This strikes me as deeply unwise:

Chicago police vaccine mandate: New CPD memo threatens discipline, firing for non-compliance

- A second memo, obtained by the I-Team, was distributed throughout CPD Sunday. The latest memo threatens the firing of officers who do not follow the city’s vaccine policy and orders it be communicated to officers at all police roll calls.

“TO BE READ AT ALL ROLL CALLS FOR SEVEN (7) CONSECUTIVE DAYS. This AMC message informs Department members of consequences of disobeying a direct order to comply with the City of Chicago’s Vaccination POlice issued 8 October 2021 and being the subject of the resulting disciplinary investigation. A Department member, civilian or sworn, who disobeys a direct order by a supervisor to comply with the City of Chicago’s Vaccination Police issued 8 October 2021 will become the subject of a disciplinary investigation that could result in a penalty up to and including separation from the Chicago Police Department. Furthermore, sworn members who retire while under disciplinary investigations may be denied retirement credentials. Any questions concerning this AMC message may be directed to the Legal Affairs Division via e-mail,” the memo said.

The part that I’ve bolded is the extremely unwise part.

Threatening public employees’ pensions is the nuclear bomb of municipal politics, even beyond “defund the police” campaigns.

Let me quote from the bottom of the piece:

“Roughly 38% of the sworn officers on this job, almost 40% can lock in a pension and walk away today,” Fraternal Order of Police President John Catanzara, Jr. said.

I will not check his quoted amount. I find it credible, given how low the retirement age generally is for public safety officers.

As it is, the lawyers on both sides are having fun (with a stupid “tell the union leaders none of them can tell union members not to enter vaccine info in the employee portal” twist), and we will see where the legality of the vaccine mandate on public safety officers land.

Public pension forfeiture policies: not all that common

I have no comment on the legal aspects other than this: I have been following news on public pensions for over a decade now, and one of the most contentious issues has been rescinding pensions for criminal officials. As in, people who were actually convicted of felonies, often directly related to their jobs (but not always), and actually in prison.

And many public pension plans are unable to rescind these pensions legally. In reaction to some particularly egregious cases, some state legislatures have stepped in and passed laws allowing it under specific circumstances, but many states have done nothing.

Here is a map from Reason Foundation in 2020 on policy:

And the entry for Illinois in their table of pension forfeiture policies says:

Pension benefits are forfeited for members who are convicted of a felony relating to their service as an employee. The member is entitled to a refund of their contributions.

Now, I’m not going to go into the ins-and-outs of the denial of “retirement credentials”, whatever that means.

While I’m sure Chicago can probably delay the start of retirement for cops who qualify for retirement via their years of service and retirement age, it seems extremely unlikely that it would be legal for them to delay it very long. Forget about rescinding the pensions entirely.

I assume the pension-related threat was simply hot air and an ineffective legal maneuver for now. The lawyers will do their thing, and, if Lori Lightfoot is wise, she will not say anything nor have the police chief say anything threatening the pensions any further than they already have.

The real pension threat: deeply underfunded plan

Let me get back to what I actually know quite a bit about, and that’s the reality of underfunded public pensions.

The Chicago Police do have a danger in getting caught in an asset death spiral.

Looking at their funded ratio trajectory:

Yeah, that’s not good.

Chicago Police would be the worst-funded Chicago pension plan, if only Chicago Fire and MEABF weren’t worse. It’s been hovering under 25% funded for many years, as you can see above.

I have mentioned before that teachers public pension plans tend to be underfunded and very expensive to governments, because they’re the most numerous of government workers, tend to be women, and tend to be long-lived.

I didn’t mention that police and fire funds tend to be much more underfunded, partly because public safety officers have much lower full retirement ages than all other government employee category. And, because especially firefighters tend to be a very small group in number, and generally have a few heroic stories under their belts, it’s always a nice little political goodie to boost the pensions of safety officers. And it doesn’t cost that much — at least, not in respect to boosting teacher goodies.

Chicago safety officers pensions have challenging statistics

Let us compare the four major Chicago pension plans (all data comes from the public pension database):

Demographics:

Both Chicago Police and Chicago Fire plans have active-to-beneficiary ratios of about 90%, and have been at that level for some years. Chicago Police, specifically, had such a ratio starting in 2012.

So, there are more people taking police pensions than are active employees already. If I take the numbers given, and shift 38% from active to beneficiaries, that gives one an active-to-beneficiary ratio of 52% (assuming you don’t get new actives, which you would, but still… this is a point-in-time estimate).

Unfunded liability per member (actives + beneficiaries):

And then, I really should have measure the unfunded liability per active member, as generally we’re trying to fund over active working lifetime:

Um, yeah. Almost $900K per active employee… and this amount has only been growing over time as the liabilities grow and the funded ratios don’t improve.

