now, and then add up all the results. There is an entire actuarial exam on all the things that result from this concept, and is usually the first or second most actuarial candidates take in the U.S.

I did the calculation, and here is the table for comparison:

0%: $1000

5%: $772

10%: $614

Thinking this through, the result should be something between the 1-year and 10-year results. Just thinking of getting all the cash at the beginning, which is going to give you the highest value because you get the cash the earliest, and if you get all the cash at the end of the period, you will get the lowest value.

The graph shows the results:

Notice that the shape of the curve for multiple, identical payments is very similar to the exponential shape of the other two graphs. That is the effect of discounting, and because of this “family” of functions, one can approximate the change in discount rate for a pension fund by estimating what is called the duration of the cash flows, and using that as the number of years to discount.

I don’t want to get into all that math, but that’s essentially what external entities have done, specifically Joshua Rauh has done when he makes “adjusted” valuation of public pensions.

Here is Professor Rauh from 2013:

Here is one of his working papers (with Robert Novy-Marx) on the matter: “The Intergenerational Transfer of Public Pension Promises”. If you want a piece of the actuarial argument on the matter, here is an Issue Brief from the American Academy of Actuaries: “Measuring Pension Obligations”.

I think that’s enough for math-y takes.

The practical effect of the discount rate in valuation

Essentially, the higher the discount rate, the lower the liability looks.

The farther into the future the discounted cash flow occurs, the even heavier it is discounted, a small change in discount rate can make a huge difference in present value.

But let us consider the meaning of the choice of discount rates for public pensions. From an archived post I wrote in 2010:

- the discount rates don’t change the real, ultimate costs of the pensions. The cashflows are what they are….when they materialize decades down the line.

- what discount rates can do is shift the costs to a different generation of taxpayers…that’s assuming each year the proper payment as per the valuation is made. Which in many cases, it hasn’t been.

- if the discount rate is too low, then current taxpayers may be paying way too much for current public employee services for their future retirement. The lower the discount rate, the higher the obligation looks. Given the incentives, it is not common nowadays to hear of the discount rate being too low.

- if the discount rate is too high, then the cost of current service retirement benefits are being pushed off to later taxpayers who did not benefit from said service. If the rate is too high, then contributions will generally be too low during the time service is provided, and later one finds “unexpected” larger and larger payments required to meet cashflow needs during retirement. This is one of the elements of a public pensions death spiral.

…..

FURTHER: Even [Mayor] Bloomberg has a dose of reality here – making the assumed return too high asks for all sorts of trouble. For example, instead of using fixed income investments to match the guaranteed cashflows, getting involved in riskier and more exotic investments….which are more likely to fail. High volatility assets to back low volatility liabilities: not a good idea. But that’s not the only possible trouble.At some point, if the discount rate is out of line with reality, the money starts to be insufficient. And current taxpayers have to cough up the dough. Except it will be at a time when they’re less and less amused with the prospect.

You see I’m talking about perverse incentives then, even before I knew about the alternative asset play pensions were making.

I wrote that back in 2010. Many taxpayers are getting unamused with higher taxes to pay for benefits that were earned decades ago.

Now, in 2020, it may be somewhat moot — as it may be that the taxpayers are not able to pay extra in taxes right now. It may get back to “normal” in years to come, but it will be interesting to see which public pension plans weather the current pandemic crisis well, and which will get sucked down into an asset death spiral.

On the dangers of too-high discount rates

The term intergenerational equity is thrown around a lot when it comes to public pensions, and it essentially means the current public should pay for benefits earned currently, even if those benefits get paid out decades in the future. If the current generation does not put aside enough money to pay for those future benefits (i.e., underfunding the pensions), then the assumption is the future generation will pay.

If contributions were made based on a too-high discount rate, then effectively the pensions were underfunded.

When arguments for intergenerational equity in public pensions are being made, people are usually arguing from the basis of “fairness”. Fairness is a slippery concept. I have heard all sorts of arguments that it’s fair for current taxpayers to pay cash right now for somebody who retired in the 1980s. So forget about fair. [It has not gotten any better in 2020 compared to 2015, when I originally wrote that.]

My argument for intergenerational equity in public pensions is that of safety for the retiree: if you’re a retired public employee, you can’t strike. If you’re a retired public employee, you may have moved somewhere else entirely, and thus have little political pull in the entity where you had earned your pension. Your political leverage is fairly low.

So if the pension fund runs dry because it was underfunded for those years in which you, the retired public employee, earned those benefits… you’re going to have a hard time getting current taxpayers, who may not have even been born when you had earned your benefits, to pay for the benefits now.

This is where they run into the legal arguments, but there is a limit to the law and a limit to how much can be squeezed out of taxpayers.

Many ex-leaders learned the hard way about that.

And now, in 2020, many current political leaders are finding that they really might not be able to get the tax revenue they need to pay for pensions. Also, that they may be losing taxpayers who have discovered in COVID lockdown that they really don’t want to be living in, say, New York City.

Alas, it is a bit too late to go 20 years in the past and change the discount rates and contributions that were used back then.

If only a little bit of risk management perspective had been in place then.