Chicago and Illinois Update: Budget Time in 2025

Huge holes of debt -- quick! Let's find one cool trick!

Don’t worry, I’ll be getting back to Social Security issues soon enough.

But I was handed a note…

This is the PDF linked to at Politico: Chicago Benchmark Poll from M3 Strategies

From the second page:

It is not clear to me that this was the complete list that respondents were being asked to select from, but from my surveying experience, I think it is.

Note the bias in what is being asked. There is nothing on the list about Chicago's ginormous debt hole, particularly its pension debt.

That is a large driver of its high taxes, and contributes to its lack of funding for classrooms in CPS (Chicago Public Schools).

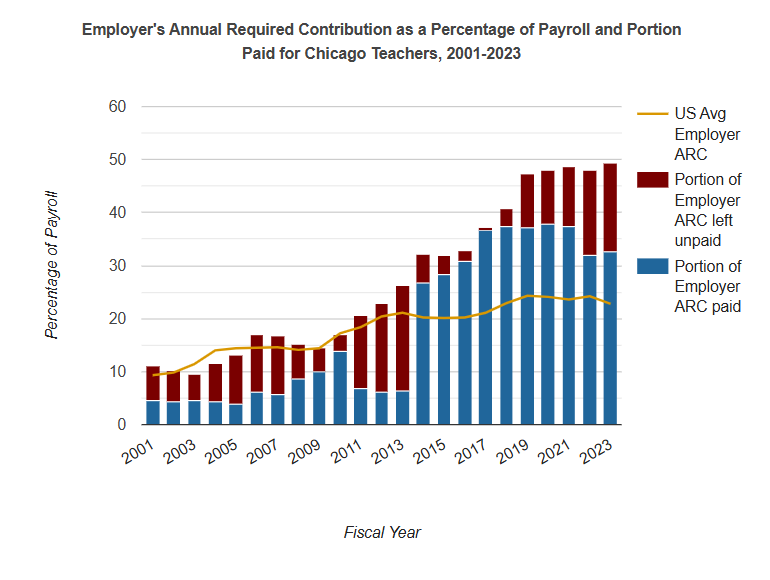

If so much of the CPS money has to go here:

…when they’re not even making full contributions to the pensions… what do you expect?

Floating a huge bond for Chicago — who will buy?

Illinois Policy, 21 Feb 2025: Chicago mayor wants to borrow $830M, which could benefit his Chicago Teachers Union cronies

Mayor Brandon Johnson asked to borrow $830 million one day after the city’s credit rating dipping to near-junk status. He would have broad discretion over how to spend the money – including on his friends at the Chicago Teachers Union.

Chicago Mayor Brandon Johnson asked the city to take out $830 million in bonds just one day after Chicago’s credit rating hit near-junk status, according to Standard & Poor’s Global.

Johnson claims the bonds are for infrastructure and capital improvements, but there is broad language in how the money could be spent. He could use it for the contract his former coworkers at the Chicago Teachers Union are seeking.

In listing acceptable uses for funds, the ordinance includes “loans or grants to assist individuals, not-for-profit organizations, or educational or cultural institutions, or for-profit organizations, or to assist other municipal corporations, units of local government, school districts, the State or the United States of America.”

Johnson could use the borrowed money to pay for the city’s contract with the CTU, which is his former employer and his largest campaign contributor at nearly $2.3 million. CTU is in the middle of contract negotiations with Chicago Public Schools.

Yes, we know that money is fungible.

Op-ed by Illinois state comptroller, Susan Mendoza, Chicago Sun-Times, 17 Feb 2025: City Council, vote no on Mayor Johnson's $830 million bond issue

If City Council members approve an $830 million bond issue this week, Chicago taxpayers can expect to be on the hook long term for the costs — which will be higher — because of a chronic lack of fiscal discipline and an administration loathe to consider any trims to its budget.

Standard & Poor’s Global became the latest bond rating agency to lower the city’s rating to just above junk status, saying the administration appears unwilling to even consider cutting spending.

The day after that downgrade, to add insult to injury, Mayor Brandon Johnson’s administration offered its plan to borrow $830 million more.

….

