The downgrade of Chicago came from S&P on Monday evening.

S&P announcement, 14 Jan 2025: Chicago GO Debt Rating Lowered To 'BBB' As The 20 | S&P Global Ratings

CHICAGO (S&P Global Ratings) Jan. 14, 2025--S&P Global Ratings lowered its rating to 'BBB' from 'BBB+' on the city of Chicago's outstanding general obligation (GO) debt and removed the rating from CreditWatch, where it was placed on Nov. 19, 2024. The outlook is stable.

"The downgrade reflects our view that the 2025 budget leaves intact a sizable structural budgetary imbalance that we expect will make balancing the budget in 2026 and outyears more challenging," said S&P Global Ratings credit analyst Scott Nees. The rating action also reflects our view that following the 2025 budget negotiations, the city's practical options for raising new revenue appear less certain, as does the willingness of city leadership to cut spending, creating a level of uncertainty around its financial trajectory that is more appropriately reflected in the lower rating.

There is additional commentary at their announcement that they expect Chicago will continue pension funding, I assume, at the levels they’ve promised. That’s why the outlook is stable.

I’m not so sure about that. When push comes to shove, cutting pension contributions has been a go-to move for many governments, and Chicago (and Illinois) have taken that path many times.

But S&P’s comments may have been intended as a warning to Chicago. Chicago can’t afford to have their bonds slip into junk (excuse me, “below investment grade”) ratings again.

Chicago Mayor and CFO Responds to S&P Action

Chicago’s response, 14 Jan 2025: City Of Chicago Responds To S&P Credit Rating Adjustment

Today, S&P Global Ratings announced the downgrade of Chicago’s general obligation bond rating from 'BBB+' to 'BBB.' This rating action resolved the negative credit watch the agency had assigned to the City and their outlook is now stable. Despite the public budget negotiations over the last couple of months, the City’s credit fundamentals have not changed, and the rating does not accurately reflect the strength of the City’s credit or ability to meet its debt and pension obligations.

Chicagoland’s economic output is larger than most countries, the region has seen steady economic growth for decades, and the local economy continues to grow. Chicagoland’s labor force also increased from 5,052,596 to 5,062,661 (+10,065) between October 2024 and November 2024. This is the region’s largest labor force in at least the last 10 years.

The economic strength of Chicago is showcased by several transformative development projects, including the Illinois Quantum and Microelectronics Park on the City's south side, anchored by PsiQuantum and supported by the Department of Defense; the expansion and redevelopment of O'Hare International Airport through the Terminal Area Plan; the 1901 Project and the revitalization of the area surrounding the United Center; the Obama Presidential Center, and the expansion of the Chicago Transit Authority's Red Line Extension Project, which recently secured nearly $2 billion in federal funding. This extension will unlock significant economic opportunities and provide improved transit times for south side residents.

So far, none of this is really to the point. That’s all about getting funding for projects, and perhaps not needing the bonds. Huzzah, I suppose.

It doesn’t address the issue of operating revenue.

Chicago's structural budgetary imbalance has nothing to do with capital projects. It has to do with its operating budget. Every single project mentioned above is a capital project.

“The S&P report focuses on the fiscal challenges we face, but it does not accurately reflect our fundamental economic strength and the steps we’ve taken to address legacy issues. My administration remains committed to working collaboratively with the City Council to achieve structural balance and strengthen Chicago’s financial future,” Mayor Brandon Johnson said. “We will meet these challenges head-on, just as Chicago has always done and we will engage with all stakeholders to create sustainable policies that reflect our shared commitment to progress and accountability."

Yes, and you have a big budget hole. Some of this is due to “legacy issues” (aka underfunded pensions). But a big problem is that Johnson has added to the deficit.

Other Commentary on the Downgrade

Wirepoints, 17 Jan 2025: While S&P downgrades Chicago, Mayor Johnson and city officials deny failures – Wirepoints

The billions in federal covid aid has finally run out and Chicago no longer has the ability to paper over its fiscal problems. The recent $17.1 billion budget passed by Mayor Brandon Johnson and Chicago’s city council fooled no one. As a result, S&P Ratings this week downgraded the city’s credit rating one notch to BBB from BBB+.

Chicago is now tied with Detroit for the title of nation’s worst-rated major city, though Moody’s already has Chicago at a worse rating than Detroit. S&P even warned city officials a few months ago of a credit downgrade if they continued to play games with the budget. But games they played and, as promised, S&P acted.