That’s not good.

And that’s even before a “shock” of 38% of the people shifting over from active to retired. If that happened, and before they could hire new cops, you’d have an unfunded liability of $1.2 million per active employee… but you might find the pension fund valuation might be a bit different, as the standards for valuing the pension value for someone already retired and for someone not yet retired are quite different.

(Searching through my archives for the “they won’t all retire tomorrow” quotes from years past….ah, here’s something appropriate, talking about what pension funded ratios mean.)

First rule of holes: stop digging

Politicians never seem to learn the first rule of holes, especially when it comes to public pensions. When the pensions are in a deep hole, please don’t make it worse.

Even before this brou-ha-ha, there had been some displeasure coming from the cops, especially the retired cops, with respect to the financial health of their pension plan. They commissioned a forensic audit of their plan, and the subsequent report can be seen here: Twisted Priorities — Preliminary Findings of Forensic Investigation, Police Benefit Annuity Fund of Chicago Commissioned by Chicago Police Pension Accountability Group. It’s from 31 August 2021.

The report is preliminary, partly because Chris Tobe, the investigator and author, was unable to get access to some key information. Chris Tobe has sued, seeking this information.

The preliminary report details hidden asset management fees in certain asset class types, as well as poor management and governance. These are the types of details that are very difficult to get, and calls into question the appropriateness of public pensions to follow such opaque practices. Should government pensions really be more secretive than those in the private sector?

But there is very public information that gives an extremely clear picture of big problems.

Here is the investment performance:

For both the 5-year and 10-year returns, they greatly underperform peer plans.

You may think that 7.6% versus 8.5% isn’t a big difference, but given these are 10-year periods, that’s a cumulative return of 108% for Chicago Police versus a cumulative return of 126% for their peer plans.

Those differences add up.

The other Chicago pensions do not have the iffy fund returns that Chicago Police does, and it’s appropriate to dig into that further.

But the high-level problem is that Chicago has never adequately funded its pensions.

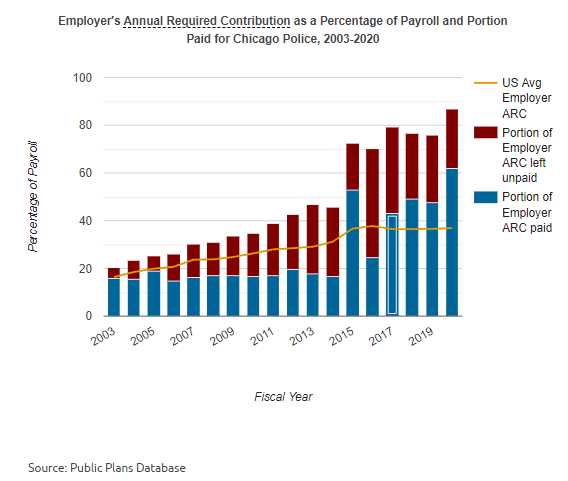

Going back to 2003, they paid 78% of the “required” contribution back then… and just squeezed over 71% in 2020FY. However, most years, they didn’t even contribute 50% of the “required” contributions.

Little wonder that the required contributions, as a percentage of payroll, has climbed precipitously, from 20.5% in 2003 up to 86.8% in 2020.

The other underfunded pensions, even though their asset returns are in line with their national peers, have the same problem. The very underfunded plans got that way primarily due to an explicit choice to underfund them.

This didn’t happen by “bad luck”.

Doom is likely

When it comes to Chicago, predicting financial doom is pretty easy, especially now in the age of work-from-home.

Last year, I looked at the nasty financial state of Chicago and Cook County, and while federal bailouts have given them a little reprieve, now that Biden et. al. are controlling the money spigot, it’s not a sure thing that the money taps will stay on… or even that the amount being thrown at Chicago will be enough.

Many have pointed to the likely crime results from having 40% of the Chicago police force going poof, and have already pointed to the carnage wreaked in 2020 and getting worse in 2021.

But I’m here to say that encouraging the cops to leave, and essentially retire, is going to hit the pension funds hard.

A fund that’s only 23% funded really can’t afford such a hit.

We saw with Detroit and its bankruptcy that a 10% reduction in its population in a decade had a large effect on its finances; while Chicago manages to get some money from the state of Illinois to keep up its spending habits, Illinois is seeing its own population crunch as well.

If Lori Lightfoot is lucky, the judge will say she can’t force a vaccine mandate on the police without going through standard union bargaining processes. She has gotten herself way over a ledge, like so many other politicians in the past two years, and if she can’t have cover from somebody else for backing down, it may turn out the pit she was walking over was far deeper than she knew.

I don’t envy my friends in Chicago. I knew fiscal doom would hit the city in this decade, but this was not the form I was expecting.