As the state’s chief fiscal and accountability officer, I have worked hard over the past eight years to bring the state’s credit rating back up from where the previous administrations sunk it. I saved state taxpayers $82 million in interest by repaying a $2 billion COVID-19 loan two years early. After 20 years of credit downgrades, the state of Illinois has enjoyed nine straight credit upgrades on my watch.

Finance Committee Vice Chair Ald. Bill Conway’s analysis of the terms of the repayment schedule made clear that this bond deal gets monumentally worse by the second.

As ill-advised and tone deaf as it was for the Johnson administration to seek an additional $830 million in bonding less than 24 hours after having its credit downgraded, it would be absolutely reckless to structure it as an interest-only deal that defers principal for the first 20 years, as the Johnson administration reportedly plans. Paying only interest and no principal for the first 20 years would take the cost of the $830 million bond deal to upward of $2 billion. This shortsighted cash grab is a full scam on taxpayers and needs to be stopped. It would very likely invite another credit downgrade, plunging the city into junk territory.

….

Meantime, I strongly urge the members of the Chicago City Council to vote “no” on the additional $830 million in borrowing. If Johnson insists on pursuing a path leading Chicago over a fiscal cliff, you should choose to avoid that cliff dive. Chicagoans are counting on you to be the adults in the room and show fiscal discipline. You have the power to stop this, so do it.

The members of the Chicago City Council were originally to vote on the bond plan last week, but they delayed the vote to Wednesday, 26 February 2025.

Fox 32 Chicago, 19 Feb 2025 Chicago alderman slams Johnson's $830M bond proposal as city council stalls final vote

Chicago aldermen pushed back on Wednesday and stalled a final vote on Mayor Brandon Johnson's planned $830 million bond proposal.

What we know:

The bond would pay for various capital projects, but many are concerned over its long-term costs.

According to initial estimates, the total cost to repay the bond is about $2 billion. However, the city would only pay interest for the first 19 years.

Principal payments would not start until 2045 — a cost that would grow from $27 million to about $129 million by the debt's due date.

….

After more than 30 minutes of debate, Aldermen Anthony Beale and Ray Lopez used a parliamentary maneuver to put off the vote until the council's next meeting.

A huge interest-only period for these bonds, while rates are rising… who, exactly, would be buying these bonds?

Cry Nazi! A new budget tactic

Wirepoints, 24 Feb 2025: Beyond the Nazi accusations. What you should know about Gov. Pritzker’s budget address – Wirepoints