….

….

Their [Mayor Brandon Johnson and the city’s financial officer, Jill Jaworski’s] comments are comical. Johnson and the city council have done nothing to address the legacy issues that are crippling the city. Nothing for the massive pension debts. Nothing for the school district or the transit government’s deep budget holes. Chicagoans are tapped out as property taxes have doubled in the last decade and commercial property tax rates are already the nation’s highest. There’s been no relief. And the city’s tax base is at risk, with Chicago facing one of the worst population drops in the country over the last 25 years. City officials have done literally nothing structural to improve things.

And yet the city’s financial officer can say, “The strength of the City’s credit”?

Just look at Chicago’s pensions, typically the rating agencies’ biggest concern. Have Johnson or the city council done or proposed any structural reforms to stop the city’s pension funds from running dry? No.

….

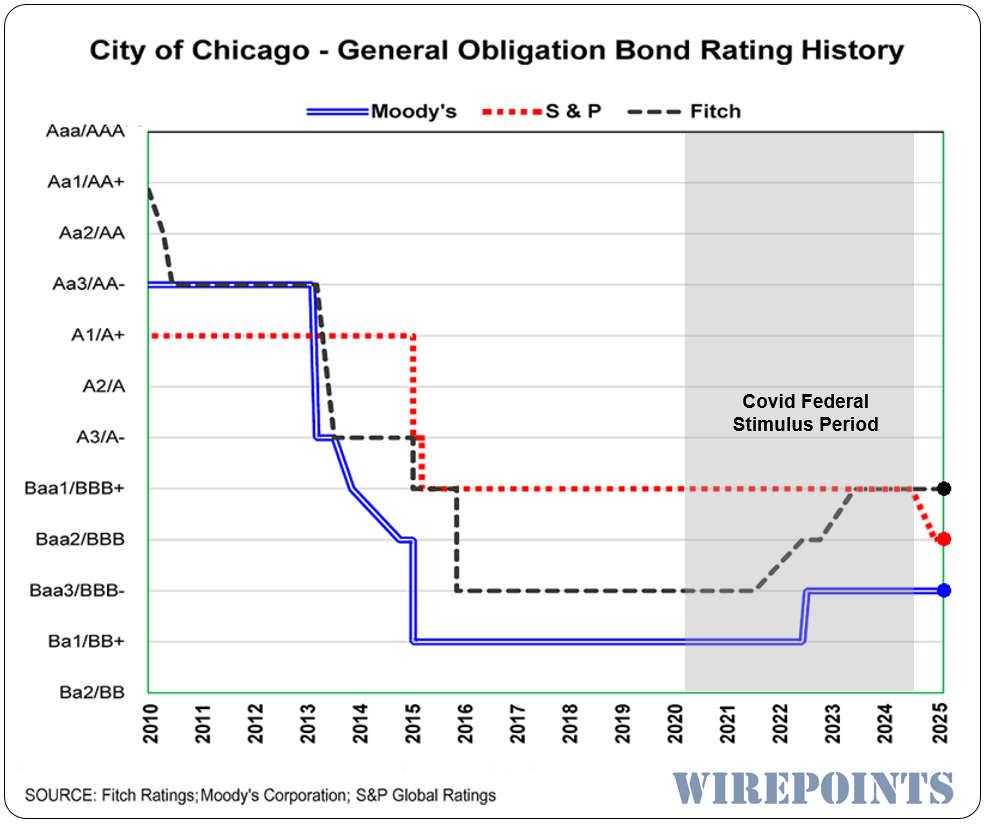

S&P’s downgrade puts an end to Chicago’s short streak of credit upgrades that occurred during the pandemic period when the city was flush with federal cash. Moody’s upgraded its own rating of the city in 2022, while Fitch issued two, one in 2021 and 2022.

As of today, Moody’s rates Chicago at Baa3, just one notch above junk. S&P’s new BBB rating is two notches from a junk rating, and Fitch’s BBB+ rating is three notches higher than junk.

Chicago’s problems can be summed up with one recent exchange with the mayor.

When asked by reporters if he had taken the warnings of a credit downgrade seriously during the budget debate, Johnson said, “I did. I did take it seriously.”

Ok.

I guess they’re fine with the downgrade then.

