Chicago Finances Update: Other People's Money Doesn't Go Too Far, Does It?

Pensions loom larger as the next budget cycle begins

The way the Twitchy folks put it: Chicago Went WOKE, and Now Its School District Is BROKE and HUNDREDS of Staff Face Layoffs, and while “WOKE” certainly didn’t help their situation, Chicago was already in a huge hole from pensions if nothing else.

Let’s look at the latest Chicago fiscal news and see if we can figure out what the next steps are.

Chicago Budget Season is Now Upon Us… Where Did All the Money Go? Oh. Pensions.

14 July 2025, Chicago Tribune/Yahoo: Upcoming Chicago budget ‘grimmest picture of all’ for Mayor Brandon Johnson, aldermen

Excerpt: EMPHASIS ADDED

It was the only allusion Johnson made to the disorder in Chicago’s fiscal house that threatens the improvements and investments he’s fought for: a more than $1 billion anticipated deficit for 2026, a major pending union contract, a fractious City Council resistant to both new revenues and cuts, federal threats to cancel grants to local governments and a school district long overdue on a promised pension payback.

Two days after that roundtable, Johnson’s finance team would disclose the city ended 2024 with a $161 million deficit, emptying one of its key emergency funds. Adding to the bad tidings last week was a final $7 billion estimate for the cost of a state bill boosting benefits for police and fire pensioners through 2055.

That zeroed out “unallocated” reserve balance is even lower than the depths of the 2008 recession, when it held just $226,000, according to the city’s annual financial reports. It represents a serious financial alarm for the cash-strapped city, according to Justin Marlowe, the director of the Center for Municipal Finance at the University of Chicago

….

Given that the costs that drove that drawdown — the failure of Chicago Public Schools to pay back the city for a $175 million pension payment and a shortfall in state income tax revenues — were not surprises, that figure is likely to result in a rebuke or threat of a downgrade from ratings agencies, he predicted.

They say “failure” like it was an “oopsie”.

It was a deliberate choice… but also, the CPS has little fiscal leeway itself.

Chicago and all the groups that touch the till have been profligate with taxpayer money, and there is really little to elaborate on there. They have been profligate with current outflow, and they have definitely been profligate with pension promises.

It’s always easy to say “I’ll pay you later”…. until the later comes.

Wouldn’t ya know that everybody needs the money NOW, and, well, they don’t have enough to go around. What bad “luck”.

The last time I posted about Chicago finances was April 26 in this post: Chicago and Illinois Update: Salary Sweeteners, Begging for Revenue, and Pensions Pensions Pensions, where the city of Chicago was saying “Pretty please CPS, give us that pension contribution money back…” and CPS said: “No.”

Guess what.

No, Chicago didn’t get that money. CPS also didn’t have that money.

On top of that, the state of Illinois had a piece of legislation boosting first responder pensions throughout the state, and the bill has come in. I will get to that news in a moment.

Where do Chicago police and fire pensions stand?

You may be wondering what the funded ratios for Chicago police and firefighters’ pensions looked like before the proposed sweeteners.

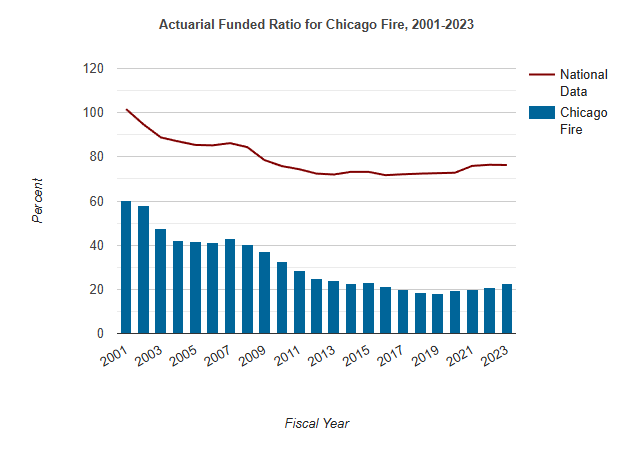

Here’s the firefighters’ pension fund:

That’s right, sitting a little above 20% fundedness (compared to a national average of about 80% — when they all should be at 100% fundedness).

The $7 billion is additional pension liabilities added to the amount they’re already short.

As the above are percentages, let me give you the numbers from the last reports I can grab from the Public Plans Database:

Police: $3.87B in assets, 23.4% funded FY2023 → $12.67B in unfunded liab

Fire: 1.77B in assets, 22.8% funded FY2023 → $5.99B in unfunded liab

For a total of $18.66B in unfunded liabilities before any sweetener… which is estimated to boost the unfunded liability by about 40%.