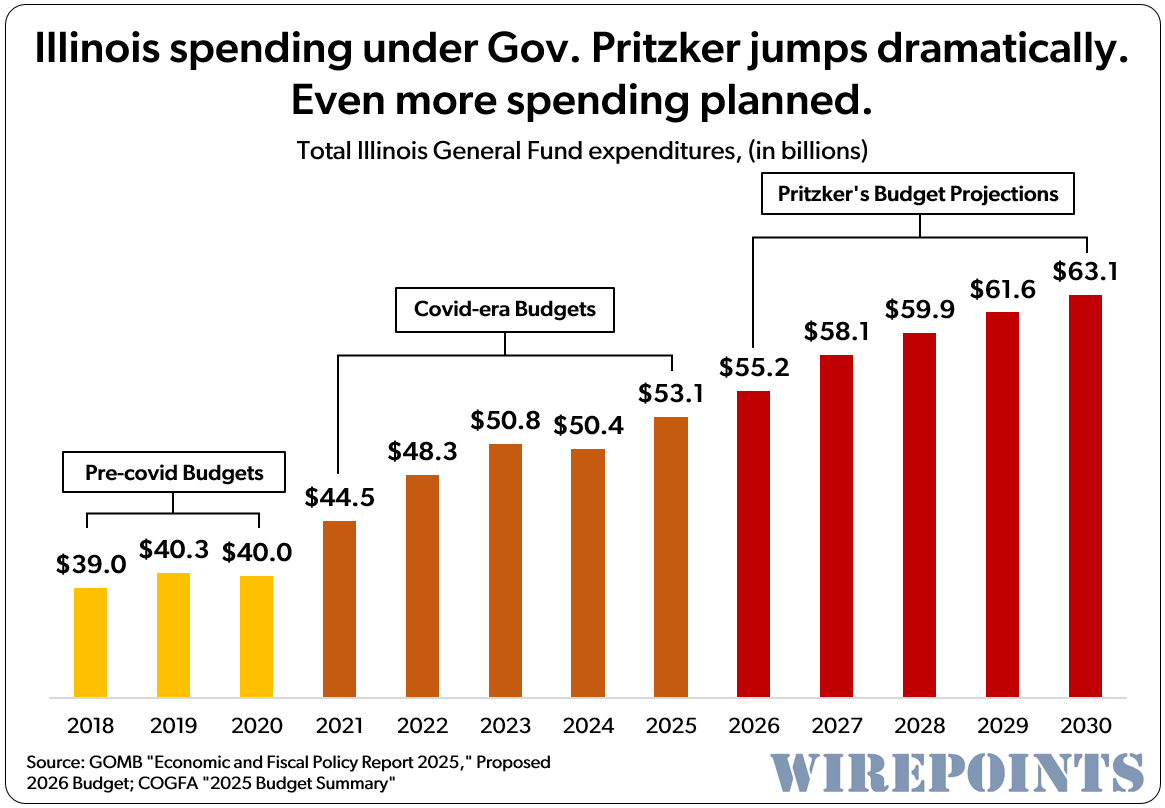

There were two big takeaways from Gov. J.B. Pritzker’s 2026 combined state of the state and budget address last week.

First was Pritzker’s use of a constitutionally-required speech to frame Trump and, by extension, his 70 million-plus supporters, as Nazis. “I do not invoke the specter of Nazis lightly,” Pritzker said, as he proceeded to equate the MAGA movement with Nazism.

Somebody forgot to tell Pritzker about Godwin’s Law – that when you invoke Nazis in an argument, you automatically lose. Wirepoints detailed Pritzker’s comments in a sister piece, Pritzker says he is fighting against Nazis in astounding speech, so we won’t go into more detail here.

The second big takeaway – and the focus of this piece – is how wide the gap has gotten between what the governor says he’s done for Illinois versus reality on the ground. Look beyond the spin and you’ll see that Illinois’ economic growth since he took office ranks nearly last nationally. Same for private-sector job creation. Educational outcomes have also worsened despite billions more in spending. All the while, Illinoisans’ tax burdens are going up.

This state is increasingly an extreme national outlier on most fiscal, economic and demographic issues that matter. The data is undeniable.

Me, too. Me, too.

I’m not going to invoke Godwin’s Law here. Or even argue Trump.

I’m going to argue budget, debt, and obviously, pension debt, as Dabrowski and Klingner do here.

Unless “fighting Nazis” is a line item in the Illinois budget, I’m not that interested in Pritzker’s speech items on that front. It’s a nonsequitur for a state budget that had been boosted in the COVID era by federal support that went away even before Trump came in.

This is not unique to Illinois. Many states and cities are pinched as COVID-era federal boosts have been cut off by the end of 2024.

This is a piece from last year: The End of Federal COVID Money Means Shortfalls for States and Schools, from Feb 2024, by Liz Farmer:

In 2020 and 2021, the federal government passed six relief bills in response to the COVID-19 pandemic that provided additional funding for state and local governments, Medicaid and particularly hard-hit public sectors such as transit. All told, states received an unprecedented $800 billion in relief during this time, including $307 billion in flexible fiscal recovery funding that went directly to state coffers.

Now, however, most pandemic aid programs have either ended or are slated do so by the end of 2024. And with sectors such as public education, child care, and transit having suffered lasting harm from the pandemic, the end of that funding means state policymakers throughout the country will have tough decisions to make in the upcoming legislative session.

And even though those funds were cut off, Illinois had its budgets go ever-higher.

When you see what a huge line item the pensions are - and they still won’t be making full contributions. I’ll show only the state teachers’ fund below, which highlights the state pension debt problem:

You can see why the governor would rather talk about hypothetical Nazis than the very real chasm of debt he would rather not battle.

He could take on fictional Nazis and win.

The very real debt…he will not be winning against that.

When "investors" / speculators stop giving Chicago & Illinois money, could we have a panic sale of bonds? Chicago can go through a bankruptcy process, Illinois can't declare itself bankrupt. I see the demands for pension payments to slowly apply more pressure. How much is needed for the dam to burst? And when?