Chicago Tribune: Credit rating downgrade an unsurprising warning about city's financial stability

It's bad news -- though unsurprising -- that following the passage of Mayor Brandon Johnson's most recent city budget, S&P downgraded the city's credit rating to BBB. Bad policy decisions trigger bad outcomes, and ratings agencies serve as harbingers of these consequences, good or bad. This marks the first ratings downgrade since May 2015, when Moody's Investors Service downgraded the city's rating to junk status.

….

In sum, S&P confirms what the editorial board has long said: The city is not being managed sustainably, with projections suggesting higher taxes and cuts to government services in the future. The city's budget has grown at an incredible rate -- just 10 years ago, city spending was $8.9 billion. The most recent budget will cost taxpayers $17.3 billion. City officials narrowly avoided a property tax hike in the most recent budget, which would've led to public revolt, though Johnson's initial proposal included a $300 million property tax hike. As Chicagoans continue to suffer from inflation and a cost of living that's rising faster than wage growth, plus continued basic government service failures, city officials need to come up with a long-term plan. Our city cannot afford to eke by year after year building on a leviathan spending baseline that isn't giving residents what they need, while also crippling the city's finances and reputation.

I added the emphasis.

Chicago Pensions Part of the Structural Deficit

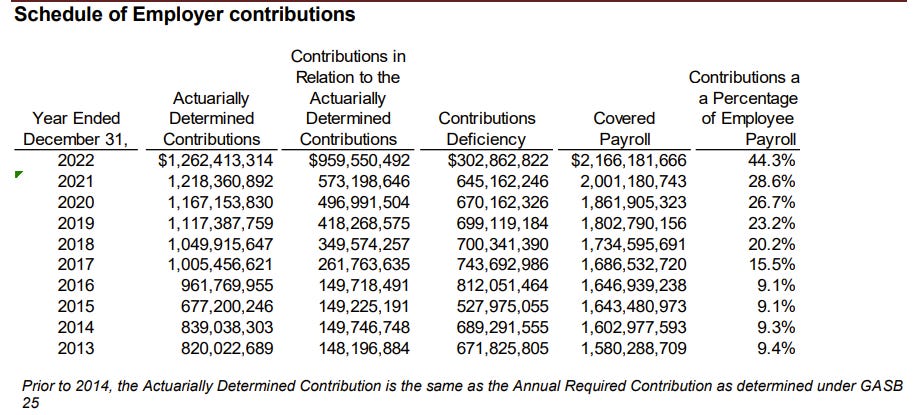

How much of that increase was increased pension contributions, I wonder? Ten years ago, the pension contributions were grossly underfunding the plans. I will pick on the worst one, MEABF (the municipal plan).

Let’s check their entry in the Public Plans Database:

The blue bars are what they paid, and the red bars are the balance of what they should have paid. That’s based on percentage of payroll.

Going to the 2022 ACFR for this plan, we can see the dollar amounts:

They went from about $150 million per year in 2015 up to almost $1 billion in 2022. No wonder they were feeling the pinch.

Of course, they should have contributed $1.3 billion, but what’s $300 million between friends?

Note that they are barely coming out of the basement on their funding level with this huge increase in contributions:

It will take increasingly larger contributions to dig their way out of that hole.

Of course, the municipal pension fund isn’t Chicago’s only pension to deal with, but it is one of its most problematic. It’s large and grossly underfunded for decades, beyond what many of the other funds were. Contributions were held at absurdly low levels.

It took the obvious trajectory that the MEABF was going to run out of assets within a decade before they did a turn-around and increased contributions.

But digging out of such a deep hole of under-fundedness is extremely expensive. It would not have been so expensive if they had been making larger contributions all those years before. Oh well.

News Coverage

WTTW: Ratings Agency Downgrades Chicago’s Credit, Pointing to ‘Structural Budgetary Imbalance’

The Center Square: Chicago mayor, CFO react to S&P Global dropping city’s debt rating

Chicago Sun-Times: Chicago's bond rating dropped to BBB — one step above lowest investment grade

Bloomberg: Chicago Seeks Authorization to Sell Up to $830 Million in Bonds

Bond Buyer: Chicago receives S&P downgrade to BBB

On the Bloomberg piece: the question may be, what one notch’s worth of credit is worth?

Potential Impacts on Bond Sales?

Back in November 2010, Chicago was looking at a sale of about the same amount, $800 million, and they put it off for a while to try to seek a better price.