Yay.

That’s just Chicago, of course. I wonder how all those small towns in Illinois are doing after this sweetener. Promising tomorrow for service today may not be looking so cheap, eh?

Illinois Police/Fire Pension Boosters

27 June 2025, Wirepoints: Why Gov. Pritzker Should Veto Chicago Tier 2 Pension Sweeteners – Wirepoints

In the dark of night during the recent state budget negotiations, Illinois’ General Assembly passed legislation to sweeten the Tier 2 pensions of Chicago police and firemen. If Gov. Pritzker signs the bill, the obligations of Chicago’s public safety pension funds, already nearly insolvent, will get bigger. For police and firemen, it will be another blow to their retirement security. For taxpayers, it will mean even higher property taxes.

The governor should veto this reckless and unnecessary measure.

This is just the latest piece of sweetener legislation that’s arisen due to Tier 2 pensions. Tier 2 government employees across Illinois, those hired after January 1, 2011, were originally given reduced, but still handsome pension benefits by the General Assembly. But recently, some lawmakers and unions have claimed that the benefits for some Tier 2 workers are too low, violating arcane IRS regulations tied to Social Security.

Several proposals subsequently arose to sweeten the Tier 2 pensions of state-level employees, with potential costs rising as high as $80 billion, even though no real proof of any violation was ever provided.

Fortunately, lawmakers avoided increasing pension benefits by wisely inserting a new reserve fund into the budget to ensure the state will comply with Social Security requirements if any violations are ever proven. That should have been enough to head-off any future issues with the IRS.

My own attitude, of course, is that all the states and localities should be forced to participate in Social Security. But that’s not on the table currently.

Back to Wirepoints:

First, the sweeteners were never actually scored, so no one knows just how big the costs will be. Chicago’s police and fire pension plans are just 23% funded and are two of the most insolvent funds in the country. Pushing even more costs onto them amounts to political malpractice.

Well, the costs have just come in, as mentioned above.

14 July 2025, Fox32Chicago: Chicago taxpayers may be on the hook for added police, firefighter pension costs

About 10 years ago, in response to the pension crisis, the Illinois state lawmakers passed a bill creating these Tier 2 pensions, meaning some of the younger employees would receive slightly reduced benefits than their older peers.

Now, a bill sponsored by State Sen. Robert Martwick (D-Chicago) aims to raise some of those pension levels for Chicago police and firefighters.

Civic Federation President Joe Ferguson said it will cost taxpayers as much as $7 billion over the next 30 years, $60 million this coming year alone, and then $750 million per year by 2055.

18 July 2025, Wirepoints: Chicago pension sweeteners: Threatening public safety retirement security, soaking future Chicagoans – Wirepoints

In case you missed it, the Illinois General Assembly recently passed a bill full of pension sweeteners for Chicago police and firefighters hired after 2010 – the so-called Tier 2 workers. Chicago officials say it will cost city taxpayers an additional $6.6 billion over the next 30 years and that it’ll worsen the funding levels of the public safety pension funds to a miserable 18%.

….

The other thing you should know is that lawmakers have figured out a trick to “soften” the blow of these big pension sweeteners: throw as much of the costs into the future through the use of what’s called a “ramp”.

In this case, the bill hits the city budget (aka, taxpayers) with an additional $60 million in contributions to public safety pensions in 2027. By 2055 the increase in contributions ramps up by a whopping $753 million. Talk about sticking it to the city’s future generations.

Thank Gov. Edgar and the Illinois General Assembly of 1994. The ramp they passed back then is still used today to hide the true costs of benefit increases from taxpayers.

As it is, Chicago is straining to make its current schedule of pension payments without adding more.

Going back to the Public Plans Database, this is what the contributions have looked like:

The blue portion is the part that was paid, the red portion was the part that should have been paid (to keep up with a reasonable amortization of pension debt) but wasn’t.

The yellow line is what comparable pension funds have as their “required” contribution levels as percentage of payroll. Yes, about 40% of payroll, not 100% of payroll as we’re seeing with Chicago Fire.

But then, most firefighter pensions aren’t as abysmally funded as Chicago.

The data here are only through FY2023, when they made a “full” contribution (yay.)

Again, the contribution level as a percentage of payroll is much higher for Chicago Police than comparable pensions (the yellow line) primarily due to the very low funded ratio the Chicago Police fund has.

That “ramp” hasn’t been doing anybody any favors.