WSJ, 5 Nov 2010: Chicago Puts Bond Sale on Hold

The city of Chicago is delaying a roughly $800 million general obligation bond sale scheduled for next week, amid hefty municipal bond supply and a flurry of negative fiscal headlines about the Windy City.

"As always, the city looks to price bonds in the most favorable borrowing rate environment," said Peter Scales, spokesman for the city's Chief Financial Officer, Gene Saffold. "We decided to postpone the G.O. bond sale planned for next week to wait for a more opportune time to access the lowest possible rates."

Mr. Scales said the city hasn't decided on a date when it might sell the bonds.

They still sold the bonds, just at a later date. If you look above, Chicago had ratings in the A+ to AA- range in 2010, higher than where they are now. This was a matter of them trying to time the market to get the best possible rate at the time, not that they were seen as junk.

And what about Illinois? Chicago often looks to the state for funds to top it up.

The state of Illinois has seen nasty yields on their bonds before, as during the first waves of COVID in the spring of 2020:

Reuters, 13 May 2020: Illinois hit with fat yields in $800 million bond sale

Illinois paid a stiff penalty for its financial woes on Wednesday with yields in the state's sale of $800 million of bonds topping out at a hefty 5.85%.

While investor demand lowered yields on the tax-exempt, general obligation bonds in a repricing, they remained at extremely wide spreads over the U.S. municipal market's benchmark scale.

Illinois is the lowest-rated U.S. state at just a notch above junk due to its huge unfunded pension liability and chronic structural budget deficits. With its revenue sinking due to the economic fallout from the COVID-19 pandemic, the state risks eventually slipping below investment grade.

….

At 5.65%, the yield on 10-year bonds was 452 basis points over the Municipal Market Data (MMD) triple-A scale's 1.13%, and the 5.85% yield for 25-year bonds was 396 basis points over the scale's 1.89%. By contrast, New York State's 10-year bond spread was just 13 basis points.

Illinois was upgraded later; it’s not at the precipice to junk. Currently.

It took multiple actions to get to this improvement, just as it took several steps to get to that low point in spring 2020. The federal funds dished out to the state and localities surely helped, but that’s now dried up.

The state will surely not hold onto those credit ratings if it feeds the bottomless pit that is the endless desires of Chicago politicians and public unions.

Governor Pritzker has already given some big hints to Mayor Johnson that no, the state is not going to be giving Chicago whatever it wants.

7 Jan 2025: Pritzker hammers Johnson over poor ‘relationships in Springfield' amid hemp fight

A day after lawmakers dropped a plan to regulate hemp sales, Illinois Gov. J.B. Pritzker blasted Chicago Mayor Brandon Johnson over a lack of communication in multiple instances during his administration.

During a press conference Tuesday, Pritzker said Johnson “doesn’t have good relationships” in Springfield due to a lack of communication during his time in office, and that the mayor’s administration is falling far short in its outreach efforts, including during the city's recent contentious budget negotiations as they tried to navigate a $1 billion deficit.

“They don't reach out very often. And it seems like they don't have good relationships in Springfield, in part because they don't do the outreach that's necessary,” he said. “I've always taken calls from the mayor….(and) he has my direct number.”

Pritzker told reporters that Johnson has reached out “perhaps five times” during his nearly two years in office, his most pointed criticism of the mayor since Johnson entered City Hall.

….

“With regard to his budget, literally the last call we got from them was in September,” he said. “We, by the way, scheduled calls and then they didn’t show up. And then there was a December call that happened in which they didn’t ask for anything.”

There is more, including the issue of COVID funds reaching the end in 2026 for Chicago Transit.

But it is interesting that Johnson doesn’t seem to understand that yeah, he’s going to have to get the state-level politicians involved, and he can’t just set terms.

He doesn’t seem to understand that Chicago is not self-sufficient. He will have to ask for funds… and it involves actual negotiation. Not the fake '“negotiation” he does with the Chicago Teachers Union.

Just saying “I take it seriously” does not magically make money appear.

Both Chicago and Illinois will have at least a rough couple of years, that’s for sure.

Dear Mary Pat,

Have you heard of the new "investor" plan Bally's Casinos is trying to float to get their Chicago hotel/casino built? Whooo, baby, it's amazing -- an excellent write-up here. The city government is backing this officially.

https://www.bitsaboutmoney.com/archive/chicago-casino-investment-offering/

Chicago politicians drag the rest of the State of Ill down. When does the point of no return come?