Old choices have consequences: Chicago Pension Debt at $36 Billion

Those old choices led to this:

10 July 2025, Washington Examiner/MSN: Chicago pension debt climbs to $36B, up 13% in five years

Wirepoints Executive Editor Mark Glennon is warning Chicago residents the city appears on the road to destruction as a mounting pension crisis has seen such debt soar by 13% over the last five years alone.

The 2024 Annual Comprehensive Financial Report for the city of Chicago now pegs the city’s unfunded liabilities at almost $36 billion, even after overall debt has dipped by $1.3 billion over the last year.

Brandon Johnson finds himself under loads of constraints, even if the Chicago alderman can’t vote down his town credit card usage, as it were.

Daley left when the fun money was gone. Rahm tried to make some changes, but left under different circumstances and without having made much dent in the pension debt. Lori Lightfoot was forced to contribute much more money to the pensions because the money was going to run out.

But the reason they hadn’t been contributing more to the pensions for all those years in the first place was they had been promising way more than they could afford.

These contributions are necessary, because otherwise they will get caught in an asset death spiral, with more cash flowing out of the funds than are generated by investment returns or contributions, meaning assets would have to be liquidated, and funded ratios erode. Thus, the simulation seen above.

For now, Johnson is casting about for more revenue to cover his budget, and I would argue the pensions are the big problem, not “WOKE”, however you define that.

Chicago: The Search for Revenue Sources

Back to the Tribune/Yahoo piece:

But the mayor’s major options for finding new, significant money are limited without state approval, again raising the possibility of a property tax hike, this time even closer to reelection for him and the City Council that roundly rejected such an increase last fall.

Other possibilities also face political headwinds. Many aldermen are flatly opposed to replacing the outgoing state grocery tax with a city grocery tax as they pressure the mayor to instead make spending cuts.

Their unwillingness to vote to bring in more money ties Chicago’s hands in a critical moment, argued Ald. William Hall, 6th, tasked by Johnson with leading aldermen in identifying more revenue.

Let’s not forget bonds. But, alas, the credit card has yet to be taken away.

15 July 2025, The Center Square: Frustrations expressed as Chicago aldermen reject limiting mayoral borrowing

A measure to help Chicago’s city council limit the mayor’s ability to borrow money has fallen short in committee.

Alderman Marty Quinn proposed an ordinance that would have required future borrowing to be approved by two thirds of the council instead of just a majority. The council’s finance committee rejected the proposal by one vote.

Chicago resident Anthony Pruitt expressed his frustration Monday afternoon during public comments before the Committee on Budget and Government Operations.

“While this city claims to be evolving, it’s quietly being sold, stripped and suffocating the very people who built it,” Pruitt said. “And who suffers? We do. Not just the Black and browns, but the whites, the visitors, they suffer, too, and now we’re being treated like outsiders in our own home. We treat lifelong Chicagoans like second-class citizens while new arrivals get red carpets. Compassion is good, but fairness is justice,” Pruitt added.

They have some structural spending problems (see the pensions issue above), and some structural revenue problems, and the debt, with potentially increasing interest rates, will not help matters.

Yes, people have mentioned the spending on non-citizens:

Over the last two years, Chicago’s government has spent hundreds of millions of taxpayer dollars on noncitizen migrants.

Under Trump — that can be a mixed bag for cutting.

Trump gives one cover to make a choice either way. If you spend on these groups, it’s resistance against Big Bad Trump!

Except, Chicago can’t really afford to do this spending on its own, and Big Bad Trump and the Evil Republicans in Congress(TM) are choking off federal funds for this spending. If the Illinois state legislature won’t cough up the funds, Chicago has the out of “Well, We Tried.”

So yes, my eyes are on the Chicago budget process (and New York City, with its mayoral elections and the stupid ideas there, which I will also look at later.)

More Chicago Stories

16 Jul 2025, Chicago Contrarian: Chicago’s Finances in 2024: Where the Money Comes from and Where It Goes — comment: maybe put in some graphs

15 Jul 2025, A City That Works: A 2025 update on the State of Chicago Pensions

10 June 2024, Illinois Policy: Chicago might join 209 voting to tax groceries: is your town on list

11 July 2025, Chicago Tribune/Yahoo: Chicago Public Schools lays off 1,458 employees to adjust for enrollment, programming changes

9 July 2025, WGN9: ‘We won’t let it stand’: Chicago Teachers Union calls for state aid amid budget deficit

7 July 2025, WBEZ Chicago: CPS struggling to deliver retroactive teacher raises

Thanks MEEP!